Idaho Form 967

Idaho Form 967 - Contact us if you have questions that aren't answered on this website. The deadline for filing the form 967, idaho annual withholding report is january 31. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Web this form is to help you estimate your penalty and interest. Sign the return if you’re filing on paper. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record).

Web this form is to help you estimate your penalty and interest. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Contact us if you have questions that aren't answered on this website. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. This is the fastest way to submit the information. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. The deadline for filing the form 967, idaho annual withholding report is january 31.

Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. Web friday january 14, 2022. This is the fastest way to submit the information. Sign the return if you’re filing on paper. Please make sure to choose the correct tax type before entering your information. Contact us if you have questions that aren't answered on this website. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission.

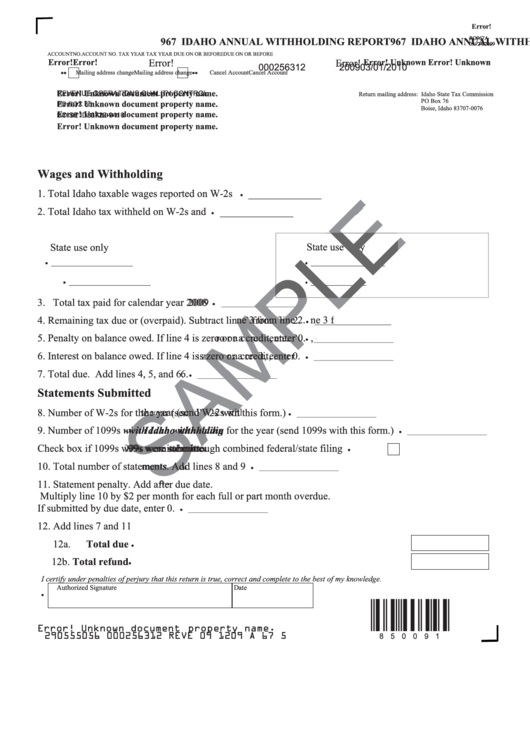

Form 967 Idaho Annual Withholding Report Instructions printable pdf

Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Please make sure to choose the correct tax type before entering your information. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This form is for income earned in tax year 2022, with.

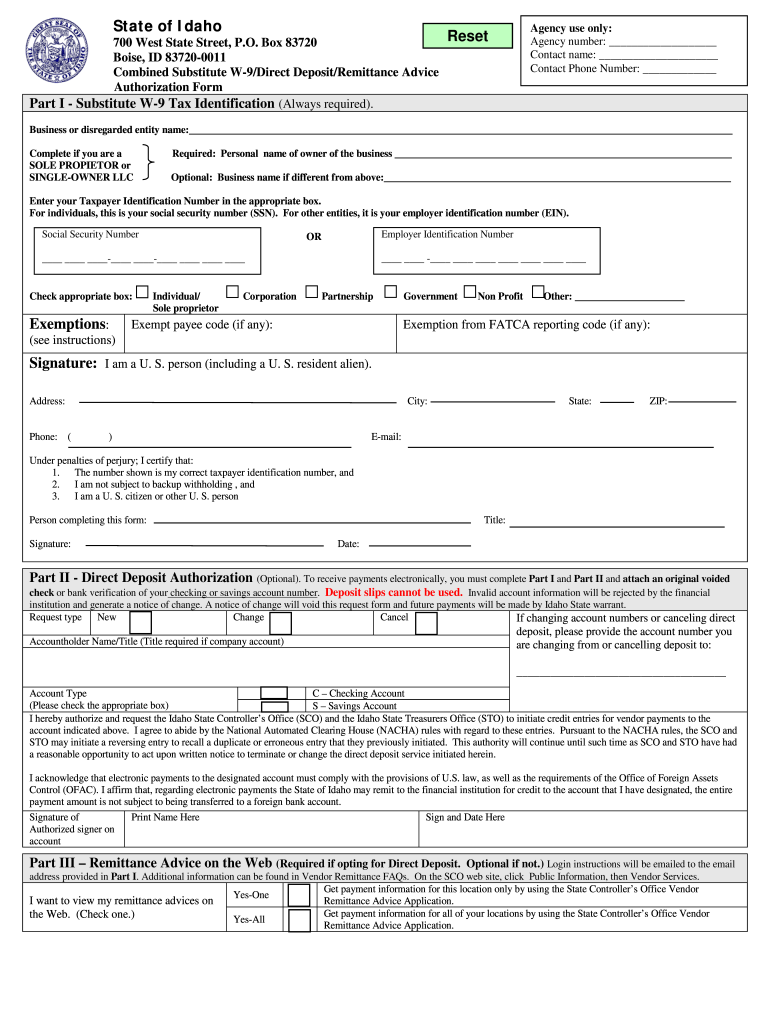

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and.

1+ Idaho POLST Form Free Download

Please make sure to choose the correct tax type before entering your information. Contact us if you have questions that aren't answered on this website. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing.

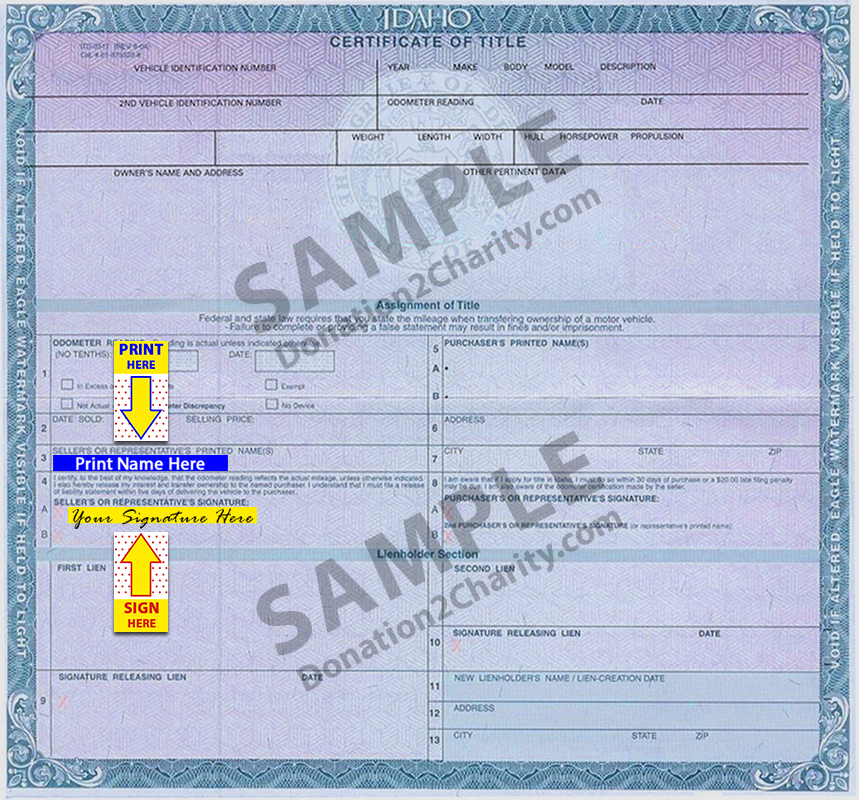

Idaho Donation2Charity

Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Sign the return if you’re filing on paper. This is the fastest way to submit the information. Web friday january 14, 2022. Web this form is to help you estimate your penalty and interest.

Form Ro967a 967 Idaho Annual Withholding Report 2009 printable pdf

Sign the return if you’re filing on paper. Web friday january 14, 2022. This is the fastest way to submit the information. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros.

W 9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. The deadline for filing the form 967, idaho annual withholding report is january 31. Web this form is to help you estimate your penalty and interest. Sign the return if you’re filing on paper. Contact us if you.

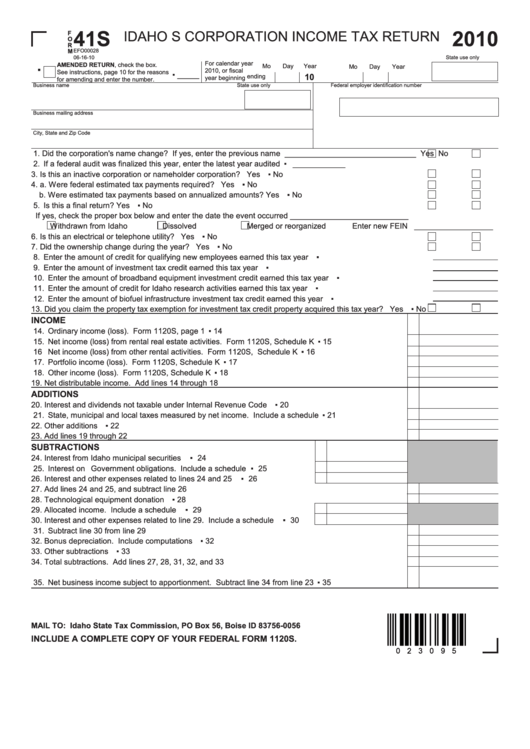

Form 41s Idaho S Corporation Tax Return,form Id K1 Partner

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. This is the fastest way to.

Idaho Form 967 Fill and Sign Printable Template Online US Legal Forms

Contact us if you have questions that aren't answered on this website. This is the fastest way to submit the information. Sign the return if you’re filing on paper. The deadline for filing the form 967, idaho annual withholding report is january 31. Web this form is to help you estimate your penalty and interest.

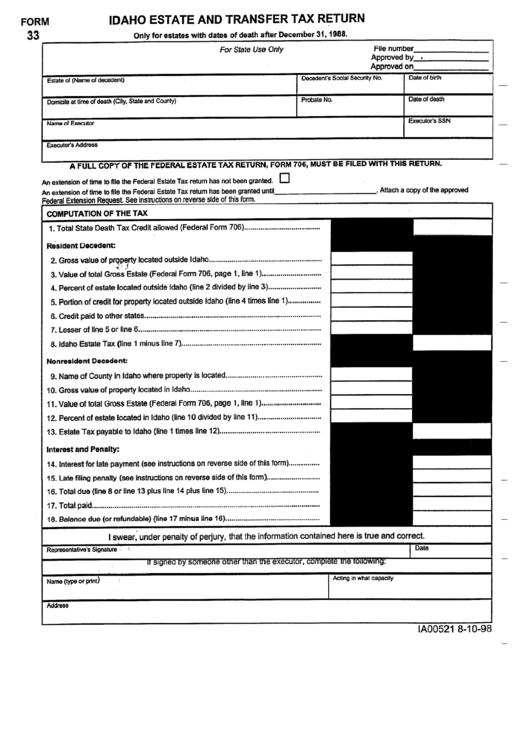

Form 33 Idaho Estate And Transfer Tax Return printable pdf download

Sign the return if you’re filing on paper. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. The deadline for filing the form 967, idaho annual withholding report is january 31. Please.

1+ Idaho Offer to Purchase Real Estate Form Free Download

Sign the return if you’re filing on paper. This is the fastest way to submit the information. Web friday january 14, 2022. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This form is for income earned in tax year 2022, with tax returns.

Web Friday January 14, 2022.

Contact us if you have questions that aren't answered on this website. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Web this form is to help you estimate your penalty and interest.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Idaho Government.

This is the fastest way to submit the information. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. The deadline for filing the form 967, idaho annual withholding report is january 31.

Sign The Return If You’re Filing On Paper.

Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Please make sure to choose the correct tax type before entering your information. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding.