Irs Form 8881

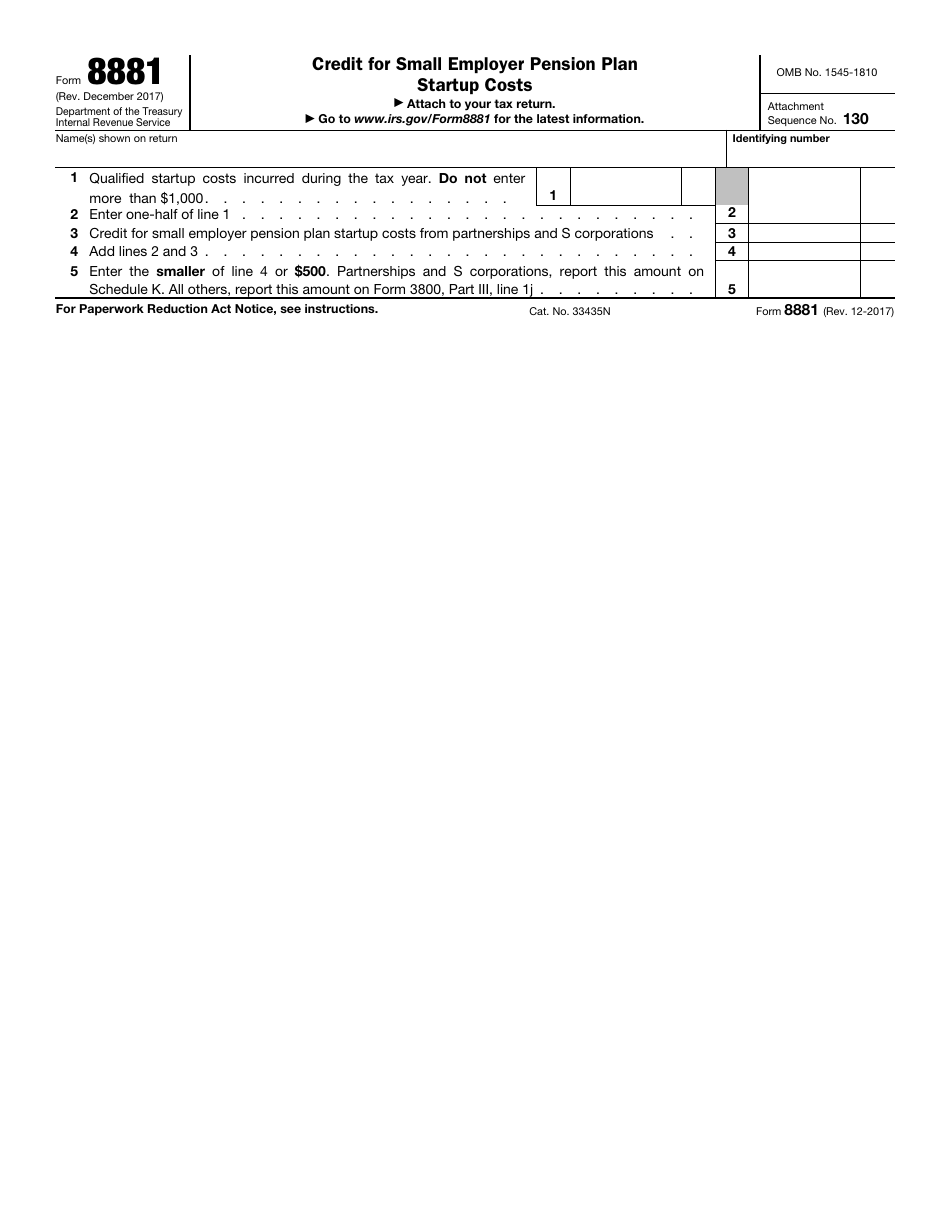

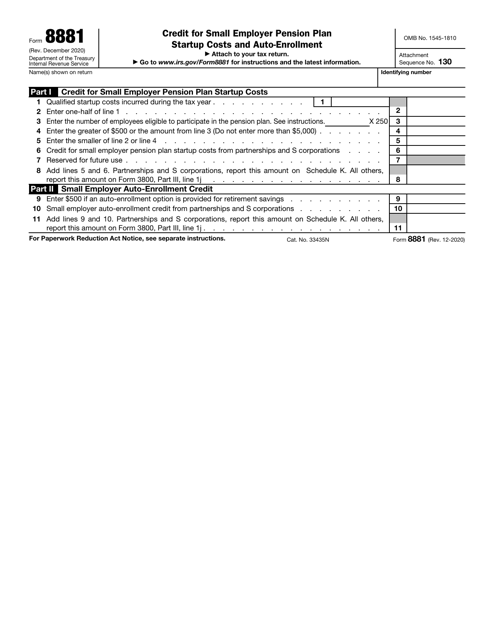

Irs Form 8881 - Web the irs has revised form 8881, credit for small employer pension plan startup costs. Written comments should be received on or before. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web you may be eligible for a substantial tax credit on form 8881 to offset your plan costs. The credits cover the costs of starting a new retirement plan and adding. Eligible employers you qualify to claim this. Web (irs form 8881, credit for small employer pension plan startup costs). Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. The irs will need to amend the form for the. An eligible employer with 50 or fewer employees may claim a tax credit.

September 2014) department of the treasury internal revenue service information return for publicly offered original issue discount instruments information. The revision is effective in december 2017. Web you may be eligible for a substantial tax credit on form 8881 to offset your plan costs. Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. Written comments should be received on or before. If you’ve set up a new qualified pension plan for your employees, you can. Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022. Web form 8881 from the main menu of the corporation tax return (form 1120) select: Web the irs has revised form 8881, credit for small employer pension plan startup costs. Web irs form 8881 is typically used by small business owners in the following scenarios:

An eligible employer with 50 or fewer employees may claim a tax credit. You are not required to file annual financial reports. Web establish or administer a qualifying retirement plan, or educate employees about the plan. Written comments should be received on or before. Tax and payments total tax (schedule j, part i) total credits general business credits (form. Web irs form 8881 is typically used by small business owners in the following scenarios: If you’ve set up a new qualified pension plan for your employees, you can. Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web irs form 8881 (credit for small employer pension plan startup costs) is filed in conjunction with the employer’s tax return. Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan startup costs, up to.

Irs 2290 Form 2016 To 2017 Universal Network

Web form 8881 allows small businesses to claim tax credits created by the secure act. Web irs form 8881 is typically used by small business owners in the following scenarios: Written comments should be received on or before. Web you may be eligible for a substantial tax credit on form 8881 to offset your plan costs. The revision is effective.

Revisiting the consequences of a “covered expatriate” for

The credits cover the costs of starting a new retirement plan and adding. Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan startup costs, up to. If you’ve set up a new qualified pension plan for your employees, you can. The revision is.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

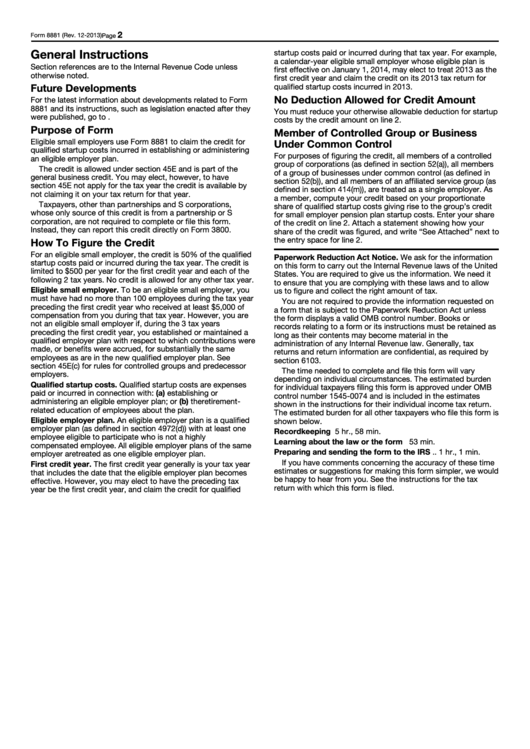

Web irs form 8881 is typically used by small business owners in the following scenarios: Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in establishing or.

Instructions For Form 8881 Credit For Small Employer Pension Plan

An eligible employer with 50 or fewer employees may claim a tax credit. Web irs form 8881 (credit for small employer pension plan startup costs) is filed in conjunction with the employer’s tax return. Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan.

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Web form 8881 from the main menu of the corporation tax return (form 1120) select: Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. Web establish or administer a qualifying retirement plan, or educate employees about the plan. An eligible employer with 50 or fewer employees may claim a tax credit. Plans covered.

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan. Web irs is soliciting comments concerning form 8881, credit for.

IRS FORM 8281 PDF

Tax and payments total tax (schedule j, part i) total credits general business credits (form. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Eligible employers you qualify to claim this. Web we last updated the credit for small employer pension plan startup costs in february 2023, so.

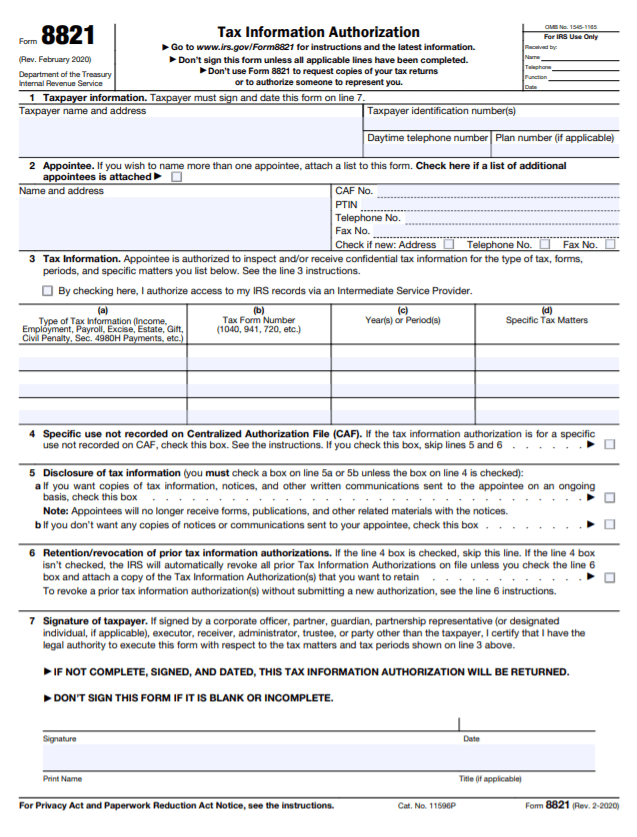

IRS Form 8821 (How to Give Tax Information Authorization to Another

Tax and payments total tax (schedule j, part i) total credits general business credits (form. Web the irs has revised form 8881, credit for small employer pension plan startup costs. Written comments should be received on or before. Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in.

Irs Form 2290 Printable Form Resume Examples

Web form 8881 allows small businesses to claim tax credits created by the secure act. You are not required to file annual financial reports. The irs will need to amend the form for the. Web form 8881 from the main menu of the corporation tax return (form 1120) select: Web irs form 8881 (credit for small employer pension plan startup.

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan startup costs, up to. Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web we last updated the.

Plans Covered Under This Credit Would Be Any Qualified Plans That Cover.

The revision is effective in december 2017. Eligible employers you qualify to claim this. Web the irs has revised form 8881, credit for small employer pension plan startup costs. Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022.

Web Irs Form 8881 (Credit For Small Employer Pension Plan Startup Costs) Is Filed In Conjunction With The Employer’s Tax Return.

Written comments should be received on or before. The credits cover the costs of starting a new retirement plan and adding. September 2014) department of the treasury internal revenue service information return for publicly offered original issue discount instruments information. Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan.

Web Form 8881 From The Main Menu Of The Corporation Tax Return (Form 1120) Select:

Web irs form 8881 is typically used by small business owners in the following scenarios: Web establish or administer a qualifying retirement plan, or educate employees about the plan. Web form 8881 allows small businesses to claim tax credits created by the secure act. If you’ve set up a new qualified pension plan for your employees, you can.

Web (Irs Form 8881, Credit For Small Employer Pension Plan Startup Costs).

Web you may be eligible for a substantial tax credit on form 8881 to offset your plan costs. An eligible employer with 50 or fewer employees may claim a tax credit. Tax and payments total tax (schedule j, part i) total credits general business credits (form. The irs will need to amend the form for the.