K-5 Tax Form

K-5 Tax Form - Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Web here is a link to its new location. Other web filing methods are still available for wage and tax. Divide the gross annual kentucky tax by the number of annual pay. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web water bills can be paid online or in person at city hall (414 e. This form is for income earned in tax year. The kentucky department of revenue conducts work. Please update your bookmarks to this new location.

Employers and payers who issue kentucky. This form is for income earned in tax year. Kentucky has also published instructions for this form. However, due to differences between state and. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. The kentucky department of revenue conducts work. 12th st.) or at the water services department (4800 e. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Under the authority of the finance.

63rd st.) using cash, check or credit card. 12th st.) or at the water services department (4800 e. The kentucky department of revenue conducts work. Kentucky has also published instructions for this form. It is important to make this final payment on time (along with the rest of the payments, of. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Divide the gross annual kentucky tax by the number of annual pay. Web water bills can be paid online or in person at city hall (414 e. Other web filing methods are still available for wage and tax. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024.

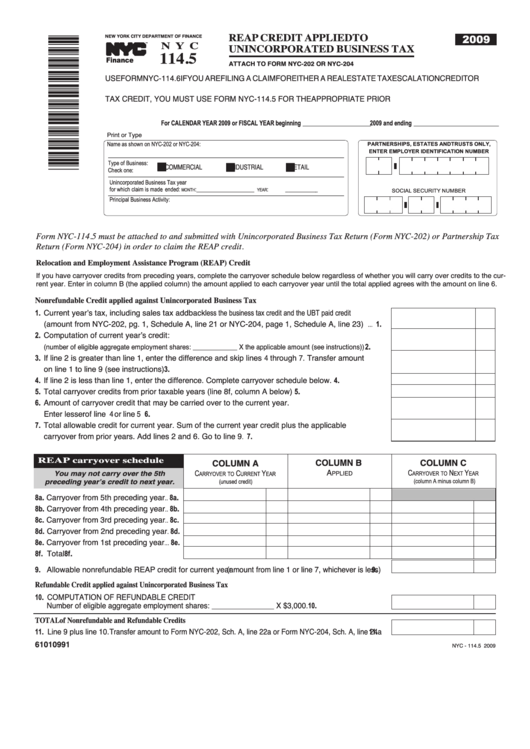

Form Nyc 114.5 Reap Credit Applied To Unincorporated Business Tax

Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. 12th st.) or at the water services department (4800 e. Web water bills can be paid online or in person at city hall (414 e. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal..

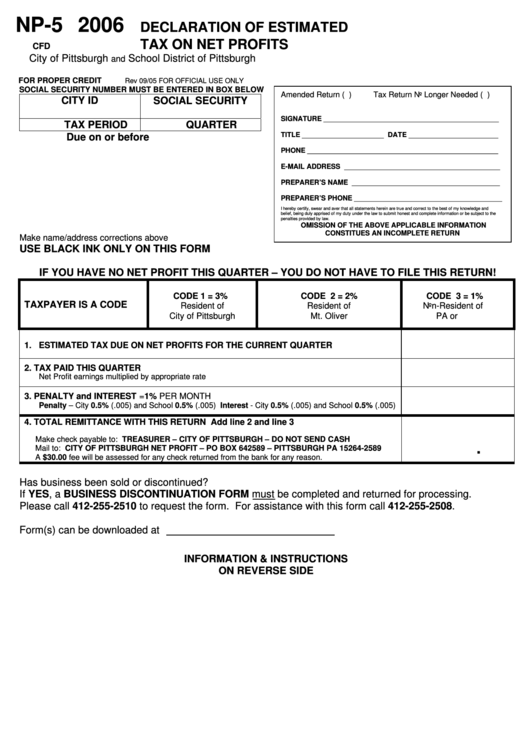

Form Np5 Declaration Of Estimated Tax On Net Profits 2006

12th st.) or at the water services department (4800 e. 63rd st.) using cash, check or credit card. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Under the authority of the finance. Please update your bookmarks to this new location.

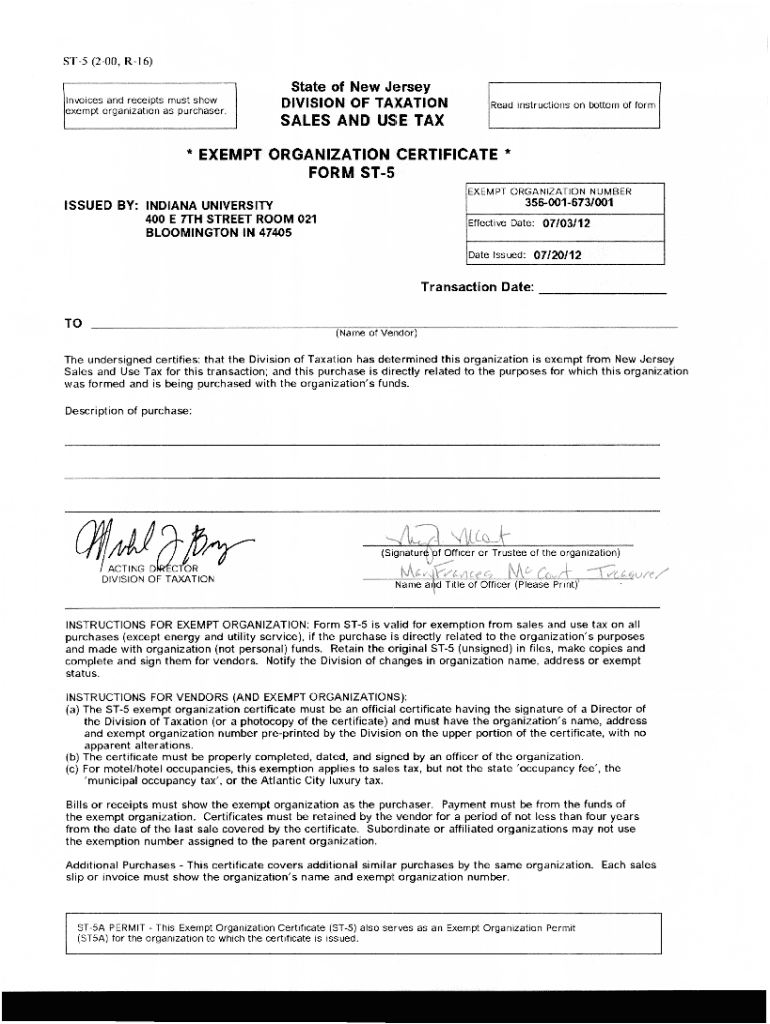

2008 Form NJ DoT ST8 Fill Online, Printable, Fillable, Blank pdfFiller

Web water bills can be paid online or in person at city hall (414 e. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. If claiming a foreign tax. Kentucky has also published instructions for this form. Divide the gross annual kentucky tax by the number of annual pay.

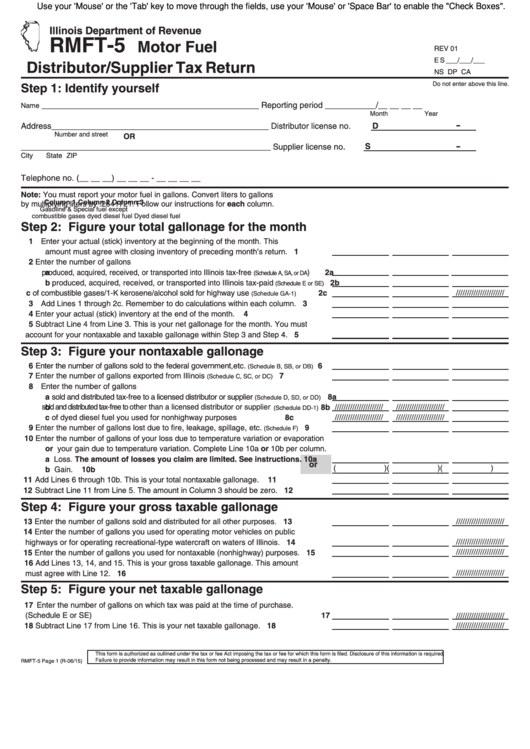

Fillable Form Rmft5 Motor Fuel Distributor/supplier Tax Return

Please update your bookmarks to this new location. This form is for income earned in tax year. Web here is a link to its new location. If claiming a foreign tax. The kentucky department of revenue conducts work.

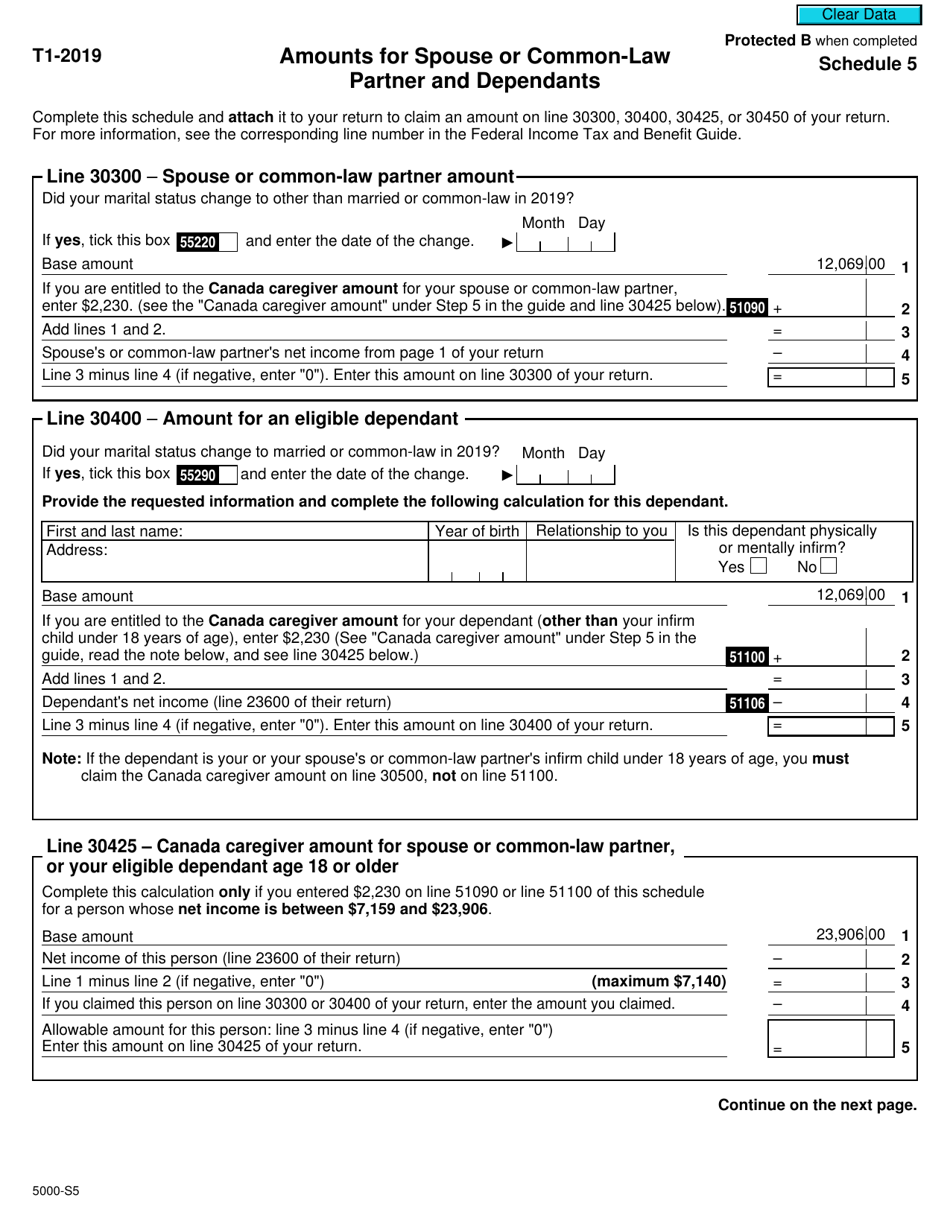

Form 5000S5 Schedule 5 Download Fillable PDF or Fill Online Amounts

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. The kentucky department of revenue conducts work. Kentucky has also published instructions for this form. Divide the gross annual kentucky tax by the number of annual pay. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name.

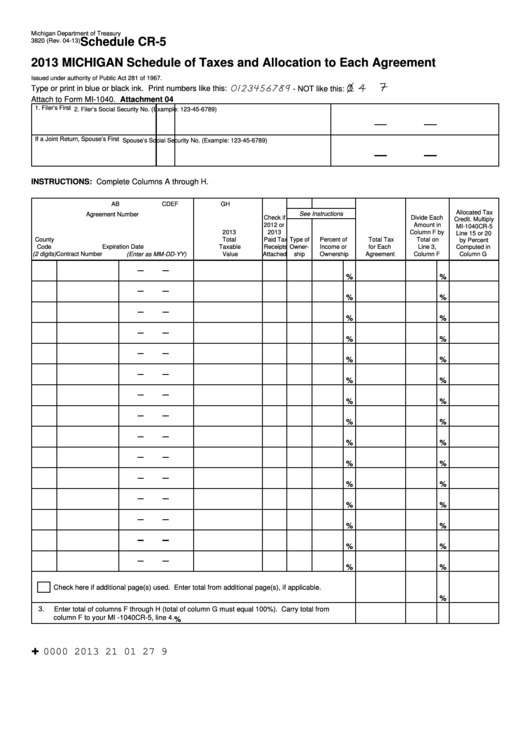

Fillable Schedule Cr5 (Form 3820) Michigan Schedule Of Taxes And

Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. This form is for income earned in tax year. However, due to differences between state and. Web compute tax on wages using the 5% kentucky flat tax rate to determine.

NJ DoT LF5 2020 Fill out Tax Template Online US Legal Forms

Employers and payers who issue kentucky. Divide the gross annual kentucky tax by the number of annual pay. The kentucky department of revenue conducts work. Other web filing methods are still available for wage and tax. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest.

20092022 Form MA DoR ST5 Fill Online, Printable, Fillable, Blank

Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Please update your bookmarks to this new location. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Under the authority of.

Nc Nc5 Form Fill Online, Printable, Fillable, Blank pdfFiller

Kentucky has also published instructions for this form. However, due to differences between state and. Divide the gross annual kentucky tax by the number of annual pay. Web here is a link to its new location. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024.

Other Web Filing Methods Are Still Available For Wage And Tax.

This form is for income earned in tax year. Please update your bookmarks to this new location. However, due to differences between state and. 63rd st.) using cash, check or credit card.

It Is Important To Make This Final Payment On Time (Along With The Rest Of The Payments, Of.

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Kentucky has also published instructions for this form. Employers and payers who issue kentucky. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting.

Divide The Gross Annual Kentucky Tax By The Number Of Annual Pay.

The kentucky department of revenue conducts work. If claiming a foreign tax. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. Web here is a link to its new location.

Under The Authority Of The Finance.

Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. 12th st.) or at the water services department (4800 e. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web water bills can be paid online or in person at city hall (414 e.