Irs Form 5564 Pdf

Irs Form 5564 Pdf - This form notifies the irs that you agree with the proposed additional tax due. Web spouses must sign form 5564. The notice explains how the amount was calculated, what to do if you agree or disagree,. This may result in an increase or decrease in your tax. Web this letter explains the changes and your right to challenge the increase in tax court. Web you must file your petition within 90 days (or 150 days if the notice is addressed to a person outside of the united states) from the date of this letter, which is. Web get this form now! November 2022) department of the treasury internal revenue service. Web irs form 5564 pdfl solution to design form 5564? Web complete form 5564 online with us legal forms.

If you’ve received notice cp3219 from the irs, you may be wondering what it means and what you need to do. It is used by employers to report employee tips on a. Save or instantly send your ready documents. This may result in an increase or decrease in your tax. Type text, add images, blackout confidential. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web find out how to save, fill in or print irs forms with adobe reader. Web you must file your petition within 90 days (or 150 days if the notice is addressed to a person outside of the united states) from the date of this letter, which is. Web wage and tax statement. Review the changes and compare them to your tax return.

Get access to thousands of forms. Web spouses must sign form 5564. If you’ve received notice cp3219 from the irs, you may be wondering what it means and what you need to do. This may result in an increase or decrease in your tax. November 2022) department of the treasury internal revenue service. Web you should review the complete audit report enclosed with your letter. Save or instantly send your ready documents. Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail. Web find out how to save, fill in or print irs forms with adobe reader. Web irs notice of deficiency:

Irs Form W4V Printable / IRS W4T PDFfiller / The internal revenue

Easily fill out pdf blank, edit, and sign them. It is used by employers to report employee tips on a. Web find out how to save, fill in or print irs forms with adobe reader. If you are making a. Type text, add images, blackout confidential.

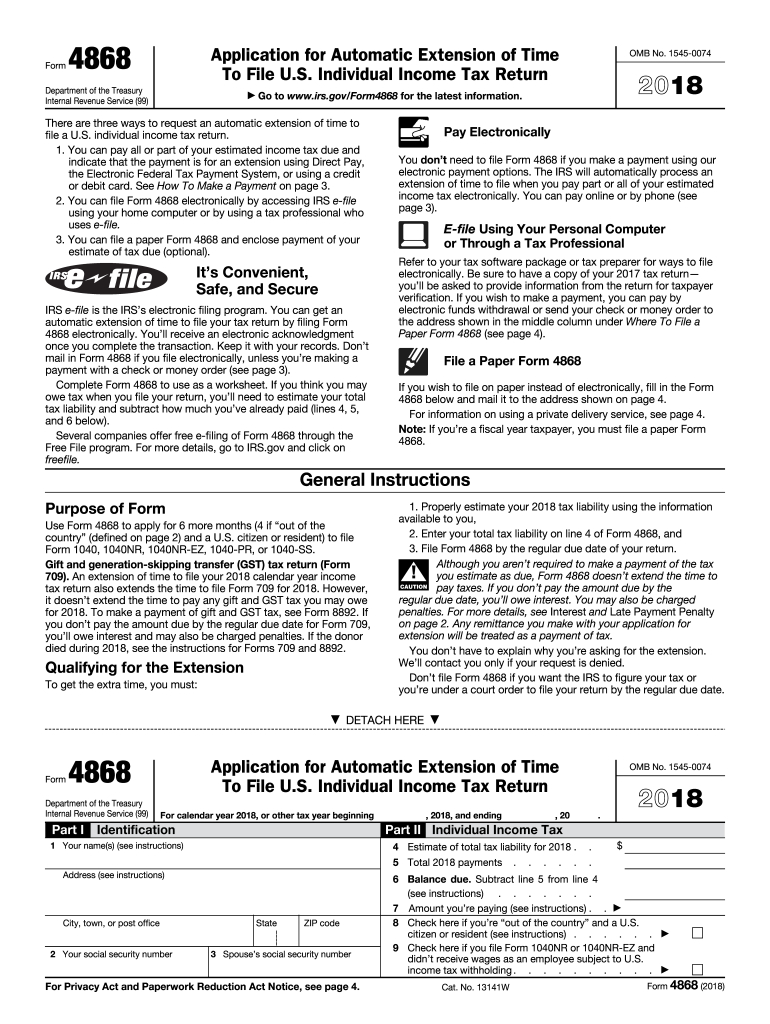

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Web you must file your petition within 90 days (or 150 days if the notice is addressed to a person outside of the united states) from the date of this letter, which is. If you are making a. If you’ve received notice cp3219 from the irs, you may be wondering what it means and what you need to do. Web.

Form 8689 2020 IRS Form 8689 Fill Out Digital PDF Sample

Edit your how to fill form 5564 online. November 2022) department of the treasury internal revenue service. This form notifies the irs that you agree with the proposed additional tax due. You can also download it, export it or print it out. Web you must file your petition within 90 days (or 150 days if the notice is addressed to.

Irs Form 1096 Box 7 Form Resume Examples 8lDRpVeOav

If you are making a. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Web this letter explains the changes and your right to challenge the increase in tax court. Web up to $40 cash back irs.

IRS Audit Letter CP3219A Sample 1

Form 5564 & notice 3219a. We use adobe acrobat pdf files to provide electronic access to our forms and publications. Web find out how to save, fill in or print irs forms with adobe reader. Type text, add images, blackout confidential. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you.

IRS Audit Letter CP3219A Sample 1

Save or instantly send your ready documents. We received information that is different from what you reported on your tax return. You should determine if you agree with the proposed changes or wish to file a petition with. Easily fill out pdf blank, edit, and sign them. November 2022) department of the treasury internal revenue service.

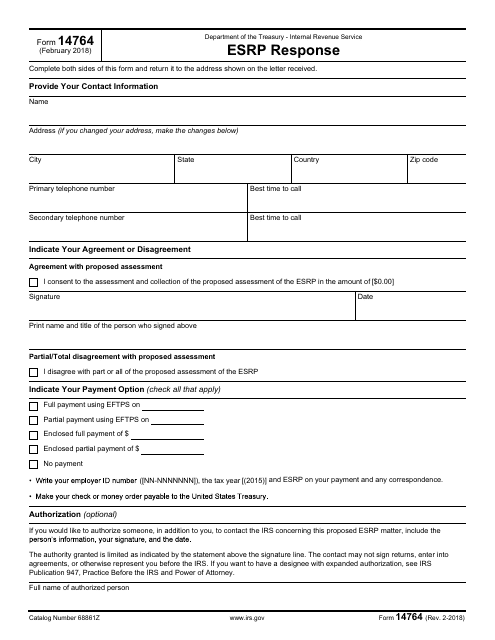

IRS Form 14764 Download Fillable PDF or Fill Online Esrp Response

You should determine if you agree with the proposed changes or wish to file a petition with. We received information that is different from what you reported on your tax return. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a.

Irs Cp2000 Example Response Letter amulette

Form 5564 & notice 3219a. November 2022) department of the treasury internal revenue service. The notice explains how the amount was calculated, what to do if you agree or disagree,. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. United states (english) united states (spanish) canada (english) canada (french) tax.

IRS FORM 13825 PDF

Web up to $40 cash back irs form 5564 is a form used by employers to report employee tips to the internal revenue service (irs). Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. You should determine if you agree with the proposed changes or wish to file a petition with. United states.

IRS Audit Letter CP3219A Sample 1

If we do not hear from you and you do. Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail. You can also download it, export it or print it out. Web irs form 5564 pdfl solution to design form 5564?.

We Received Information That Is Different From What You Reported On Your Tax Return.

Web up to $40 cash back irs form 5564 is a form used by employers to report employee tips to the internal revenue service (irs). Notice concerning fiduciary relationship (internal revenue code sections 6036 and. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web irs notice of deficiency:

Web Irs Form 5564 Pdfl Solution To Design Form 5564?

You should determine if you agree with the proposed changes or wish to file a petition with. Type text, add images, blackout confidential. Web you should review the complete audit report enclosed with your letter. Web complete form 5564 online with us legal forms.

Web Irs Form 5564 Is Included When The Federal Tax Agency Sends The Irs Notice Cp3219A.

Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Web send tax form 5564 via email, link, or fax. Web this letter explains the changes and your right to challenge the increase in tax court. Mail the form 5564 or any payment of your liability to the tax court.

Save Or Instantly Send Your Ready Documents.

Review the changes and compare them to your tax return. If we don’t hear from you. Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail. The notice explains how the amount was calculated, what to do if you agree or disagree,.