Illinois Chapter 7 Income Limits

Illinois Chapter 7 Income Limits - Web the following are the chapter 7 income limits for illinois households as of august 2021: If you fail the means test, you cannot file a chapter 7 bankruptcy. For individuals, there are two main types of bankruptcies that can be filed: Your average tax rate is 25.0% and your marginal tax rate is 34.6%. Add up all of your income from the last full 6 months. Web it’s the analysis that determines whether you’re eligible for relief under chapter 7 bankruptcy based on your monthly income. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. The “means test” is the method used to determine if you qualify to file ch. Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. Web illinois median income breakdown.

It’s called the bankruptcy means test because it calculates whether. For example, if you are filing on september 15th, include all income. Web updated january 5, 2022 table of contents what are the illinois bankruptcy exemptions, and why are they important in a chapter 7 bankruptcy? Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. Web the illinois income tax was lowered from 5% to 3.75% in 2015. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. The “means test” is the method used to determine if you qualify to file ch. If you fail the means test, you cannot file a chapter 7 bankruptcy. Filing $70,000.00 of earnings will result in $3,344.96 of your earnings being taxed as state tax (calculation based on 2023 illinois. Web “about 90% of the people who file bankruptcy can file chapter 7 based on their income alone because their income is below the median for a family of their size in their location,” pamela foohey, a professor of.

Chapter 7 bankruptcy and chapter 13 bankruptcy. Chapter 7 cases are also referred to as liquidation cases, while chapter 13. If you expect to owe $500 or more on april 15th, you must pay your income tax to illinois. Updated may 10, 2023 table of contents how to file bankruptcy in illinois for free illinois. Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. 7 provides a greater amount of debt relief, income limits and other conditions are placed on who is eligible to use this type of bankruptcy. Add up all of your income from the last full 6 months. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Web the illinois income tax was lowered from 5% to 3.75% in 2015.

2023 Covered California Chart Explained YouTube

Web the following are the chapter 7 income limits for illinois households as of august 2021: If you expect to owe $500 or more on april 15th, you must pay your income tax to illinois. Chapter 7 bankruptcy and chapter 13 bankruptcy. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any.

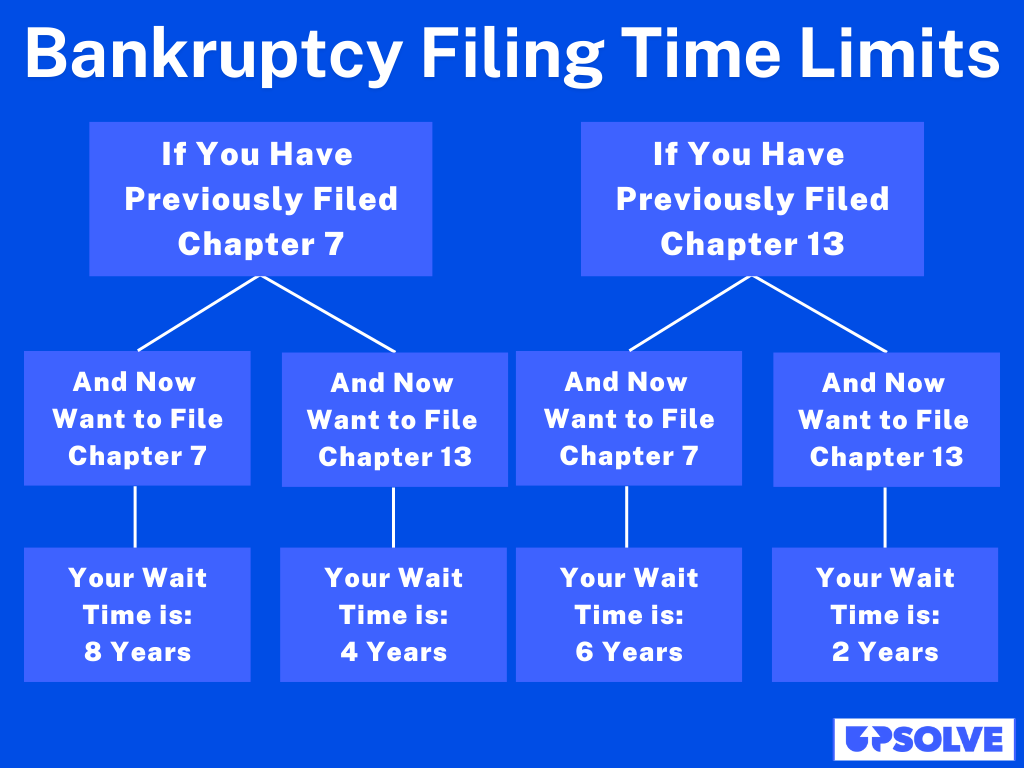

How Often Can I File Bankruptcy? Upsolve

Add $9,000 for each household member exceeding four; Chapter 7 cases are also referred to as liquidation cases, while chapter 13. Web if the leftover income is too high, you fail the means test. Web “about 90% of the people who file bankruptcy can file chapter 7 based on their income alone because their income is below the median for.

30+ Chapter 7 Limits 2022 AemiliaKhiara

Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. Add $9,000 for each household member exceeding four; You probably just did the math in your head. Add up all of your income from.

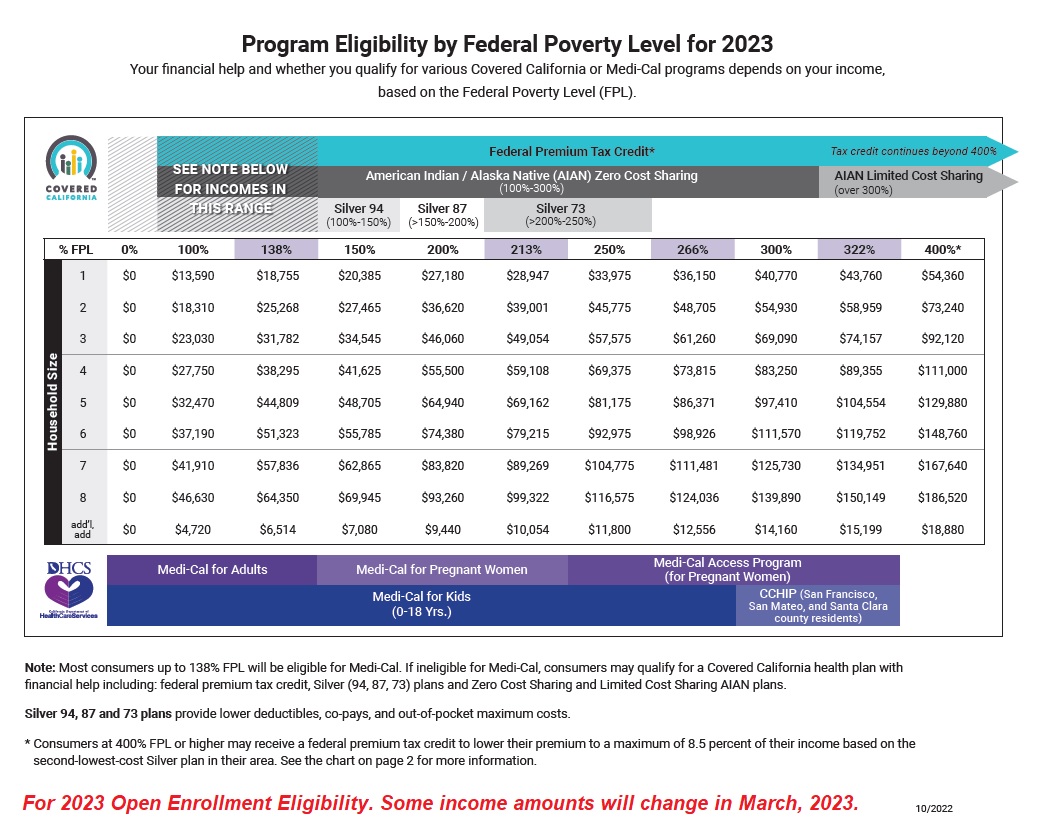

Why Are Your Children Suddenly MediCal in Covered California?

7 provides a greater amount of debt relief, income limits and other conditions are placed on who is eligible to use this type of bankruptcy. Written by attorney andrea wimmer. Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. (see illinois exemptions) the trustee sells the assets and pays you, the debtor, any. Web the.

Illinois Medicaid Archives Medicaid Nerd

Chapter 7 cases are also referred to as liquidation cases, while chapter 13. Updated may 10, 2023 table of contents how to file bankruptcy in illinois for free illinois. (see illinois exemptions) the trustee sells the assets and pays you, the debtor, any. Web when looking at expenses, those who make more than the median household income may still qualify.

Illinois with Holding Tax Return Wikiform Fill Out and Sign

Add $9,000 for each household member exceeding four; Chapter 7 bankruptcy and chapter 13 bankruptcy. For individuals, there are two main types of bankruptcies that can be filed: If your household income is above the state median, you can still qualify for chapter 7 bankruptcy based on your disposable income. The “means test” is the method used to determine if.

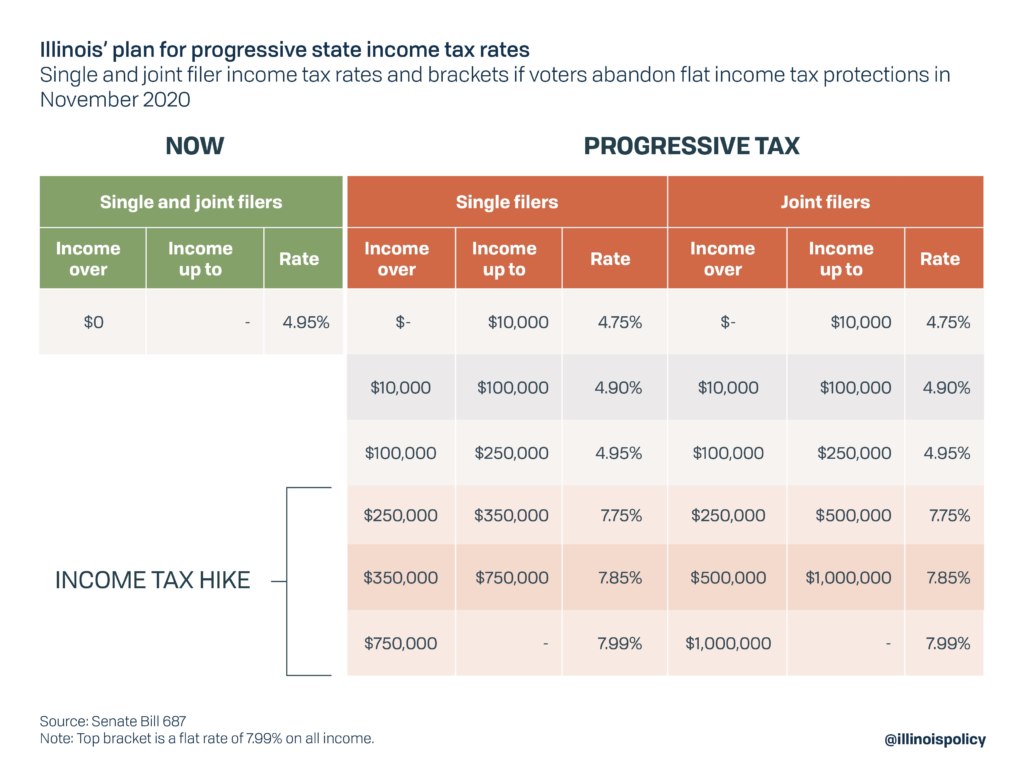

With voters set to decide on progressive tax, Illinois wealth

If you passed, thats great you likely qualify for chapter 7 bankruptcy in illinois. Updated may 10, 2023 table of contents how to file bankruptcy in illinois for free illinois. The means test qualification in illinois is based on your household size, income, and location. You probably just did the math in your head. This marginal tax rate means that.

Limits for Chapter 7 Bankruptcies Bruner Wright P.A.

Web illinois median income breakdown. It’s called the bankruptcy means test because it calculates whether. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Web “about 90% of the people who file bankruptcy can file chapter 7 based on their income alone because their income is below the median for a family.

Colorado Means Test Ascend Blog

Previously, the tax rate was raised from 3% to 5% in early 2011 as part of a statewide plan to reduce deficits. Updated may 10, 2023 table of contents how to file bankruptcy in illinois for free illinois. If you passed, thats great you likely qualify for chapter 7 bankruptcy in illinois. We provide helpful tips and resources to help.

Illinois’ latest progressive tax ad Seven things every Illinoisan

Web the following are the chapter 7 income limits for illinois households as of august 2021: Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. If you expect to owe $500 or more on april 15th, you must pay your income tax to illinois. Introduction to.

Introduction To General Financial Requirements (A) 130 Cmr 520.000 Describes The Rules Governing Financial Eligibility For Masshealth.

Does illinois allow the use of federal bankruptcy exemptions? Web if you make $75,000 a year living in the region of illinois, usa, you will be taxed $18,718. Web the following are the chapter 7 income limits for illinois households as of august 2021: For example, if you are filing on september 15th, include all income.

(See Illinois Exemptions) The Trustee Sells The Assets And Pays You, The Debtor, Any.

Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. Chapter 7 cases are also referred to as liquidation cases, while chapter 13. Web if the leftover income is too high, you fail the means test.

If You Passed, Thats Great You Likely Qualify For Chapter 7 Bankruptcy In Illinois.

You probably just did the math in your head. We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. If your household income is above the state median, you can still qualify for chapter 7 bankruptcy based on your disposable income. Web the illinois income tax was lowered from 5% to 3.75% in 2015.

If You Fail The Means Test, You Cannot File A Chapter 7 Bankruptcy.

Your average tax rate is 25.0% and your marginal tax rate is 34.6%. This marginal tax rate means that your immediate additional income. The “means test” is the method used to determine if you qualify to file ch. Filing $70,000.00 of earnings will result in $3,344.96 of your earnings being taxed as state tax (calculation based on 2023 illinois.