Ky Form 720 Instructions 2021

Ky Form 720 Instructions 2021 - Don't enter adjustments on form 720. Enjoy smart fillable fields and interactivity. Ad get ready for tax season deadlines by completing any required tax forms today. Line 1(b)— enter the amount of current. This form is for income earned in tax year 2022, with tax. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web • pursuant to krs 131.183, the 2021 tax interest rate has partners have 180 days to pay any additional tax due. This form is for income earned in tax year 2022, with.

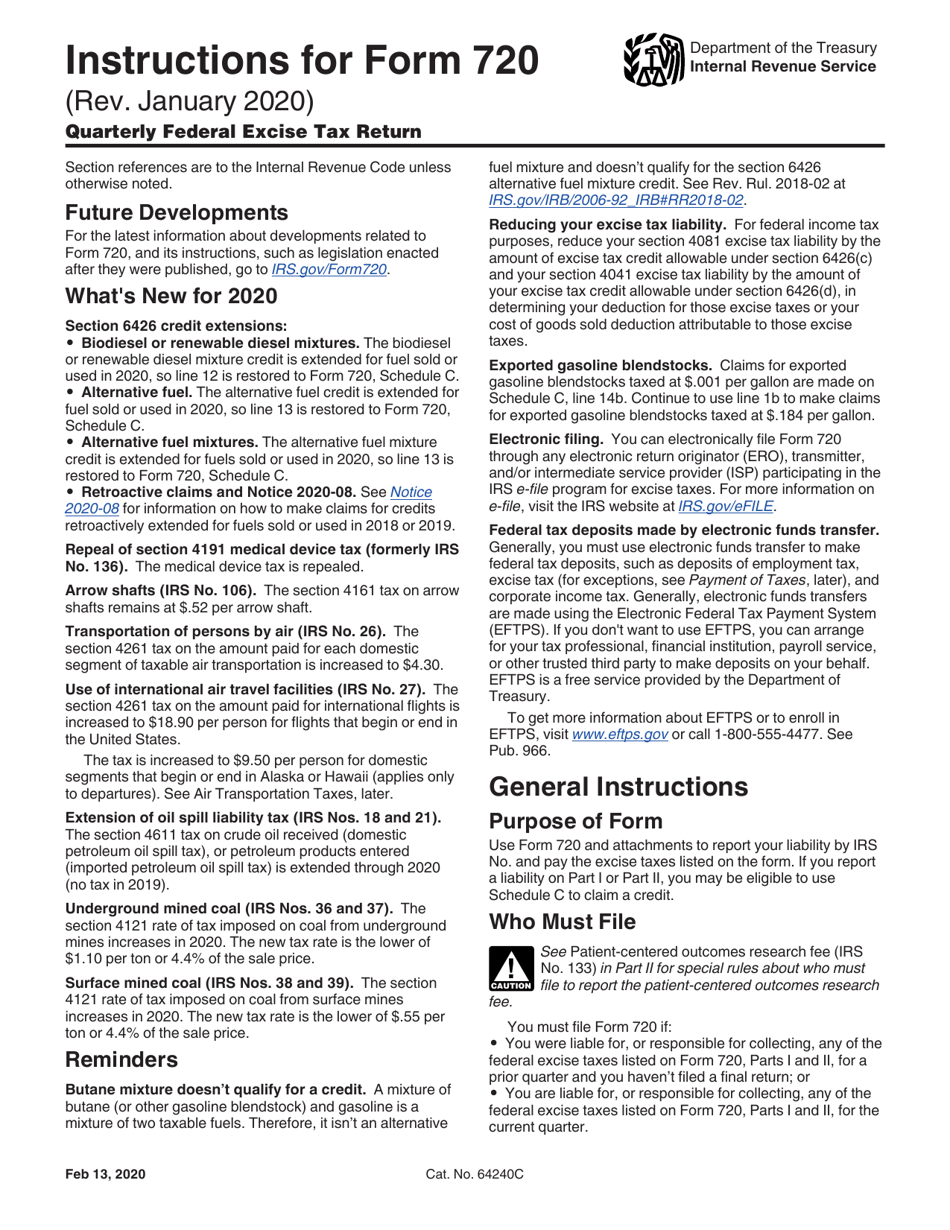

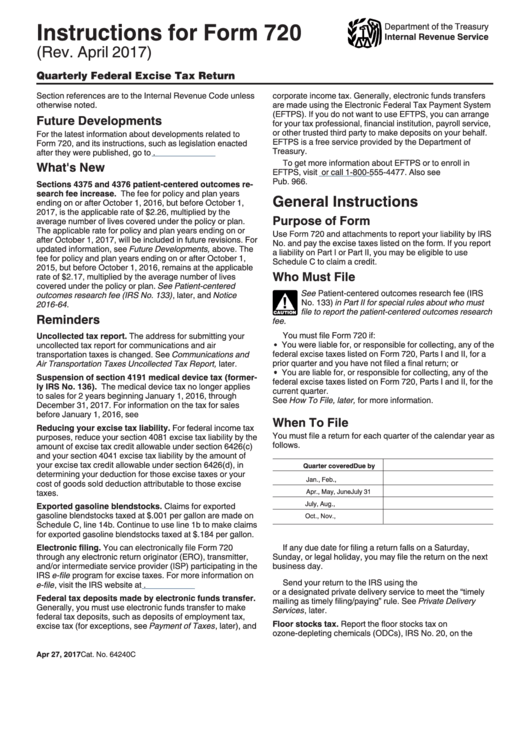

9.5 draft ok to print ah xsl/xmlfileid:. This form is for income earned in tax year 2022, with tax. Web kentucky tax law changes enacted by the 2022 regular session of the kentucky general assembly— internal revenue code (irc) update—house bill (hb) 8 and hb. • five percent (5%) and when interest is due on a refund, in lieu of the. Web instructions for form 720 (rev. Get your online template and fill it in using progressive features. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web we last updated kentucky form 720s instructions in february 2023 from the kentucky department of revenue. 6 nonrefundable llet credit (part i,. This form is for income earned in tax year 2022, with.

If you attach additional sheets, write your name and ein on. Web how to fill out and sign ky form 720 instructions 2021 online? Web kentucky tax law changes enacted by the 2022 regular session of the kentucky general assembly— internal revenue code (irc) update—house bill (hb) 8 and hb. Form 720s is a kentucky corporate income tax form. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. • five percent (5%) and when interest is due on a refund, in lieu of the. This form is for income earned in tax year 2022, with. This form is for income earned in tax year 2022, with tax. Web 2021 form 720s instructions 2020 form 720s instructions 2019 form 720s instructions 2018 form 720s instructions 2017 form 720s instructions. Web download the taxpayer bill of rights.

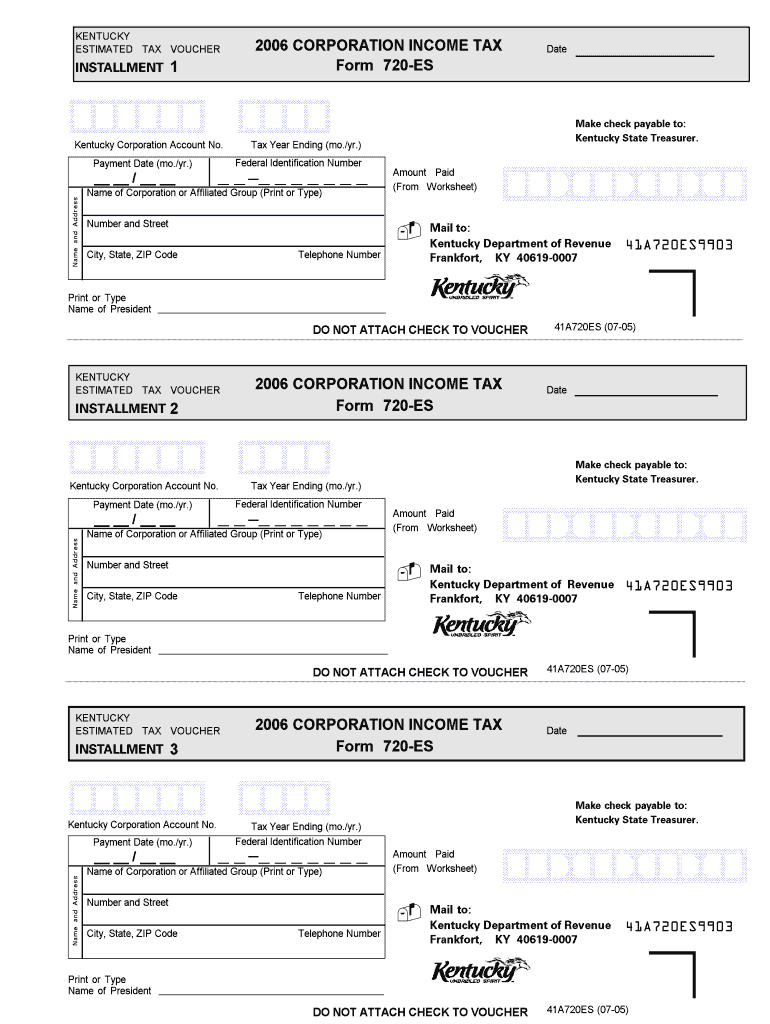

Taxes Archives · Page 2 of 3 · Fit Small Business Page 2

Line 1(b)— enter the amount of current. Don't enter adjustments on form 720. June 2021) quarterly federal excise tax return department of the treasury internal revenue service section references are to the. Also, include the amounts from lines 8, 10, and 11 that do not pass through to form 740. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky.

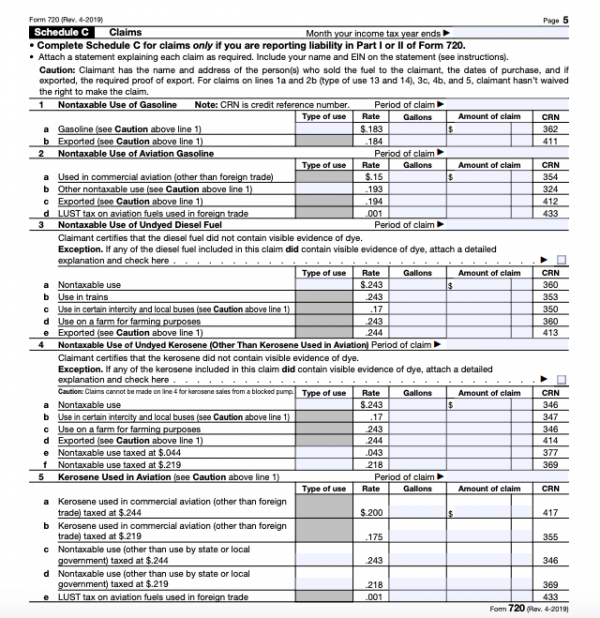

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

Web we last updated kentucky form 720s from the department of revenue in may 2021. Web kentucky tax law changes enacted by the 2022 regular session of the kentucky general assembly— internal revenue code (irc) update—house bill (hb) 8 and hb. Web we last updated kentucky form 720s instructions in february 2023 from the kentucky department of revenue. This form.

720 Tax Form Fill Out and Sign Printable PDF Template signNow

Web we last updated kentucky form 720s instructions in february 2023 from the kentucky department of revenue. Web 2021 form 720s instructions 2020 form 720s instructions 2019 form 720s instructions 2018 form 720s instructions 2017 form 720s instructions. Web we last updated kentucky form 720s from the department of revenue in may 2021. This form is for income earned in.

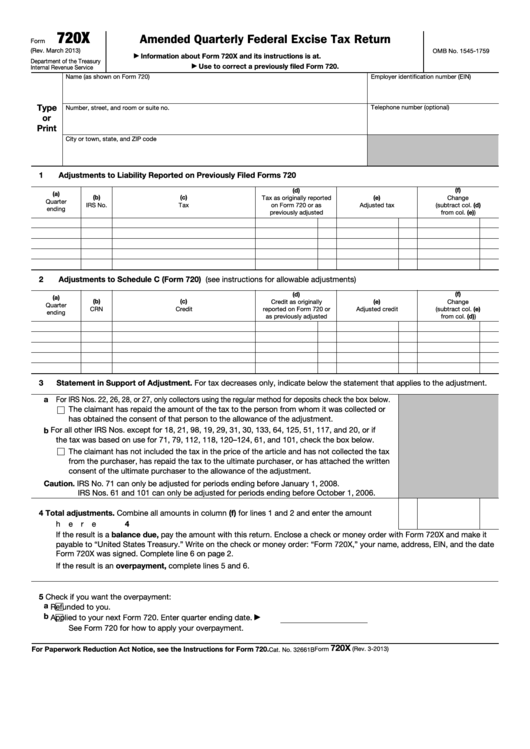

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Don't enter adjustments on form 720. If you attach additional sheets, write your name and ein on. Web • pursuant to krs 131.183, the 2021 tax interest rate has partners have 180 days to pay any additional tax due. Web.

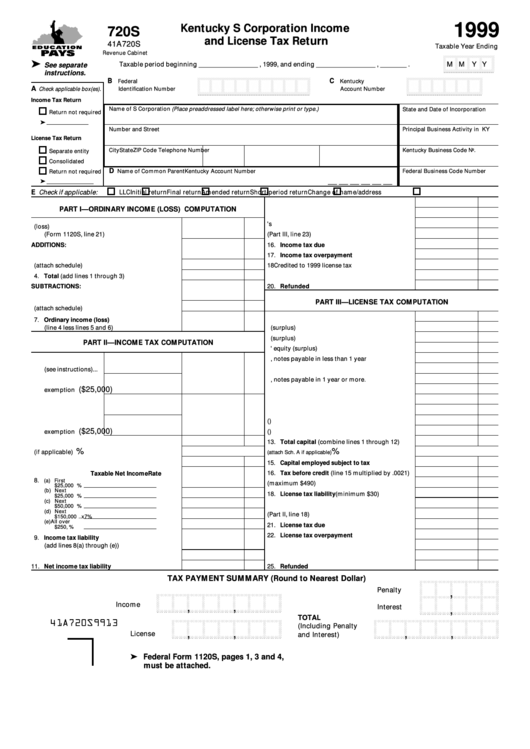

Form 720s Kentucky S Corporation And License Tax Return 1999

Web we last updated kentucky form 720s from the department of revenue in may 2021. Line 1(b)— enter the amount of current. If you attach additional sheets, write your name and ein on. Web download the taxpayer bill of rights. Upload, modify or create forms.

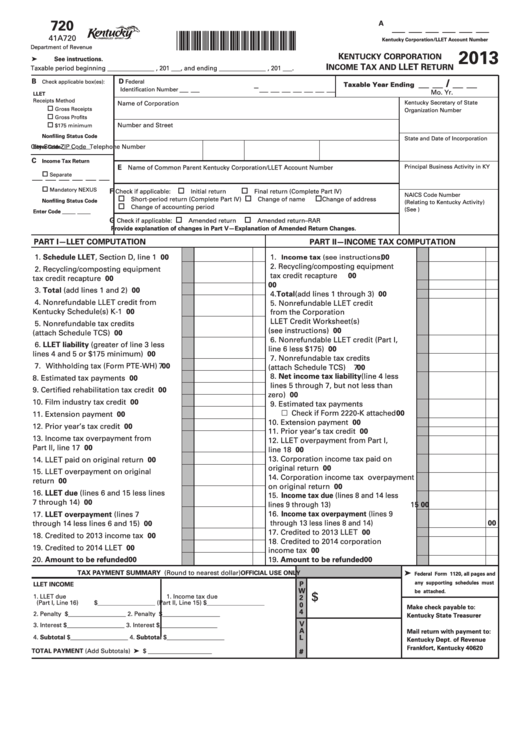

Form 720 Kentucky Corporation Tax And Llet Return 2013

Enjoy smart fillable fields and interactivity. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). If you attach additional sheets, write your name and ein on. Try it for free now! Also, include the amounts from lines 8, 10, and 11 that do not pass through.

Download Instructions for IRS Form 720 Quarterly Federal Excise Tax

Web we last updated kentucky form 720s instructions in february 2023 from the kentucky department of revenue. 6 nonrefundable llet credit (part i,. Web we last updated kentucky form 720s from the department of revenue in may 2021. Web you don't import gas guzzling automobiles in the course of your trade or business. June 2021) quarterly federal excise tax return.

IRS Form 720 Instructions for the PatientCentered Research

• five percent (5%) and when interest is due on a refund, in lieu of the. Get your online template and fill it in using progressive features. Web instructions for form 720(rev. 9.5 draft ok to print ah xsl/xmlfileid:. Form 720s is a kentucky corporate income tax form.

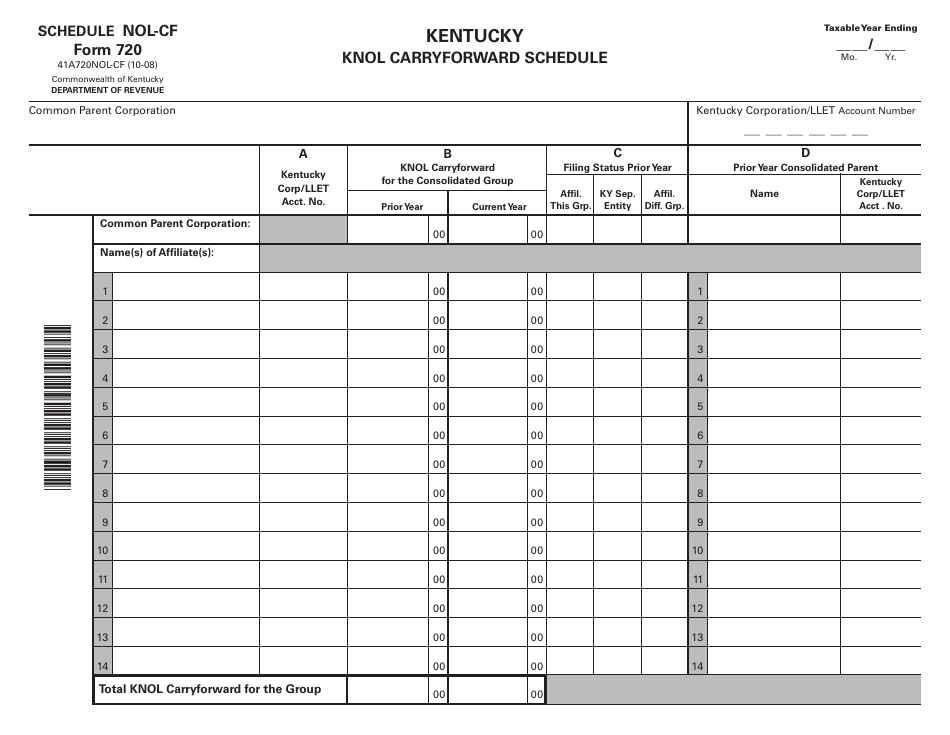

Form 720 Schedule NOLCF Download Printable PDF or Fill Online Kentucky

Web kentucky tax law changes enacted by the 2022 regular session of the kentucky general assembly— internal revenue code (irc) update—house bill (hb) 8 and hb. • five percent (5%) and when interest is due on a refund, in lieu of the. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet.

Top 42 Form 720 Templates free to download in PDF format

Form 720s is a kentucky corporate income tax form. Web we last updated kentucky form 720s instructions in february 2023 from the kentucky department of revenue. Try it for free now! Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web line 1(a)—specify if kentucky gross receipts (kgr) or.

Web We Last Updated The Kentucky Corporation Income Tax And Llet Return In February 2023, So This Is The Latest Version Of Form 720, Fully Updated For Tax Year 2022.

Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with. Web instructions for form 720 (rev. Web kentucky tax law changes enacted by the 2022 regular session of the kentucky general assembly— internal revenue code (irc) update—house bill (hb) 8 and hb.

9.5 Draft Ok To Print Ah Xsl/Xmlfileid:.

You aren't required to file form 720 reporting excise taxes for the calendar quarter,. Web instructions for form 720(rev. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. June 2021) quarterly federal excise tax return department of the treasury internal revenue service section references are to the.

6 Nonrefundable Llet Credit (Part I,.

Web download the taxpayer bill of rights. Don't enter adjustments on form 720. Web you don't import gas guzzling automobiles in the course of your trade or business. Web • pursuant to krs 131.183, the 2021 tax interest rate has partners have 180 days to pay any additional tax due.

Upload, Modify Or Create Forms.

Also, include the amounts from lines 8, 10, and 11 that do not pass through to form 740. Try it for free now! Form 720s is a kentucky corporate income tax form. If you attach additional sheets, write your name and ein on.