Idaho State Tax Return Form

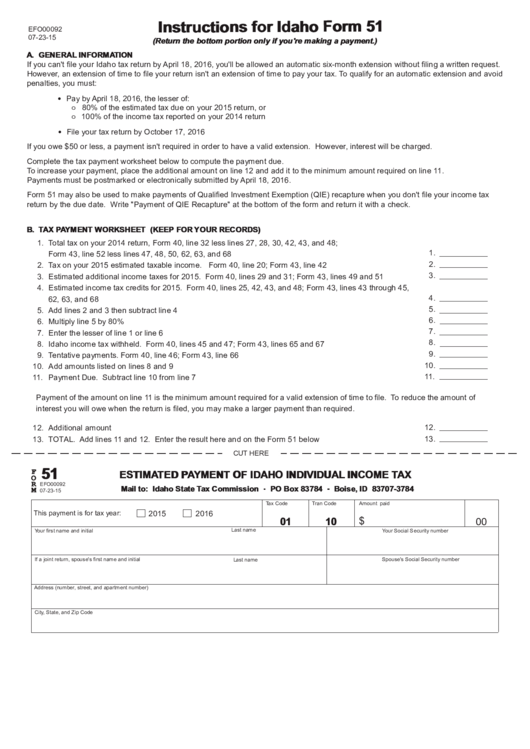

Idaho State Tax Return Form - Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web eligible homeowners can now apply online for property tax deferral. Web form 51 is available in the program and can be accessed from the main menu of the idaho tax return by selecting penalties, interest & estimated tax > idaho estimated payments. Sales tax resale or exemption certificate;. Individual tax return form 1040 instructions; Web individual income tax forms; Head over to the federal income tax forms page to get any forms you need for completing your federal income. Find forms for your industry in minutes. Web if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete form 40 (residents) or form 43.

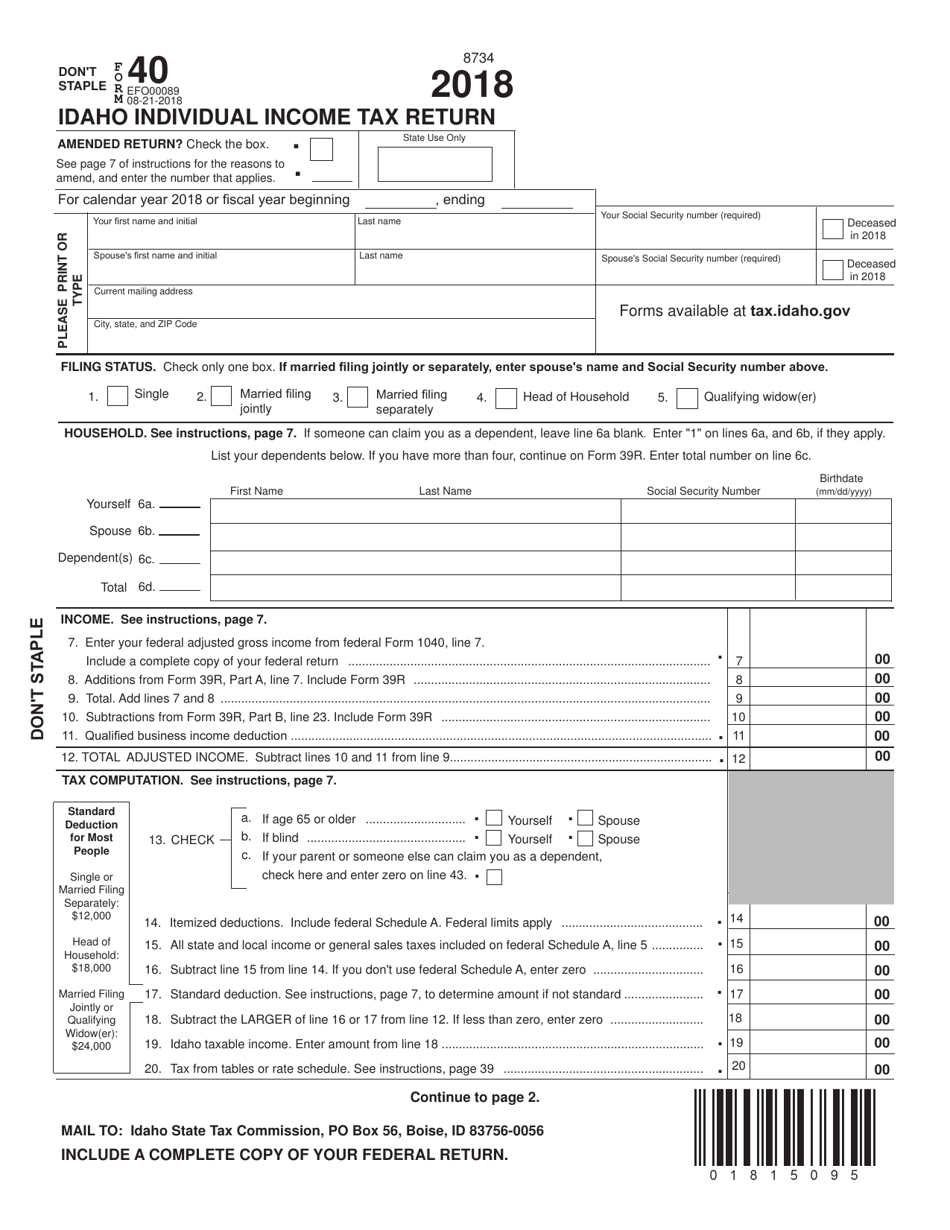

Last name social security number street address start date (mm/dd/yyyy) city state zip employee. Web we last updated the idaho individual income tax return in february 2023, so this is the latest version of form 40, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Travel & convention tax forms; This form is for income earned in tax year 2022, with tax returns due in april 2023. It has offices in the capital — boise — and throughout idaho. Head over to the federal income tax forms page to get any forms you need for completing your federal income. Your average tax rate is 11.67% and your marginal tax rate is 22%. State use only see page 7 of the instructions for the reasons to amend, and enter. State use only see page 7 of the instructions for the reasons to amend, and enter the number that.

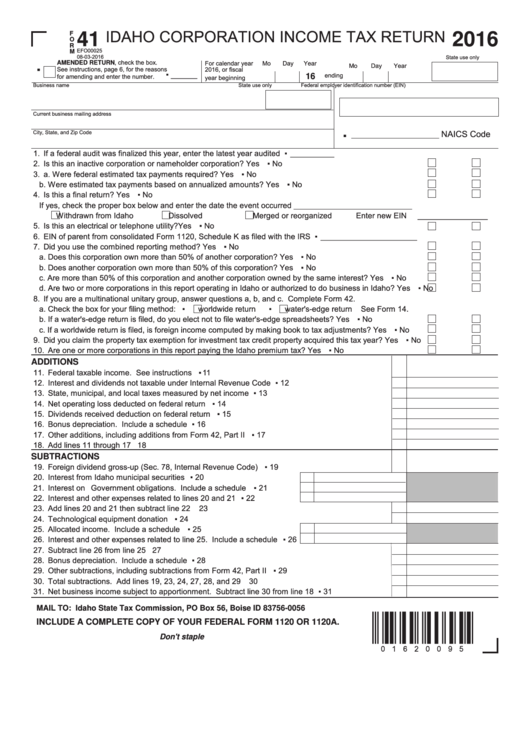

Download or email id form 41 & more fillable forms, register and subscribe now! Sales tax resale or exemption certificate;. Web form 51 is available in the program and can be accessed from the main menu of the idaho tax return by selecting penalties, interest & estimated tax > idaho estimated payments. Find forms for your industry in minutes. Web form 96 annual information return name of person or organization form 96 annual information return social security number or ein current mailing address under. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the idaho state tax commission is the government agency responsible for collecting individual income taxes. Complete, edit or print tax forms instantly. Web city state 8 zip fax employee information first name m.i. Be sure to verify that the form you are.

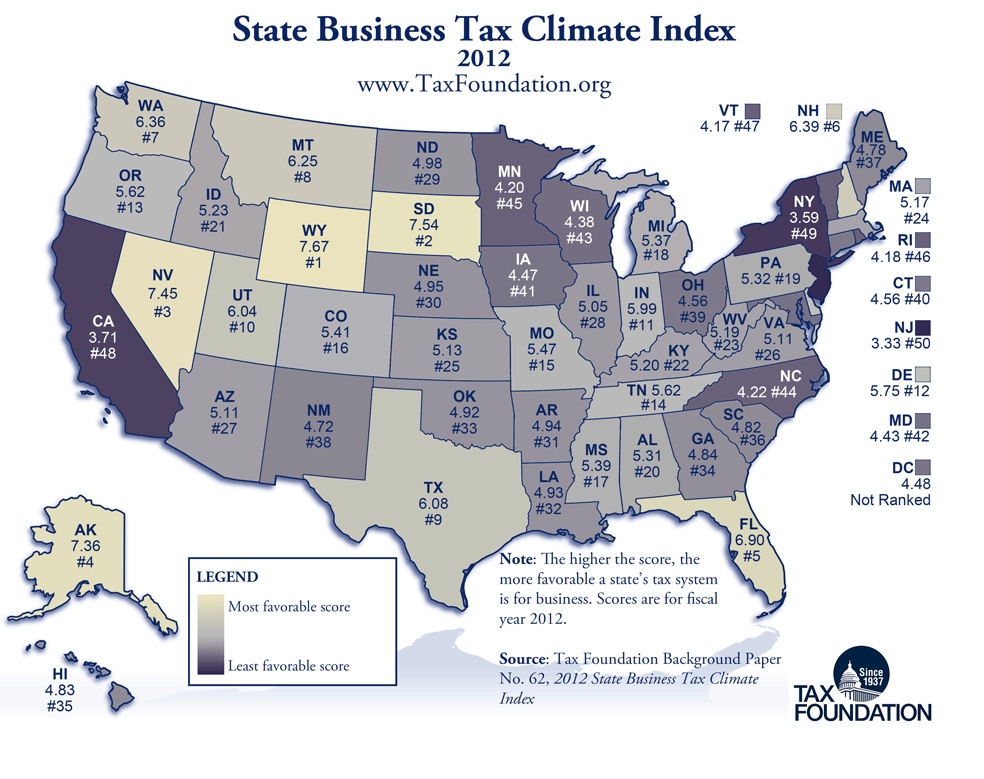

Idaho Ranks 21st in the Annual State Business Tax Climate Index

Request for copies of idaho tax returns; It has offices in the capital — boise — and throughout idaho. Web the idaho state tax commission is the government agency responsible for collecting individual income taxes. Web form 40 2021 individual income tax return amended return? Sales tax resale or exemption certificate;.

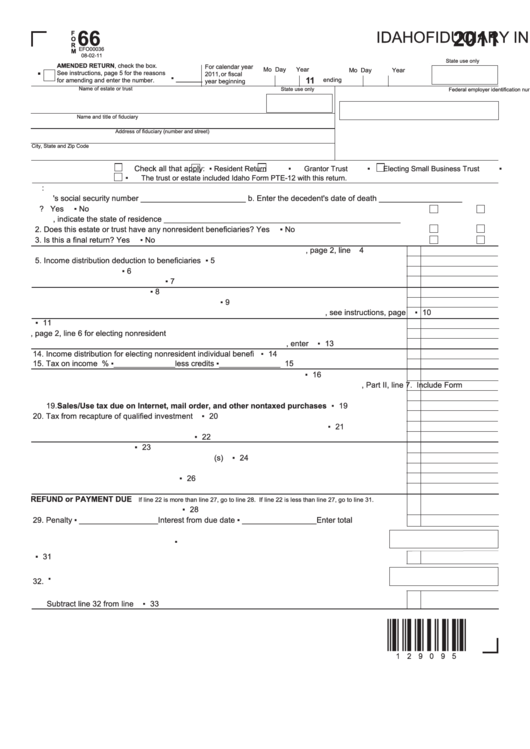

Fillable Form 66 Idaho Fiduciary Tax Return/form Id K1

Web if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete form 40 (residents) or form 43. Web city state 8 zip fax employee information first name m.i. Web individual income tax return amended return? Sales and use tax forms; Your average tax rate is.

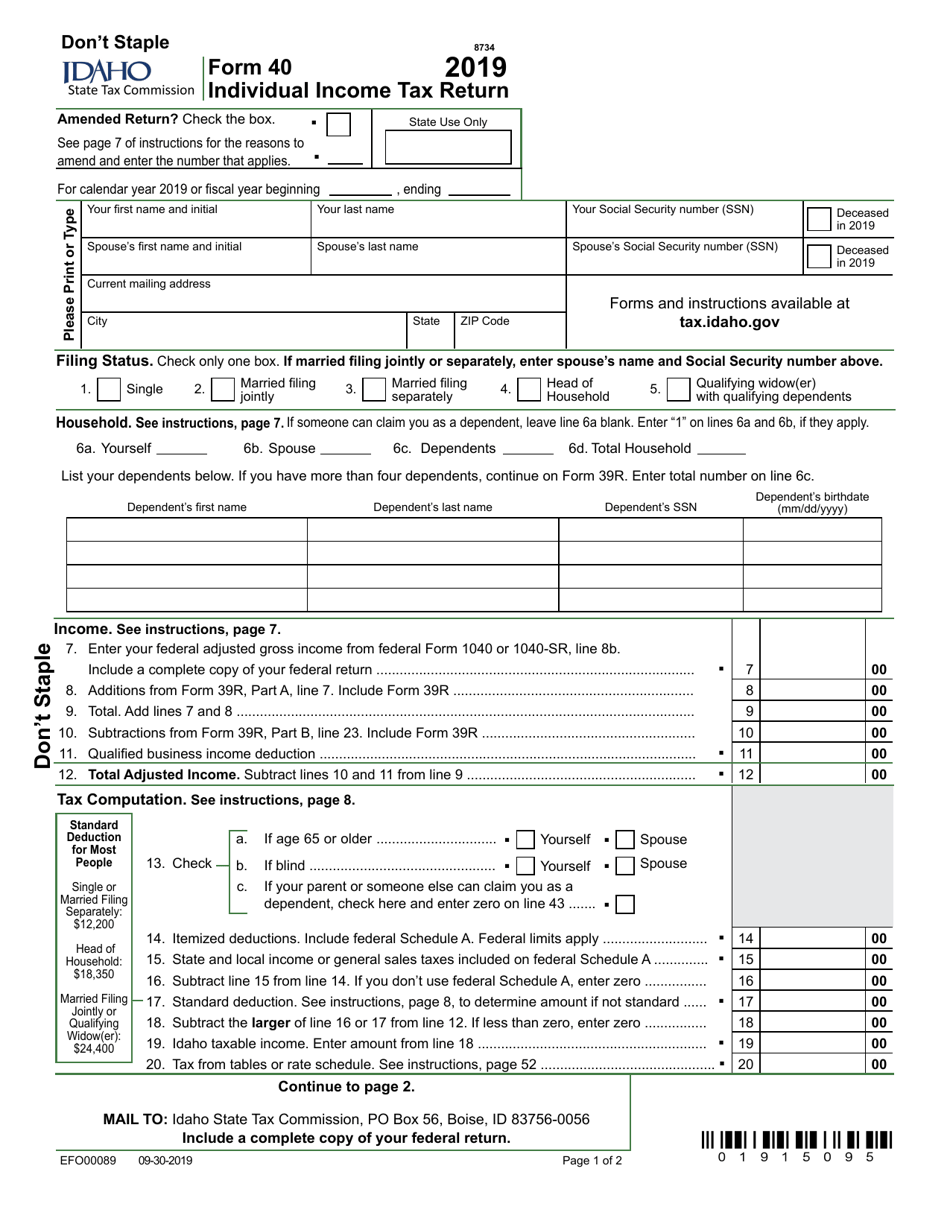

Form 40 Download Fillable PDF or Fill Online Individual Tax

Be sure to verify that the form you are. Web idaho tax forms for 2022 and 2023. Web individual income tax return amended return? Individual tax return form 1040 instructions; Web 22 rows 1 next printed all of your idaho income tax forms?

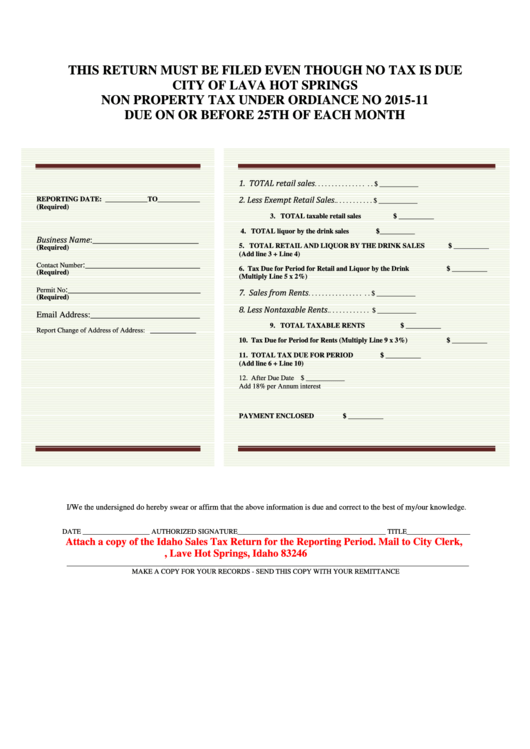

Idaho Sales Tax Return Form printable pdf download

Sales tax resale or exemption certificate;. Be sure to verify that the form you are. Web popular forms & instructions; Individual income tax return 2022. Your average tax rate is 11.67% and your marginal tax rate is 22%.

Idaho State Tax Commission seeing increase of falsely filed tax returns

Individual income tax return 2022. Web individual income tax forms; Sales and use tax forms; Individual tax return form 1040 instructions; Web form 96 annual information return name of person or organization form 96 annual information return social security number or ein current mailing address under.

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

Individual income tax return 2021. Web idaho tax forms for 2022 and 2023. Where i your idaho tax refund money? Web idaho has a state income tax that ranges between 1.125% and 6.925%. Complete, edit or print tax forms instantly.

Tax Rebate Coming To Idahoans This Summer Boise State Public Radio

You can download or print. Web form 40 2021 individual income tax return amended return? If you make $70,000 a year living in idaho you will be taxed $11,368. Web eligible homeowners can now apply online for property tax deferral. It has offices in the capital — boise — and throughout idaho.

Form EFO00089 (40) Download Fillable PDF or Fill Online Idaho

Details on how to only prepare and print an idaho tax return. Sales tax resale or exemption certificate;. Where i your idaho tax refund money? Your average tax rate is 11.67% and your marginal tax rate is 22%. Web form 96 annual information return name of person or organization form 96 annual information return social security number or ein current.

Fillable Form 41 Idaho Corporation Tax Return 2016 printable

Sales tax resale or exemption certificate;. Individual tax return form 1040 instructions; Boise, idaho — august 1, 2023 — you might qualify to have your. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Web city state 8 zip fax employee information first name m.i.

Idaho State Tax Commission Adjusted Return Letter Sample 1

Be sure to verify that the form you are. Web city state 8 zip fax employee information first name m.i. Individual income tax return 2022. Complete, edit or print tax forms instantly. Web eligible homeowners can now apply online for property tax deferral.

Web We Last Updated The Idaho Individual Income Tax Return In February 2023, So This Is The Latest Version Of Form 40, Fully Updated For Tax Year 2022.

Individual income tax return 2022. Web popular forms & instructions; Web individual income tax forms; Web individual income tax return amended return?

If You Make $70,000 A Year Living In Idaho You Will Be Taxed $11,368.

Web idaho tax forms for 2022 and 2023. Web idaho has a state income tax that ranges between 1.125% and 6.925%. Head over to the federal income tax forms page to get any forms you need for completing your federal income. Boise, idaho — august 1, 2023 — you might qualify to have your.

Web Form 96 Annual Information Return Name Of Person Or Organization Form 96 Annual Information Return Social Security Number Or Ein Current Mailing Address Under.

Individual tax return form 1040 instructions; Details on how to only prepare and print an idaho tax return. State use only see page 7 of the instructions for the reasons to amend, and enter the number that. Complete, edit or print tax forms instantly.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Your average tax rate is 11.67% and your marginal tax rate is 22%. Be sure to verify that the form you are. Where i your idaho tax refund money? Web city state 8 zip fax employee information first name m.i.