Insolvency Form 982

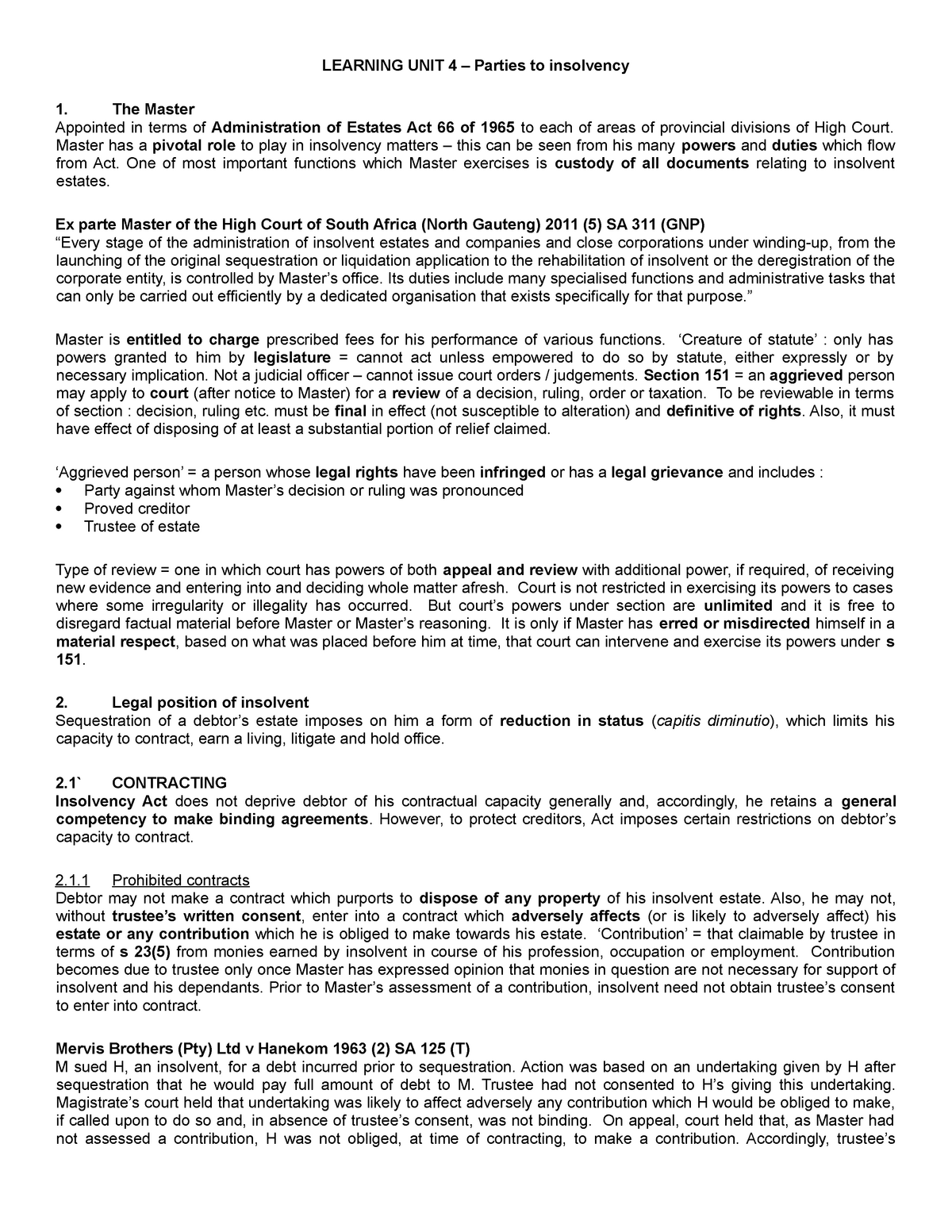

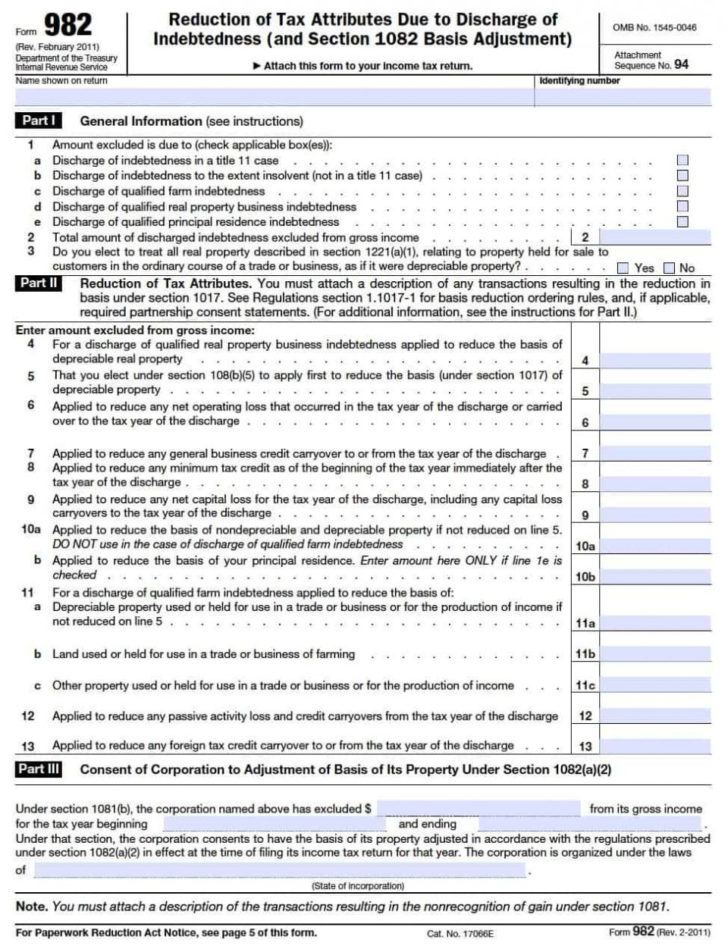

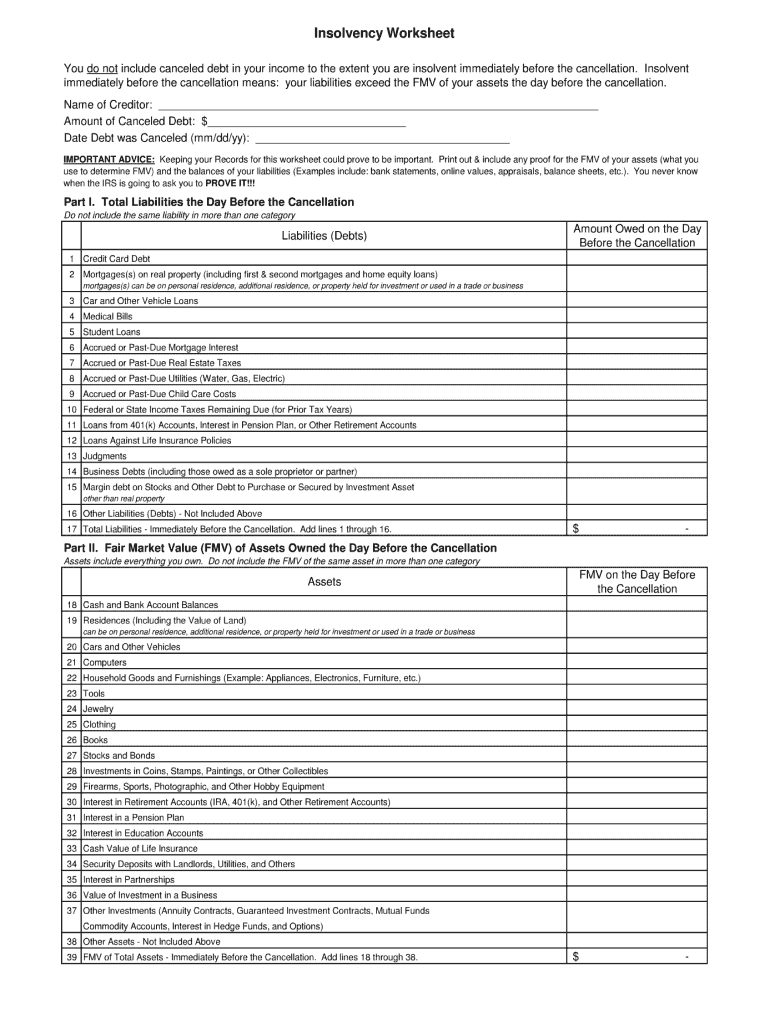

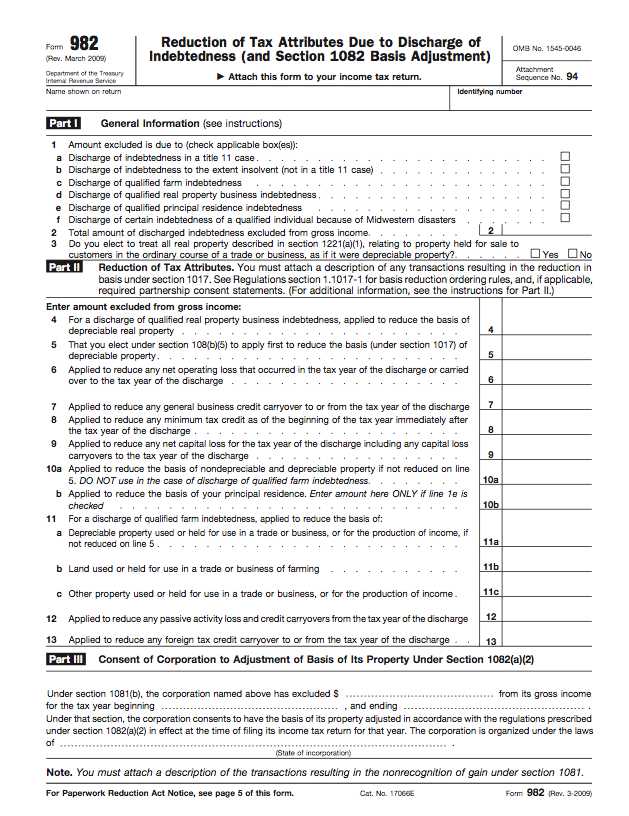

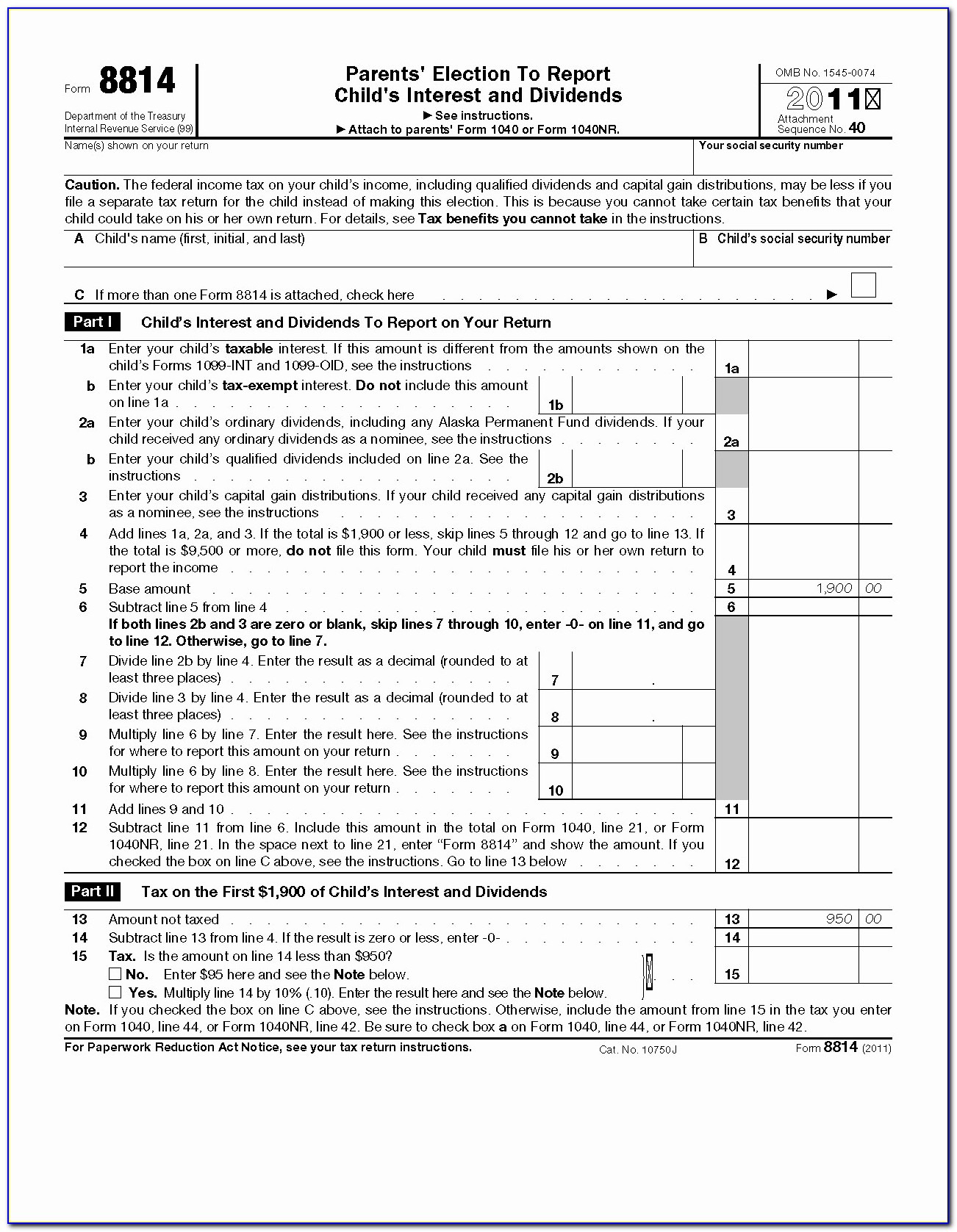

Insolvency Form 982 - On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately before the cancellation. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the box on line 1b. Qualified principal residence indebtedness ; Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. You don’t have to do anything else, but you might want to complete the insolvency worksheet, showing how you arrived at the number, to avoid the irs questioning your. Following the reasoning and steps below will keep things straight for you, produce a clean return and shouldn't take too long. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Qualified real property business indebtedness Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Sign in products lacerte proconnect proseries easyacct

Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the box on line 1b. On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately before the cancellation. Following the reasoning and steps below will keep things straight for you, produce a clean return and shouldn't take too long. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income. Web you must complete and file form 982 with your tax return to do so. What is a discharge of indebtedness to the extent insolvent? Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. If you have any other details regarding this question, please feel free to post them in the comment section.

If you have any other details regarding this question, please feel free to post them in the comment section. Qualified principal residence indebtedness ; Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Qualified real property business indebtedness Attach this form to your income tax return. March 2018) department of the treasury internal revenue service. Certain individuals may need to complete only a few lines on form 982. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the box on line 1b.

Insolvacy units 4 and 5 Summary Hockly’s Insolvency Law LEARNING

For instructions and the latest information. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. What is a discharge of indebtedness to the extent insolvent? If you have any other details regarding this question, please feel free to post them in the comment section. Certain individuals may need to complete.

Solved I need to know about the insolvency exception for 1099c. Do I

Common situations covered in this publication Qualified real property business indebtedness What is a discharge of indebtedness to the extent insolvent? For instructions and the latest information. Qualified principal residence indebtedness ;

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

March 2018) department of the treasury internal revenue service. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Certain individuals may need to complete only a few lines on form 982. Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Web information about form.

Form 982 Insolvency Worksheet —

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file. On line 2, include the smaller of the amount of the debt canceled or the amount.

Form 982 Insolvency Worksheet —

Qualified real property business indebtedness Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. You don’t have to do anything else, but you might want to complete the insolvency worksheet, showing how you arrived at the number, to avoid the irs questioning your. Web below are five scenarios where an.

Form 982 Insolvency Worksheet

Qualified real property business indebtedness Sign in products lacerte proconnect proseries easyacct For instructions and the latest information. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section.

Form 982 Insolvency Worksheet —

What is a discharge of indebtedness to the extent insolvent? On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately before the cancellation. Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: Certain individuals may need.

Tax Form 982 Insolvency Worksheet

Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the box on line 1b. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to.

Form 982 Insolvency Worksheet

Attach this form to your income tax return. Sign in products lacerte proconnect proseries easyacct Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per.

Fresh Form 982 For 2016 Insolvency Worksheet Kidz —

Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Following the reasoning and steps below will keep things straight for you, produce a clean return and shouldn't take too long. On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately.

Following The Reasoning And Steps Below Will Keep Things Straight For You, Produce A Clean Return And Shouldn't Take Too Long.

Sign in products lacerte proconnect proseries easyacct On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately before the cancellation. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). What is a discharge of indebtedness to the extent insolvent?

If You Have Any Other Details Regarding This Question, Please Feel Free To Post Them In The Comment Section.

Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: You don’t have to do anything else, but you might want to complete the insolvency worksheet, showing how you arrived at the number, to avoid the irs questioning your. Attach this form to your income tax return. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related forms, and instructions on how to file.

Web To Show That You Are Excluding Canceled Debt From Income Under The Insolvency Exclusion, Attach Form 982 To Your Federal Income Tax Return And Check The Box On Line 1B.

Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Qualified real property business indebtedness Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment).

Certain Individuals May Need To Complete Only A Few Lines On Form 982.

March 2018) department of the treasury internal revenue service. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Common situations covered in this publication If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income.