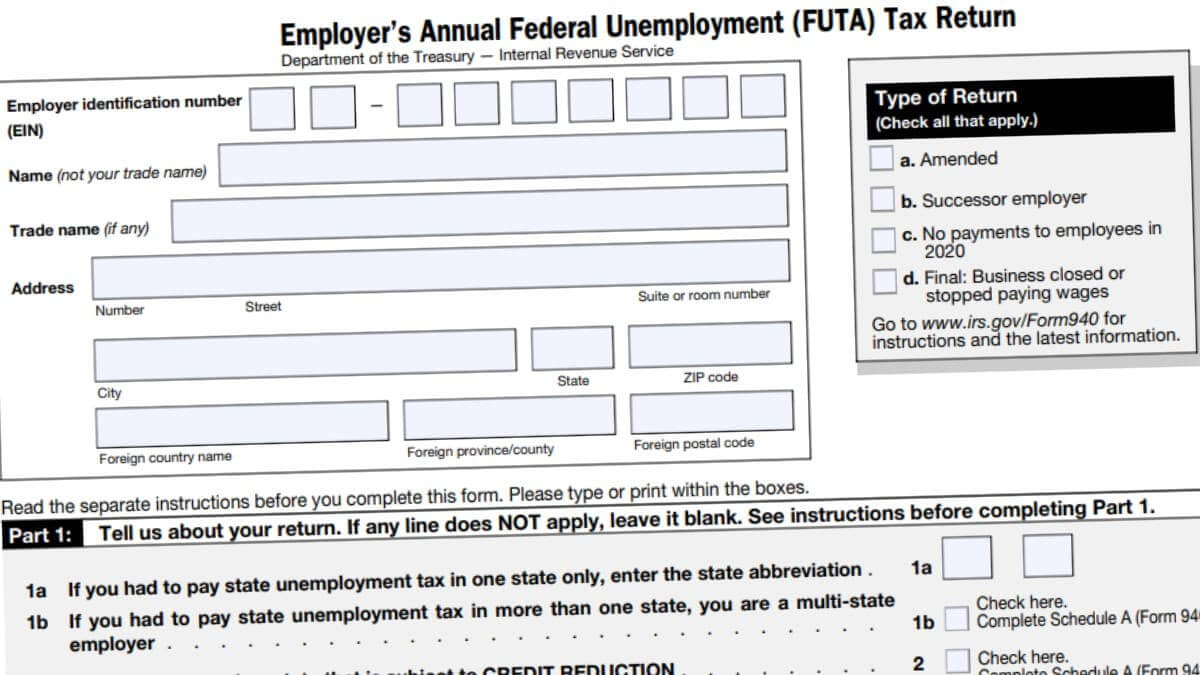

Is There A Form 940 For 2021

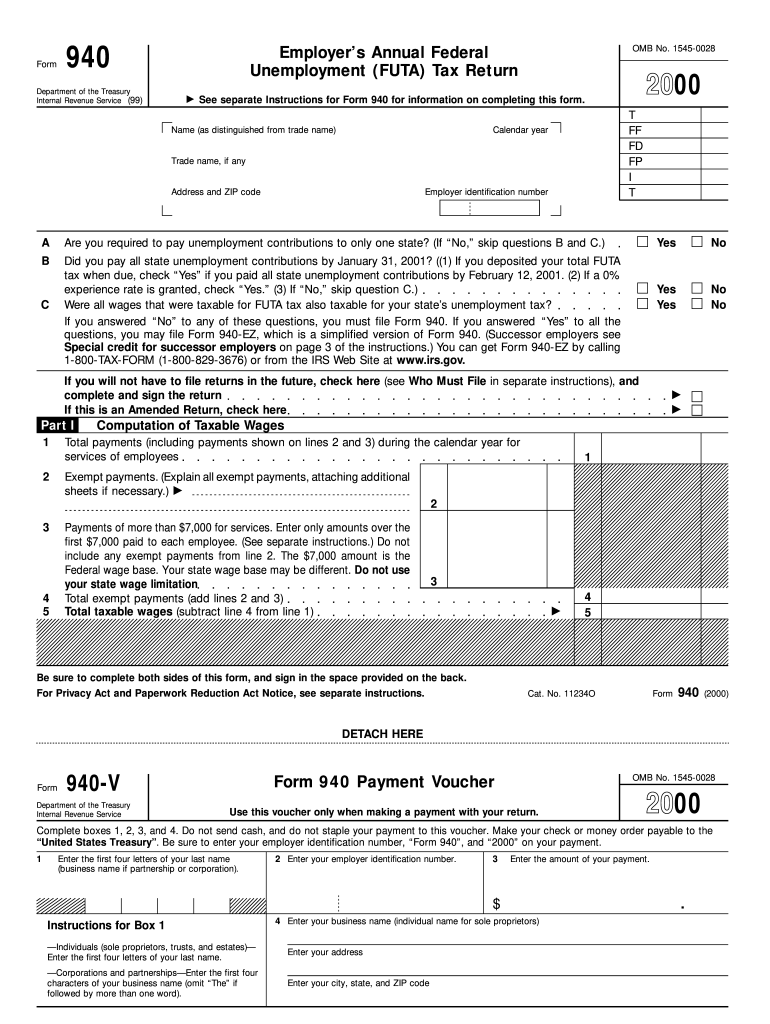

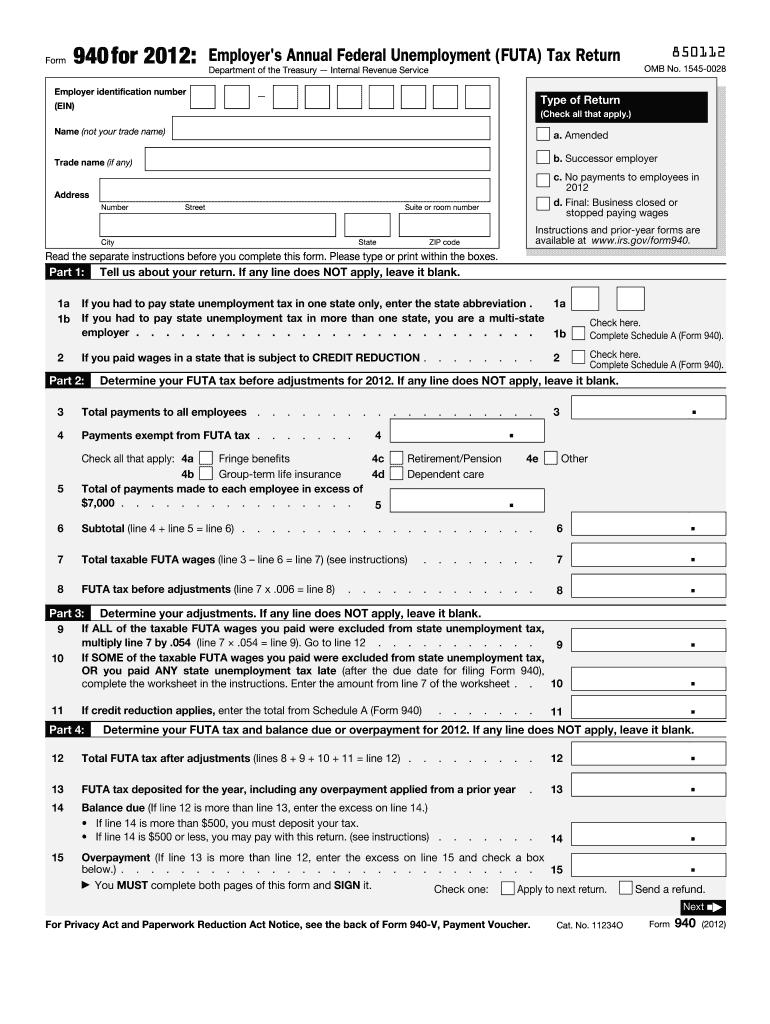

Is There A Form 940 For 2021 - Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. As a small business, you’re required to file form 940 if either of the following is true: Web get federal tax return forms and file by mail. 31 each year for the previous year. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. What information is required to file form 940 for 2022? Must be removed before printing. This means that for 2021 tax returns, irs form 940 must be. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

This means that for 2021 tax returns, irs form 940 must be. 31 each year for the previous year. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Ad download or email irs 940 & more fillable forms, register and subscribe now! As a small business, you’re required to file form 940 if either of the following is true: Employers pay federal unemployment tax on the first $7,000 of each. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa).

If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web finances and taxes. Web requirements for form 940. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 940 is due on jan. Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Web instructions instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless. Employers pay federal unemployment tax on the first $7,000 of each. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Together with state unemployment tax systems, the futa tax provides.

940 Form 2021

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. Web get federal tax return forms and file by mail. Employers pay federal unemployment tax on.

940 Form Fill Out and Sign Printable PDF Template signNow

Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. This means that for 2021 tax returns, irs form.

IRS Instructions 940 2018 2019 Fillable and Editable PDF Template

Web form 940 is due on jan. Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. Ad get ready for tax season deadlines by completing any.

940 Form 2021 IRS Forms TaxUni

Together with state unemployment tax systems, the futa tax provides. Web get federal tax return forms and file by mail. Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. Web form 940 reports federal unemployment taxes to the irs at the beginning.

940 Form 2021

Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Get paper copies of.

Printable 940 Form 2021 Printable Form 2022

Employers pay federal unemployment tax on the first $7,000 of each. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web an employer's annual federal unemployment tax return, the irs’ form 940, is an.

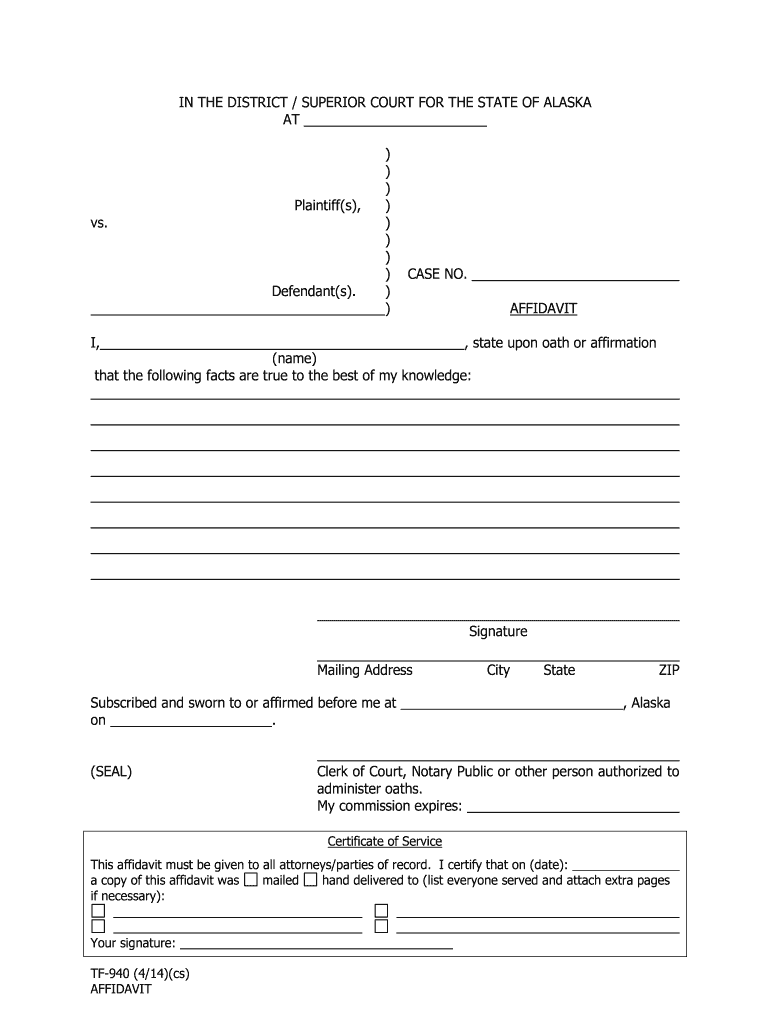

Tf 940 Fill Out and Sign Printable PDF Template signNow

Web form 940 is due january 31 (or the next business day if this date falls on a weekend or holiday). Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Together with state unemployment tax systems, the futa tax provides. Ad get ready for tax season deadlines by.

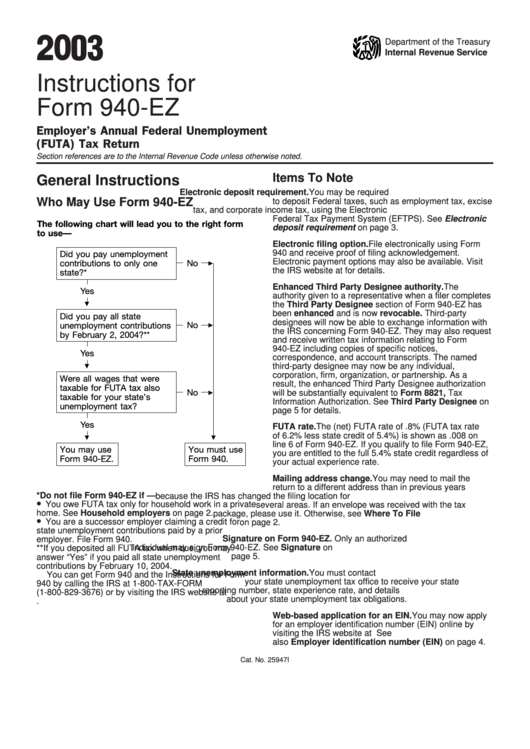

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Web use form 940 to report your annual federal unemployment tax act (futa) tax..

Form 940 and Schedule A YouTube

Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web under the general test, you're subject to futa tax on the wages you pay employees.

2020 Form IRS Instructions 940 Fill Online, Printable, Fillable, Blank

Futa is different from fica as employees don’t contribute. What information is required to file form 940 for 2022? Web get federal tax return forms and file by mail. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web under the general test, you're subject to futa tax on.

Web Form 940 Is Due January 31 (Or The Next Business Day If This Date Falls On A Weekend Or Holiday).

31 each year for the previous year. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Must be removed before printing.

Complete, Edit Or Print Tax Forms Instantly.

Ad get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 940 & more fillable forms, register and subscribe now! Are there penalties associated with form. Web finances and taxes.

Web Requirements For Form 940.

Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Futa is different from fica as employees don’t contribute.

Complete, Edit Or Print Tax Forms Instantly.

Employers pay federal unemployment tax on the first $7,000 of each. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. When is the 940 tax form due? This means that for 2021 tax returns, irs form 940 must be.