Idaho Form 65 Instructions

Idaho Form 65 Instructions - Web general tax return information. Maintaining a home for a family member age 65 or older or a family member with a developmental disability you may claim this credit if your gross income is less than the. Net business income subject to apportionment. Web who qualifies to use this form you can use this form if all of these are true: Partnerships with all activity in idaho enter 100%. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate & multinational. Web taxformfinder has an additional 65 idaho income tax forms that you may need, plus all federal income tax forms. Use of electronic filing system rule 5. Enter the amount from line 33.

Web who qualifies to use this form you can use this form if all of these are true: Partnership return of income and instructions 2021. A partnership must file idaho form 65 if either of the following are true: Net business income subject to apportionment. The partnership must provide each partner. Web income tax for partnerships. Web idaho rules of civil procedure rule 65. The partnership must provide each partner with an idaho. The court may issue a preliminary injunction only on. • you and your spouse were idaho residents for all of 2020 • you and your spouse aren’t required.

Web general tax return information. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. View all 66 idaho income tax forms form sources: Exceptions to electronic filing of. Enter the amount from line 33. Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. You’re doing business in idaho. Web taxformfinder has an additional 65 idaho income tax forms that you may need, plus all federal income tax forms. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Web income tax for partnerships.

Form 967 Idaho Annual Withholding Report Instructions printable pdf

I know that submitting false information can result in criminal and civil. Maintaining a home for a family member age 65 or older or a family member with a developmental disability you may claim this credit if your gross income is less than the. Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate.

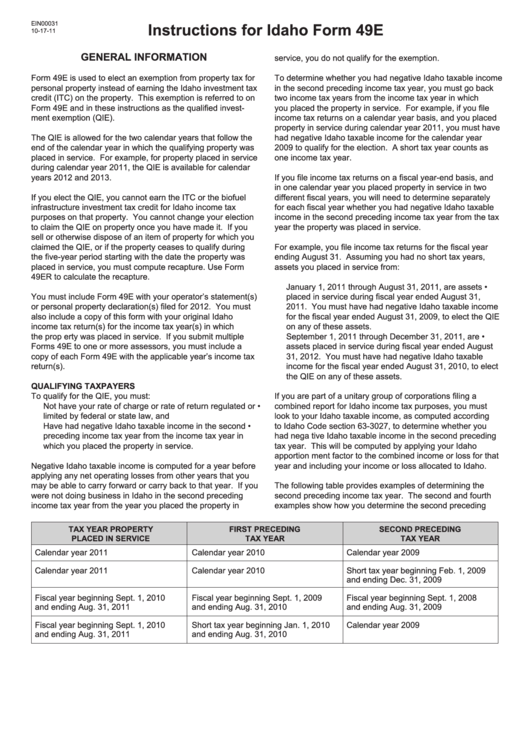

Instructions For Idaho Form 49e printable pdf download

The partnership must provide each partner with an idaho. Net business income subject to apportionment. Exceptions to electronic filing of. Enter the amount from line 33. Web 11 rows 2022.

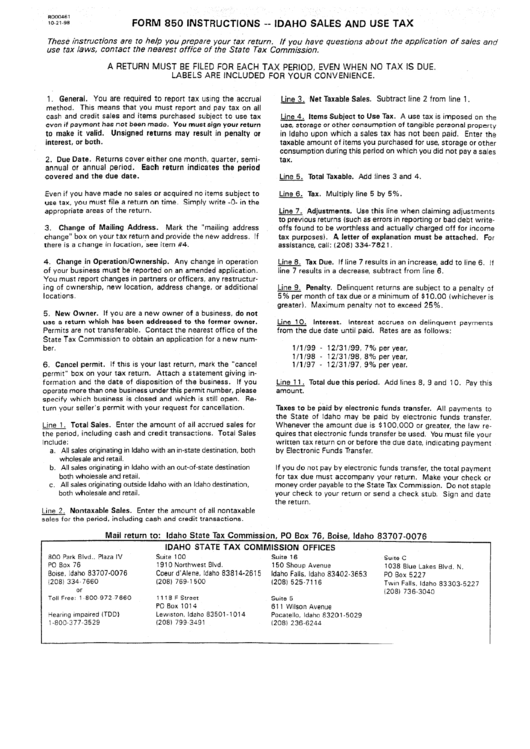

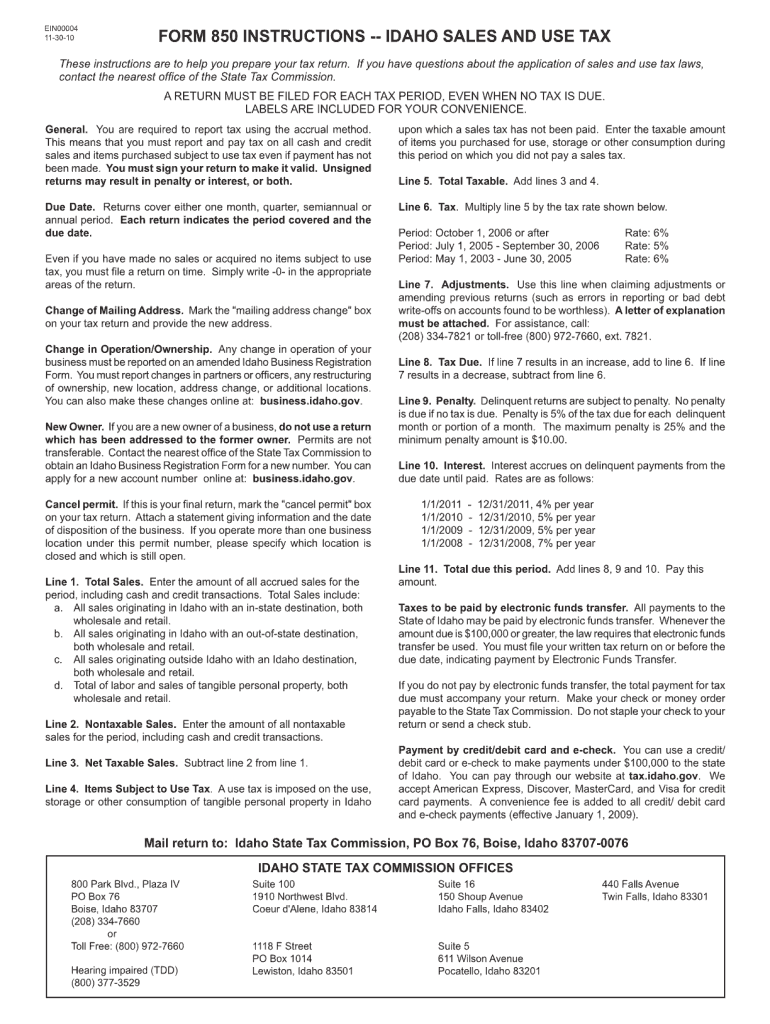

Form 850 Instructions Idaho Sales And Use Tax printable pdf download

Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. Net business income subject to apportionment. Partnerships with all activity in. Web according to idaho instructions for form 40, “if you're required to file a federal income tax return, you must file an idaho return. Form 44 form 42 idaho.

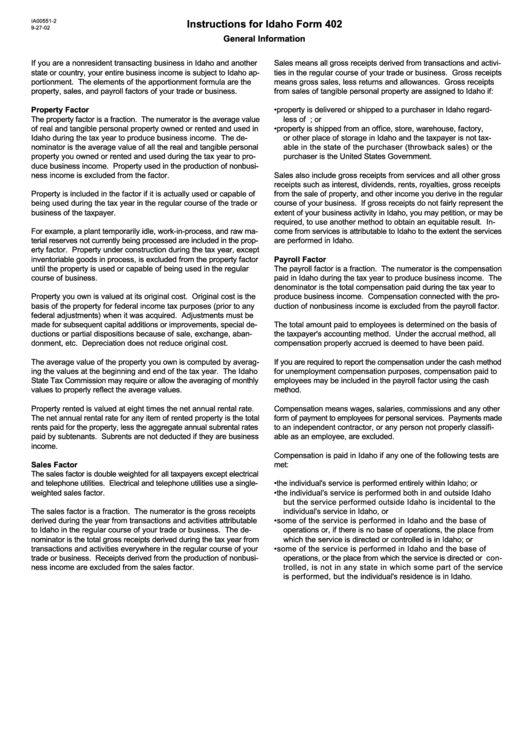

Instructions For Idaho Form 402 printable pdf download

Official court record rule 4. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Exceptions to electronic filing of. Use of electronic filing system rule 5. I know that submitting false information can result in criminal and civil.

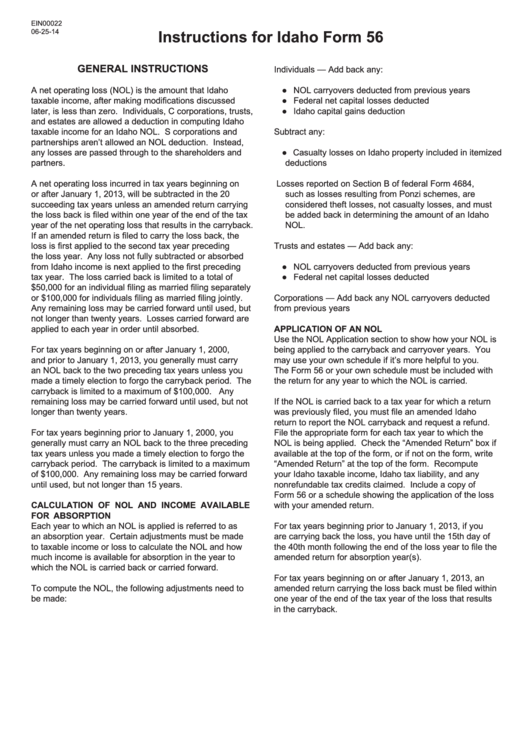

Instructions For Idaho Form 56 printable pdf download

Web general tax return information. Web idaho rules of civil procedure rule 65. Web income tax for partnerships. Exceptions to electronic filing of. The partnership must provide each.

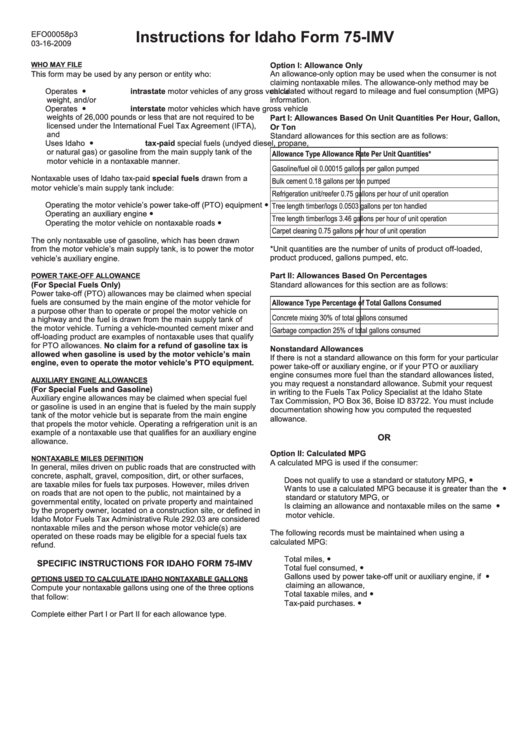

Instructions For Idaho Form 75Imv printable pdf download

View all 66 idaho income tax forms form sources: Partnership return of income and instructions 2021. Applicability of these rules rule 2. The partnership must provide each partner with an idaho. Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate & multinational.

Idaho Form 850 PDF Fill Out and Sign Printable PDF Template signNow

Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form. Web income tax for partnerships. Beneficiary’s percentage of distributive share % owner’s share of profit and. A partnership must file idaho form 65 if either of the following are true: The partnership must provide each partner with an idaho.

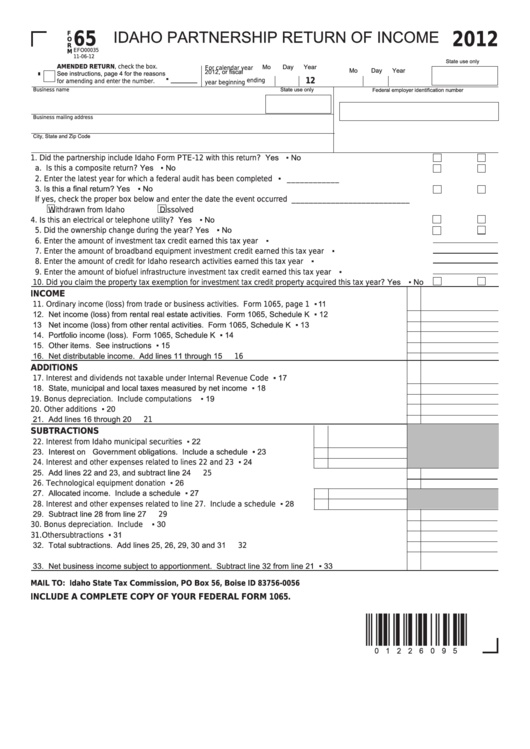

Fillable Form 65 Idaho Partnership Return Of 2012 printable

The court may issue a preliminary injunction only on. Use of electronic filing system rule 5. Partnerships with all activity in idaho enter 100%. Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate & multinational. Web 11 rows 2022.

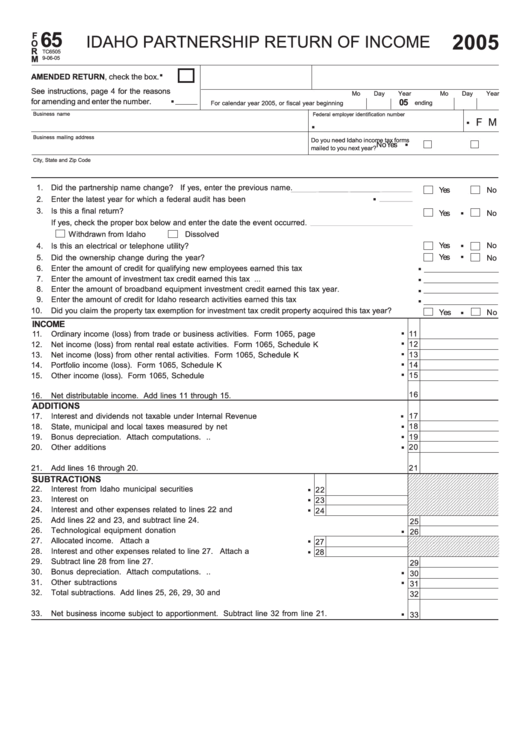

Form 65 Idaho Partnership Return Of 2005 printable pdf download

The court may issue a preliminary injunction only on. Web income tax for partnerships. Web who qualifies to use this form you can use this form if all of these are true: Web general tax return information. The partnership must provide each.

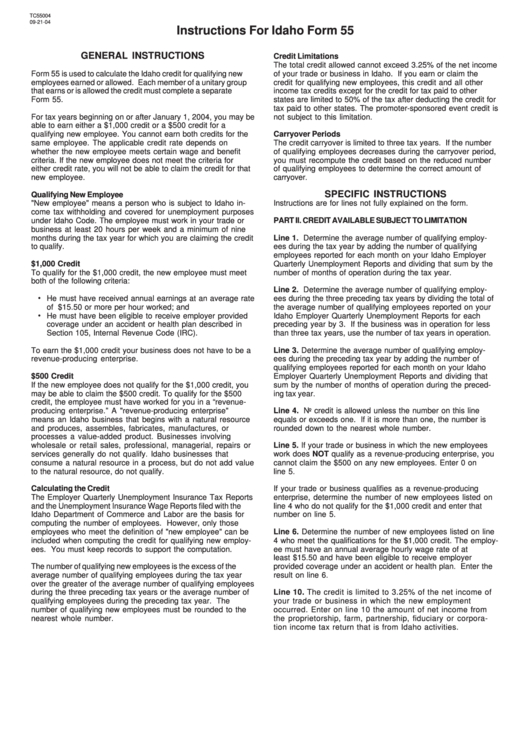

Instructions For Idaho Form 55 2004 printable pdf download

Exceptions to electronic filing of. Maintaining a home for a family member age 65 or older or a family member with a developmental disability you may claim this credit if your gross income is less than the. Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate & multinational. The court may issue a.

Web Income Tax For Partnerships.

Partnerships with all activity in idaho enter 100%. Exceptions to electronic filing of. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. The court may issue a preliminary injunction only on.

Official Court Record Rule 4.

Beneficiary’s percentage of distributive share % owner’s share of profit and. Web form 65 — instructions partnership return of income 2021 instructions are for lines not fully explained on the form. Applicability of these rules rule 2. Web idaho rules of civil procedure rule 65.

Web By Signing This Form, I Certify That The Statements I Made On This Form Are True And Correct.

Partnerships with all activity in. I know that submitting false information can result in criminal and civil. Web according to idaho instructions for form 40, “if you're required to file a federal income tax return, you must file an idaho return. Web 11 rows 2022.

Web Fuels Taxes And Fees Forms.

Form 44 form 42 idaho business income tax credits supplemental schedule for and credit recapture multistate & multinational. Use of electronic filing system rule 5. A partnership must file idaho form 65 if either of the following are true: Web form 65 — instructions partnership return of income 2020 instructions are for lines not fully explained on the form.