Ks Withholding Form

Ks Withholding Form - Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Create legally binding electronic signatures on any device. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. Log in or register unemployment forms and guides expand all unemployment. Ad signnow allows users to edit, sign, fill and share all type of documents online. File your state taxes online; A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employee's withholding certificate form 941; Web electronic services for withholding. Employers engaged in a trade or business who.

Log in or register unemployment forms and guides expand all unemployment. First, it summarizes your withholding deposits. File your state taxes online; A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employers engaged in a trade or business who. File your state taxes online; For kansas webfile or customer service center. If too little tax is withheld, you will generally owe tax when you. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Web kansas — employees withholding allowance certificate download this form print this form it appears you don't have a pdf plugin for this browser.

If too little tax is withheld, you will generally owe tax when you. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web electronic services for withholding. Please use the link below. First, it summarizes your withholding deposits. However, due to differences between state and. Create legally binding electronic signatures on any device. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employee's withholding certificate form 941; File your state taxes online;

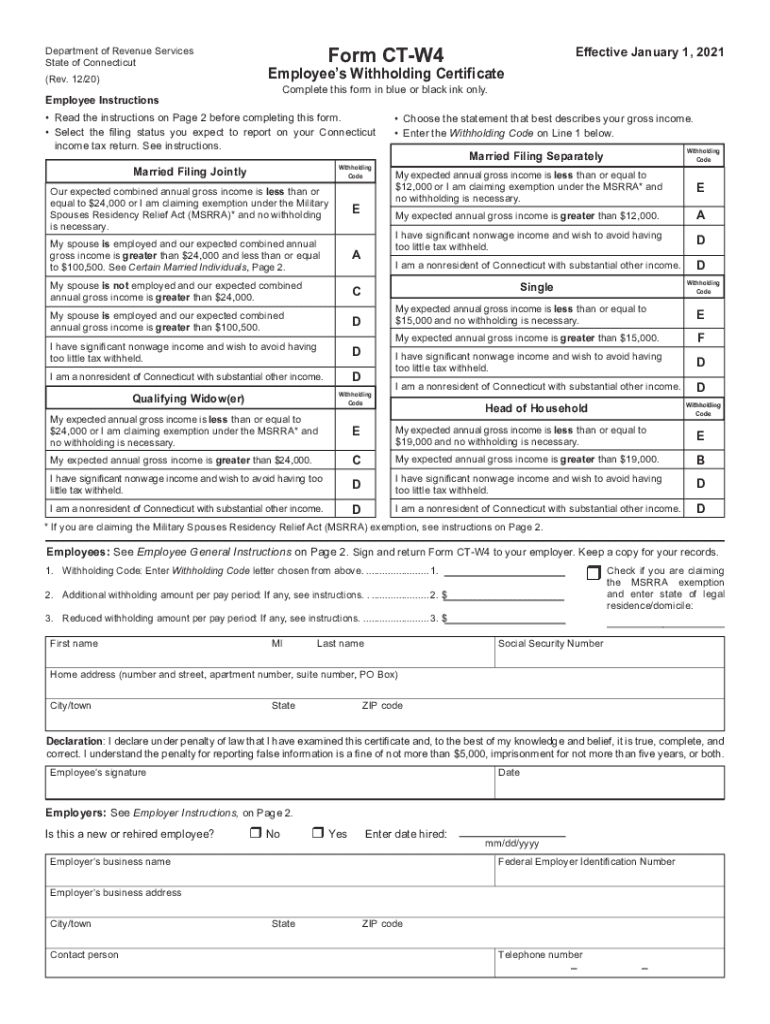

Connecticut Employee Withholding Form 2021 2022 W4 Form

Log in or register unemployment forms and guides expand all unemployment. Ad signnow allows users to edit, sign, fill and share all type of documents online. First, it summarizes your withholding deposits. Web electronic services for withholding. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

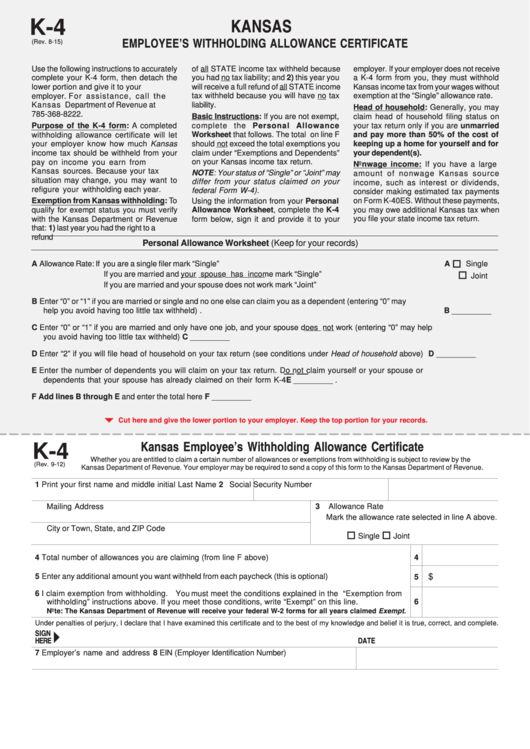

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Create legally binding electronic signatures on any device. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. First, it summarizes your withholding deposits. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web any employer or payor who must.

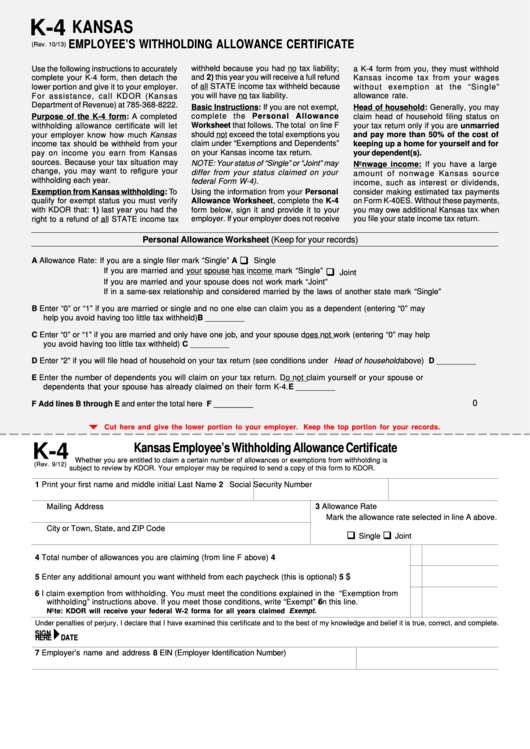

Kansas Withholding Form K 4 2022 W4 Form

File your state taxes online; Your withholding is subject to review by the. First, it summarizes your withholding deposits. Web electronic services for withholding. Ad download or email kansas nonresident & more fillable forms, register and subscribe now!

Irs New Tax Employee Forms 2023

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online; Your withholding is subject to review by the. If too little tax is withheld, you will generally owe tax when you. Employee's withholding certificate form 941;

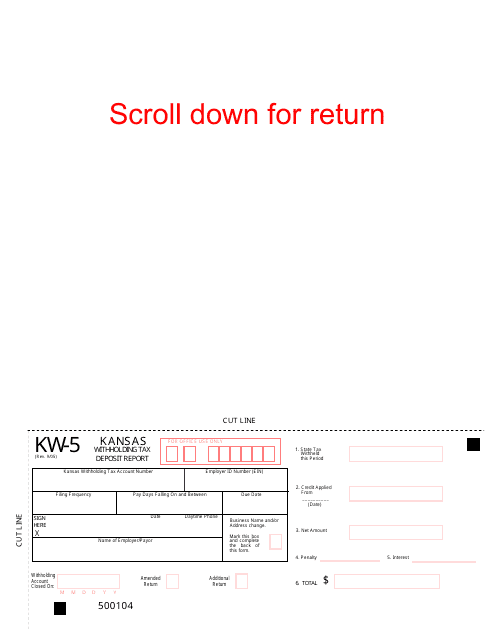

Form KW5 Download Fillable PDF or Fill Online Kansas Withholding Tax

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File.

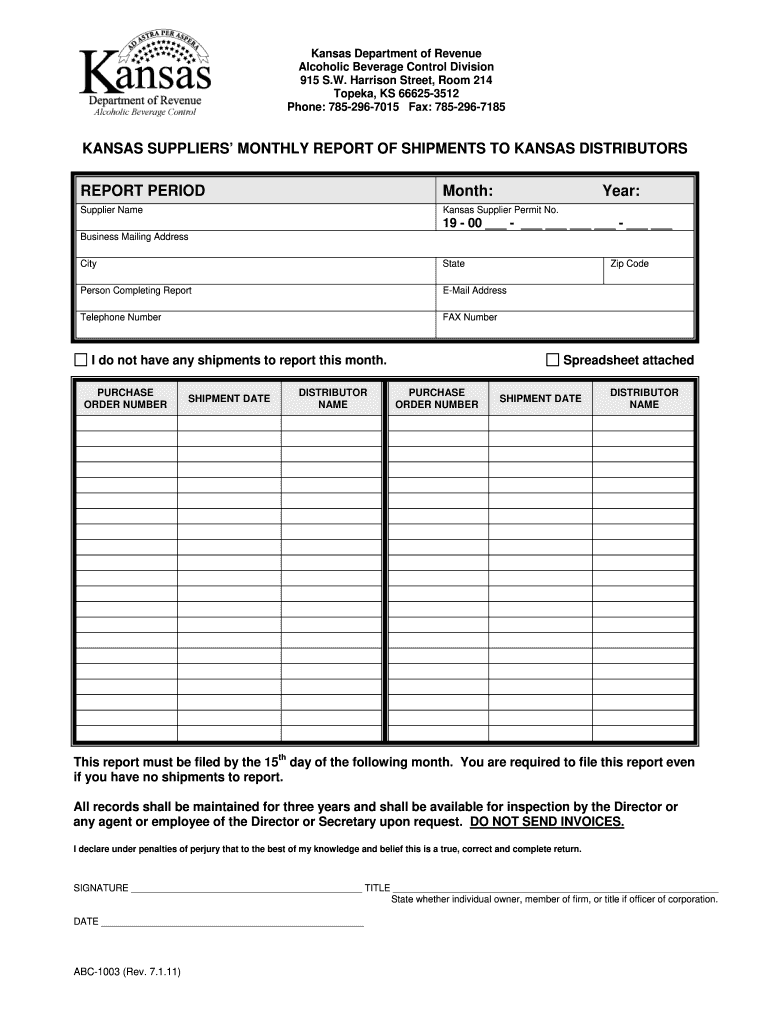

Kansas Monthly Report Fill Online, Printable, Fillable, Blank pdfFiller

First, it summarizes your withholding deposits. Create legally binding electronic signatures on any device. Ad download or email kansas nonresident & more fillable forms, register and subscribe now! For kansas webfile or customer service center. File your state taxes online;

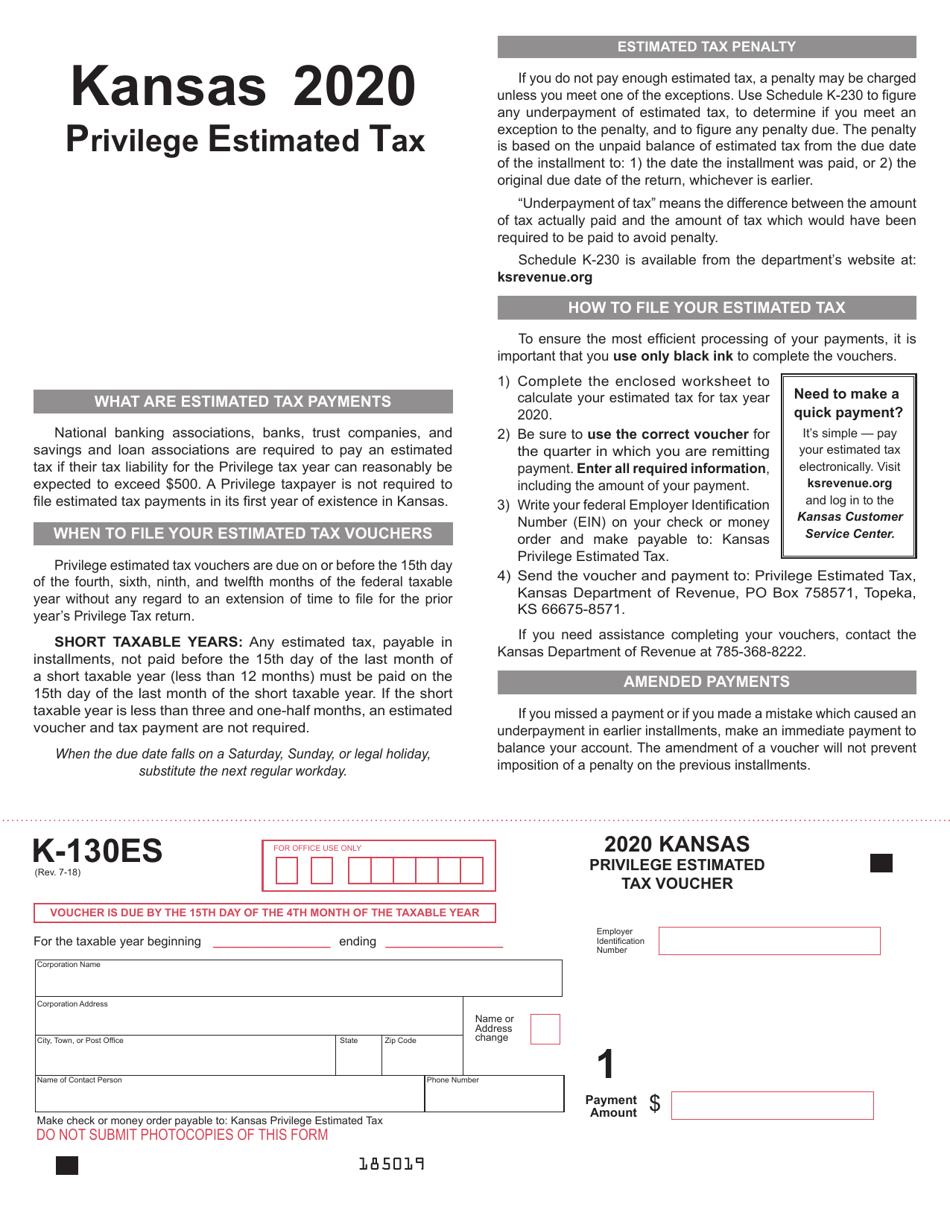

Form K130ES Download Fillable PDF or Fill Online Privilege Estimated

Ad download or email kansas nonresident & more fillable forms, register and subscribe now! However, due to differences between state and. Your withholding is subject to review by the. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. A completed withholding allowance certificate will let your employer know how much kansas income tax should be.

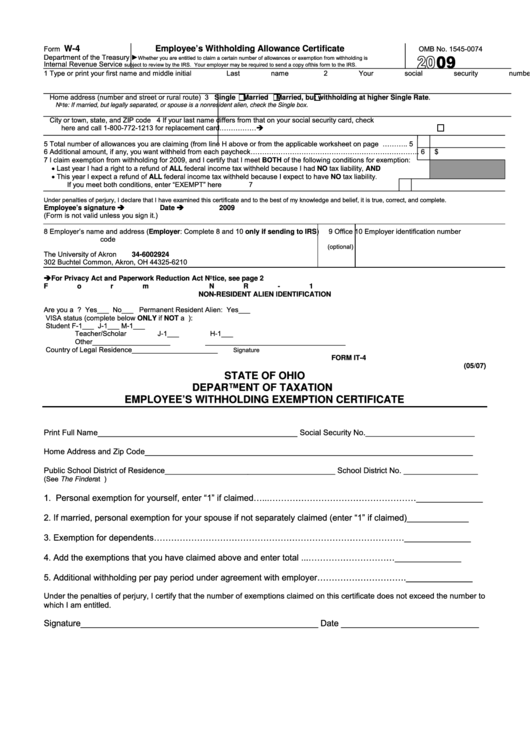

Ohio Withholding Form W 4 2022 W4 Form

Log in or register unemployment forms and guides expand all unemployment. For kansas webfile or customer service center. Ad signnow allows users to edit, sign, fill and share all type of documents online. Web kansas — employees withholding allowance certificate download this form print this form it appears you don't have a pdf plugin for this browser. Web any employer.

2022 Tax Table Weekly Latest News Update

Your withholding is subject to review by the. Ad download or email kansas nonresident & more fillable forms, register and subscribe now! Create legally binding electronic signatures on any device. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Log in or register unemployment forms and guides expand all unemployment.

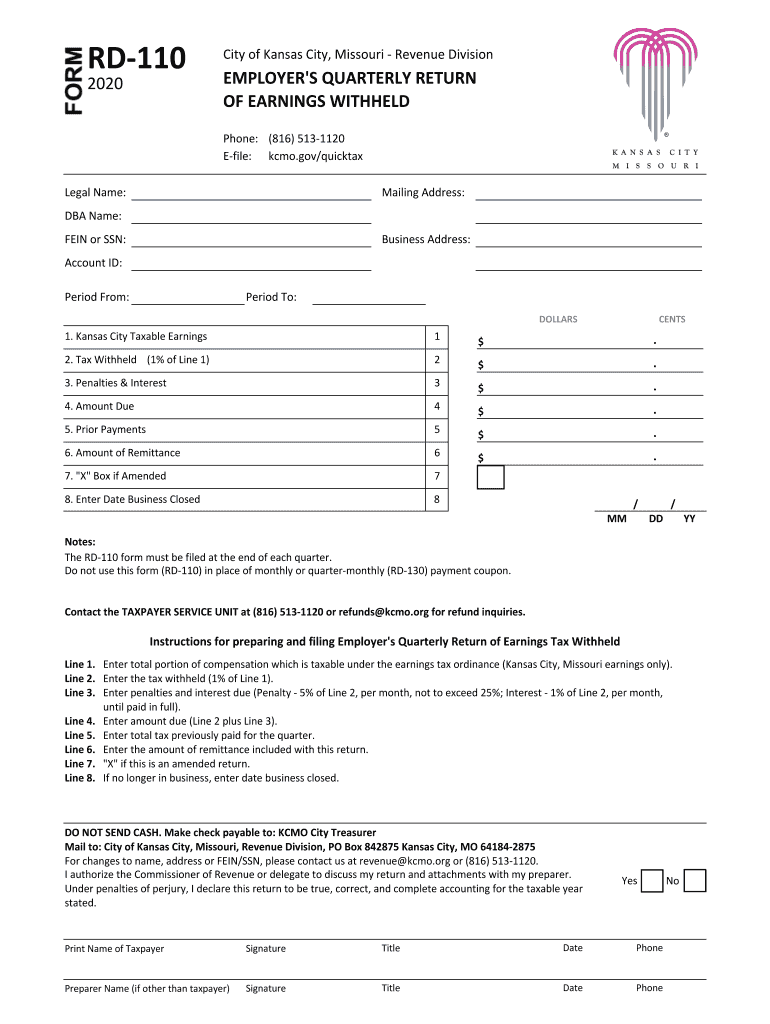

20202022 Form MO RD110 Fill Online, Printable, Fillable, Blank

File your state taxes online; For kansas webfile or customer service center. Employee's withholding certificate form 941; However, due to differences between state and. Ad download or email kansas nonresident & more fillable forms, register and subscribe now!

Ad Signnow Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

Web any employer or payor who must withhold federal income tax from payments other than wages made to kansas residents must also withhold kansas tax. First, it summarizes your withholding deposits. File your state taxes online; Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim.

Log In Or Register Unemployment Forms And Guides Expand All Unemployment.

Web electronic services for withholding. Please use the link below. File your state taxes online; Employee's withholding certificate form 941;

A Completed Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

If too little tax is withheld, you will generally owe tax when you. Ad download or email kansas nonresident & more fillable forms, register and subscribe now! Your withholding is subject to review by the. Employers engaged in a trade or business who.

Web Kansas — Employees Withholding Allowance Certificate Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

For kansas webfile or customer service center. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. However, due to differences between state and. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.