Irs Form 8825 Instructions

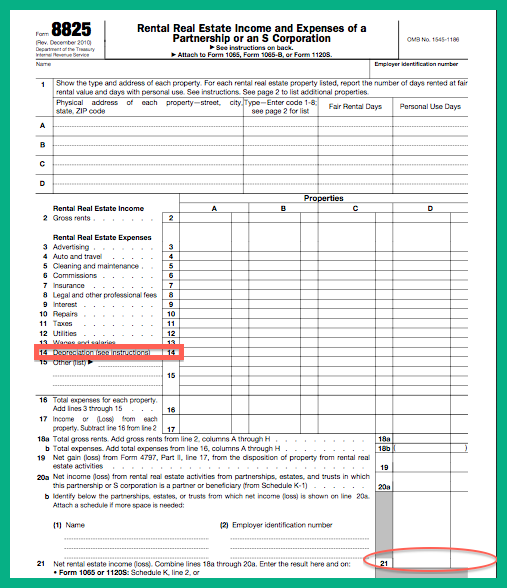

Irs Form 8825 Instructions - Rental real estate income and expenses of a partnership or an s corporation. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). See the instructions for the tax return with which this form is filed. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. December 2010) department of the treasury internal revenue service. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. File your federal and federal tax returns online with turbotax in minutes. Use this november 2018 revision of form 8825 for tax. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web to complete the form:

Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web to complete the form: File your federal and federal tax returns online with turbotax in minutes. Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. Use this november 2018 revision of form 8825 for tax. Of the treasury, internal revenue service. You must start by identifying each property. Web attach to form 1065 or form 1120s. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (online) imprint [washington, d.c.] : Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate.

Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Web attach to form 1065 or form 1120s. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (online) imprint [washington, d.c.] : Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). See the instructions for the tax return with which this form is filed. The form allows you to record. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. December 2010) department of the treasury internal revenue service.

IRS Form 8825 Fill out & sign online DocHub

When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web attach to form 1065 or form 1120s. Then indicate the amount.

20202022 Form IRS 9423 Fill Online, Printable, Fillable, Blank pdfFiller

Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Web irs form 8825 is a special tax form specifically for reporting the rental.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. Web attach to form 1065 or form 1120s. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental.

Form 1065 U.S. Return of Partnership (2014) Free Download

Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Use this november 2018 revision of form 8825 for tax. File your federal and federal tax returns online with turbotax in minutes. Then indicate the amount of income and expenses associated with that property. Web partnerships and s corporations use form.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web form 8825, rental real estate.

2020 Form IRS Instruction 1040 Schedule E Fill Online, Printable

Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web to hear from you. Partnerships and s corporations use form 8825 to report income and. Ad download.

Fill Free fillable Form 1065 U.S. Return of Partnership 2019

Web to hear from you. Web attach to form 1065 or form 1120s. Web to complete the form: Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. Use this november 2018 revision of form 8825 for tax.

OMB Archives PDFfiller Blog

Then indicate the amount of income and expenses associated with that property. Partnerships and s corporations use form 8825 to report income and. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. When using irs form 8825, determine the number of months the property was in service by dividing the.

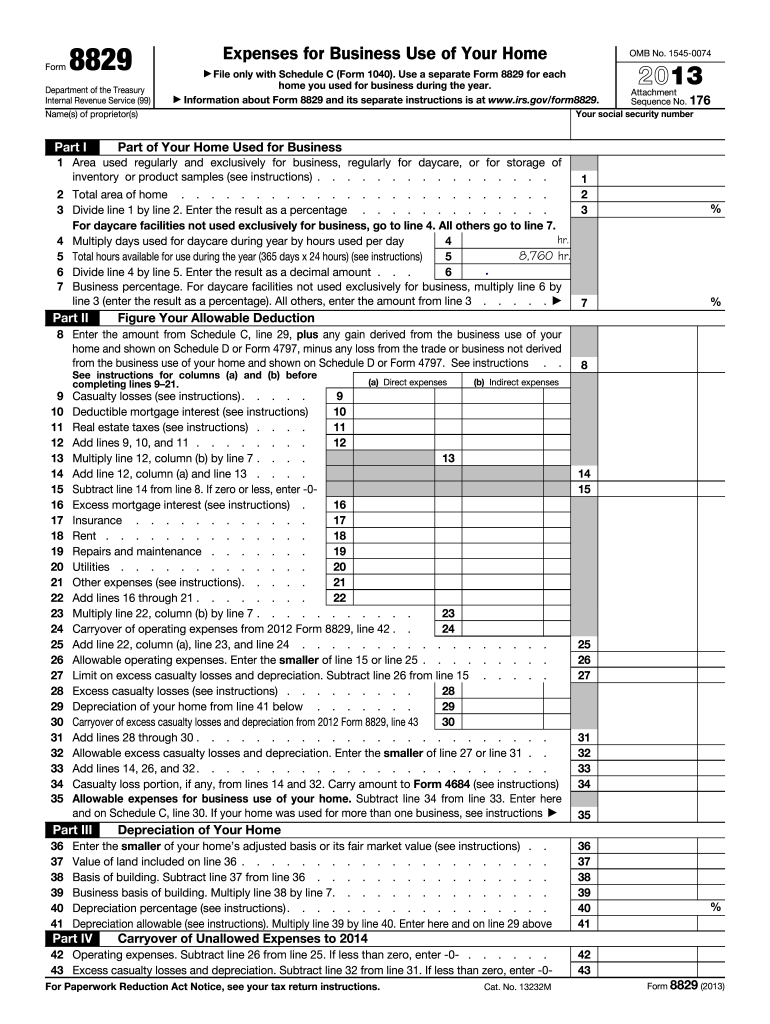

2013 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Rental real estate income and expenses of a partnership or an s corporation. Then indicate the amount of income and expenses associated with that property. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Partnerships and s corporations use form 8825 to.

Linda Keith CPA » All about the 8825

Use this november 2018 revision of form 8825 for tax. Then indicate the amount of income and expenses associated with that property. Web attach to form 1065 or form 1120s. December 2010) department of the treasury internal revenue service. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (online) imprint [washington, d.c.] :

Rental Real Estate Income And Expenses Of A Partnership Or An S Corporation.

Ad download or email irs 8825 & more fillable forms, register and subscribe now! Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. See the instructions for the tax return with which this form is filed.

File Your Federal And Federal Tax Returns Online With Turbotax In Minutes.

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web to hear from you. Web to complete the form: Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms.

Partnerships And S Corporations Use Form 8825 To Report Income And Deductible Expenses From Rental Real Estate Activities, Including Net Income (Loss).

Of the treasury, internal revenue service. You must start by identifying each property. Use this november 2018 revision of form 8825 for tax. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate.

Partnerships And S Corporations Use Form 8825 To Report Income And.

December 2010) department of the treasury internal revenue service. When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Then indicate the amount of income and expenses associated with that property. The form allows you to record.