Irs Form 5564

Irs Form 5564 - Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency explaining the additional tax due and how the amount was calculated. Web welcome to irs appeals. Online videos and podcasts of the appeals process. Web it indicates your consent with the proposed decrease or increase in tax payments. Forms and publications about your appeal rights. Letters and notices offering an appeal opportunity. If you agree with the information on your notice, you can sign this waiver and return it to the irs. Web use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Along with notice cp3219a, you should receive form 5564. Mail using the return address on the enclosed envelope, or

If you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail to the commission. Web welcome to irs appeals. You can submit your response by: Get everything done in minutes. Web it indicates your consent with the proposed decrease or increase in tax payments. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Letters and notices offering an appeal opportunity. Mail using the return address on the enclosed envelope, or What if you disagree with the information on notice cp3219a? If you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter.

How to fill out form 5564. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes. Online videos and podcasts of the appeals process. Along with notice cp3219a, you should receive form 5564. If you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail to the commission. Web it indicates your consent with the proposed decrease or increase in tax payments. Web use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. If you agree with the information on your notice, you can sign this waiver and return it to the irs. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency explaining the additional tax due and how the amount was calculated.

IRS Audit Letter CP3219A Sample 1

You can submit your response by: Forms and publications about your appeal rights. Letters and notices offering an appeal opportunity. Along with notice cp3219a, you should receive form 5564. Web welcome to irs appeals.

FIA Historic Database

Web this letter explains the changes and your right to challenge the increase in tax court. Review the changes and compare them to your tax return. How to fill out form 5564. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Mail using the return address on the enclosed envelope,.

IRS FORM 12257 PDF

Web use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. If you are making a payment, include it with the form 5564. Letters and notices offering an appeal opportunity. Get everything done in minutes. What if you disagree with the information on notice cp3219a?

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Web welcome to irs appeals. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency explaining the additional tax due and how the amount was calculated. Web what is irs form 5564? Along with notice cp3219a, you should.

Tax Form 5564 Fill Online, Printable, Fillable, Blank pdfFiller

How to fill out form 5564. What if you disagree with the information on notice cp3219a? Web this letter explains the changes and your right to challenge the increase in tax court. Review the changes and compare them to your tax return. Get everything done in minutes.

IRS Letter CP3219A Statutory Notice of Deficiency YouTube

Web it indicates your consent with the proposed decrease or increase in tax payments. Online videos and podcasts of the appeals process. How to fill out form 5564. If you are making a payment, include it with the form 5564. Review the changes and compare them to your tax return.

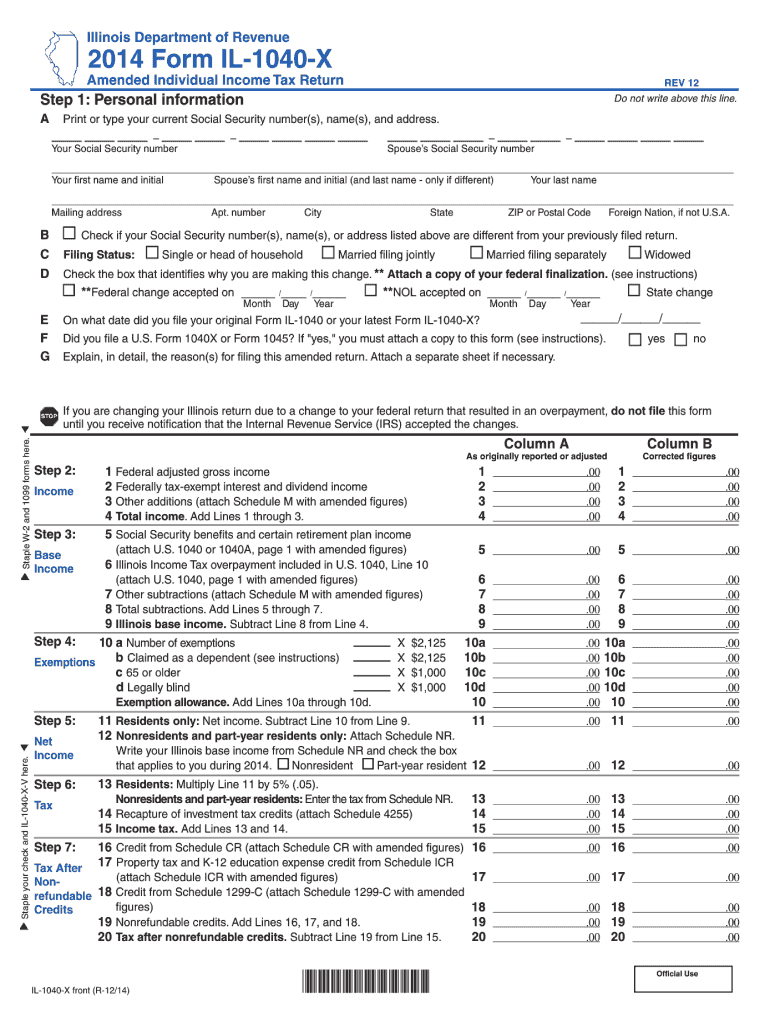

1040X Instructions 2014 Fill Out and Sign Printable PDF Template

If you agree with the information on your notice, you can sign this waiver and return it to the irs. Web it indicates your consent with the proposed decrease or increase in tax payments. Forms and publications about your appeal rights. Web welcome to irs appeals. If you agree, sign the enclosed form 5564 and mail or fax it to.

Here's What to Do with an IRS Notice of Deficiency

Web what is irs form 5564? If you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. How to fill out form 5564. If you agree with the information on your notice, you can sign this waiver and return it to the irs. What if you disagree with.

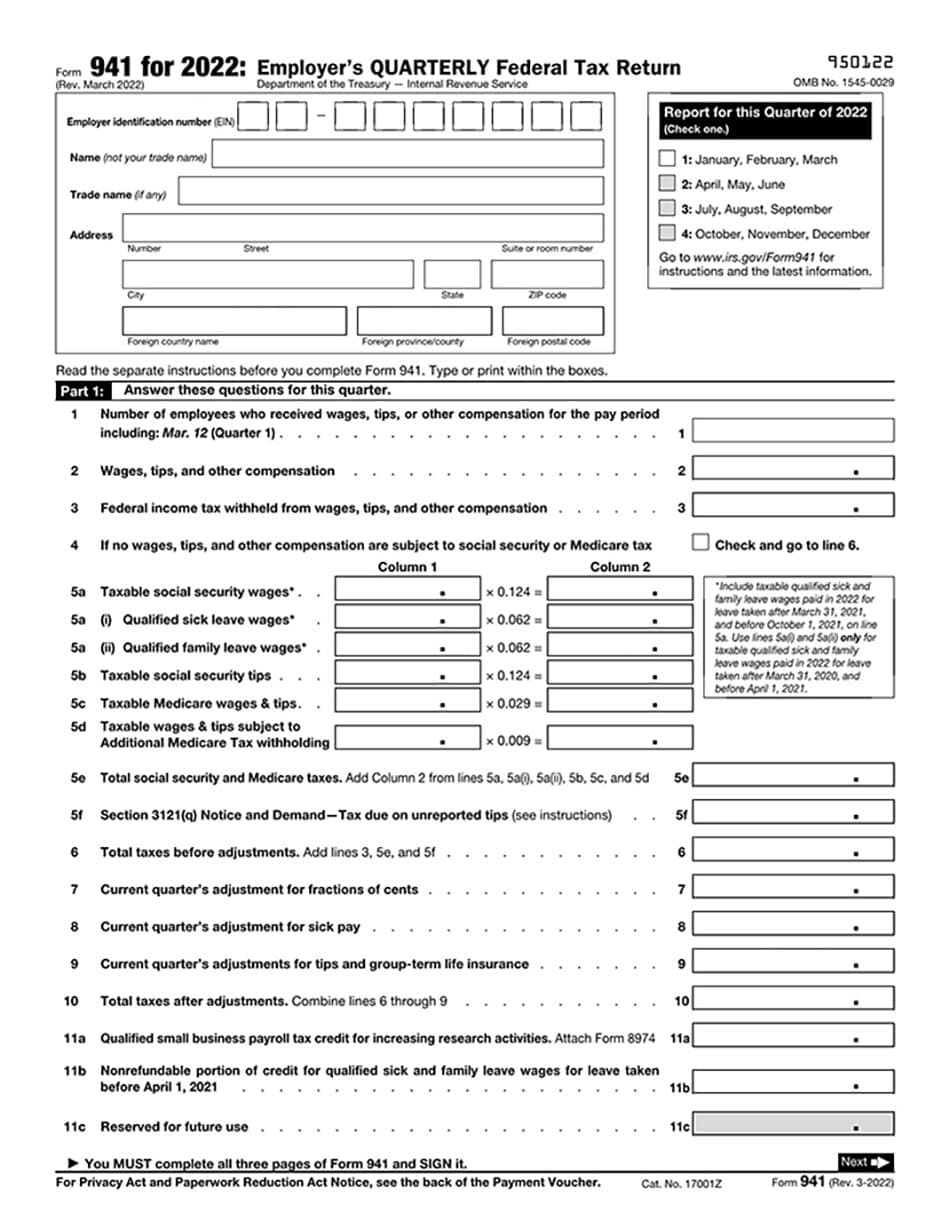

941 Form Internal Revenue Service Fillable Form

If you agree with the information on your notice, you can sign this waiver and return it to the irs. If you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail to the commission. Web it indicates your consent with the proposed decrease.

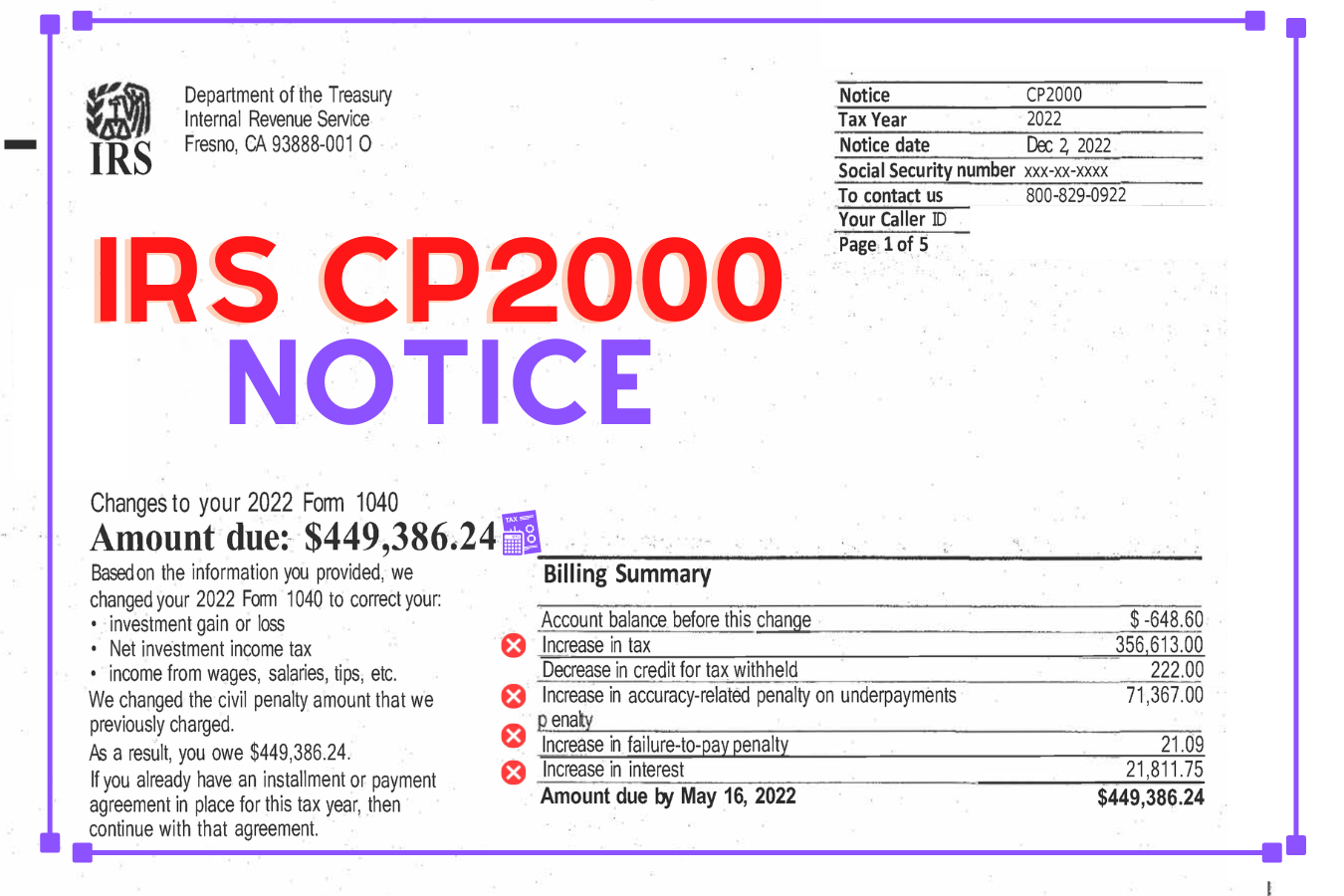

IRS CP2000 Notice, IRS proposed changes can be reversed, and eliminate

If you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified mail to the commission. Web welcome to irs appeals. Along with notice cp3219a, you should receive form 5564. Mail using the return address on the enclosed envelope, or Review the changes and compare.

Mail Using The Return Address On The Enclosed Envelope, Or

If you agree with the information on your notice, you can sign this waiver and return it to the irs. Get everything done in minutes. Web what is irs form 5564? Forms and publications about your appeal rights.

Hand Off Your Taxes, Get Expert Help, Or Do It Yourself.

If you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Web welcome to irs appeals. Web this letter explains the changes and your right to challenge the increase in tax court.

Review The Changes And Compare Them To Your Tax Return.

If you are making a payment, include it with the form 5564. How to fill out form 5564. Letters and notices offering an appeal opportunity. Web it indicates your consent with the proposed decrease or increase in tax payments.

Online Videos And Podcasts Of The Appeals Process.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You can submit your response by: Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency explaining the additional tax due and how the amount was calculated. Along with notice cp3219a, you should receive form 5564.

.jpg)

.png)