Il 1065 Form

Il 1065 Form - Amended partnership replacement tax return. Enter your federal employer identification number (fein). If no payment is due or you make your. Get ready for tax season deadlines by completing any required tax forms today. Electronic filing is supported for the current year and two prior years. Return of partnership income partnerships file an information return to report their income, gains, losses, deductions, credits, etc. , 2022, ending , 20. To “illinois department of revenue.”) if no payment is due or you make your. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. For calendar year 2022, or tax year beginning.

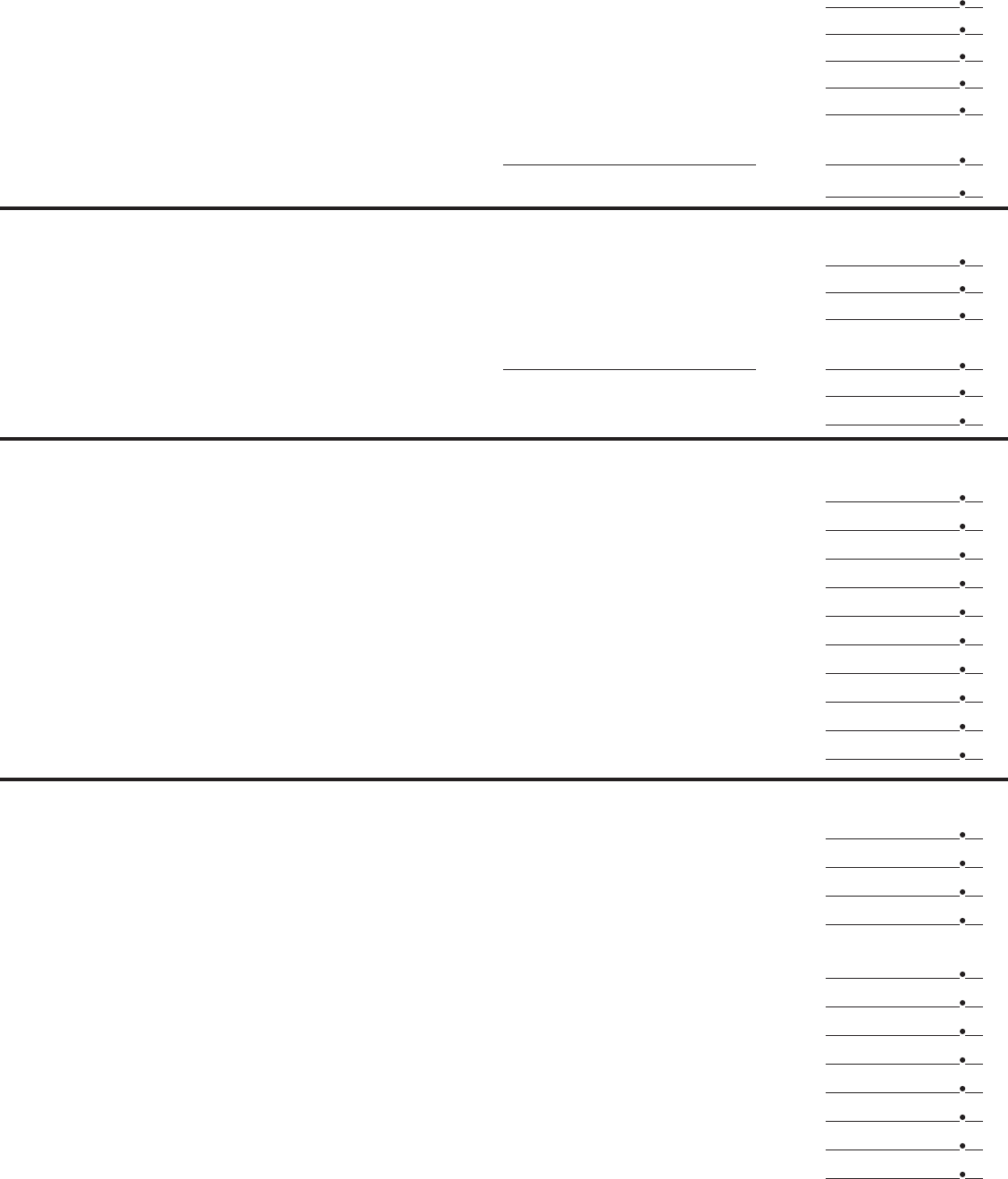

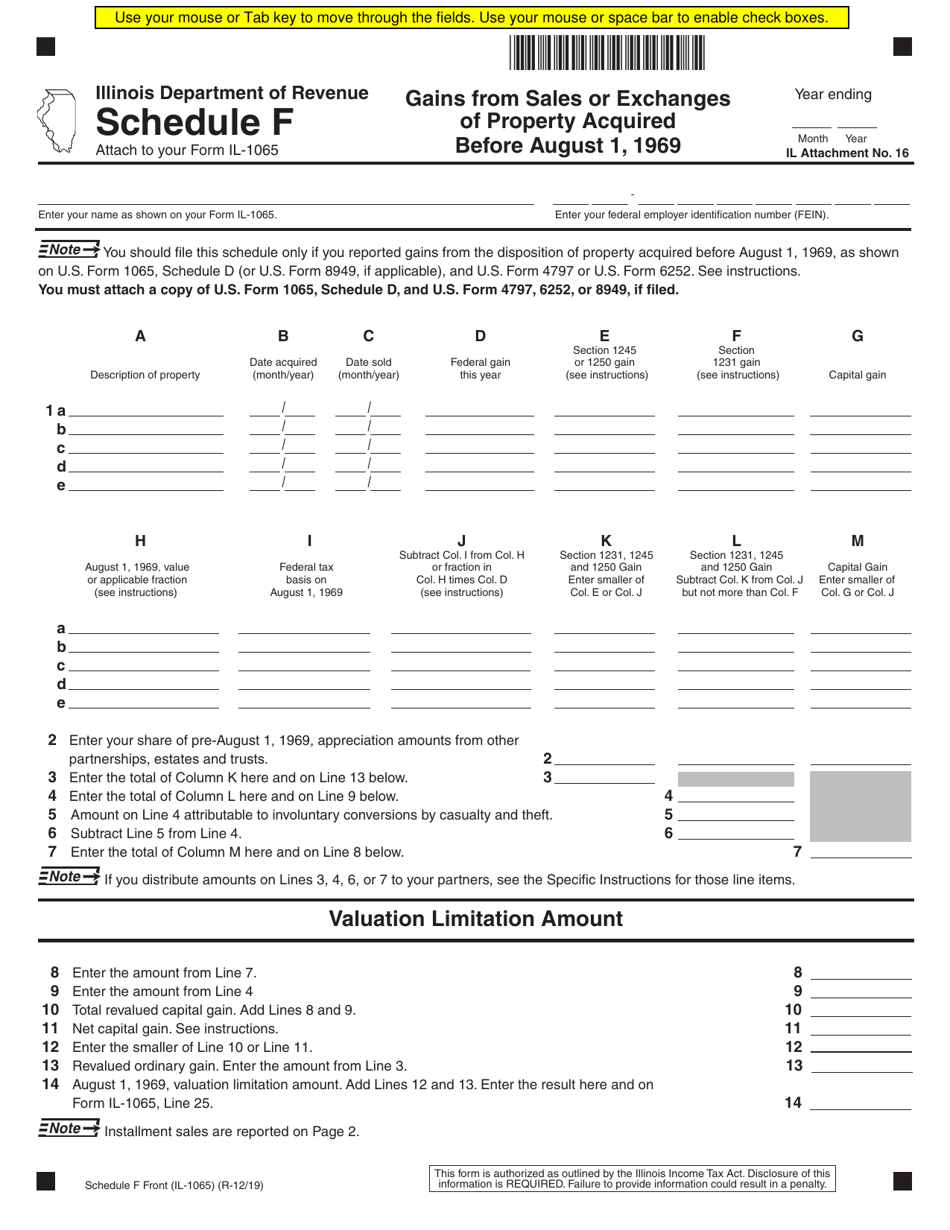

Amended partnership replacement tax return. , 2022, ending , 20. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. For instructions and the latest information. Indicate what tax year you are amending: Get ready for tax season deadlines by completing any required tax forms today. Enter your federal employer identification number (fein). For calendar year 2022, or tax year beginning. A partnership does not pay. Return of partnership income partnerships file an information return to report their income, gains, losses, deductions, credits, etc.

To “illinois department of revenue.”) if no payment is due or you make your. Indicate what tax year you are amending: For instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. A partnership does not pay. Web yment is due or you make your payment electronically, do not file this form.if no pa official use only $ 00 *63112231w* payment amount (whole dollars only) write your fein, tax. If no payment is due or you make your. Indicate what tax year you are amending: Amended partnership replacement tax return. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment.

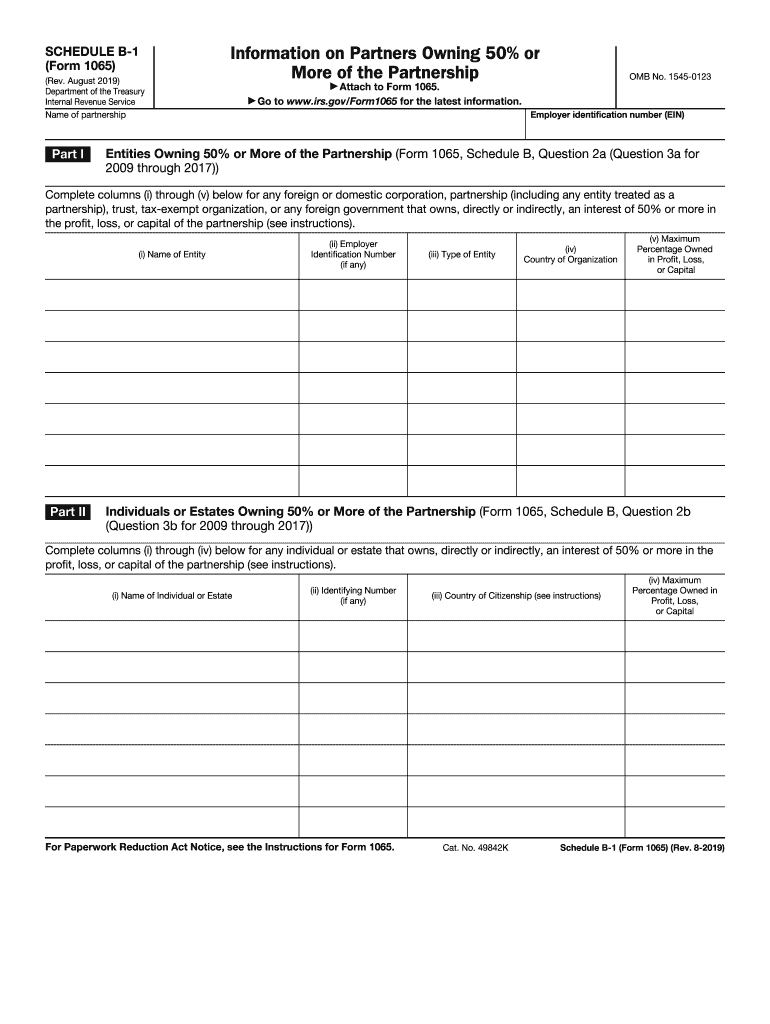

IRS 1065 Schedule B1 20192021 Fill and Sign Printable Template

Amended partnership replacement tax return. Payment voucher replacement tax illinois department of revenue. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Complete, edit or print tax forms instantly. Read this information first you must read the.

2014 Form Il1065, Partnership Replacement Tax Return Edit, Fill

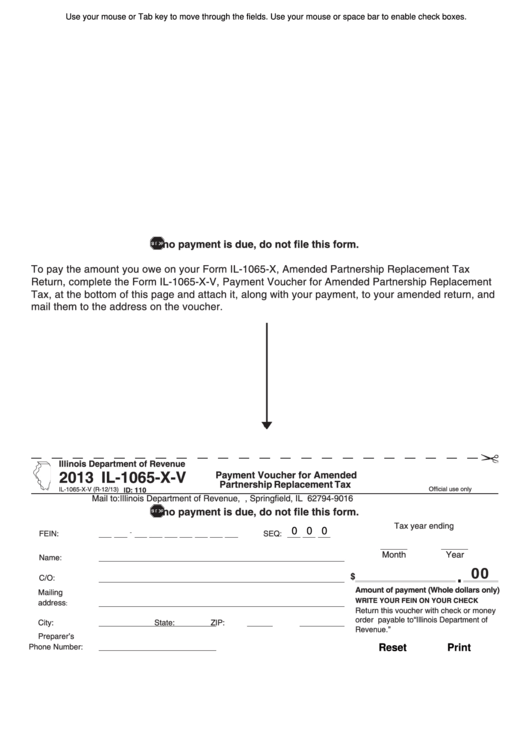

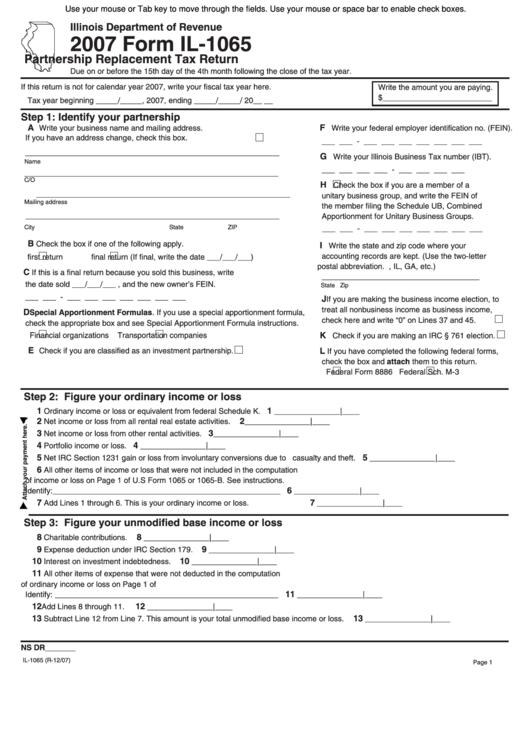

Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Electronic filing is supported for the current year and two prior years. Amended partnership replacement tax return. To “illinois department of revenue.”) if no payment is due or you.

2016 Form Il1065, Partnership Replacement Tax Return Edit, Fill

, 2022, ending , 20. Complete, edit or print tax forms instantly. Indicate what tax year you are amending: Enter your federal employer identification number (fein). Amended partnership replacement tax return.

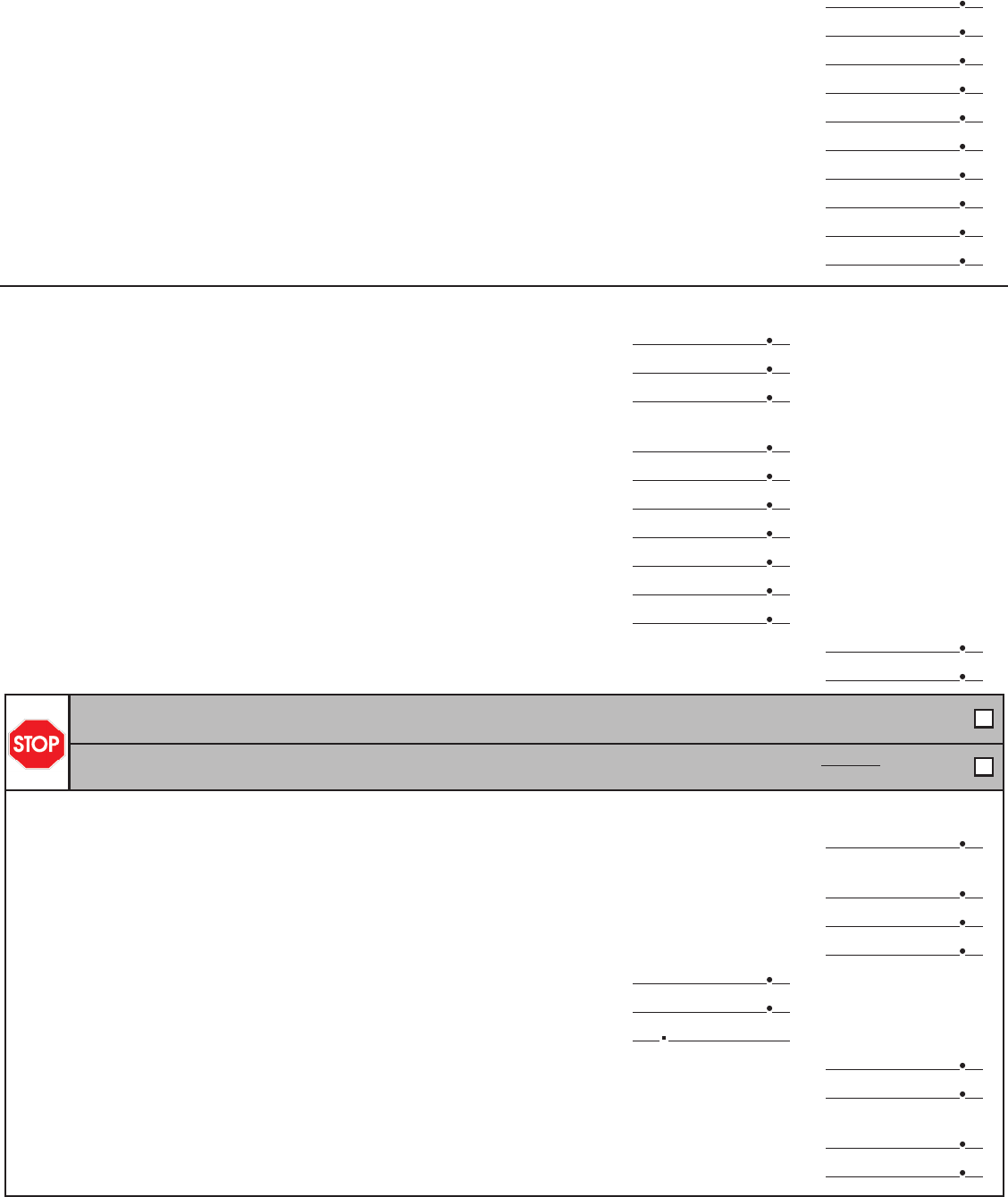

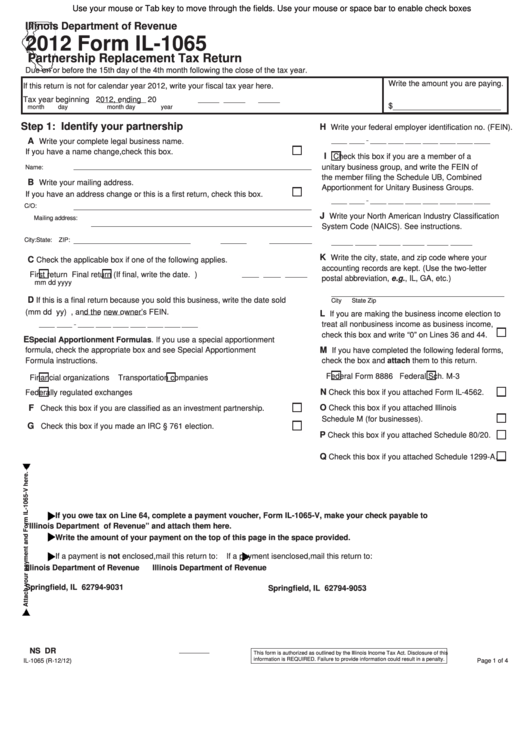

Fillable Form Il1065, Partnership Replacement Tax Return 2012

Enter your federal employer identification number (fein). Web about form 1065, u.s. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. For instructions and the latest information. If no payment is due or you make your.

Form 2012 Il1065, Partnership Replacement Tax Return Edit, Fill

Payment voucher replacement tax illinois department of revenue. If no payment is due or you make your. Indicate what tax year you are amending: To “illinois department of revenue.”) if no payment is due or you make your. Indicate what tax year you are amending:

Fillable Form Il1065XV Payment Voucher For Amended Partnership

Return of partnership income partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Web yment is due or you make your payment electronically, do not file this form.if no pa official use only $ 00 *63112231w* payment amount (whole dollars only) write your fein, tax. A partnership does not pay. Electronic filing is supported for.

Fillable Form Il1065 Partnership Replacement Tax Return 2007

Return of partnership income partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Indicate what tax year you are amending: Get ready for tax season deadlines by completing any required tax forms today. If no payment is due or you make your. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois.

Form IL1065 Schedule F Download Fillable PDF or Fill Online Gains From

For calendar year 2022, or tax year beginning. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Indicate what.

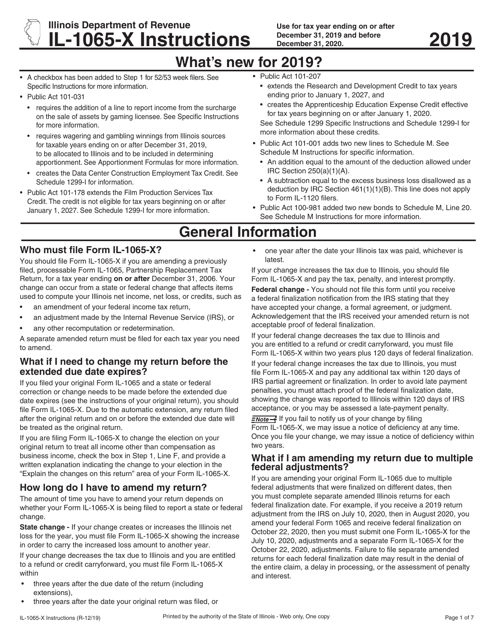

Download Instructions for Form IL1065X ' amended Partnership

Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Amended partnership replacement tax return. , 2022, ending , 20. If no payment is due or you make your. Amended partnership replacement tax return.

Form 1065 E File Requirements Universal Network

A partnership does not pay. For instructions and the latest information. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Electronic filing is supported for the current year and two prior years. Web illinois income tax forms.

Return Of Partnership Income Partnerships File An Information Return To Report Their Income, Gains, Losses, Deductions, Credits, Etc.

Electronic filing is supported for the current year and two prior years. , 2022, ending , 20. Web yment is due or you make your payment electronically, do not file this form.if no pa official use only $ 00 *63112231w* payment amount (whole dollars only) write your fein, tax. Payment voucher replacement tax illinois department of revenue.

Complete, Edit Or Print Tax Forms Instantly.

If no payment is due or you make your. Enter your federal employer identification number (fein). Read this information first you must read the. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment.

Amended Partnership Replacement Tax Return.

Indicate what tax year you are amending: For instructions and the latest information. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. For calendar year 2022, or tax year beginning.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

A partnership does not pay. Web about form 1065, u.s. Amended partnership replacement tax return. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.