How To Form A Trust Company

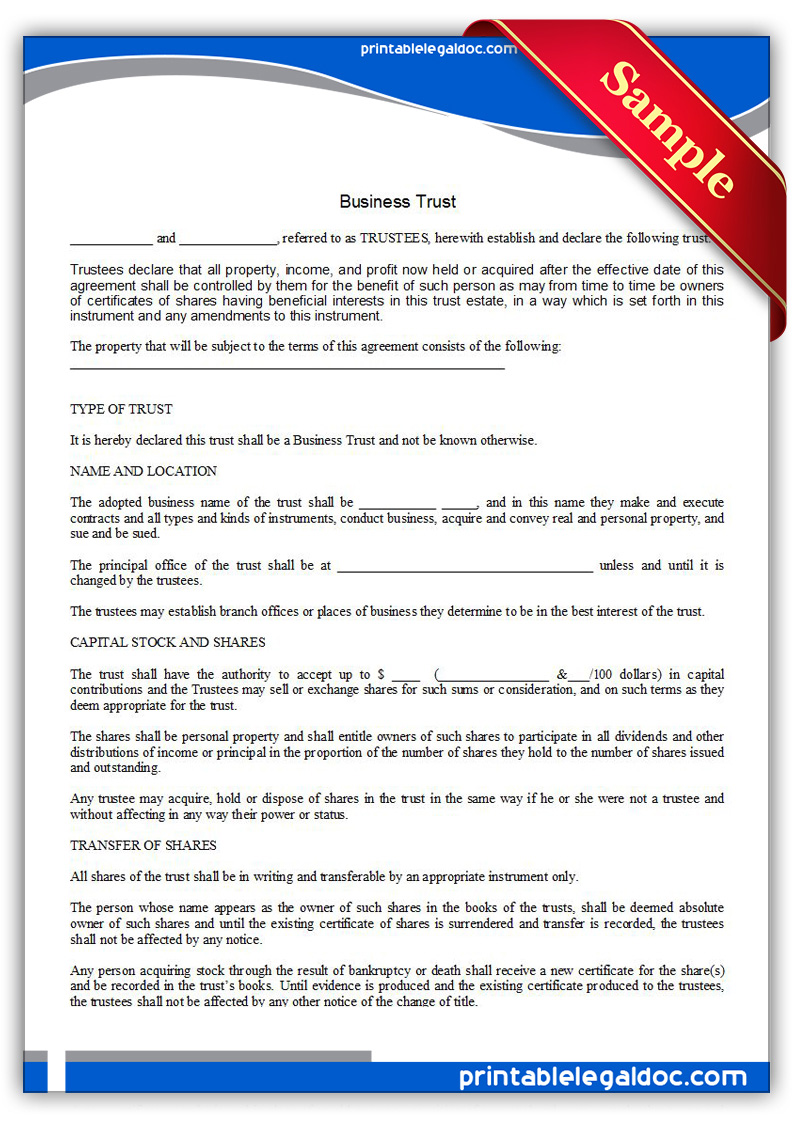

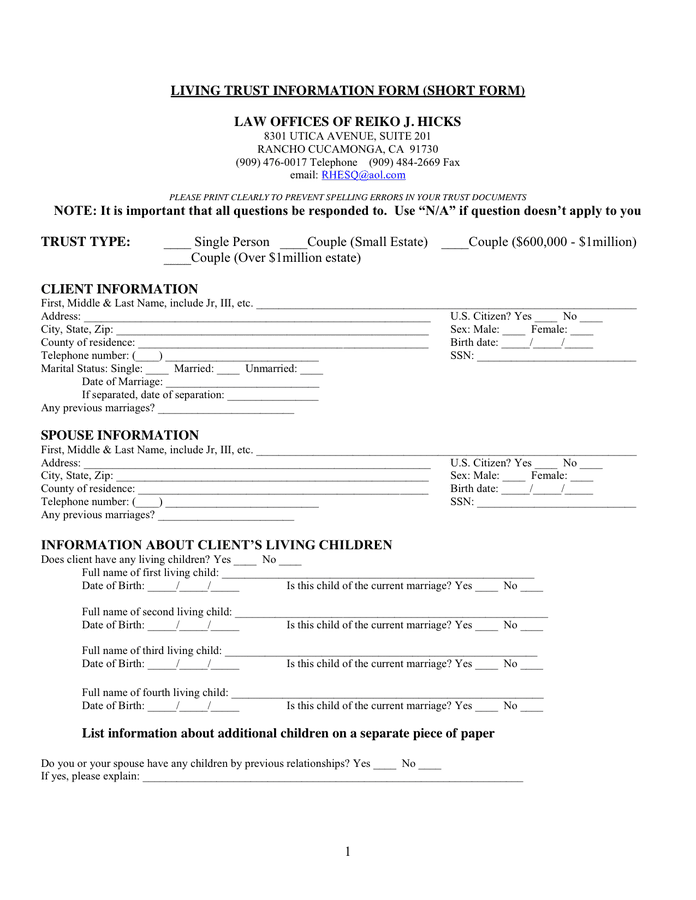

How To Form A Trust Company - Web establishing a private trust company is based on a variety of factors, including: Web take your trust documents to a bank or financial institution and open a trust fund bank account with the same name as the trust. But another type of trust exists for entrepreneurs and companies called business trusts, which are also known as common law trusts. Susan hartley moss | mar 28, 2012. Setting up your own trust company if you’d like to offer trust services to your client, but do not want to give an outside institution control over their assets, you may want to consider starting your own trust company. When completing section 2, use information from the documentation the employee presented to enter the document title, issuing authority, document number, and expiration date (if any) in section 2: Web key takeaways a trust company is a legal entity that acts as a fiduciary, agent, or trustee on behalf of a person or business for a trust. Typically the new trust company would run alongside your wealth How to set up a trust 3. Web limited purpose trust company:

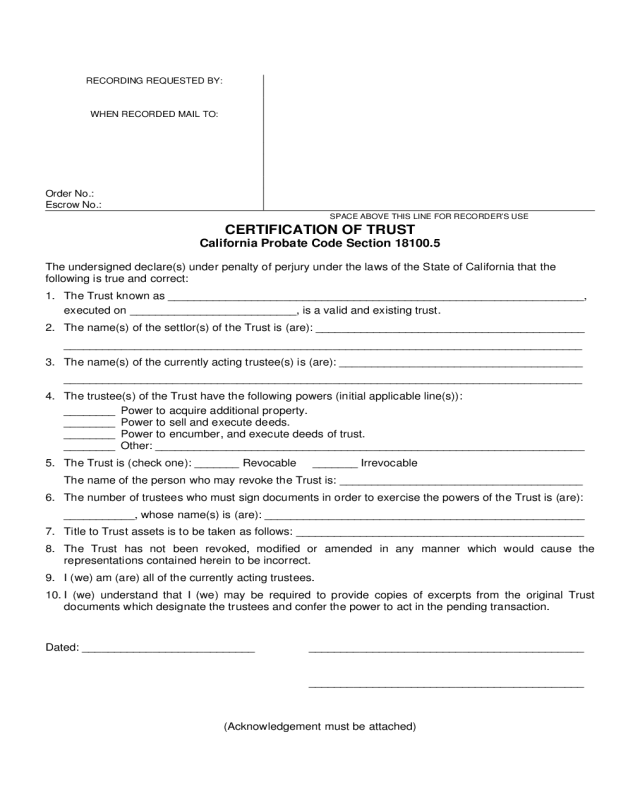

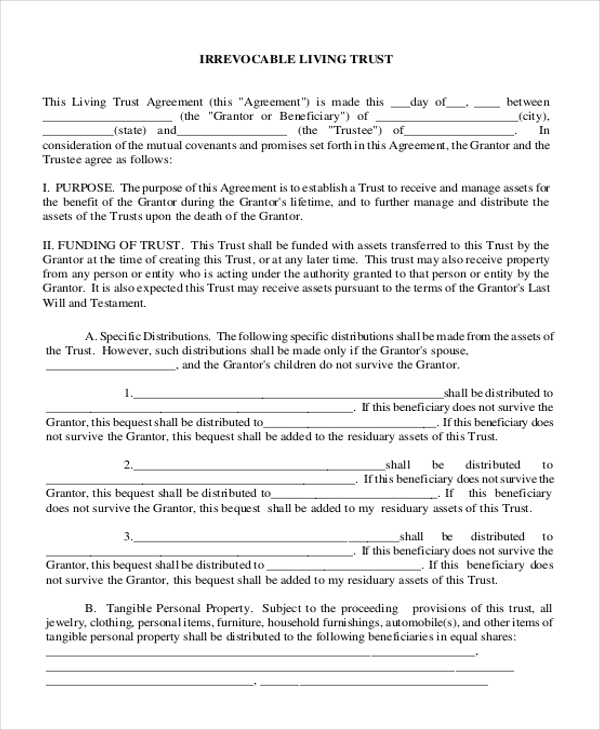

A person who eventually receives some or all of the assets in the trust. Rather than choosing an individual to act as trustee, a trust company can fill the same role. A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being. Web the exact process for setting up a trust will vary based on what assets you want to include in the trust and who is set to receive the assets, but there are generally five key steps. Web trusts have three main players: Web take your trust documents to a bank or financial institution and open a trust fund bank account with the same name as the trust. Setting up your own trust company if you’d like to offer trust services to your client, but do not want to give an outside institution control over their assets, you may want to consider starting your own trust company. States and the district of columbia also impose some form of estate or inheritance tax with limits much lower than the federal $12.92 million. You can either deposit a lump sum or pay into the trust over time. Web establishing a private trust company is based on a variety of factors, including:

When completing section 2, use information from the documentation the employee presented to enter the document title, issuing authority, document number, and expiration date (if any) in section 2: Web vdom dhtml tml> what is a business trust and how does it work? A trust company is typically tasked with the. Web a trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. A person who eventually receives some or all of the assets in the trust. Web key takeaways a trust company is a legal entity that acts as a fiduciary, agent, or trustee on behalf of a person or business for a trust. The need to maintain a level of control on how the trust is created. First, the applicant must submit a detailed business plan which shall include a “reasonable promise of successful operation” based on local conditions. Rather than choosing an individual to act as trustee, a trust company can fill the same role. Determine whether a trust is needed.

Letter Of Wishes Template Trust PDF Template

The need to maintain a level of control on how the trust is created. Web a trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. Web trusts have three main players: Web edward jones trust company provides three different levels of service based on your current and future needs: First, the applicant.

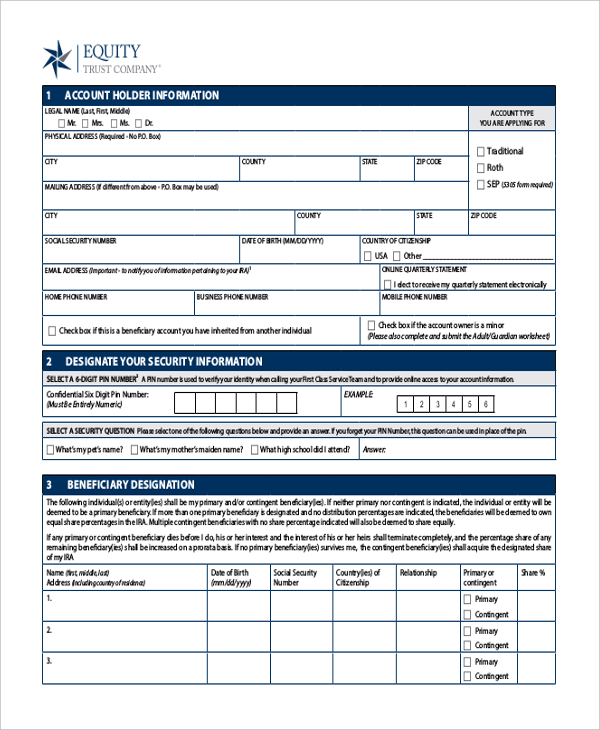

2022 Will and Trust Forms Fillable, Printable PDF & Forms Handypdf

Web edward jones trust company provides three different levels of service based on your current and future needs: When completing section 2, use information from the documentation the employee presented to enter the document title, issuing authority, document number, and expiration date (if any) in section 2: Biden, who hosted executives from the seven companies at the. Find a cfp®.

FREE 10+ Sample Living Trust Form Templates in PDF Word

Employer or authorized representative review and verification. State estate and inheritance taxes. Web fill out the ledger and the certificate in the name of your trust. Web converting a family office to a private trust company. Web take your trust documents to a bank or financial institution and open a trust fund bank account with the same name as the.

Free Printable Business Trust Form (GENERIC)

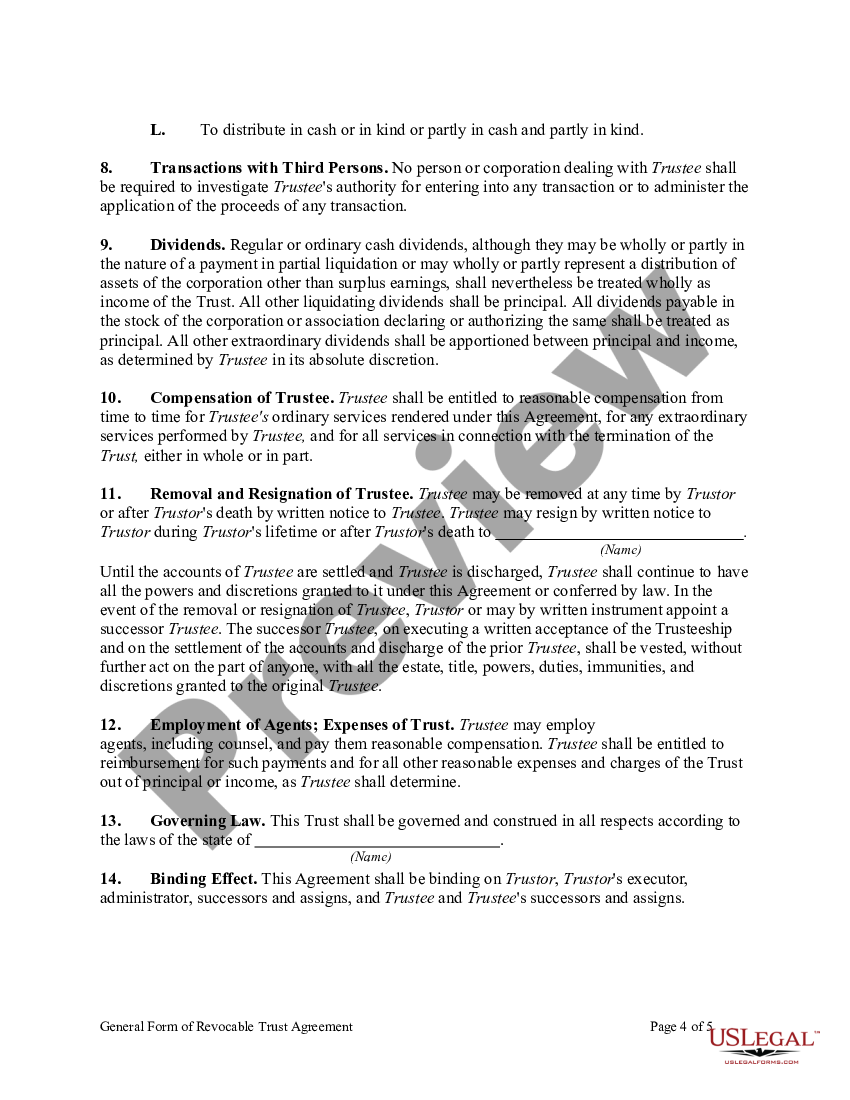

Web in contrast, if you have a trust that you control, called a revocable living trust, the trust will generally avoid probate if funded properly. Based on the financial supplement you want to. Web a trust company is an entity, often a division of a commercial bank, that can serve as an agent or trustee to either a personal or.

Free Printable TrustAgreement Form (PDF & WORD)

Web converting a family office to a private trust company. First, the applicant must submit a detailed business plan which shall include a “reasonable promise of successful operation” based on local conditions. You can either deposit a lump sum or pay into the trust over time. Rather than choosing an individual to act as trustee, a trust company can fill.

FREE 8+ Sample Living Trust Forms in PDF MS Word

A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being. When putting a company into a trust, remember the trust has three parts to the name. A person who eventually receives some or all of the assets in the trust. Web florida statute §658.21 outlines the.

Living trust information form in Word and Pdf formats

A trust is an arrangement that allows a. Typically the new trust company would run alongside your wealth The cost of setting up a trust table of contents setting up a trust can be relatively straightforward — you can use a digital will service to make a trust online or you can even open one on your own by writing.

FREE 16+ Sample Will and Trust Forms in PDF MS Word

State estate and inheritance taxes. You can either deposit a lump sum or pay into the trust over time. If you are interested in learning how to form a trust company, we can help you through the process. Why would i want to set up a trust? The company will manage the trust and oversee the eventual transfer of assets.

Trust Handwriting image

Web vdom dhtml tml> what is a business trust and how does it work? Web limited purpose trust company: A person who eventually receives some or all of the assets in the trust. You will need to provide the names and contact information of the trustees. Web home trust company how to form a trust… trust companies have the unique.

General Form of Revocable Trust Agreement Revocable Living Trust

Find a cfp® professional and get started. The ability to preserve confidentiality. Biden, who hosted executives from the seven companies at the. A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being. A person who eventually receives some or all of the assets in the trust.

The Advantages And Disadvantages Of This Option And How To Implement It.

Web congress is considering a bill that would require political ads to disclose whether ai was used to create imagery or other content. When putting a company into a trust, remember the trust has three parts to the name. Web a trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. Decide what assets to place in your trust.

Web Establishing A Private Trust Company Is Based On A Variety Of Factors, Including:

The ability to preserve confidentiality. States and the district of columbia also impose some form of estate or inheritance tax with limits much lower than the federal $12.92 million. Biden, who hosted executives from the seven companies at the. Web a trust company is an entity, often a division of a commercial bank, that can serve as an agent or trustee to either a personal or business trust.

While Some Of Us Will Be Going Back Into The Office Soon, Others Will Not Be Going Back At.

How to set up a trust 3. Susan hartley moss | mar 28, 2012. Rather than choosing an individual to act as trustee, a trust company can fill the same role. Web follow these four steps when setting up your estate plan:

Why Would I Want To Set Up A Trust?

State estate and inheritance taxes. Web key takeaways a trust company is a separate corporate entity owned by a bank or other financial institution, law firm, or independent partnership. Web in contrast, if you have a trust that you control, called a revocable living trust, the trust will generally avoid probate if funded properly. First, the applicant must submit a detailed business plan which shall include a “reasonable promise of successful operation” based on local conditions.