Ky Farm Tax Exempt Form

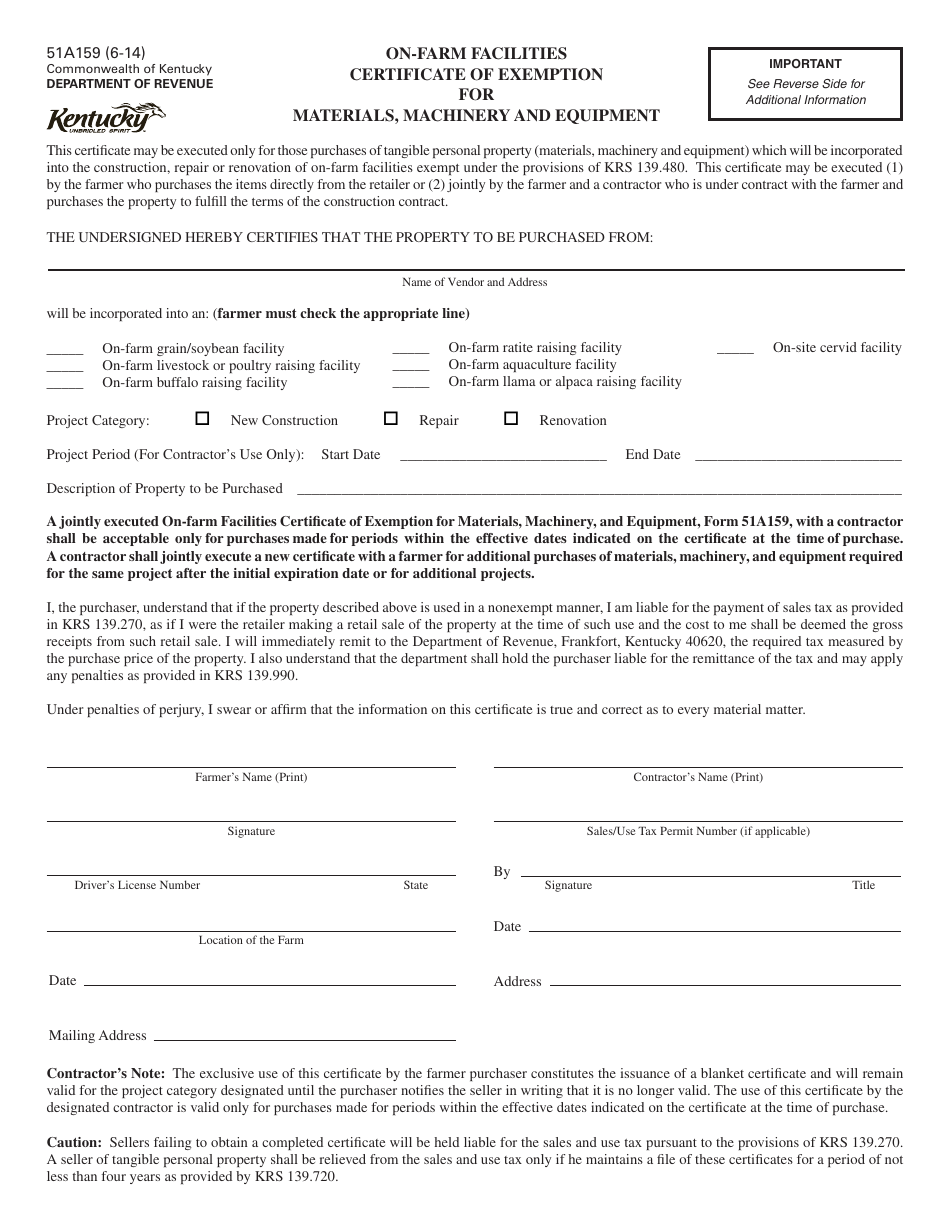

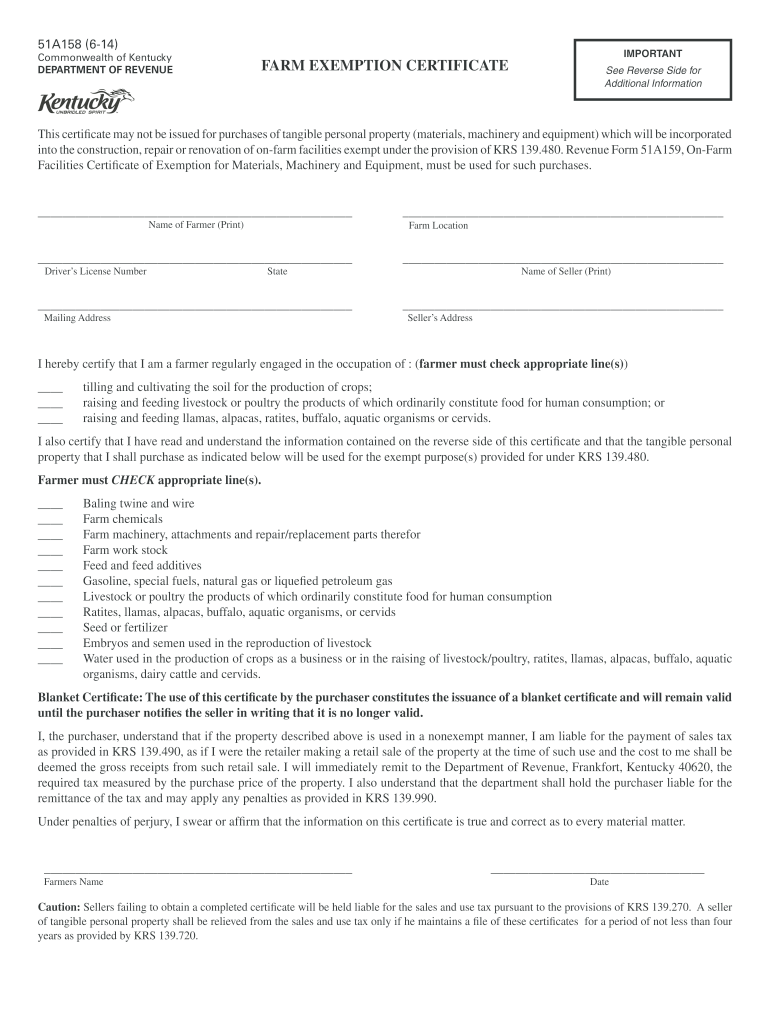

Ky Farm Tax Exempt Form - Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Completed applications should be submitted by email to dor.webresponsesalestax@ky.gov or mailed to dor's division of sales and use tax, station 66, p.o. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these facilities. Web farm certificate of exemption. (august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers designed to protect the sales and use tax exclusions available to the agricultural community. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax.

Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these facilities. (august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers designed to protect the sales and use tax exclusions available to the agricultural community. The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms. The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Web farm certificate of exemption. Completed applications should be submitted by email to dor.webresponsesalestax@ky.gov or mailed to dor's division of sales and use tax, station 66, p.o.

The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Completed applications should be submitted by email to dor.webresponsesalestax@ky.gov or mailed to dor's division of sales and use tax, station 66, p.o. The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. (august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers designed to protect the sales and use tax exclusions available to the agricultural community. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these facilities. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web farm certificate of exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax.

Bupa Tax Exemption Form / We do not accept sales tax permits, articles

Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these.

St125 2020 Fill and Sign Printable Template Online US Legal Forms

The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery,.

How To Get A Farm Tax Exempt Number In Texas Are farmers exempt from

Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web farm certificate of exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. (august 24, 2021)— the kentucky department.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Web effective january 1, 2022, krs 139.481 requires that farmers have.

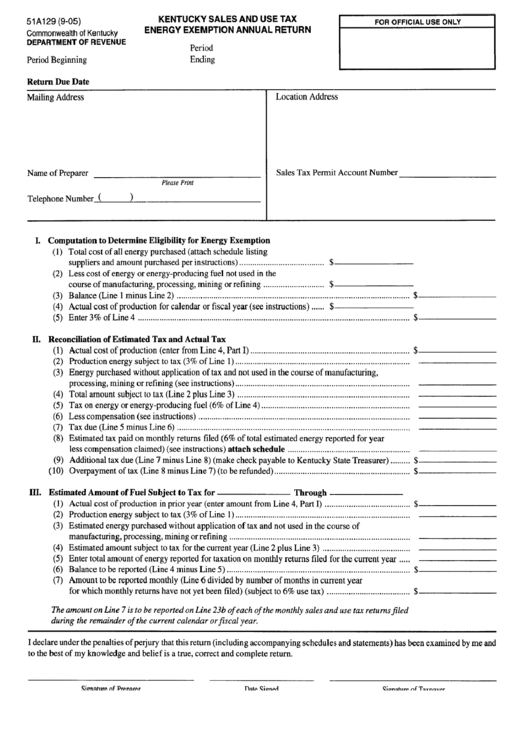

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. (august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers designed.

Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

(august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers designed to protect the sales and use tax exclusions available to the agricultural community. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Web.

Farm Tax Exemption Kentucky Fill Online, Printable, Fillable, Blank

Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these facilities. Web farm certificate of exemption. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. The.

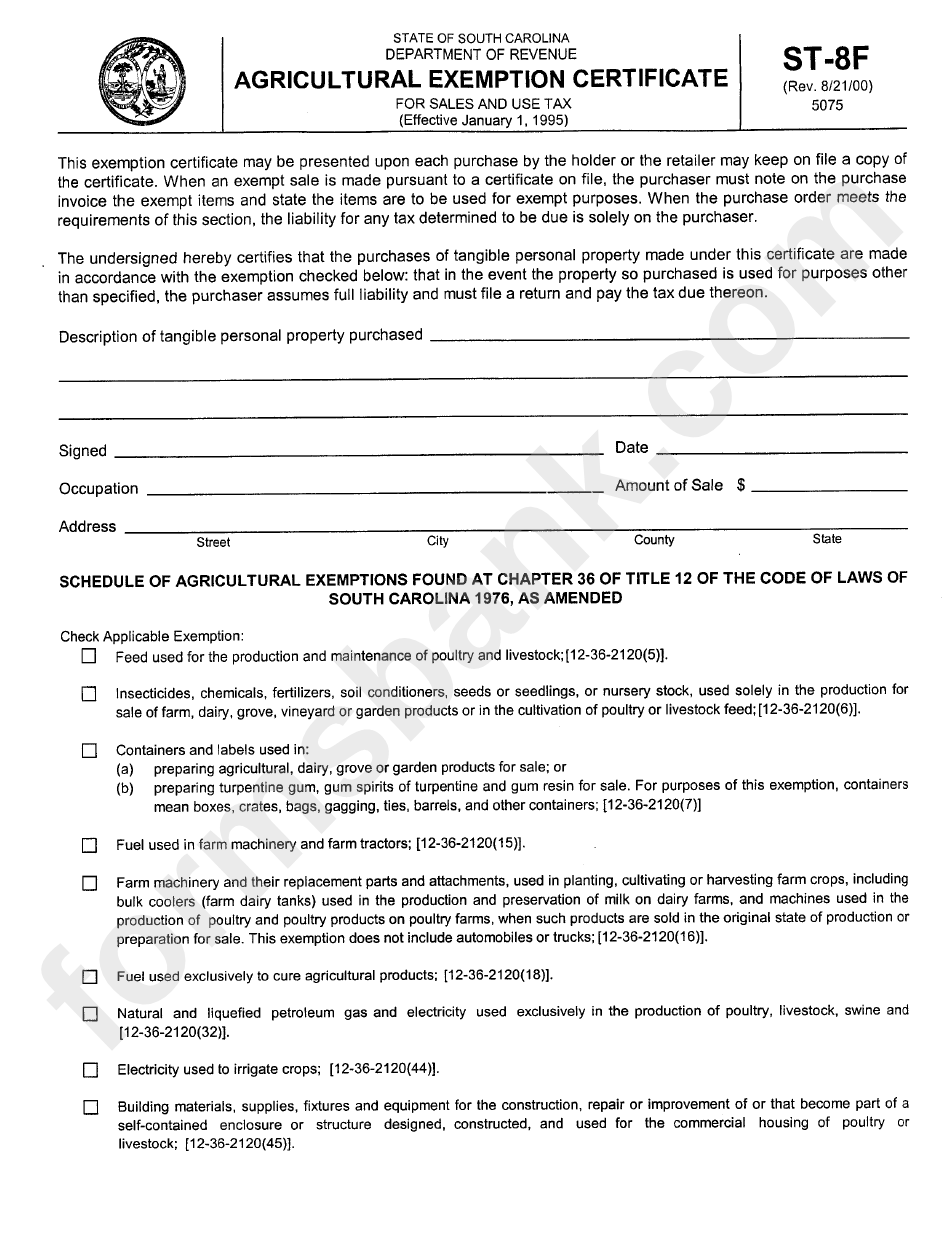

Form St8f Agricultural Exemption Certificate printable pdf download

The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. A sales tax exemption certificate.

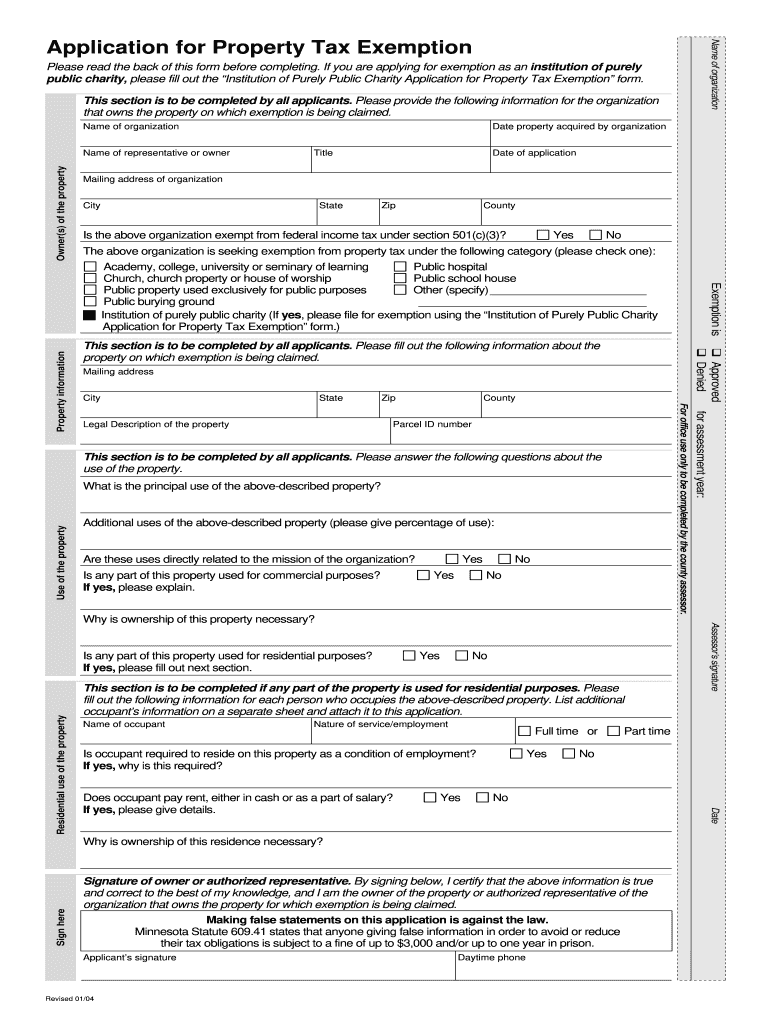

Property Tax Form Pdf Fill Out and Sign Printable PDF Template signNow

The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax. Completed applications should be submitted by email to dor.webresponsesalestax@ky.gov or mailed to dor's division.

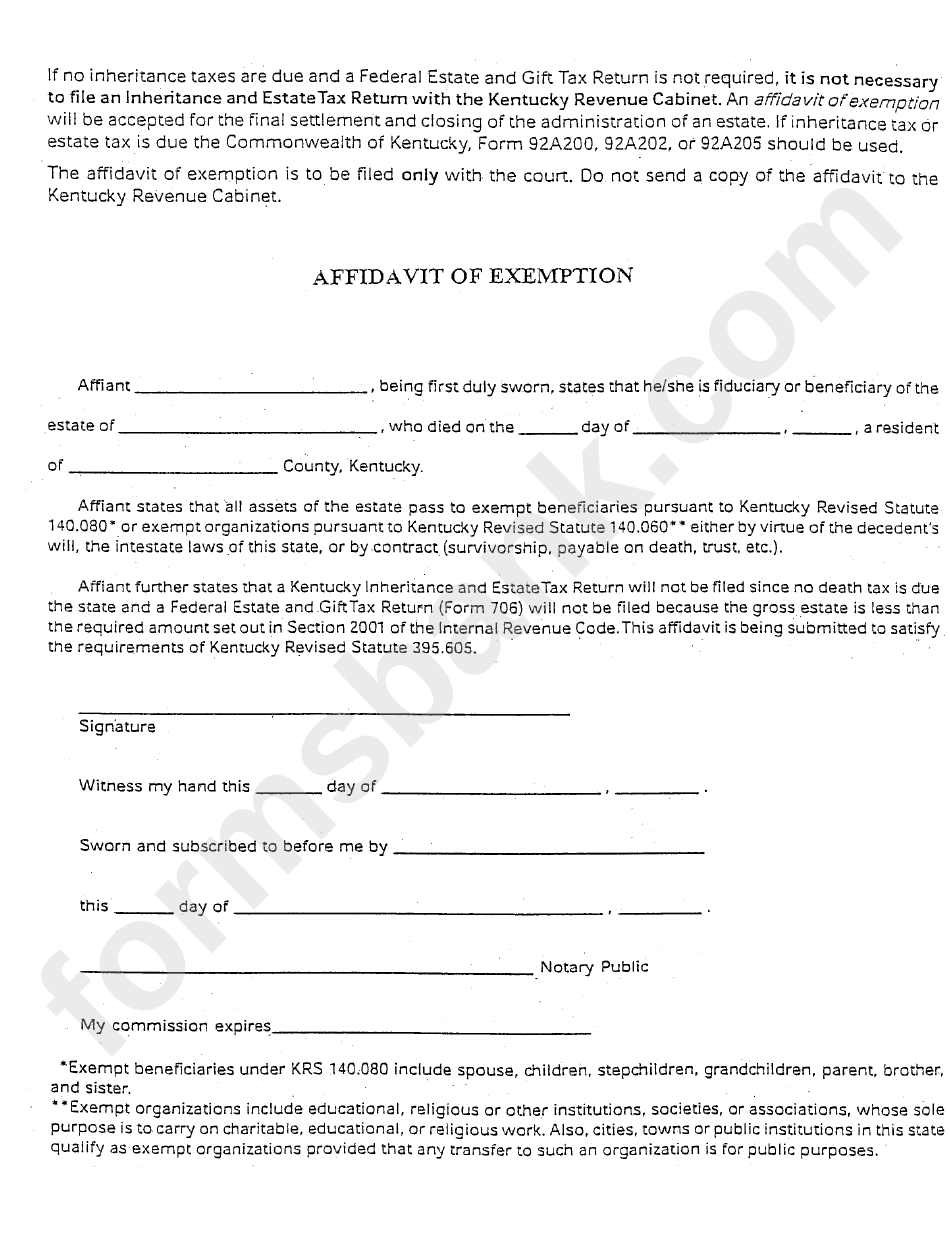

Affidavit Of Exemption Form Kentucky Revenue Kentucky

The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. (august 24, 2021)— the kentucky department of revenue (dor) is now accepting applications from eligible.

Web A New Kentucky Law Requires That Farmers Apply For An Agriculture Exemption Number To Make Qualified Purchases For The Farm Exempt From Sales Tax.

Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. The application for the agriculture exemption number, form 51a800, is available on the dor website www.revenue.ky.gov under sales tax forms.

Completed Applications Should Be Submitted By Email To Dor.webresponsesalestax@Ky.gov Or Mailed To Dor's Division Of Sales And Use Tax, Station 66, P.o.

Web revenue form 51a158, farm exemption certificate, must be used for the purchase of feed/feed additives, farm machinery, farm work stock, water, gasoline, special fuels, liquefied petroleum gas, farm chemicals, etc., for each of these facilities. The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web farm certificate of exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.