Innocent Spouse Tax Form

Innocent Spouse Tax Form - A request can also be made as part of a u.s. Web give your spouse relief; For instructions and the latest information. Separation of liability relief, 3. Important things you should know • do not file this form with your tax return. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. Web 8857 request for innocent spouse relief. Web to request relief of any of the types discussed above, use form 8857, request for innocent spouse relief. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. To request relief, file form 8857, request for innocent spouse relief.

June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. (see community property laws, later). Important things you should know • do not file this form with your tax return. Form 8857 covers innocent spouse relief, separation of liability and equitable relief. If you are requesting relief for more than 6 tax years, you must file an additional form 8857. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return. When to file form 8857 To request relief, file form 8857, request for innocent spouse relief. Web 8857 request for innocent spouse relief. The irs will review your form 8857 and let you know if you qualify.

The irs will review your form 8857 and let you know if you qualify. For instructions and the latest information. Web innocent spouse relief is for people who filed a joint tax return (the married filing jointly tax status). Form 8857 covers innocent spouse relief, separation of liability and equitable relief. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. The letter explains the reason for our decision. Separation of liability relief, 3. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. To request relief, file form 8857, request for innocent spouse relief. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return.

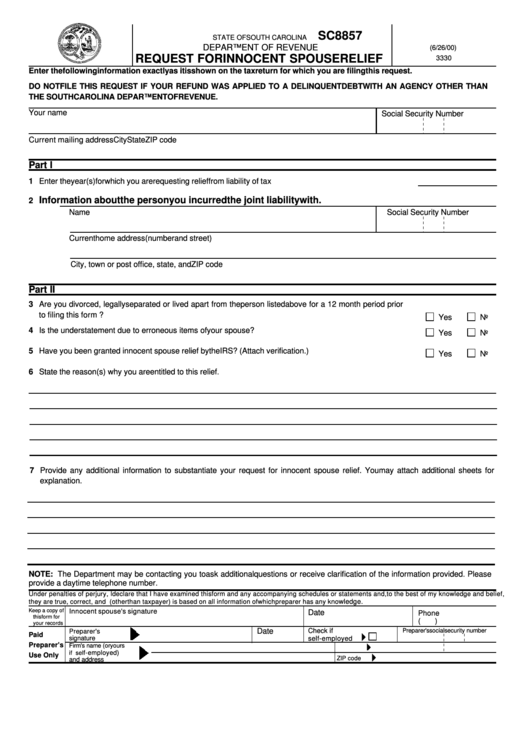

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Separation of liability relief, 3. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Relief from liability for tax attributable to an item of community income. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. Web you must request innocent.

Innocent Spouse Tax Liability Relief Roger Rossmeisl, CPA

If income is missing from your tax return, it should be income your spouse received, not you. In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. Web you must file form 8857 no later than 6 months before the expiration of the period of limitations on assessment (including extensions) against.

Form 8857Request for Innocent Spouse Relief

Form 8857 covers innocent spouse relief, separation of liability and equitable relief. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. (see community property laws, later). Web innocent spouse relief is for people who filed a joint tax return (the.

Innocent Spouse Podcast CT Attorneys Discuss Tax Relief

A request can also be made as part of a u.s. To request relief, file form 8857, request for innocent spouse relief. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Form 8857 is used to request relief from tax liability when a spouse or former spouse should.

Form Sc8857 Request For Innocent Spouse Relief printable pdf download

Relief from liability for tax attributable to an item of community income. Web 8857 request for innocent spouse relief. Web you must file form 8857 no later than 6 months before the expiration of the period of limitations on assessment (including extensions) against your spouse or former spouse for the tax year for which you are requesting relief. When to.

Innocent Spouse Relief Tax Attorney San Diego Milikowsky Law

Relief from liability for tax attributable to an item of community income. A request can also be made as part of a u.s. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. Separation of liability relief, 3. The irs will review your form 8857 and let you know if.

Your Guide To Filing Form 8857 Request For Innocent Spouse Relief

If we denied relief, you both remain responsible for the taxes, penalties and interest. For instructions and the latest information. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. (see community property laws, later). Web innocent spouse relief is for people who filed a joint tax return (the married.

Your Guide To Filing Form 8857 Request For Innocent Spouse Relief

Relief from liability for tax attributable to an item of community income. Web give your spouse relief; Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Separation of liability relief, 3. Form 8857 covers innocent spouse relief, separation of liability.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Separation of liability relief, 3. In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and.

Should I file an innocent spouse form?

Web 8857 request for innocent spouse relief. Separation of liability relief, 3. The irs will review your form 8857 and let you know if you qualify. The letter explains the reason for our decision. Important things you should know • do not file this form with your tax return.

Web Information About Form 8857, Request For Innocent Spouse Relief, Including Recent Updates, Related Forms, And Instructions On How To File.

Web you must file form 8857 no later than 6 months before the expiration of the period of limitations on assessment (including extensions) against your spouse or former spouse for the tax year for which you are requesting relief. To request relief, file form 8857, request for innocent spouse relief. (see community property laws, later). The irs will review your form 8857 and let you know if you qualify.

Web To Request Relief Of Any Of The Types Discussed Above, Use Form 8857, Request For Innocent Spouse Relief.

In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. You may be allowed innocent spouse relief only if all of the following apply. Web give your spouse relief; If we denied relief, you both remain responsible for the taxes, penalties and interest.

Form 8857 Is Used To Request Relief From Tax Liability When A Spouse Or Former Spouse Should Be.

If income is missing from your tax return, it should be income your spouse received, not you. Relief from liability for tax attributable to an item of community income. Web innocent spouse relief is for people who filed a joint tax return (the married filing jointly tax status). A request can also be made as part of a u.s.

June 2021) Department Of The Treasury Internal Revenue Service (99) Request For Innocent Spouse Relief.

We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return. When to file form 8857 Form 8857 covers innocent spouse relief, separation of liability and equitable relief.