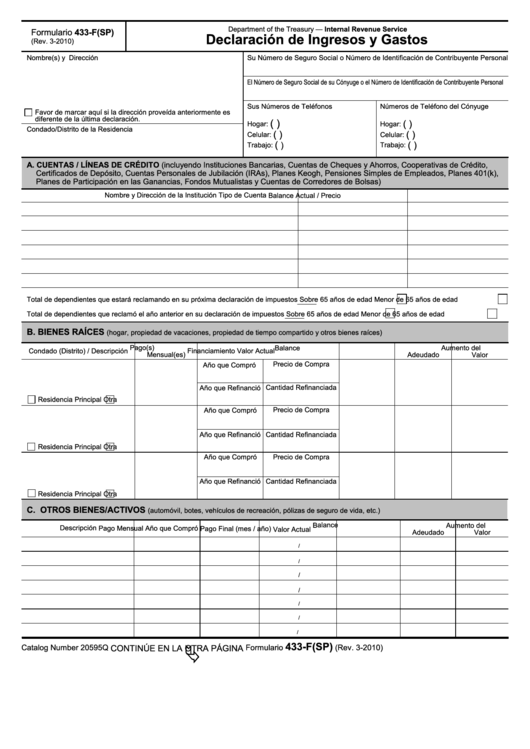

Irs Financial Hardship Form 433 F

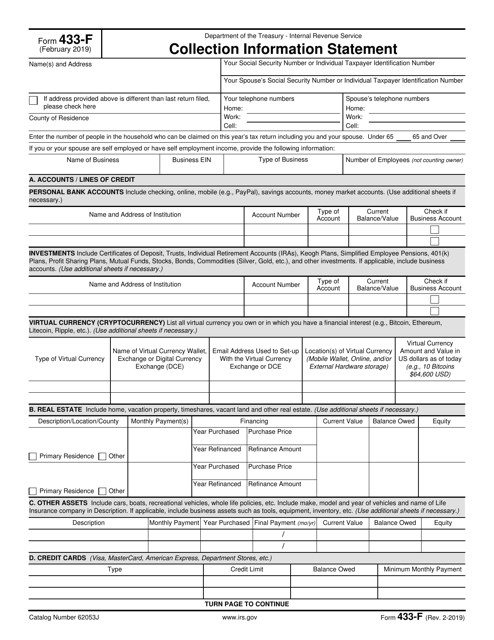

Irs Financial Hardship Form 433 F - The irs will let you know if you need to file this form. Web irs financial hardship requirements to qualify for an irs hardship, you will need to provide financial information to prove you are unable to pay your taxes. 1049 fairfield dr unit 49, is a condos home, built in 1992, with 2 beds and 2 bath, at 1,648 sqft. You may need to file this form in the following situations: Ad access irs tax forms. Ad getting into trouble with the irs can be frustrating and intimidating. How to complete irs form. Web the irs will use the information reported on the form 433a, 433b or 433f to determine whether the account is eligible for tax hardship. Learn more from the tax experts at h&r block. Ad access irs tax forms.

Ad we help get taxpayers relief from owed irs back taxes. Find out if you qualify for help and get free, competing quotes from leading tax experts. Ad getting into trouble with the irs can be frustrating and intimidating. Ad getting into trouble with the irs can be frustrating and intimidating. Web the irs will use the information reported on the form 433a, 433b or 433f to determine whether the account is eligible for tax hardship. The irs will let you know if you need to file this form. Complete, edit or print tax forms instantly. The irs can evaluate the taxpayer’s eligibility for financial. 1049 fairfield dr unit 49, is a condos home, built in 1992, with 2 beds and 2 bath, at 1,648 sqft. Web irs financial hardship defines the situation in which taxpayers cannot afford to pay for their basic living expenses.

Find out if you qualify for help and get free, competing quotes from leading tax experts. Ad access irs tax forms. Find out if you qualify for help and get free, competing quotes from leading tax experts. Ad getting into trouble with the irs can be frustrating and intimidating. Web the irs will use the information reported on the form 433a, 433b or 433f to determine whether the account is eligible for tax hardship. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad getting into trouble with the irs can be frustrating and intimidating. The irs will let you know if you need to file this form. How to complete irs form.

32 433 Forms And Templates free to download in PDF

The irs will let you know if you need to file this form. Web see sales history and home details for 1043 w hazelhurst st, ferndale, mi 48220, a 3 bed, 2 bath, 1,305 sq. Get ready for tax season deadlines by completing any required tax forms today. Find out if you qualify for help and get free, competing quotes.

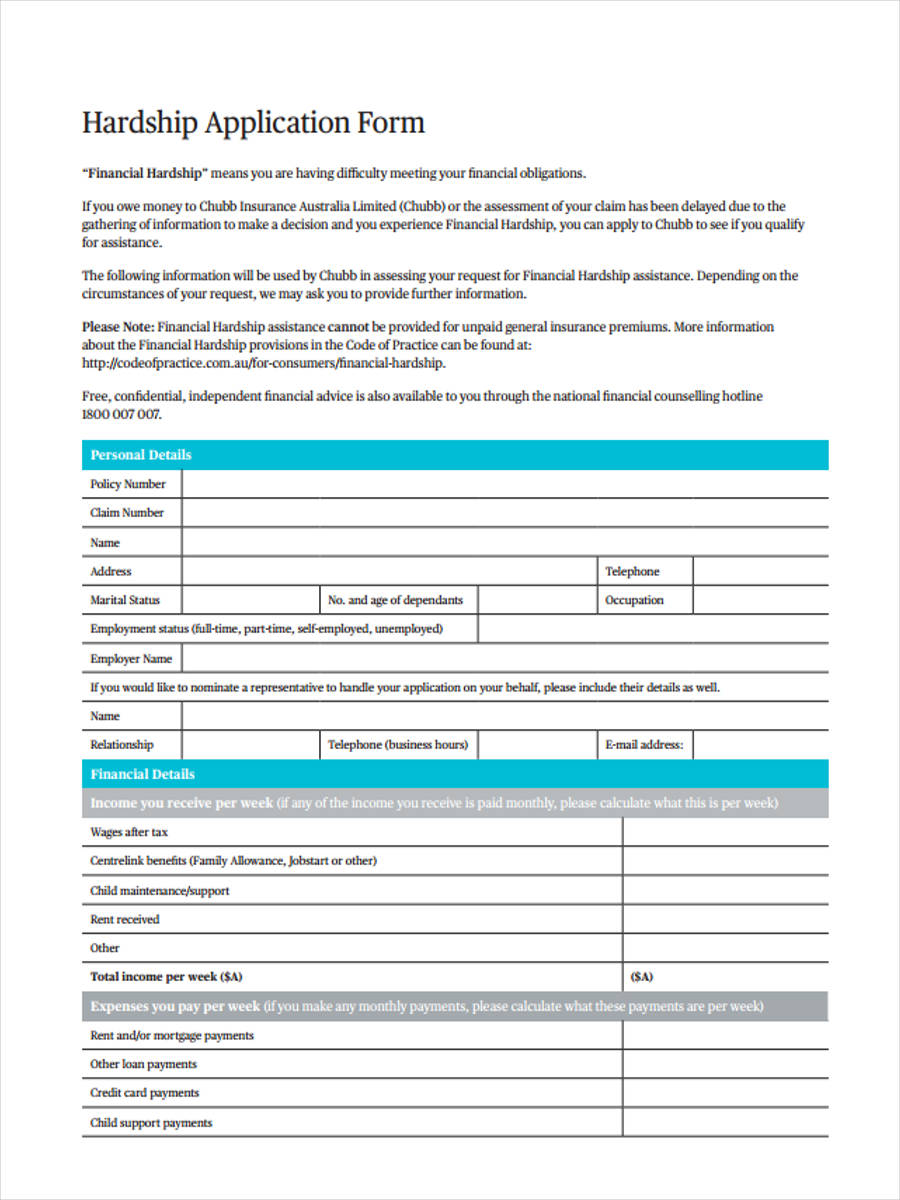

FREE 7+ Financial Hardship Forms in PDF Ms Word

Complete, edit or print tax forms instantly. Web for a routine installment agreement, you also need to submit another form: Learn more from the tax experts at h&r block. Get ready for tax season deadlines by completing any required tax forms today. Web due to hardship view our interactive tax map to see where you are in the tax process.

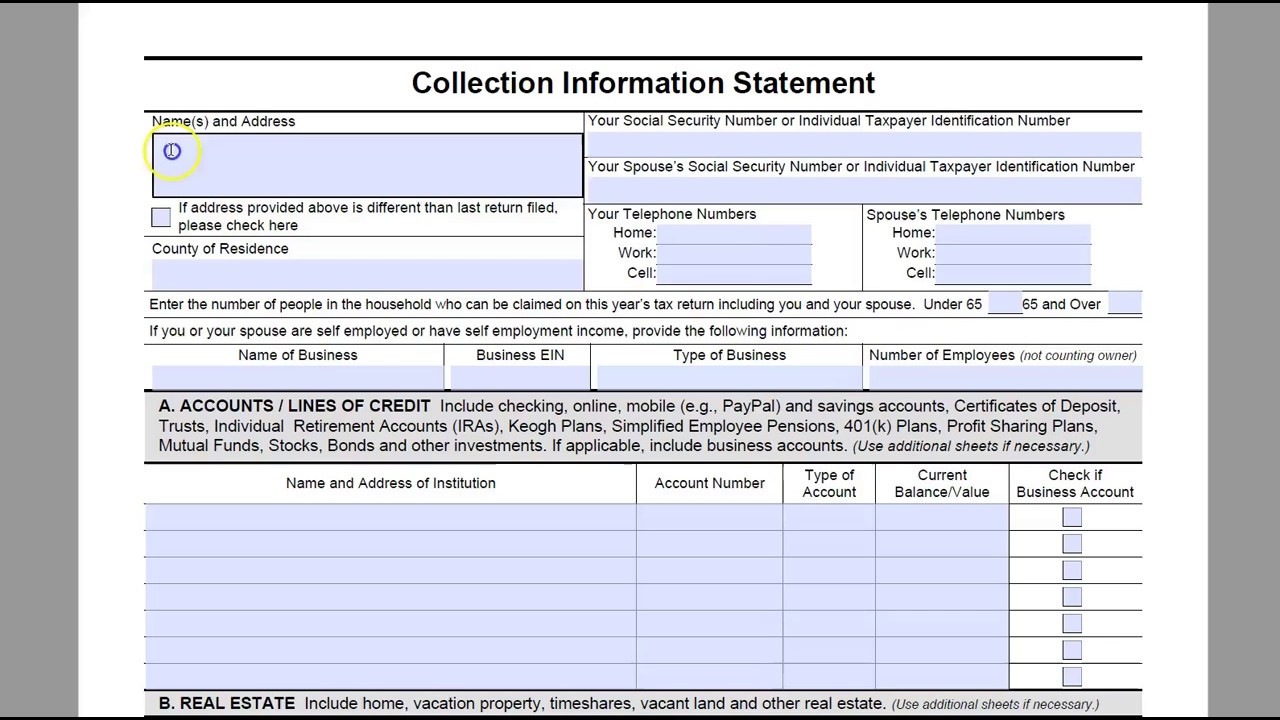

How to complete IRS form 433F YouTube

Web the irs will use the information reported on the form 433a, 433b or 433f to determine whether the account is eligible for tax hardship. Estimate how much you could potentially save in just a matter of minutes. Ad we help get taxpayers relief from owed irs back taxes. Web see sales history and home details for 1043 w hazelhurst.

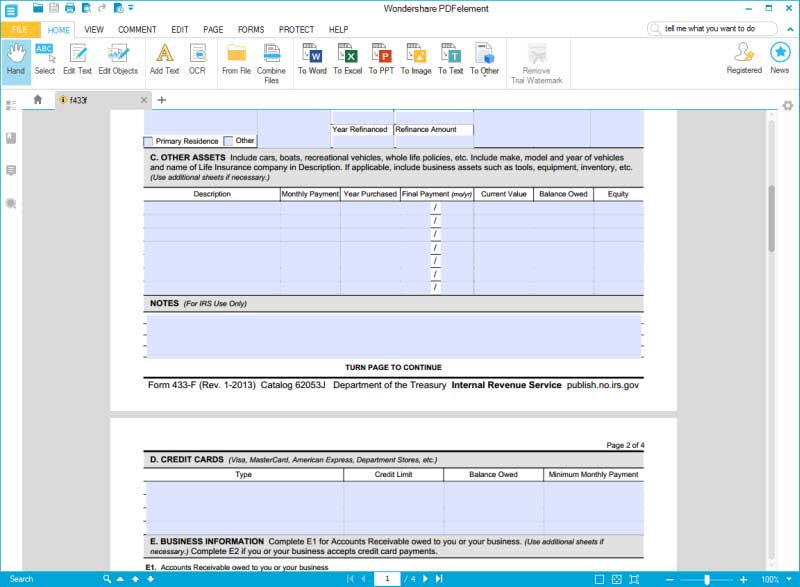

F Financial Necessary Latest Fill Out and Sign Printable PDF Template

Find out if you qualify for help and get free, competing quotes from leading tax experts. Learn more from the tax experts at h&r block. Ad getting into trouble with the irs can be frustrating and intimidating. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Irs Form 433 F Instructions Form Resume Examples qlkmd3rOaj

Web irs financial hardship defines the situation in which taxpayers cannot afford to pay for their basic living expenses. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. The irs will let you know if you need to file this form. Ad access irs tax forms.

IRS Form 433F Fill it out in Style

Find out if you qualify for help and get free, competing quotes from leading tax experts. Ad we help get taxpayers relief from owed irs back taxes. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web for a routine installment agreement, you also need to submit another form:

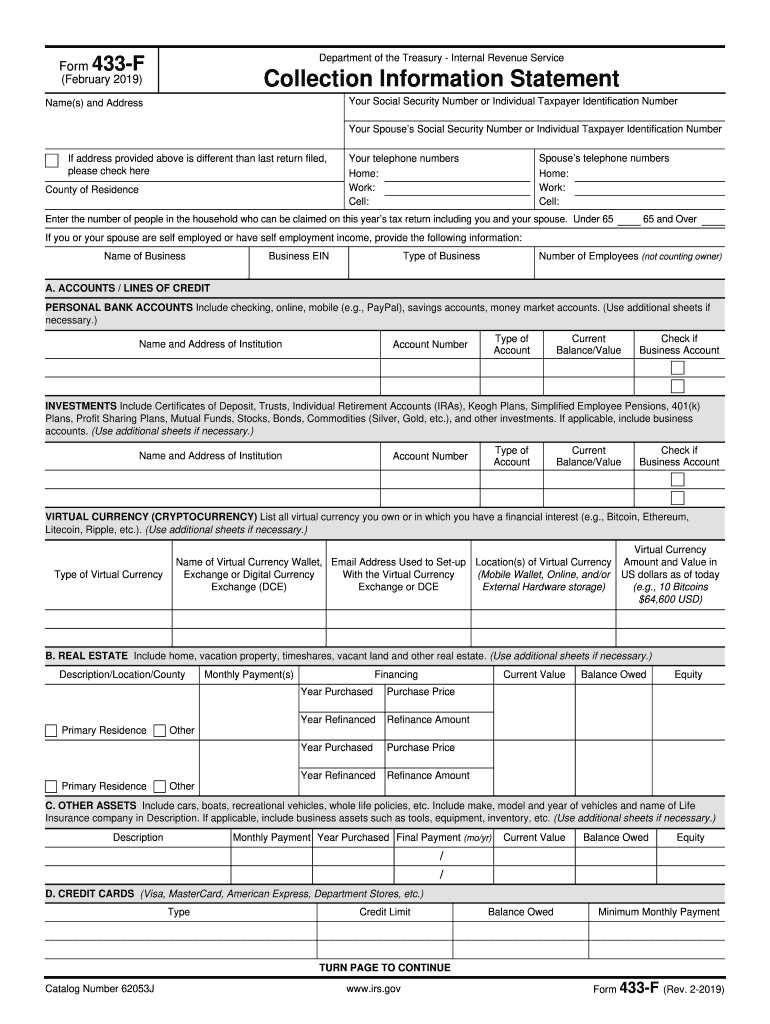

IRS Form 433F Download Fillable PDF or Fill Online Collection

Complete, edit or print tax forms instantly. Web see sales history and home details for 1043 w hazelhurst st, ferndale, mi 48220, a 3 bed, 2 bath, 1,305 sq. It could help you navigate your way through the irs. 1049 fairfield dr unit 49, is a condos home, built in 1992, with 2 beds and 2 bath, at 1,648 sqft..

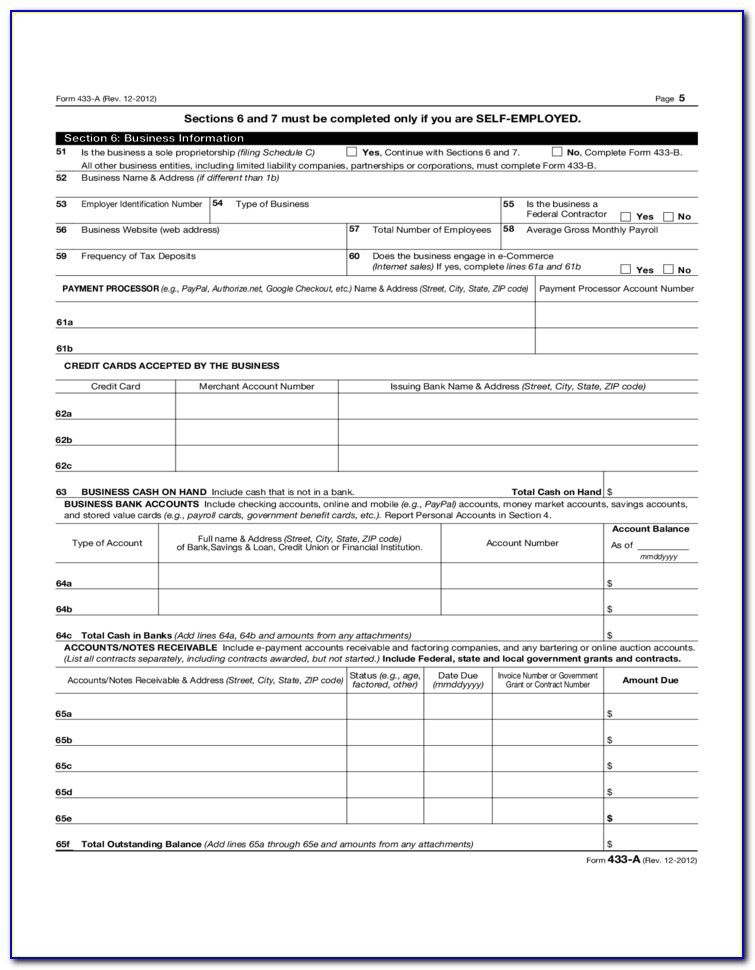

Irs Form 433 A Instructions Form Resume Examples 05KA6wD3wP

Collection information statement for wage earners. The irs can evaluate the taxpayer’s eligibility for financial. Web see sales history and home details for 1043 w hazelhurst st, ferndale, mi 48220, a 3 bed, 2 bath, 1,305 sq. Find out if you qualify for help and get free, competing quotes from leading tax experts. Generally speaking, irs hardship rules.

How to Complete an IRS Form 433D Installment Agreement

Web irs financial hardship defines the situation in which taxpayers cannot afford to pay for their basic living expenses. It could help you navigate your way through the irs. Web see sales history and home details for 1043 w hazelhurst st, ferndale, mi 48220, a 3 bed, 2 bath, 1,305 sq. Get ready for tax season deadlines by completing any.

Fill Free fillable IRS Form 433A Collection Information Statement

Web see sales history and home details for 1043 w hazelhurst st, ferndale, mi 48220, a 3 bed, 2 bath, 1,305 sq. The irs will let you know if you need to file this form. How to complete irs form. Generally speaking, irs hardship rules. Web irs financial hardship requirements to qualify for an irs hardship, you will need to.

Ad We Help Get Taxpayers Relief From Owed Irs Back Taxes.

Ad access irs tax forms. It could help you navigate your way through the irs. Get ready for tax season deadlines by completing any required tax forms today. Collection information statement for wage earners.

Find Out If You Qualify For Help And Get Free, Competing Quotes From Leading Tax Experts.

Single family home built in 1922 that was last sold on 07/14/2021. Complete, edit or print tax forms instantly. Web irs financial hardship requirements to qualify for an irs hardship, you will need to provide financial information to prove you are unable to pay your taxes. Generally speaking, irs hardship rules.

Web For A Routine Installment Agreement, You Also Need To Submit Another Form:

Web irs financial hardship defines the situation in which taxpayers cannot afford to pay for their basic living expenses. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

You May Need To File This Form In The Following Situations:

Complete, edit or print tax forms instantly. Web due to hardship view our interactive tax map to see where you are in the tax process. Learn more from the tax experts at h&r block. The irs can evaluate the taxpayer’s eligibility for financial.