Kentucky Tax Extension Form

Kentucky Tax Extension Form - Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Web use this form if you are requesting a kentucky extension of time to file. Taxformfinder provides printable pdf copies of 130. You can complete and sign the 2022 tax. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. General assembly passes hb 5 to allow for authorized. Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Web corporation income and limited liability entity tax; Web june 2023 sales tax facts with guidance updates now available; The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form.

To access this form, in the kentucky state main menu,. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Insurance premiums tax and surcharge; Web amount actually paid with extension: You can complete and sign the 2022 tax. Taxformfinder provides printable pdf copies of 130. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months.

The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. To access this form, in the kentucky state main menu,. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Complete, edit or print tax forms instantly. Web use this form if you are requesting a kentucky extension of time to file. Insurance premiums tax and surcharge; Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april 15).

2019 Kentucky Tax Changes Department of Revenue

Web use this form if you are requesting a kentucky extension of time to file. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102.

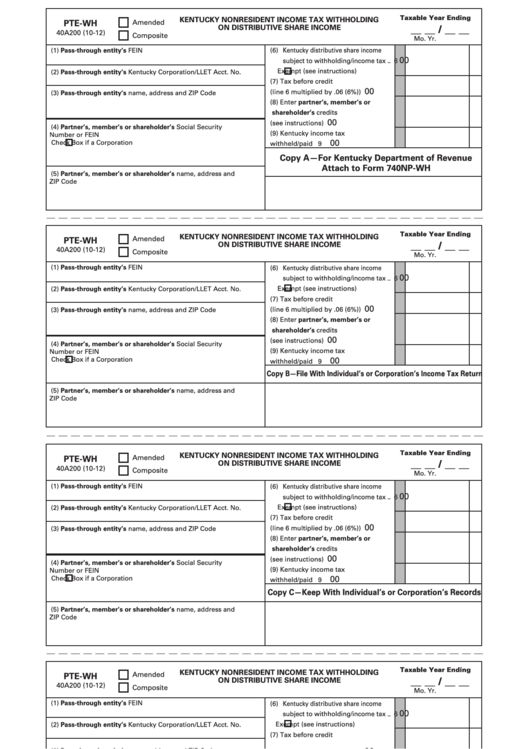

Form PteWh Kentucky Nonresident Tax Withholding On

Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Complete, edit or print tax forms instantly. Web use this form if you are requesting a kentucky extension of time to file. To access the kentucky application for. The state grants an.

US Kentucky 6 Sales Tax extension

Web free tax return preparation; The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Enter the amount on the kyext. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web filing form 740ext.

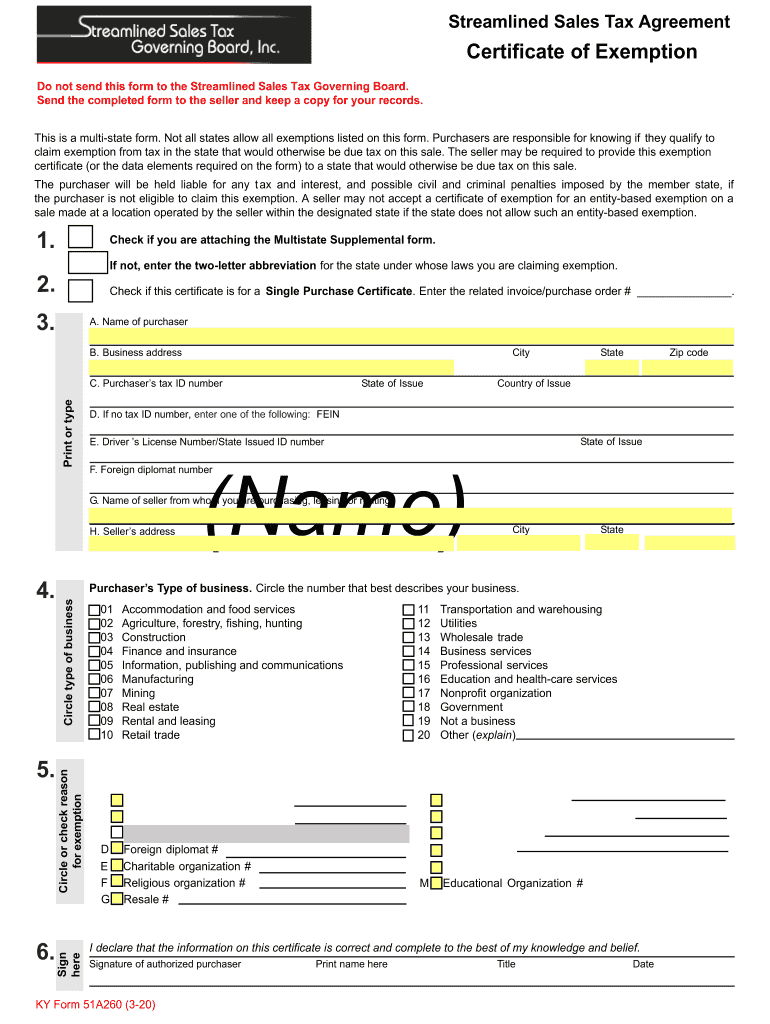

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Web use this form if you are requesting a kentucky extension of time to file. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Insurance premiums tax and surcharge; Web amount actually paid with extension: Web if additional tax is due.

Download Kentucky Tax Power of Attorney Form for Free TidyTemplates

Complete, edit or print tax forms instantly. Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. To access the kentucky application for. Download or email form 0506 & more fillable forms, register and subscribe now! Web 116 rows kentucky has a flat state income tax of 5%.

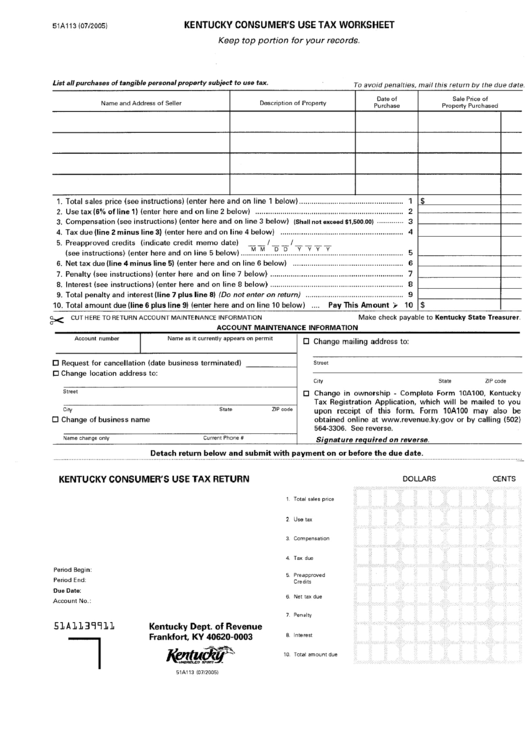

Form 51a113 Kentucky Consumer'S Use Tax Worksheet printable pdf download

Web corporation income and limited liability entity tax; Web june 2023 sales tax facts with guidance updates now available; Web use this form if you are requesting a kentucky extension of time to file. Web extended deadline with kentucky tax extension: Taxformfinder provides printable pdf copies of 130.

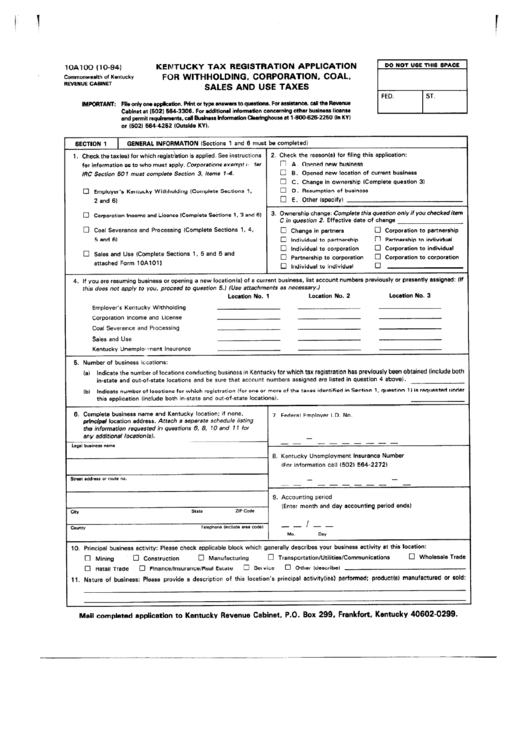

Form 10a100 Kentucky Tax Registration Application For Withholding

Complete, edit or print tax forms instantly. Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april 15). Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web.

Application for Extension of Time to File Individual, General Partner…

Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. You can complete and sign the 2022 tax. Download or email form 0506 & more fillable forms, register and subscribe now! Web corporation income and limited liability entity tax; To access this form, in the kentucky state main menu,.

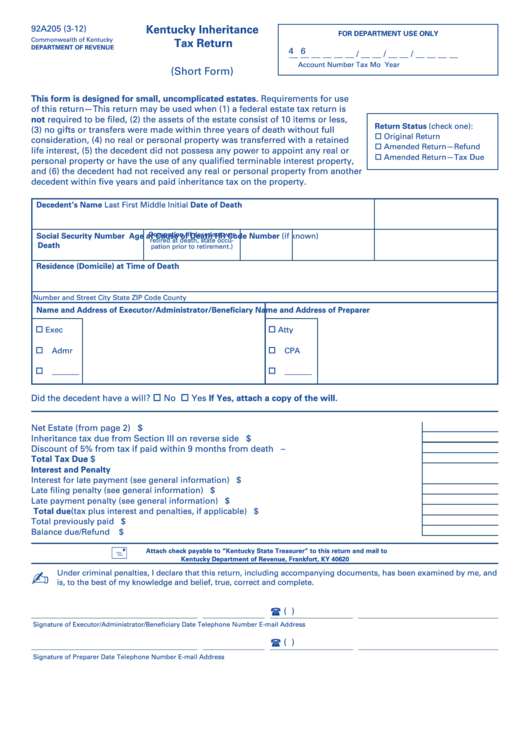

Form 92a205 Kentucky Inheritance Tax Return (Short Form) Kentucky

Web free tax return preparation; Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web amount actually paid with extension: Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Web june 2023 sales tax.

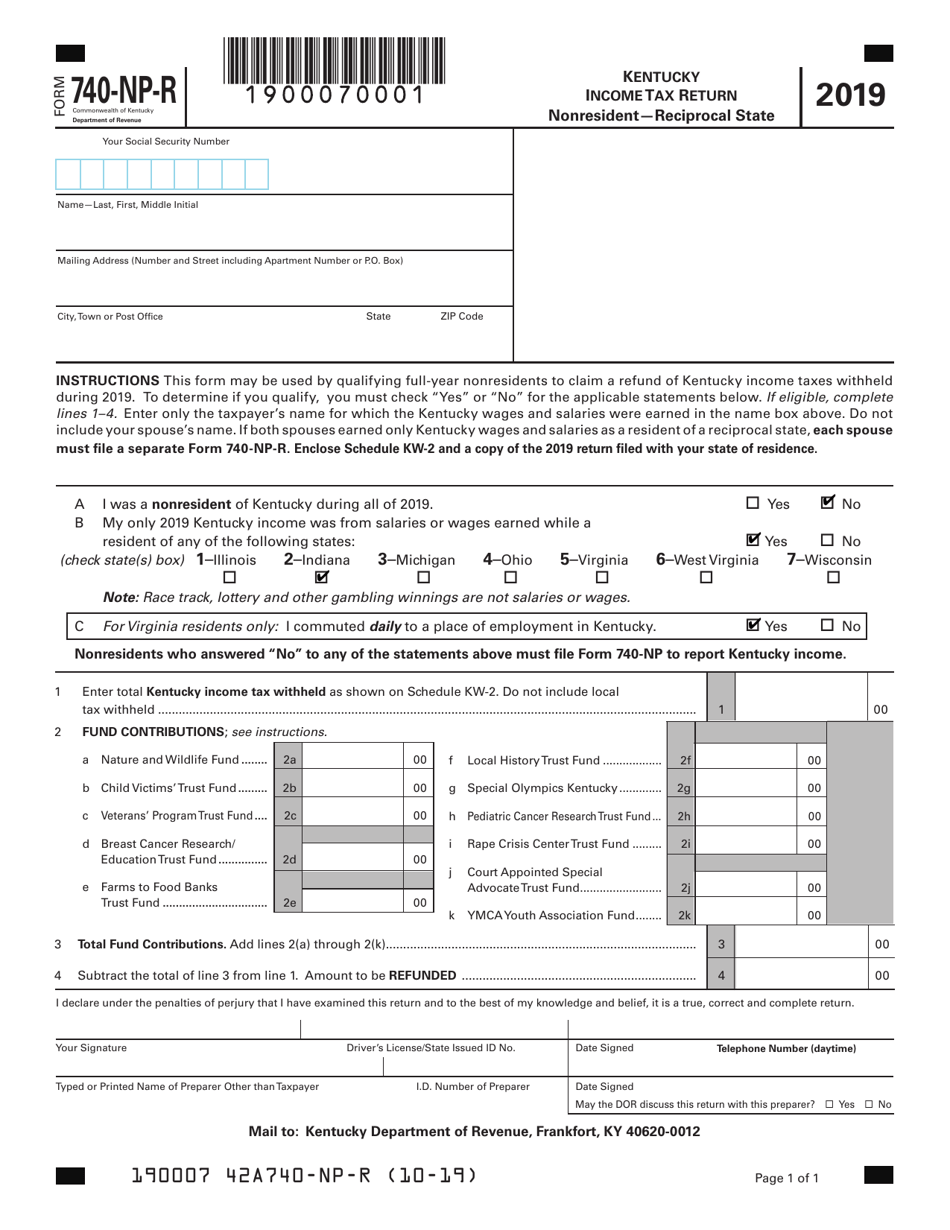

dipitdesign Kentucky Tax Form 740

The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for.

Insurance Premiums Tax And Surcharge;

You can complete and sign the 2022 tax. General assembly passes hb 5 to allow for authorized. Complete, edit or print tax forms instantly. Web extended deadline with kentucky tax extension:

To Access The Kentucky Application For.

Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Enter the amount on the kyext. Taxformfinder provides printable pdf copies of 130. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue.

To Access This Form, In The Kentucky State Main Menu,.

Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april 15). Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Download or email form 0506 & more fillable forms, register and subscribe now! Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income.

Web Filing Form 740Ext Allows Individual Taxpayers Until October 15, 2021 To File Their 2020 Tax Return But Does Not Grant An Extension Of Time To Pay Taxes Due.

Web amount actually paid with extension: Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. Web june 2023 sales tax facts with guidance updates now available; Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless.