Kansas K 4 Form

Kansas K 4 Form - Get ready for tax season deadlines by completing any required tax forms today. State and federal tax policies and laws differ. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certiicate will let your employer know how much. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. However, due to differences between state and. First and last name * please enter your first and last name step 3. Income tax should be withheld from your pay on income you. The form can be filed electronically or on. Individual incomeand estimated income schedules.

There are a few situations in which you can want to request. Get ready for tax season deadlines by completing any required tax forms today. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. Income tax should be withheld from your pay on income you. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form is for income earned in tax year 2022, with tax returns due in april. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. Web click on the links below to view the forms for that tax type. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

State and federal tax policies and laws differ. This form is for income earned in tax year 2022, with tax returns due in april. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. Individual incomeand estimated income schedules. There are a few situations in which you can want to request. However, due to differences between state and. To allow for these differences. Income tax should be withheld from your pay on income you. Web click on the links below to view the forms for that tax type.

Kansas Withholding Form K 4 2022 W4 Form

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. Web click on the links below to view the forms for that.

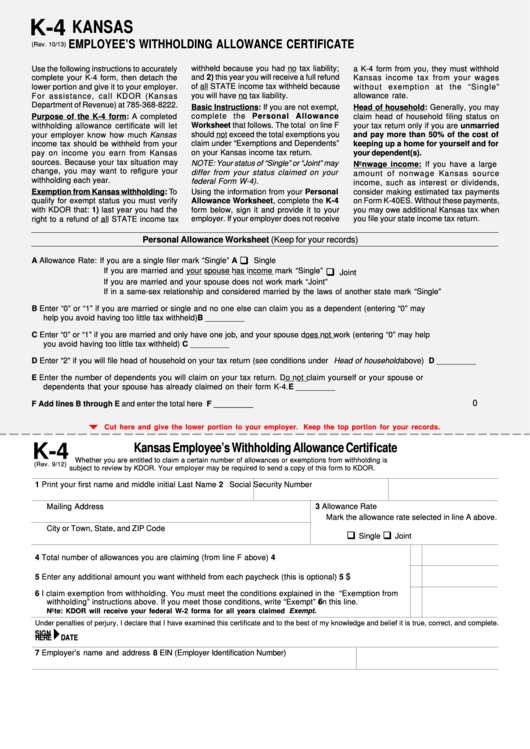

Employees Withholding Allowance Certificate Kansas Free Download

A completed withholding allowance certiicate will let your employer know how much. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. There are a few situations in which you can want to.

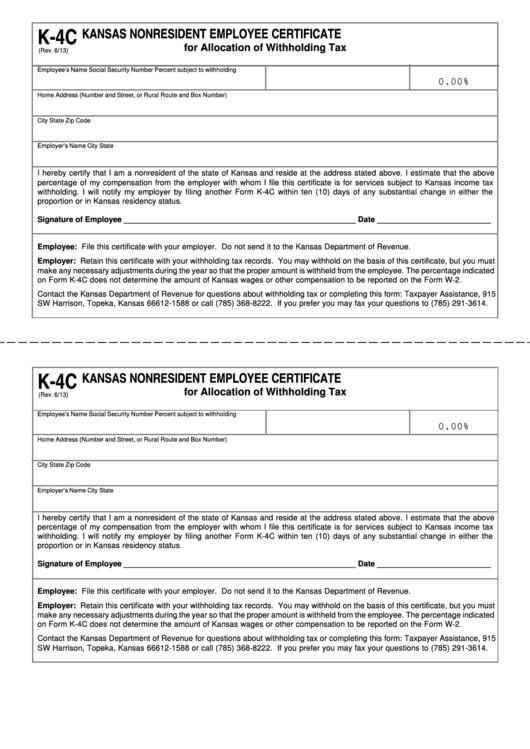

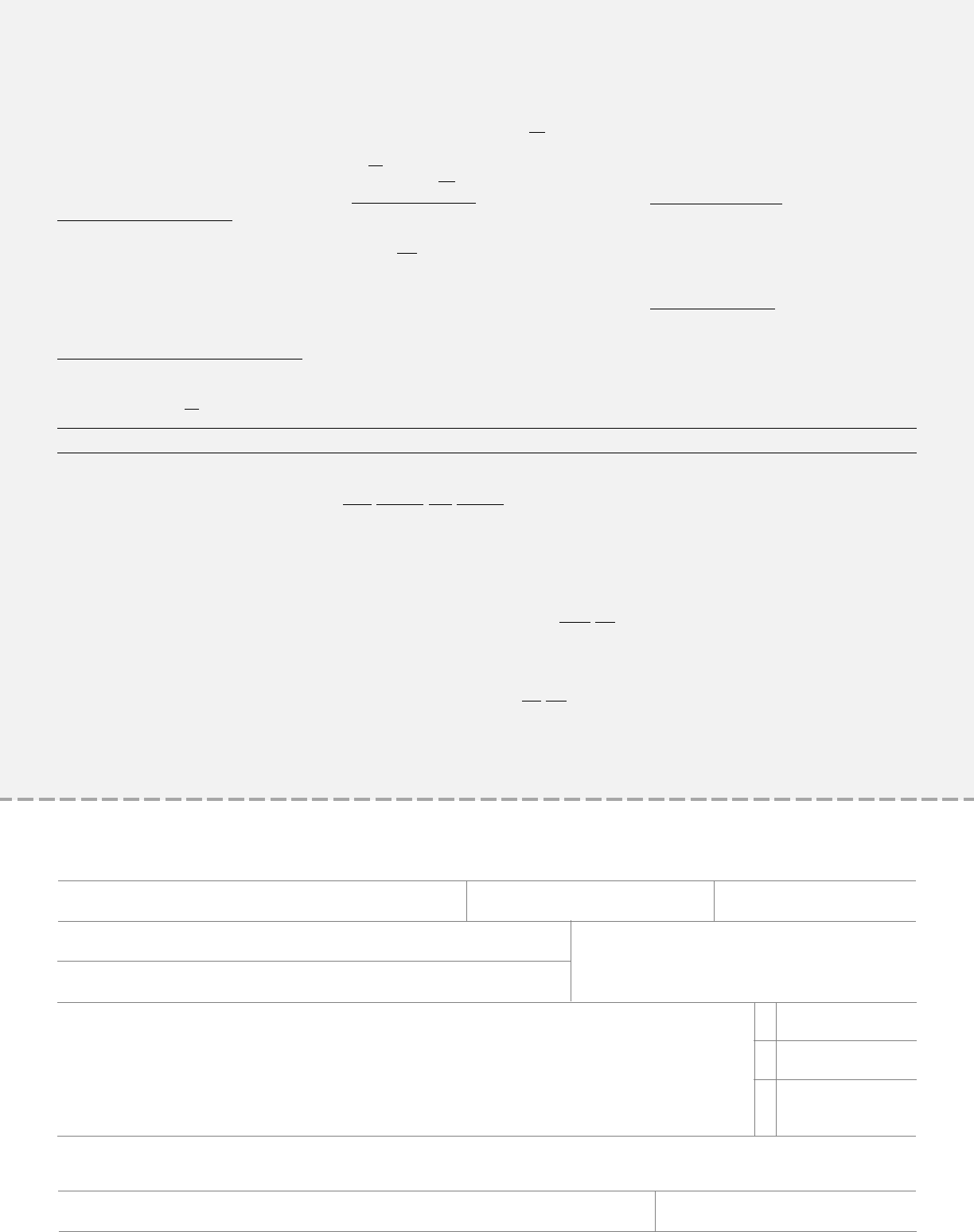

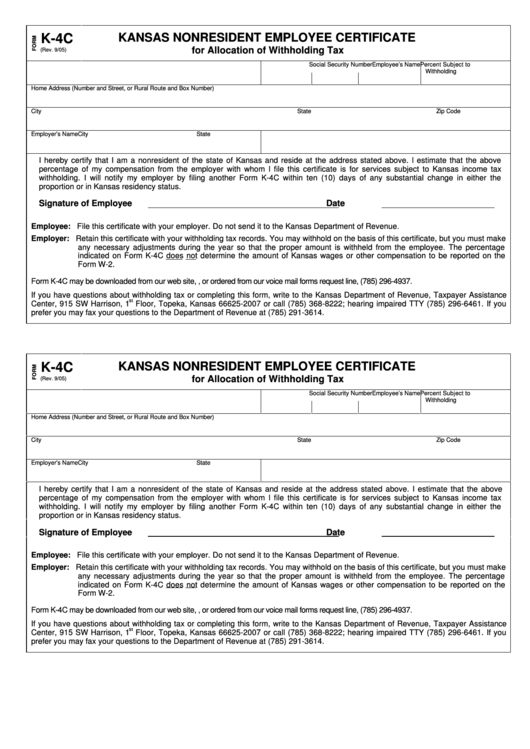

Fillable Form K4c Kansas Nonresident Employee Certificate For

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. To allow for these differences. Income tax should be withheld from your pay on income you. However, due to differences between state and. This form is for income earned in tax year 2022, with.

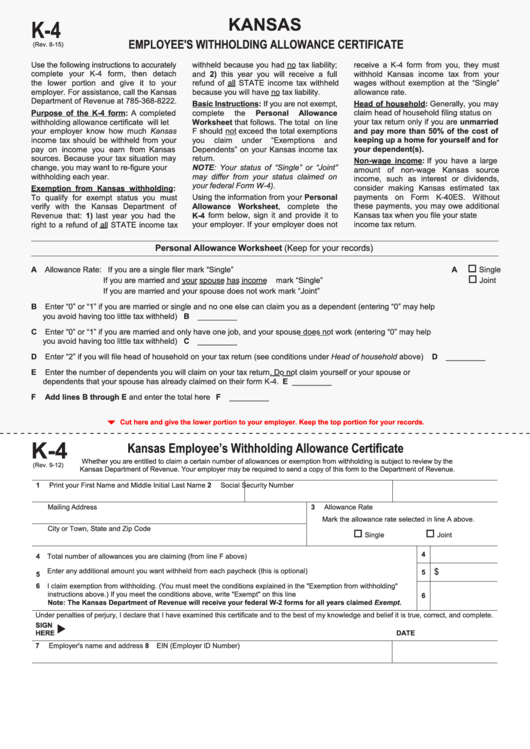

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

There are a few situations in which you can want to request. To allow for these differences. However, due to differences between state and. First and last name * please enter your first and last name step 3. Income tax should be withheld from your pay on income you.

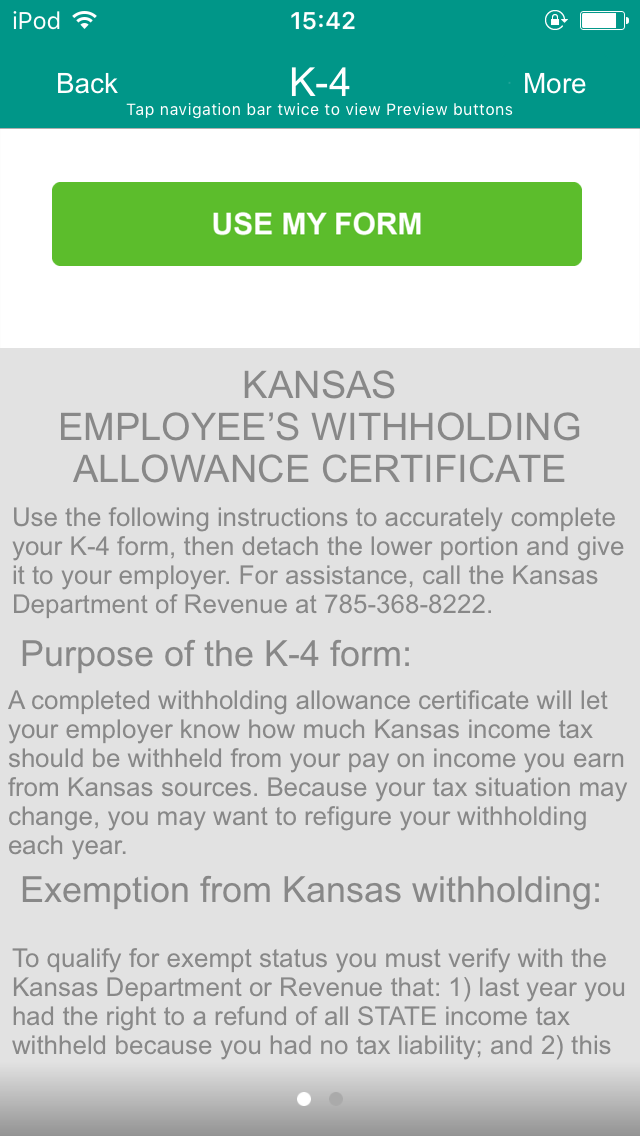

Kansas K4 App

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. To allow for these differences. Income tax should be withheld from your pay on income you..

2015 Form KS DoR K120 Fill Online, Printable, Fillable, Blank pdfFiller

The form can be filed electronically or on. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. There are a few situations in which you can want to request. A completed withholding allowance certiicate will let your employer know how much. First and last name * please enter your first.

Kansas K4 Form For State Withholding

Individual incomeand estimated income schedules. Get ready for tax season deadlines by completing any required tax forms today. There are a few situations in which you can want to request. First and last name * please enter your first and last name step 3. A completed withholding allowance certificate will let your employer know how much kansas income tax should.

Free K4 Kansas PDF 75KB 1 Page(s)

Get ready for tax season deadlines by completing any required tax forms today. Individual incomeand estimated income schedules. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your.

Fillable Form K4c Kansas Nonresident Employee Certificate For

Income tax should be withheld from your pay on income you. State and federal tax policies and laws differ. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. A completed withholding allowance.

Kansas Form C 2 2 A Fill Online, Printable, Fillable, Blank pdfFiller

There are a few situations in which you can want to request. Get ready for tax season deadlines by completing any required tax forms today. However, due to differences between state and. First and last name * please enter your first and last name step 3. Individual incomeand estimated income schedules.

Web Click On The Links Below To View The Forms For That Tax Type.

Individual incomeand estimated income schedules. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. A completed withholding allowance certiicate will let your employer know how much. The form can be filed electronically or on.

Enter The Date The K4 Should Be Effective.* Enter The Date The K4 Should Be Effective Step 2.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today.

Income Tax Should Be Withheld From Your Pay On Income You.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. To allow for these differences. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. First and last name * please enter your first and last name step 3.

There Are A Few Situations In Which You Can Want To Request.

However, due to differences between state and. State and federal tax policies and laws differ.