How To Get W-3 Form Quickbooks Online

How To Get W-3 Form Quickbooks Online - Web when you’re finished creating your form, go to the settings section (1) of the form builder and select integrations (2). Web under forms, click the category of forms you want to view. Automatically track all your income and expenses. Automatically track all your income and expenses. Includes a copy for your employee. Forgiveness options for teachers, nurses and others. Ad manage all your business expenses in one place with quickbooks®. First, you have to go to the taxes menu and then you have to choose the payroll. In the payroll center, pick the file forms tab. From the forms category page (for example, quarterly forms), click view archived forms (at the bottom.

First, you have to go to the taxes menu and then you have to choose the payroll. In the forms section, select annual forms. Automatically track all your income and expenses. Click the view link in the audit trail column for more details. Web where can i find my form w3 for 2020? Web the rules can quickly get complicated. Ad manage all your business expenses in one place with quickbooks®. Next, select quickbooks from the integration. Click the new menu to open the new account screen. In your company, head to the accounting menu on the left panel and choose chart of accounts.

Click taxes from the left menu and select payroll tax. From the forms category page (for example, quarterly forms), click view archived forms (at the bottom. In addition to those two main programs, there are several other forgiveness opportunities that many. Automatically track all your income and expenses. This report has some of the same information that you'll. Includes a copy for your employee. Click the new menu to open the new account screen. Next, select quickbooks from the integration. Get a free guided quickbooks® setup. In the forms section, select annual forms.

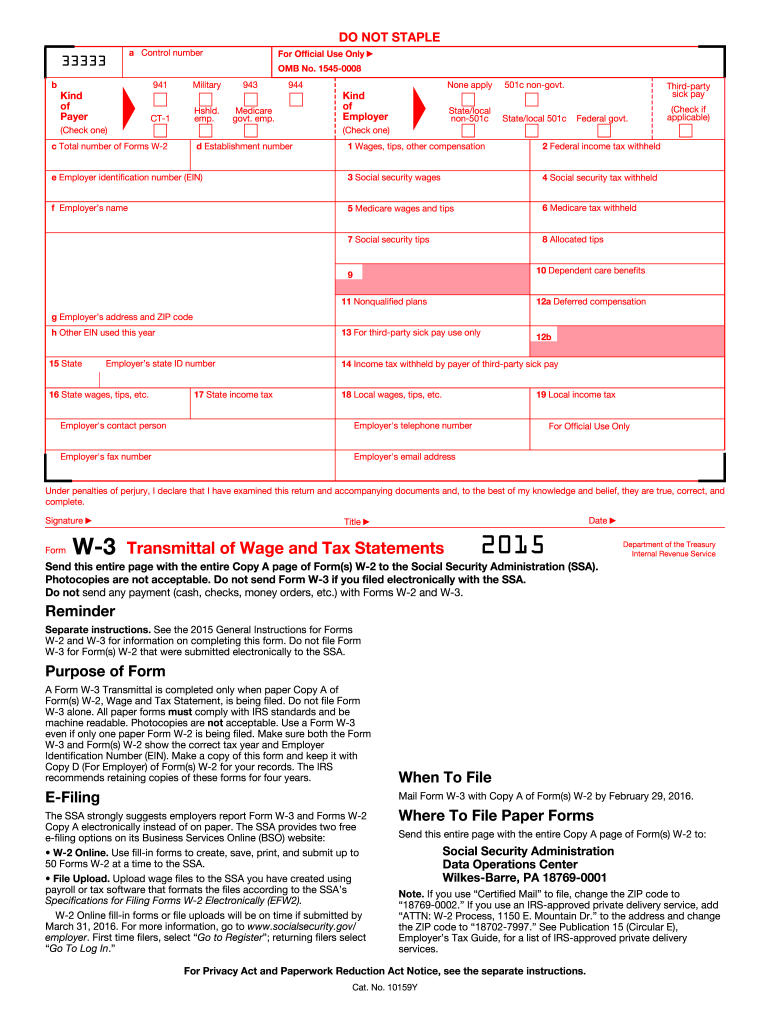

W 3 Form Fill Out and Sign Printable PDF Template signNow

From the forms category page (for example, quarterly forms), click view archived forms (at the bottom. Ad manage all your business expenses in one place with quickbooks®. Web where can i find my form w3 for 2020? Web the rules can quickly get complicated. Automatically track all your income and expenses.

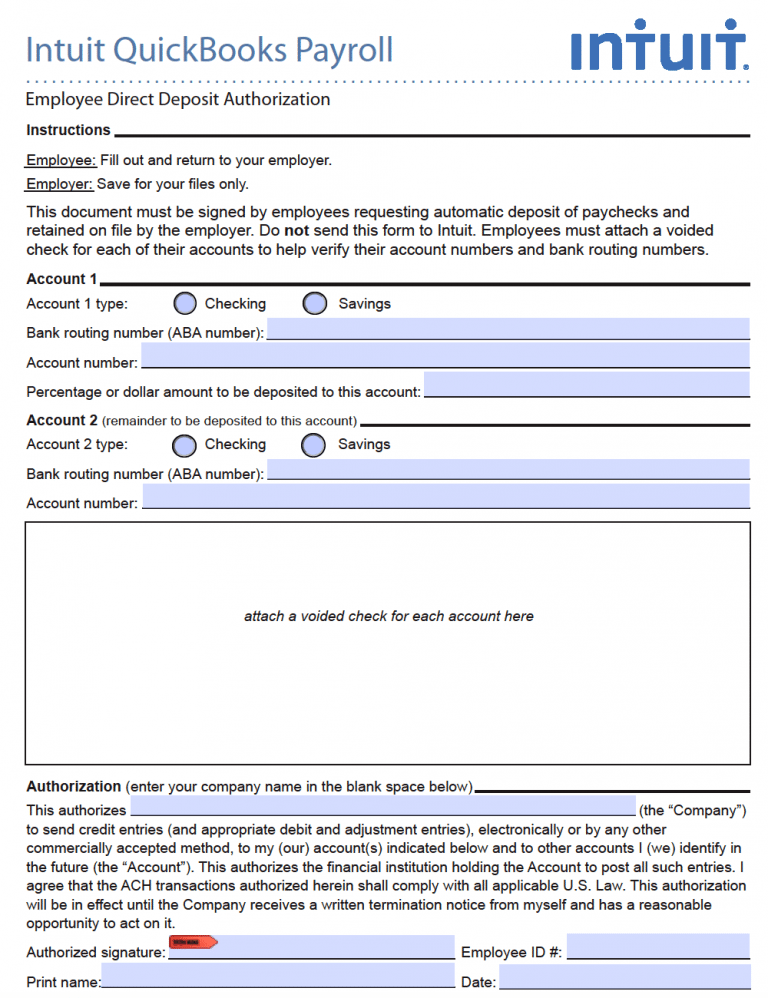

Free Intuit / Quickbooks Direct Deposit Authorization Form PDF

Click the new menu to open the new account screen. Ad manage all your business expenses in one place with quickbooks®. In the payroll center, pick the file forms tab. Web from the payroll center, go to the file forms tab. If a single taxpayer enjoys more than $232,100in taxable income or a married taxpayer enjoys more than $464,200in taxable.

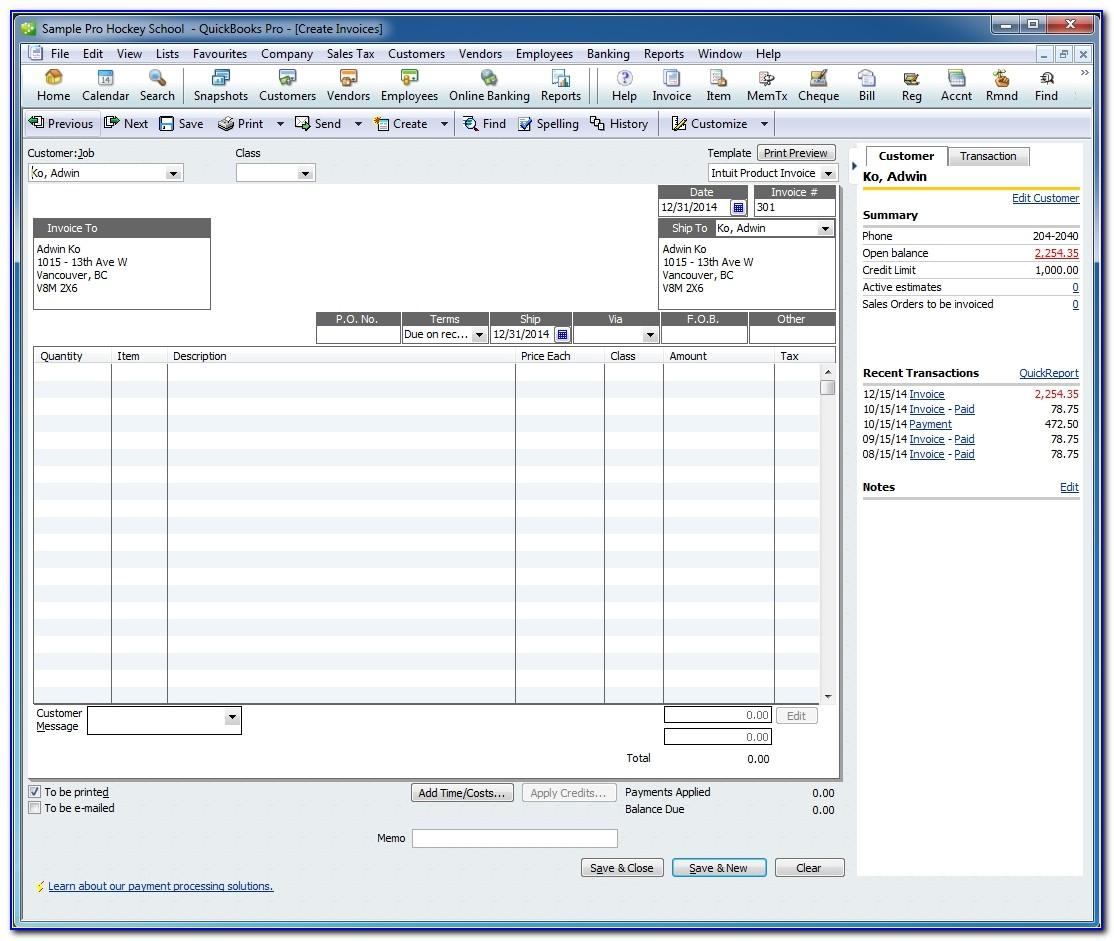

QuickBooks Online Customize Invoices BlackRock

Next, select quickbooks from the integration. In your company, head to the accounting menu on the left panel and choose chart of accounts. Web the rules can quickly get complicated. In the forms section, select annual forms. Web choose process payroll forms.

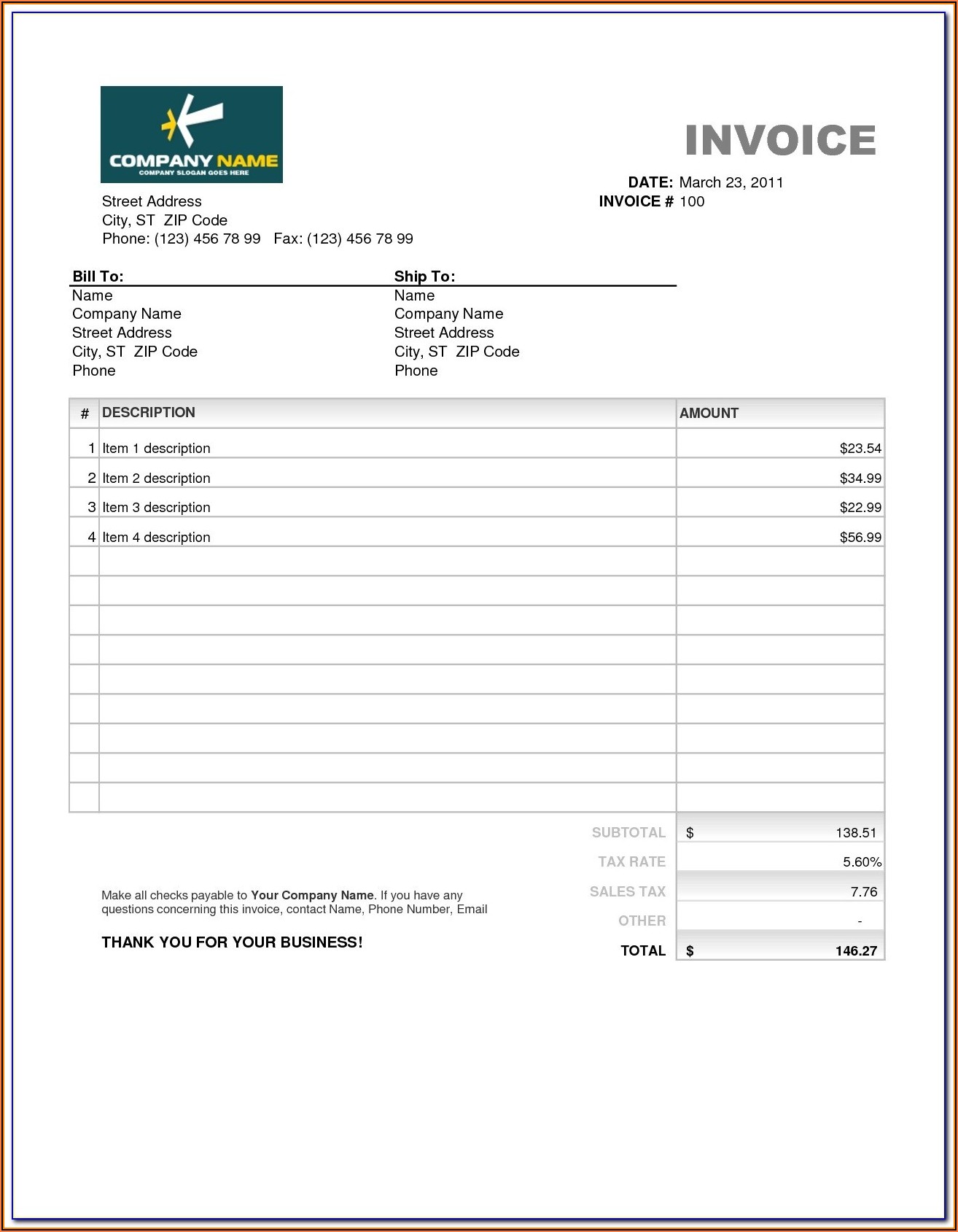

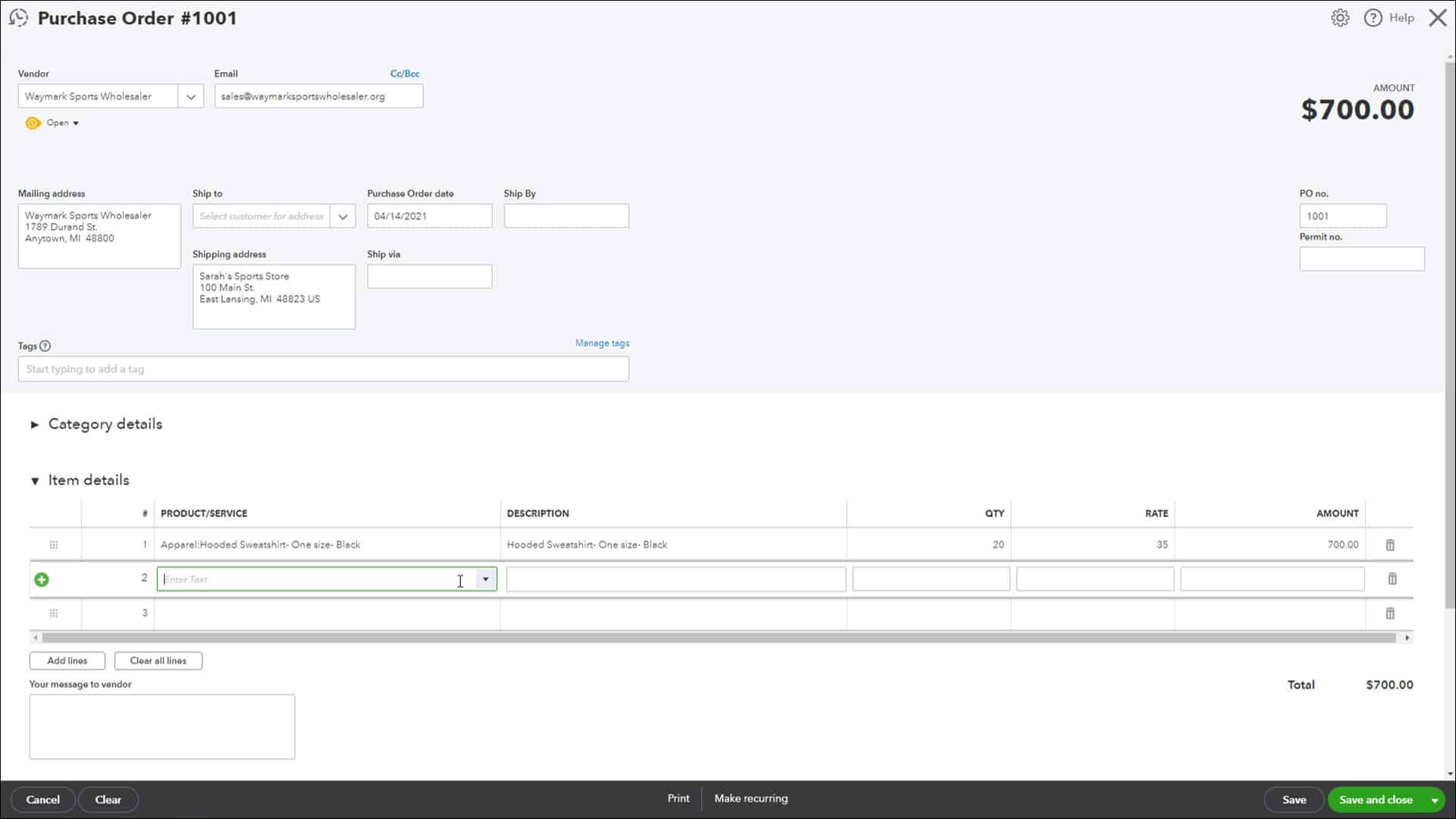

Quickbooks Online Purchase Order Template

Forgiveness options for teachers, nurses and others. Automatically track all your income and expenses. Ad manage all your business expenses in one place with quickbooks®. To use these features, go to the vendor center. These are the supported form types in quickbooks desktop payroll:

W3 Form 2016 Creative Form Ideas

Click the new menu to open the new account screen. Includes a copy for your employee. First, you have to go to the taxes menu and then you have to choose the payroll. Ad manage all your business expenses in one place with quickbooks®. These are the supported form types in quickbooks desktop payroll:

Quickbooks Invoice Forms Form Resume Examples qeYzOnMV8X

Click the new menu to open the new account screen. In addition to those two main programs, there are several other forgiveness opportunities that many. Forgiveness options for teachers, nurses and others. Web when you’re finished creating your form, go to the settings section (1) of the form builder and select integrations (2). Includes a copy for your employee.

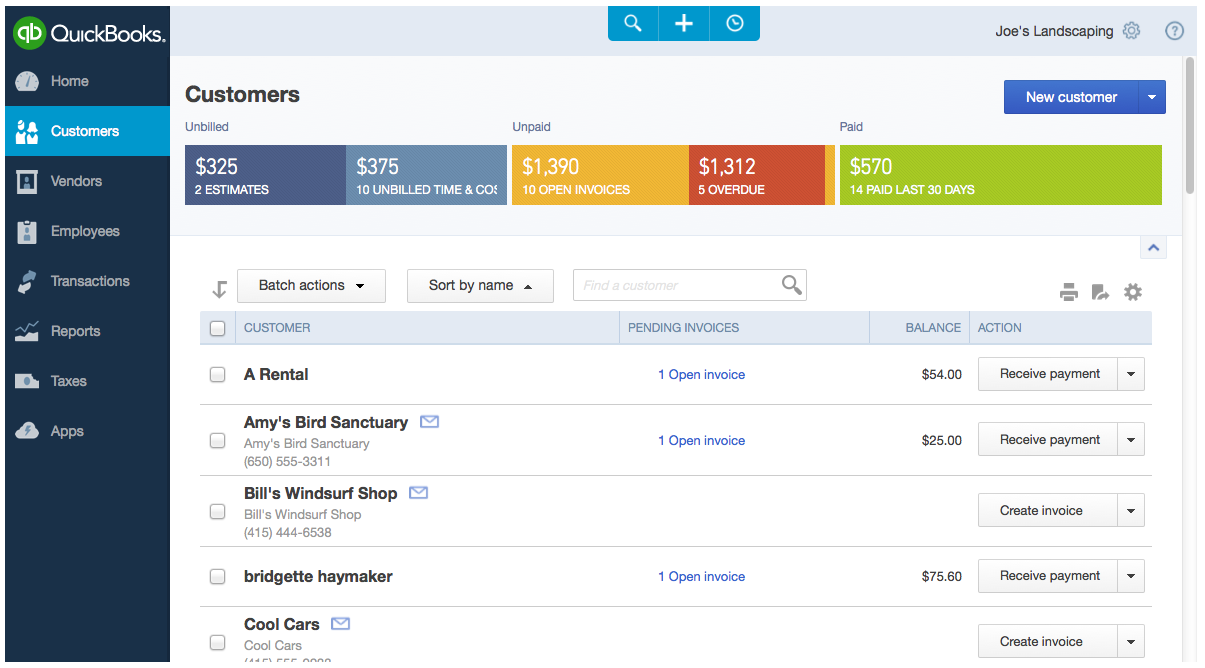

Which Accounting Software Is Better? Compare Freshbooks & Quickbooks

In addition to those two main programs, there are several other forgiveness opportunities that many. See the steps below to complete the process: Click taxes from the left menu and select payroll tax. Forgiveness options for teachers, nurses and others. Ad manage all your business expenses in one place with quickbooks®.

Create a Purchase Order in QuickBooks Online Instructions

Automatically track all your income and expenses. Automatically track all your income and expenses. See the steps below to complete the process: In addition to those two main programs, there are several other forgiveness opportunities that many. Web where can i find my form w3 for 2020?

W3 Laser Transmittal Form

These are the supported form types in quickbooks desktop payroll: Web choose process payroll forms. First, you have to go to the taxes menu and then you have to choose the payroll. Web from the payroll center, go to the file forms tab. Next, select quickbooks from the integration.

Rushcard Direct Deposit Form Form Resume Examples djVarJG2Jk

In the forms section, select annual forms. This report has some of the same information that you'll. Web the rules can quickly get complicated. Includes a copy for your employee. Web under forms, click the category of forms you want to view.

In Addition To Those Two Main Programs, There Are Several Other Forgiveness Opportunities That Many.

To use these features, go to the vendor center. In the forms section, select annual forms. Web the rules can quickly get complicated. Get a free guided quickbooks® setup.

Click Taxes From The Left Menu And Select Payroll Tax.

Web when you’re finished creating your form, go to the settings section (1) of the form builder and select integrations (2). Automatically track all your income and expenses. If a single taxpayer enjoys more than $232,100in taxable income or a married taxpayer enjoys more than $464,200in taxable. Forgiveness options for teachers, nurses and others.

These Are The Supported Form Types In Quickbooks Desktop Payroll:

In the payroll center, pick the file forms tab. First, you have to go to the taxes menu and then you have to choose the payroll. Ad manage all your business expenses in one place with quickbooks®. Next, select quickbooks from the integration.

This Report Has Some Of The Same Information That You'll.

Click the new menu to open the new account screen. Web where can i find my form w3 for 2020? Web from the payroll center, go to the file forms tab. Get a free guided quickbooks® setup.