Instructions Form 4562

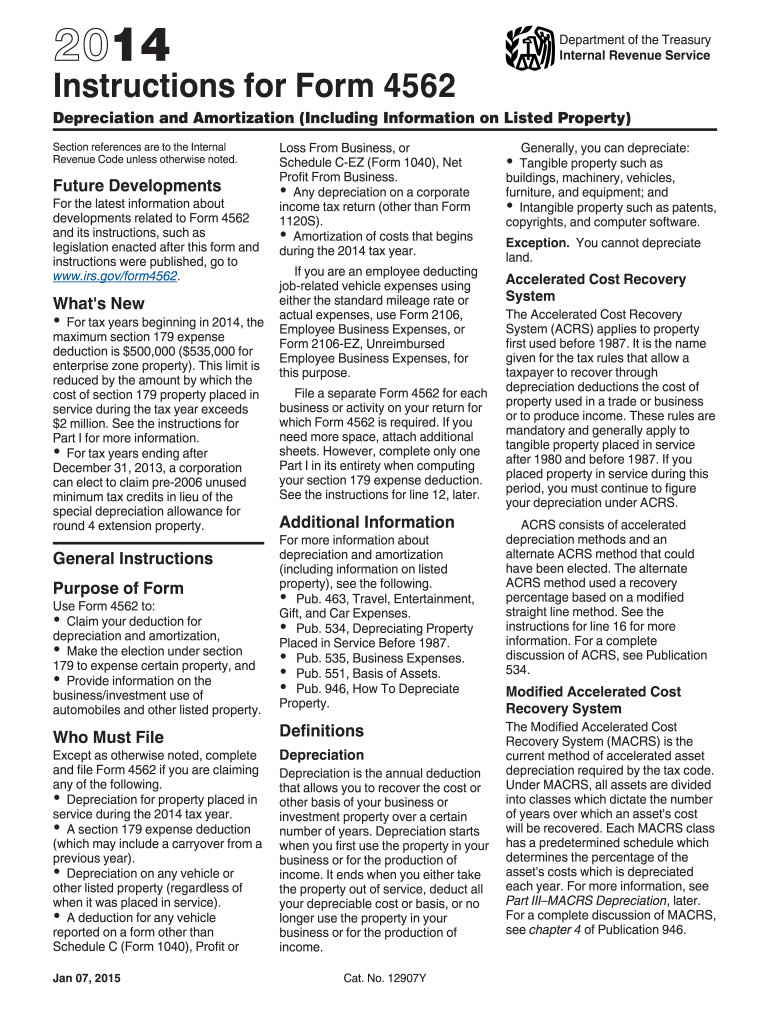

Instructions Form 4562 - • enter the amount from line 2 of federal form 4562 on line 2 of minnesota form 4562. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years beginning on or after january 1, 2008. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Must be removed before printing. Web total amounts on this form. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Here’s what each line should look like as outlined in the irs form 4562 instructions, along with a. Web instructions for form 4562. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Date of which your asset is put to use;

Web we last updated federal form 4562 in december 2022 from the federal internal revenue service. Upload, modify or create forms. Total income you are reporting in the. Web form 4562 is required. Do not use part iii for automobiles and other listed property. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Here’s what each line should look like as outlined in the irs form 4562 instructions, along with a. First, you’ll need to gather all the financial records regarding your asset. You’ll need to list the property you’re claiming as the section 179 deduction, the price, and the amount you’re deducting. Price of the asset being depreciated;

The time you need to prepare the form is roughly 4 hours and 55 minutes, with another 4 hours and 16 minutes needed. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Do not enter less than $25,000. Department of the treasury 2002 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) First, you’ll need to gather all the financial records regarding your asset. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Web instructions for form 4562. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years beginning on or after january 1, 2008. “2021 instructions for form 4562.

Fillable IRS Form 4562 Depreciation and Amortization Printable

Web the instructions for form 4562 include a worksheet that you can use to complete part i. Total income you are reporting in the. Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. Ad get ready for tax season deadlines by completing any required tax forms.

Form 4562 Do I Need to File Form 4562? (with Instructions)

Do not enter less than $25,000. Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. This form is for income earned in tax year 2022,.

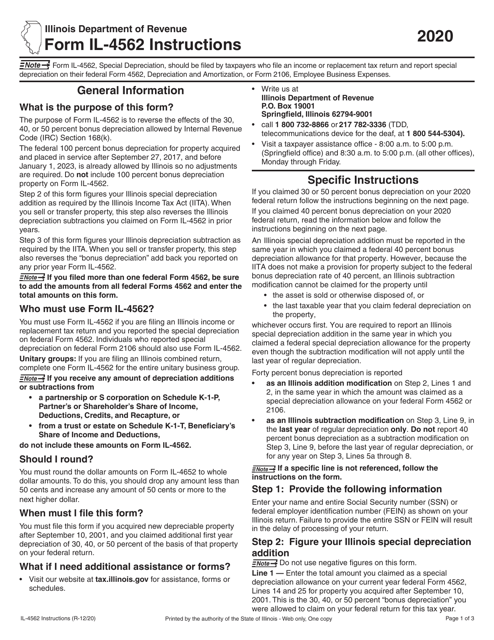

Download Instructions for Form IL4562 Special Depreciation PDF, 2020

Price of the asset being depreciated; Total income you are reporting in the. Try it for free now! Web the instructions for form 4562 include a worksheet that you can use to complete part i. In order to write off eligible property in the first year it was purchased, you must include form 4562 with your taxes and elect the.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

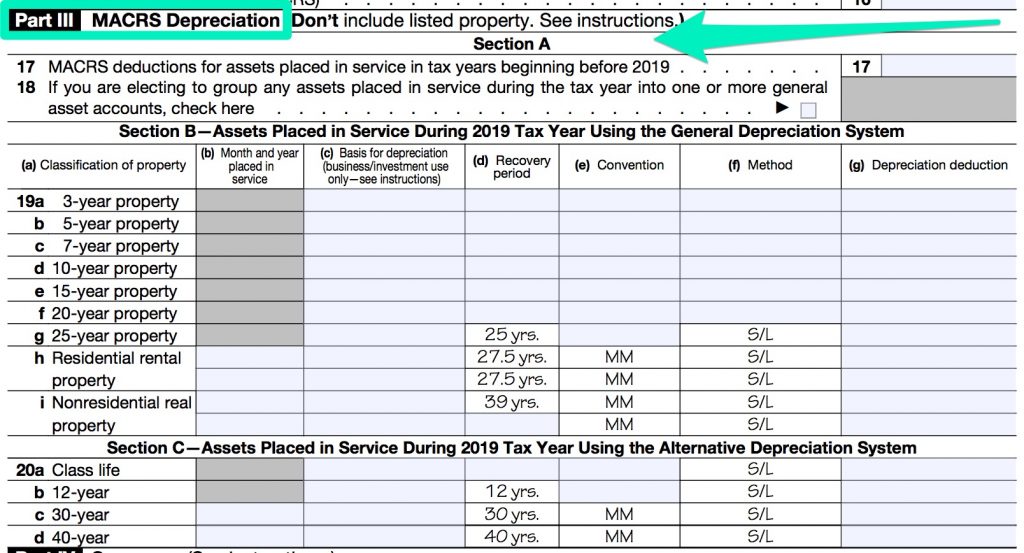

Web what information do you need for form 4562? Do not use part iii for automobiles and other listed property. Do not enter less than $25,000. Ad get ready for tax season deadlines by completing any required tax forms today. If you need more placed in service after october 3, 2008, (b) • certain machinery or equipment used in a.

Editable IRS Instructions 4562 2018 2019 Create A Digital Sample in PDF

Web what information do you need for form 4562? Web form 4562 and the following modifications: Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000. Read and follow the directions for every section, by recording the value as directed on the form 4562. Something you’ll need to consider is that the.

√ダウンロード example 60 hour driving log filled out 339415How to fill out

“2021 instructions for form 4562. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Do not use part iii for automobiles and other listed property. Date of which your asset is put to use; Web total amounts on this form.

Irs Instructions Form 4562 Fill Out and Sign Printable PDF Template

General instructions purpose of form use form 4562 to: Web the instructions for form 4562 include a worksheet that you can use to complete part i. Price of the asset being depreciated; The time you need to prepare the form is roughly 4 hours and 55 minutes, with another 4 hours and 16 minutes needed. Web form 4562 is required.

Form Boc 3 Instructions Universal Network

See the instructions for lines 20a through 20d, later. Ad get ready for tax season deadlines by completing any required tax forms today. Date of which your asset is put to use; Try it for free now! Who must file except as otherwise noted, complete

Pa Form W2 S Instructions Universal Network

Something you’ll need to consider is that the amount you can deduct depends on the amount of business income that’s taxable. Must be removed before printing. First, you’ll need to gather all the financial records regarding your asset. Total income you are reporting in the. Who must file except as otherwise noted, complete

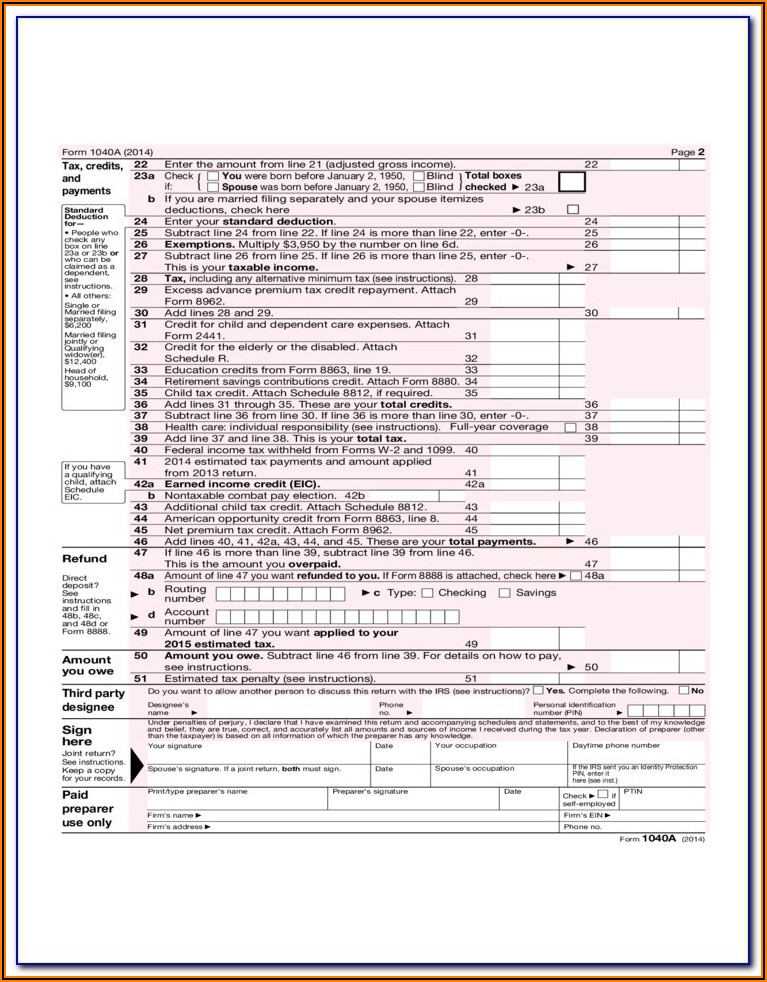

Irs Form 1040x Instructions 2014 Form Resume Examples nO9bk6AY4D

Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain.

Total Income You Are Reporting In The.

Department of the treasury 2002 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) Date of which your asset is put to use; This form is for income earned in tax year 2022, with tax returns due in april 2023. Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000.

Web Total Amounts On This Form.

Price of the asset being depreciated; Get ready for tax season deadlines by completing any required tax forms today. If you need more placed in service after october 3, 2008, (b) • certain machinery or equipment used in a space, attach additional sheets. Web we last updated federal form 4562 in december 2022 from the federal internal revenue service.

• Subtract $975,000 From Line 1 Of Federal Form 4562, And Enter The Result On Line 1 Of Minnesota Form 4562.

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. • enter the amount from line 2 of federal form 4562 on line 2 of minnesota form 4562. First, you’ll need to gather all the financial records regarding your asset. The time you need to prepare the form is roughly 4 hours and 55 minutes, with another 4 hours and 16 minutes needed.

To Properly Fill Out Form 4562, You’ll Need The Following Information:

Fortunately, you may be able to carry over part of the deduction and claim it when filing taxes for the next tax year. Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. Read and follow the directions for every section, by recording the value as directed on the form 4562. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.