Instructions Form 8854

Instructions Form 8854 - Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Web irs form 8854, initial and annual expatriation statement, is the tax form that expatriates must use to report the u.s. The irs form 8854 is required for u.s. We’ll assign you the right advisor for your situation we prepare your u.s. Deferred the payment of tax, Web in fact, the internal revenue service recently updated their instructions for form 8854 and clarified when the expatriating act happens. Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Initial expatriation statement for persons who expatriated in 2022. Form 8854 is used by individuals who have expatriated on or after june 4, 2004. A key difference between the prior and current form.

The irs form 8854 is required for u.s. Web information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to file. You must file your annual form 8854 (parts i and iii). You must file your annual form 8854 (parts i and iii) if you expatriated before 2020 and you: While the net worth and net income tax value. Form 8854 also tells the irs whether or not the taxpayer is a “covered expatriate.” covered expatriates have to pay an exit tax. Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Register online and complete your tax organizer. Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). A key difference between the prior and current form.

Web irs form 8854, initial and annual expatriation statement, is the tax form that expatriates must use to report the u.s. Government uses to when do you have to file irs form 8854? Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Form 8854 also tells the irs whether or not the taxpayer is a “covered expatriate.” covered expatriates have to pay an exit tax. Initial expatriation statement for persons who expatriated in 2022. Web form 8854 certifies to the irs that an expatriating taxpayer has complied with u.s tax obligations for at least five years before their expatriation, such as filing all u.s. Web in fact, the internal revenue service recently updated their instructions for form 8854 and clarified when the expatriating act happens. Form 8854 is used by individuals who have expatriated on or after june 4, 2004. Register online and complete your tax organizer. We’ll assign you the right advisor for your situation we prepare your u.s.

LEGO 8854 Power Crane Set Parts Inventory and Instructions LEGO

Form 8854 is used by individuals who have expatriated on or after june 4, 2004. Web information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to file. While the net worth and net income tax value. Web you must file your initial form 8854 (parts i and ii) if you relinquished.

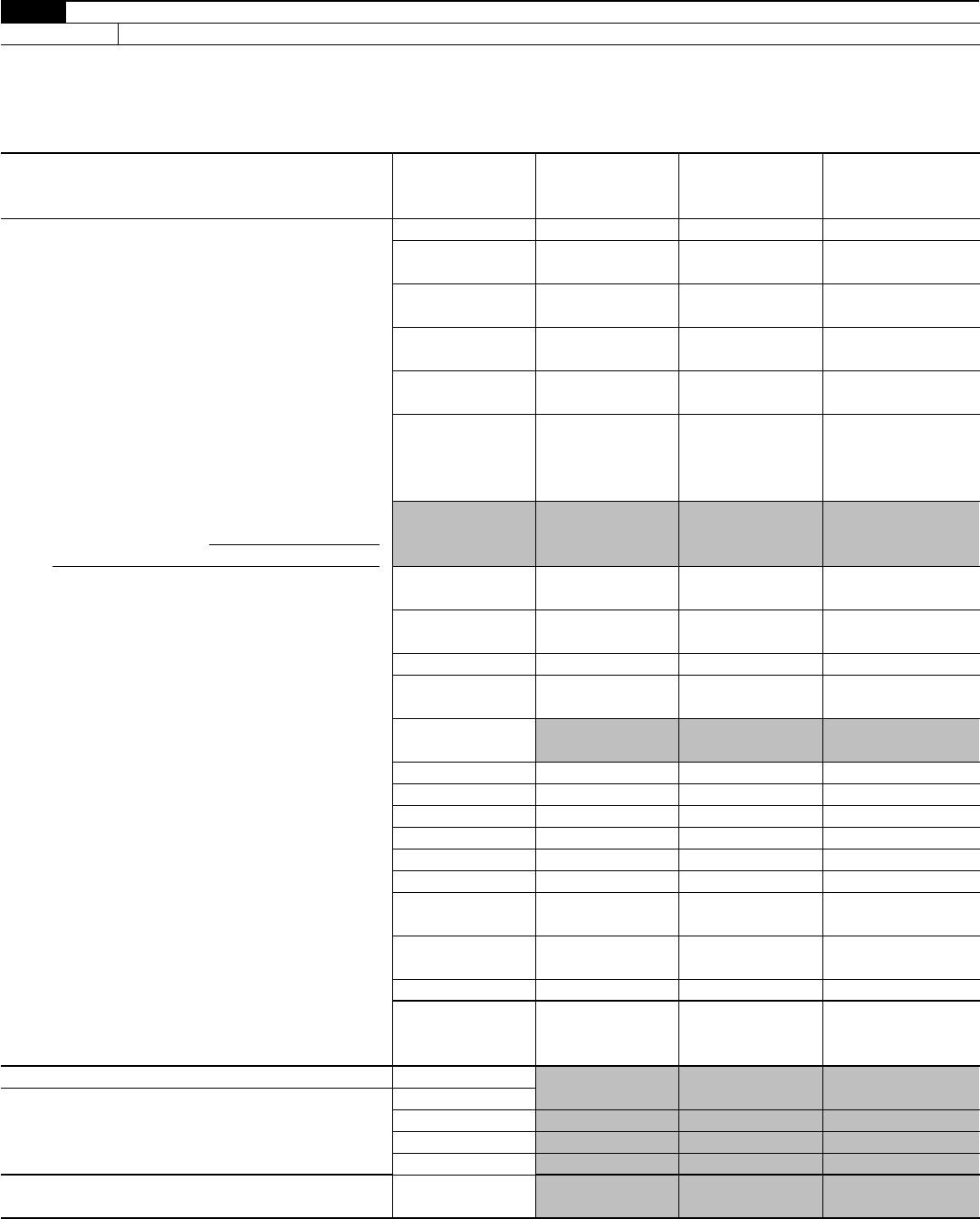

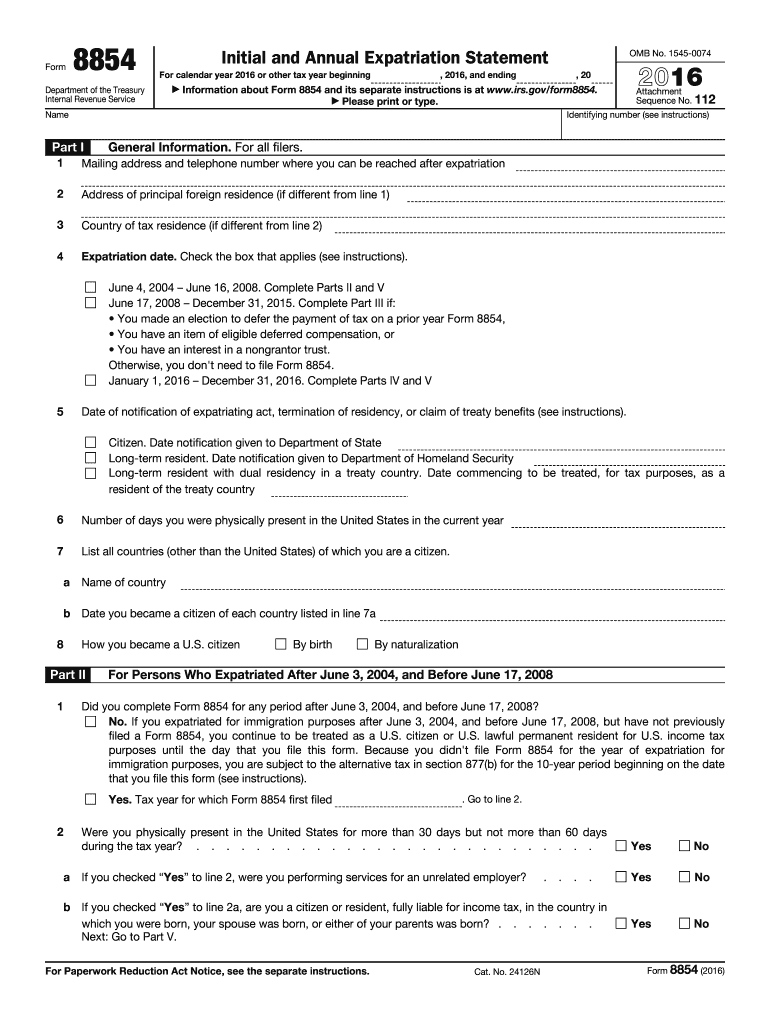

Form 8854 Edit, Fill, Sign Online Handypdf

Initial expatriation statement for persons who expatriated in 2022. Web 8854 1 mailing address and telephone number where you can be reached after expatriation 2 address of principal foreign residence (if different from line 1) 3 country of tax residence (if different from line 2) 4 check the box that applies. Income tax returns and paying any tax owed. Web.

LEGO 8854 Power Crane Set Parts Inventory and Instructions LEGO

Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). If the taxpayer is also a covered expatriate, there may exit tax consequences. Web here’s the simple process of filing form 8854 for expatriation with an h&r block expat tax advisor: A key difference between the prior and current form. We’ll assign.

LEGO 8854 Power Crane Set Parts Inventory and Instructions LEGO

Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). If the taxpayer is also a covered expatriate, there may exit tax consequences. Web in fact, the internal revenue service recently updated their instructions for form 8854 and clarified when the expatriating act happens. Form 8854 is used by individuals who have.

Form 8854 instructions 2018

We’ll assign you the right advisor for your situation we prepare your u.s. If the taxpayer is also a covered expatriate, there may exit tax consequences. Tax return you’ll pay for and review the return we file your return with the. Form 8854 is used by individuals who have expatriated on or after june 4, 2004. You must file your.

LEGO instructions Technic 8854 Power Crane YouTube

You must file your annual form 8854 (parts i and iii). If the taxpayer is also a covered expatriate, there may exit tax consequences. The irs form 8854 is required for u.s. A key difference between the prior and current form. Web 8854 1 mailing address and telephone number where you can be reached after expatriation 2 address of principal.

LEGO 8854 Power Crane Set Parts Inventory and Instructions LEGO

Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). We’ll assign you the right advisor for your situation we prepare your u.s. While the net worth and net income tax value. The irs form 8854 is required for u.s. Web irs form 8854, initial and annual expatriation statement, is the tax.

Form 8854 Initial and Annual Expatriation Statement Fill Out and Sign

The irs form 8854 is required for u.s. Web information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to file. Tax return you’ll pay for and review the return we file your return with the. A key difference between the prior and current form. You must file your annual form 8854.

Irs form 8283 instructions

Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. You must file your annual form 8854 (parts i and iii). You must file your annual form 8854 (parts i and iii) if you expatriated before 2020 and you: Income tax returns and paying any tax owed. Web you must file your initial.

How Many of the 5,211 Former U.S. Citizens (who Renounced in 2014 and

Web in fact, the internal revenue service recently updated their instructions for form 8854 and clarified when the expatriating act happens. Form 8854 is used by individuals who have expatriated on or after june 4, 2004. You must file your annual form 8854 (parts i and iii) if you expatriated before 2020 and you: You must file your annual form.

Taxpayers Must File Irs Form 8854 On Or Before The Due Date Of Their Tax Return (Including Extensions).

Income tax returns and paying any tax owed. Web form 8854 certifies to the irs that an expatriating taxpayer has complied with u.s tax obligations for at least five years before their expatriation, such as filing all u.s. Web 8854 1 mailing address and telephone number where you can be reached after expatriation 2 address of principal foreign residence (if different from line 1) 3 country of tax residence (if different from line 2) 4 check the box that applies. Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s.

Form 8854 Is Used By Individuals Who Have Expatriated On Or After June 4, 2004.

Deferred the payment of tax, You must file your annual form 8854 (parts i and iii) if you expatriated before 2020 and you: Web here’s the simple process of filing form 8854 for expatriation with an h&r block expat tax advisor: If the taxpayer is also a covered expatriate, there may exit tax consequences.

Initial Expatriation Statement For Persons Who Expatriated In 2022.

While the net worth and net income tax value. Form 8854 also tells the irs whether or not the taxpayer is a “covered expatriate.” covered expatriates have to pay an exit tax. You must file your annual form 8854 (parts i and iii). We’ll assign you the right advisor for your situation we prepare your u.s.

A Key Difference Between The Prior And Current Form.

The irs form 8854 is required for u.s. Web in fact, the internal revenue service recently updated their instructions for form 8854 and clarified when the expatriating act happens. Government uses to when do you have to file irs form 8854? Web irs form 8854, initial and annual expatriation statement, is the tax form that expatriates must use to report the u.s.