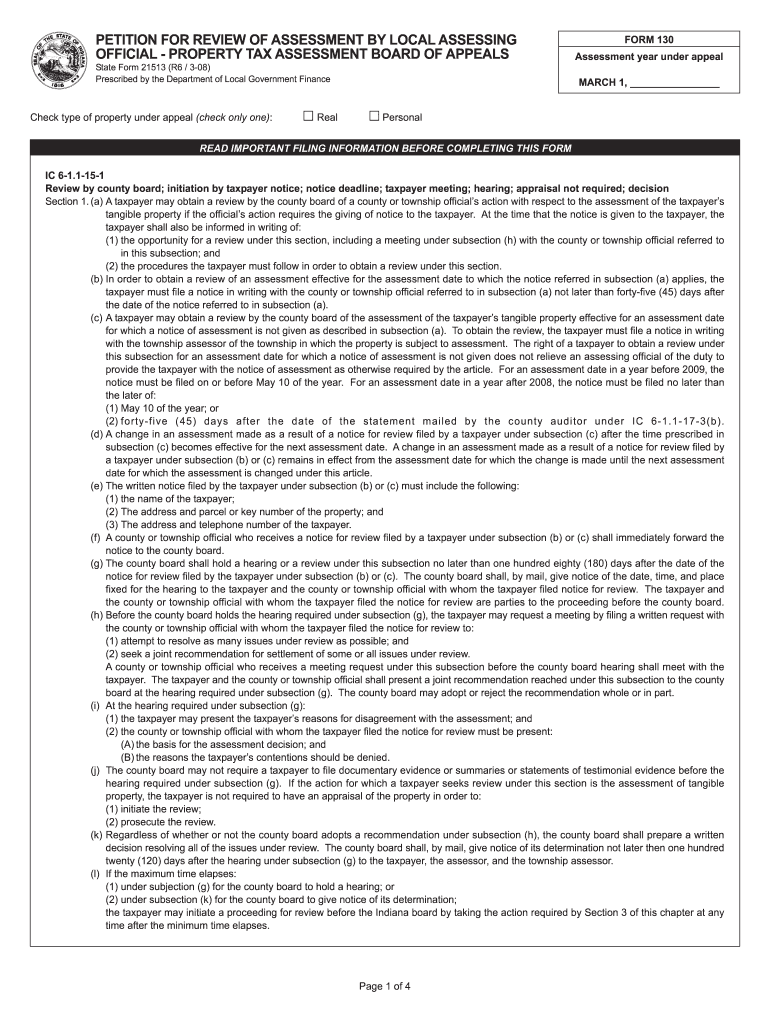

Indiana Form 130

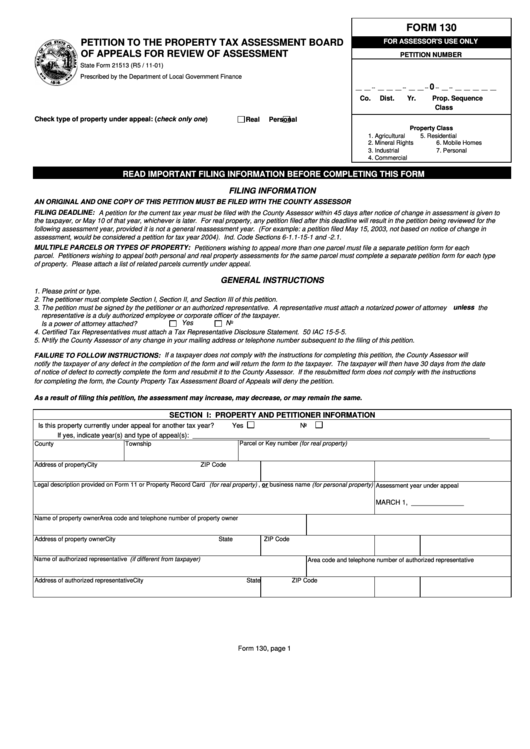

Indiana Form 130 - If you disagree with the determination of the ptaboa you may file an appeal at the state level with the indiana board of tax review (ibtr). Taxpayer’s notice to initiate an appeal. Petition for review of assessment before the indiana board of tax review. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. Web property tax assessment appeals process. Web taxpayer files a property tax appeal with assessing official. Pay my tax bill in installments. We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government. Form 130 taxpayer's notice to initiate an appeal Notice of annual session all ptaboa meetings will begin at 9:00 am and will be held in suite 419 of the edwin rousseau centre located at 1 east main street, fort wayne, indiana 46802.

This form is for income earned in tax year 2022, with tax returns due in april 2023. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Forget about scanning and printing out forms. Web you will receive the results of the determination by mail in the form of a form 115. Petition for review of assessment before the indiana board of tax review. Driver's record, title & lien and registration search. To correctly fill out the form, follow the instructions below: Procedure for appeal of assessment flow chart. The ibtr has also created several samples of documents often submitted as part of the hearing process. Try it for free now!

Know when i will receive my tax refund. Procedure for appeal of assessment flow chart. We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government. Web taxpayer files a property tax appeal with assessing official. The appeal will be heard by the county board of review. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Claim a gambling loss on my indiana return. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Pay my tax bill in installments.

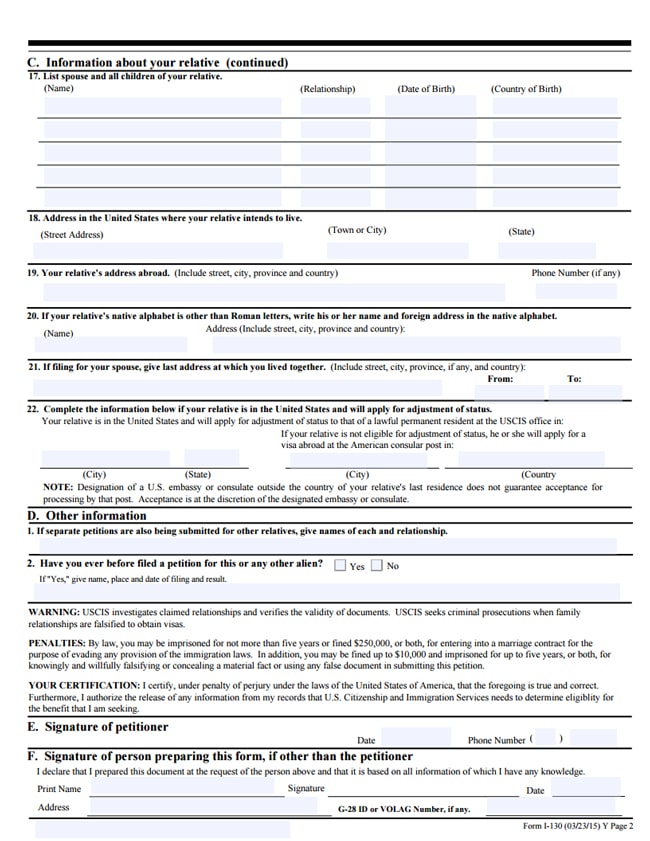

What is a Form I130 Petition? Enterline And Partners Consulting

Web to access all department of local government finance forms please visit the state forms online catalog available here. Taxpayer’s notice to initiate an appeal. Procedure for appeal of assessment flow chart. Driver's record, title & lien and registration search. Claim a gambling loss on my indiana return.

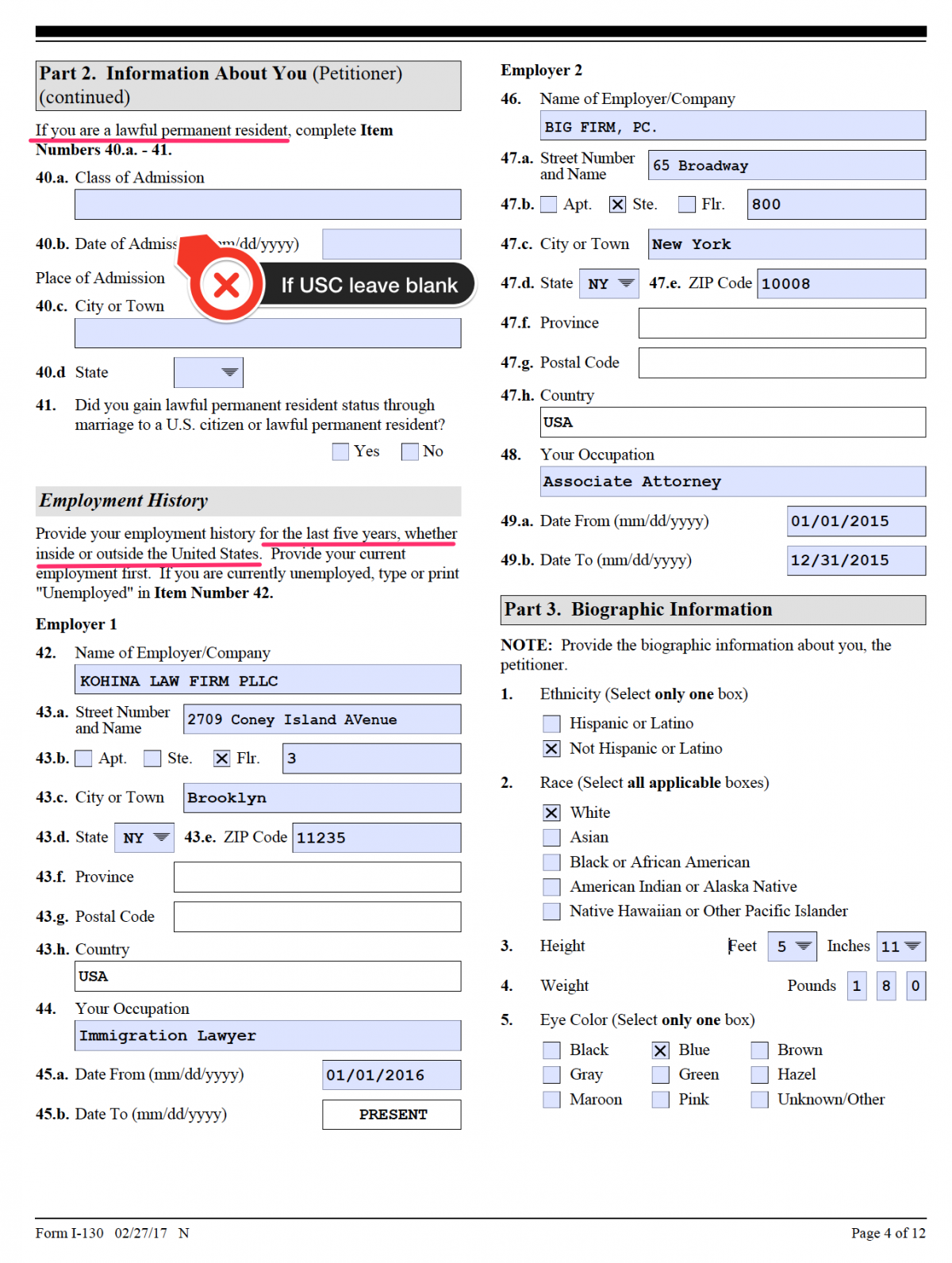

Page 3 of 8 How to Fill Form I130 and I130A Complete Step by Step

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Claim a gambling loss on my indiana return. A taxpayer may only request a. Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana form 130 as 2 stars.

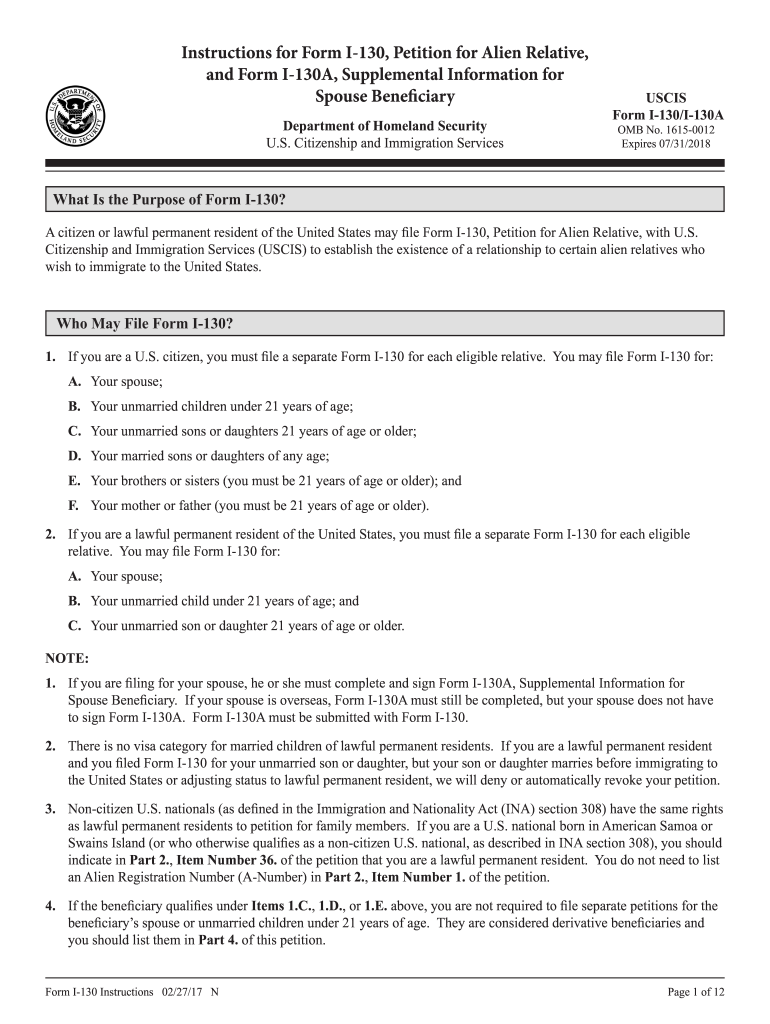

2015 Form USCIS I130 Instructions Fill Online, Printable, Fillable

Ibtr form used to appeal the decision of. Web to access all department of local government finance forms please visit the state forms online catalog available here. And 2) requires the assessing official to schedule a preliminary informal meeting with the taxpayer. Web taxpayer files a property tax appeal with assessing official. Web rate indiana form 130 as 5 stars.

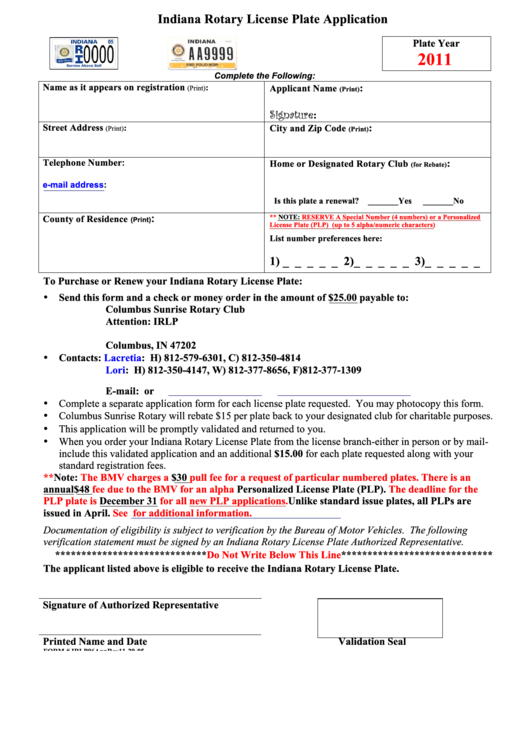

2012 IN State Form 53958 Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web to access all department of local government finance forms please visit the state forms online catalog available here. Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana.

Fillable Form 130 Petition To The Property Tax Assessment Board Of

The ibtr has also created several samples of documents often submitted as part of the hearing process. Web up to $40 cash back form 130 is typically used in indiana for vehicle title and registration transactions. Form 130 taxpayer's notice to initiate an appeal Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form.

Top 8 Indiana Bmv Forms And Templates free to download in PDF, Word and

And 2) requires the assessing official to schedule a preliminary informal meeting with the taxpayer. Driver's record, title & lien and registration search. Web you will receive the results of the determination by mail in the form of a form 115. Form 130 taxpayer's notice to initiate an appeal If you disagree with the determination of the ptaboa you may.

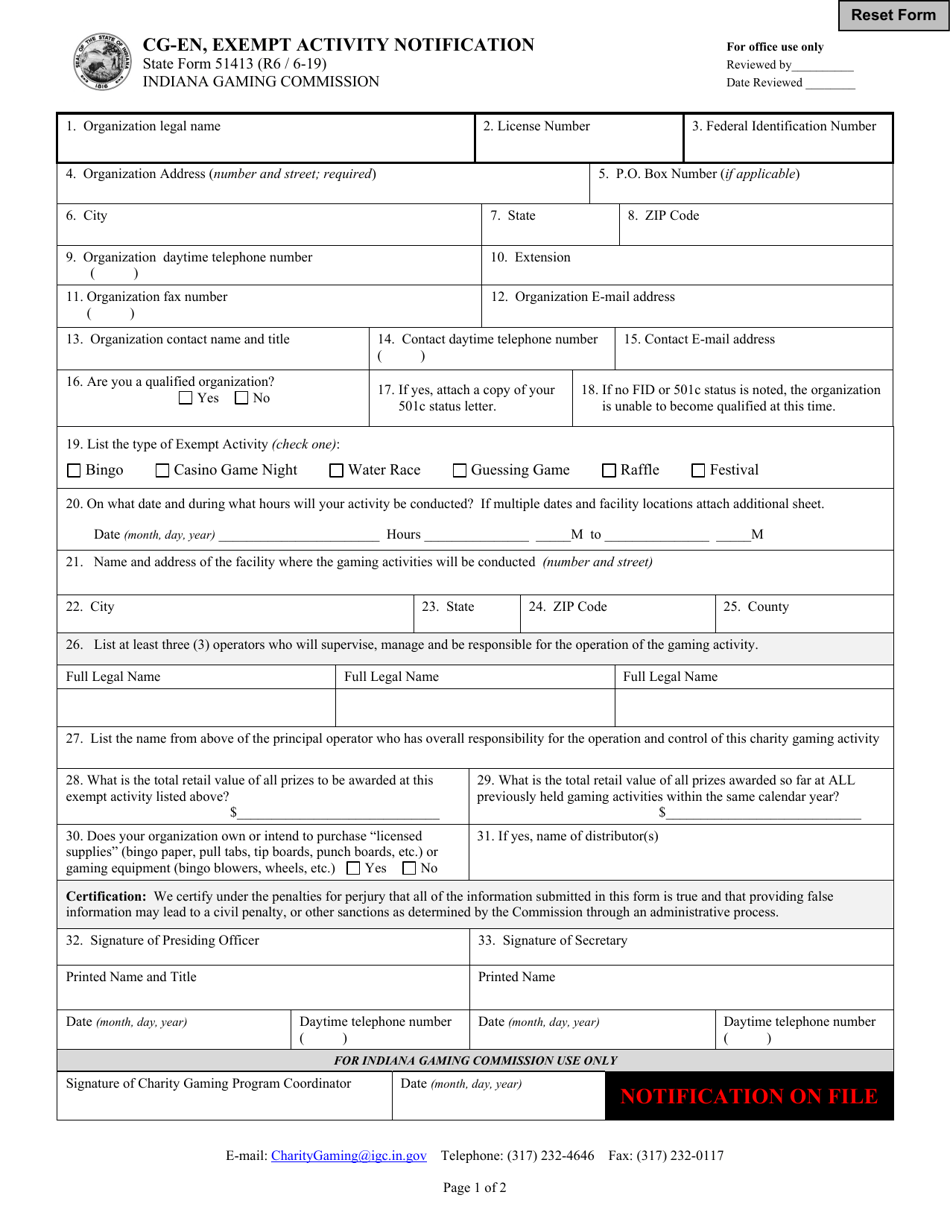

Form CGEN (State Form 51413) Download Fillable PDF or Fill Online

Pay my tax bill in installments. We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government. Petition for review of assessment before the indiana board of tax review. Form 130 taxpayer's notice to initiate an appeal If you disagree with the determination of the ptaboa.

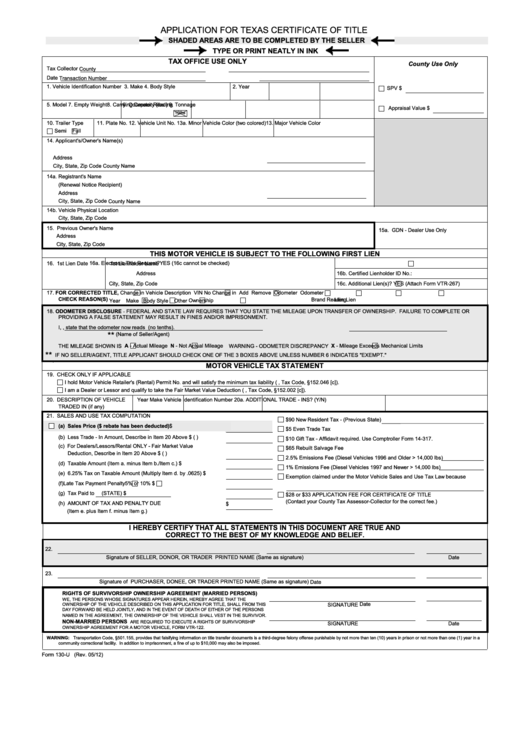

Top 6 Form 130u Templates free to download in PDF format

Web you will receive the results of the determination by mail in the form of a form 115. A taxpayer may only request a. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Notice of annual session all ptaboa meetings will begin at 9:00 am and will be held in suite 419 of the edwin.

Form I130 Petition for Alien Relative RapidVisa®

Upload, modify or create forms. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Taxpayer’s notice to initiate an appeal. Parking ticket / tollway vehicle. Claim a gambling loss on my indiana return.

Form 130 Indiana Fill Out and Sign Printable PDF Template signNow

Notice of annual session all ptaboa meetings will begin at 9:00 am and will be held in suite 419 of the edwin rousseau centre located at 1 east main street, fort wayne, indiana 46802. Claim a gambling loss on my indiana return. Web you will receive the results of the determination by mail in the form of a form 115..

Try It For Free Now!

Web to access all department of local government finance forms please visit the state forms online catalog available here. Forget about scanning and printing out forms. Parking ticket / tollway vehicle. The appeal will be heard by the county board of review.

Web The Form 130, Taxpayer's Notice To Initiate An Appeal, And The Power Of Attorney Form Are Prescribed By The Department Of Local Government Finance (Dlgf).

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Procedure for appeal of assessment flow chart. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. Taxpayer’s notice to initiate an appeal/correction of error.

Web We Last Updated Indiana Form 130 In January 2023 From The Indiana Department Of Revenue.

Petition for review of assessment before the indiana board of tax review. Know when i will receive my tax refund. To correctly fill out the form, follow the instructions below: Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana form 130 as 2 stars rate indiana form 130 as 1 stars.

Hardwood Timber Land Management Plan:

And 2) requires the assessing official to schedule a preliminary informal meeting with the taxpayer. Ad download or email 2008 130 & more fillable forms, register and subscribe now! A taxpayer may only request a. Petition for review of assessment before the indiana board of tax review.