Lady Bird Deed Form

Lady Bird Deed Form - A texas lady bird deed, or “enhanced life estate deed,” enables a grantor to transfer real estate to a beneficiary without probate. Updated on august 9th, 2022. The advantages of lady bird deed include: The deed allows for an efficient way for the designated beneficiaries to receive real property while avoiding probate. Fill now click to fill, edit and sign this form now! The property transfer occurs automatically at the owner’s death, avoiding probate. Web a texas lady bird deed form is a type of life estate deed designed specifically for estate planning. Web a michigan lady bird deed form allows a property owner to retain control over michigan real estate during his or her life and automatically transfer the real estate at his or her death. Web lady bird deed this deed is made on this day of _______________, 20__, between the grantor ______________________________ of address __________________________________________________ and the grantee beneficiary ______________________________ of address. Web the property taxes paid by the beneficiaries can skyrocket because of uncapping after the initial holder’s death.

A texas lady bird deed, or “enhanced life estate deed,” enables a grantor to transfer real estate to a beneficiary without probate. Web the property taxes paid by the beneficiaries can skyrocket because of uncapping after the initial holder’s death. As a type of estate planning tool, it is commonly used in conjunction with wills, revocable trusts, and other forms. Web texas lady bird deed form. The deed allows for an efficient way for the designated beneficiaries to receive real property while avoiding probate. Web a texas lady bird deed form is a type of life estate deed designed specifically for estate planning. The property transfer occurs automatically at the owner’s death, avoiding probate. Web lady bird deed this deed is made on this day of _______________, 20__, between the grantor ______________________________ of address __________________________________________________ and the grantee beneficiary ______________________________ of address. Regardless of name, it is a type of life estate deed. Web a lady bird deed allows a property owner to transfer property upon death while avoiding probate.

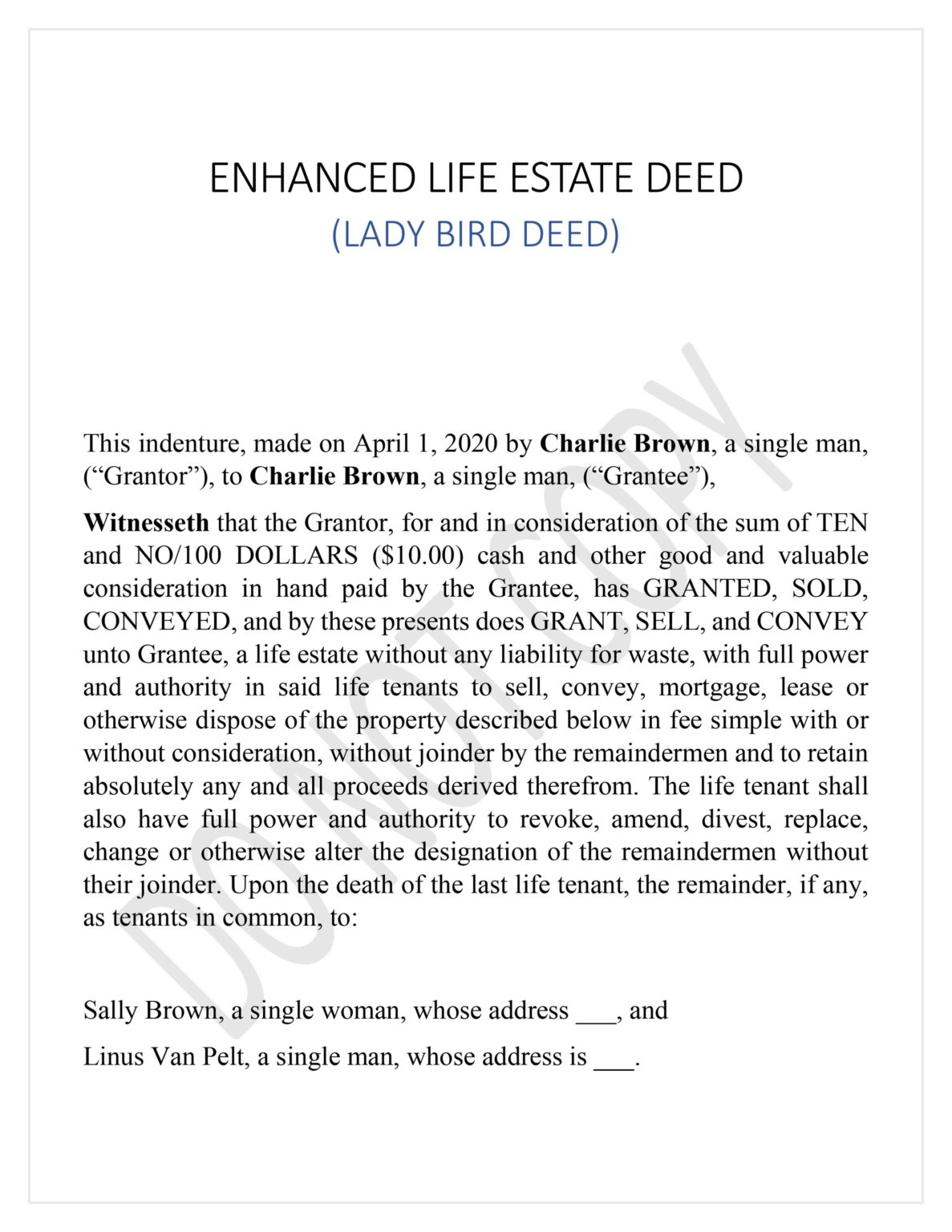

Updated on august 9th, 2022. Web the property taxes paid by the beneficiaries can skyrocket because of uncapping after the initial holder’s death. A texas lady bird deed, or “enhanced life estate deed,” enables a grantor to transfer real estate to a beneficiary without probate. Web a texas lady bird deed form is a type of life estate deed designed specifically for estate planning. Web a lady bird deed is a type of life estate deed that lets the owner maintain control of a property until their death, when the property automatically transfers to a beneficiary without going through. A lady bird deed allows a property to transfer on death to named beneficiaries without probate. Web lady bird deed this deed is made on this day of _______________, 20__, between the grantor ______________________________ of address __________________________________________________ and the grantee beneficiary ______________________________ of address. Lady bird deeds allow texas property owners to avoid probate at death without sacrificing control over the property during life. Create a free high quality lady bird deed online now! The property transfer occurs automatically at the owner’s death, avoiding probate.

Quitclaim Deed Form Florida Form Resume Examples zwRYPDPY4a

A texas lady bird deed, or “enhanced life estate deed,” enables a grantor to transfer real estate to a beneficiary without probate. Web a florida lady bird deed is an estate planning instrument that provides property owners with a means of passing on real estate to family or friends upon their death. Web a lady bird deed allows a property.

Lady Bird Deed Fill Online, Printable, Fillable, Blank pdfFiller

A lady bird deed allows a property to transfer on death to named beneficiaries without probate. The deed allows for an efficient way for the designated beneficiaries to receive real property while avoiding probate. Web texas lady bird deed form. Create a free high quality lady bird deed online now! Web a lady bird deed allows a property owner to.

Lady Bird Deed Florida Form Form Resume Examples Wk9yveRY3D

The deed is inexpensive, revocable, and simple compared to a trust. Web a lady bird deed is a type of life estate deed that lets the owner maintain control of a property until their death, when the property automatically transfers to a beneficiary without going through. Create a free high quality lady bird deed online now! The deed allows for.

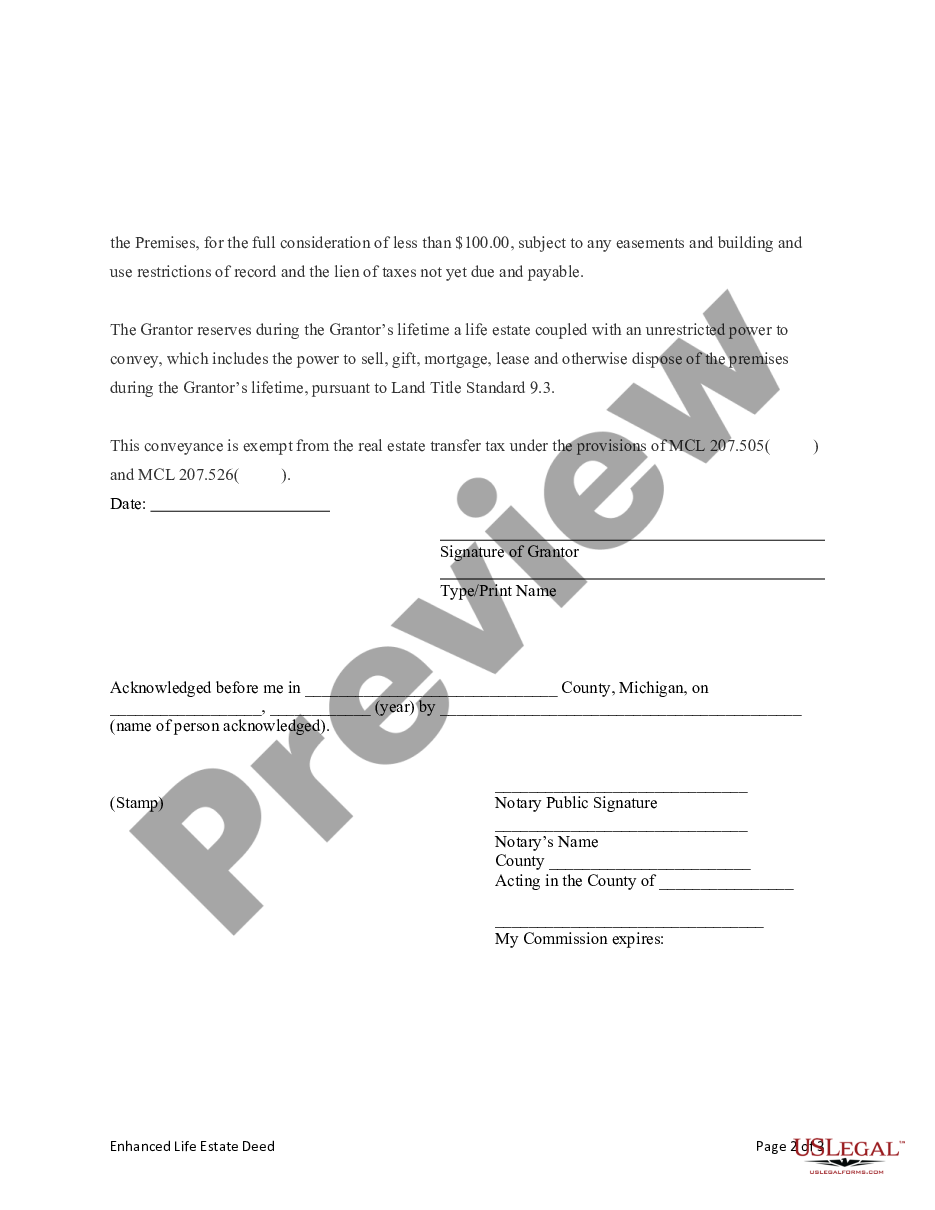

Michigan Enhanced Life Estate or Lady Bird Deed Lady Bird Deed

Web a lady bird (ladybird) deed goes by a variety of names, including an enhanced life estate deed, lady bird trust, and a transfer on death deed. Lady bird deeds allow texas property owners to avoid probate at death without sacrificing control over the property during life. A ladybird deed is a legal document used for passing down property without.

Florida Lady Bird Deed Form Pdf Form Resume Examples EvkB0vB52d

The advantages of lady bird deed include: Updated on august 9th, 2022. Since the deed creates a remainder interest in the property, it is not shielded against liens placed by creditors. As a type of estate planning tool, it is commonly used in conjunction with wills, revocable trusts, and other forms. Web a lady bird deed allows a property owner.

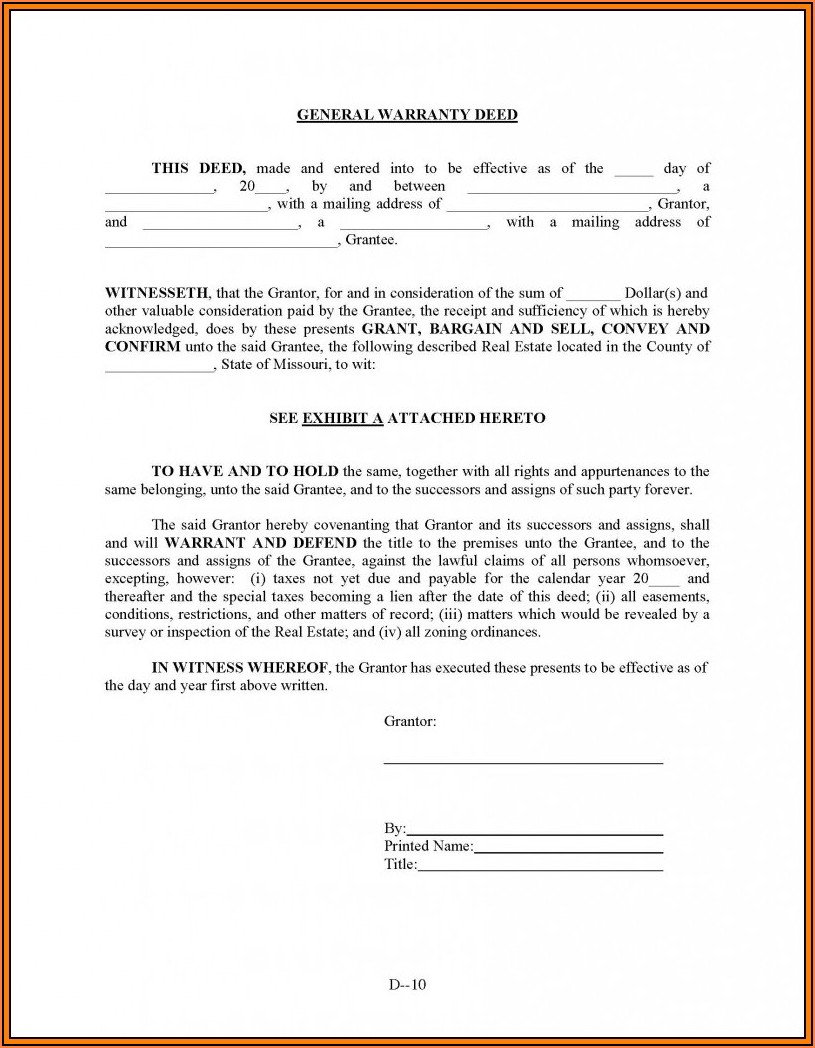

Free Lady Bird Deed Form Deed Common Law

The deed is inexpensive, revocable, and simple compared to a trust. Since the deed creates a remainder interest in the property, it is not shielded against liens placed by creditors. Web a lady bird (ladybird) deed goes by a variety of names, including an enhanced life estate deed, lady bird trust, and a transfer on death deed. Web what is.

Lady Bird Deed Michigan Form Fill Out and Sign Printable PDF Template

The advantages of lady bird deed include: Create and print online now. Since the deed creates a remainder interest in the property, it is not shielded against liens placed by creditors. Web a michigan lady bird deed form allows a property owner to retain control over michigan real estate during his or her life and automatically transfer the real estate.

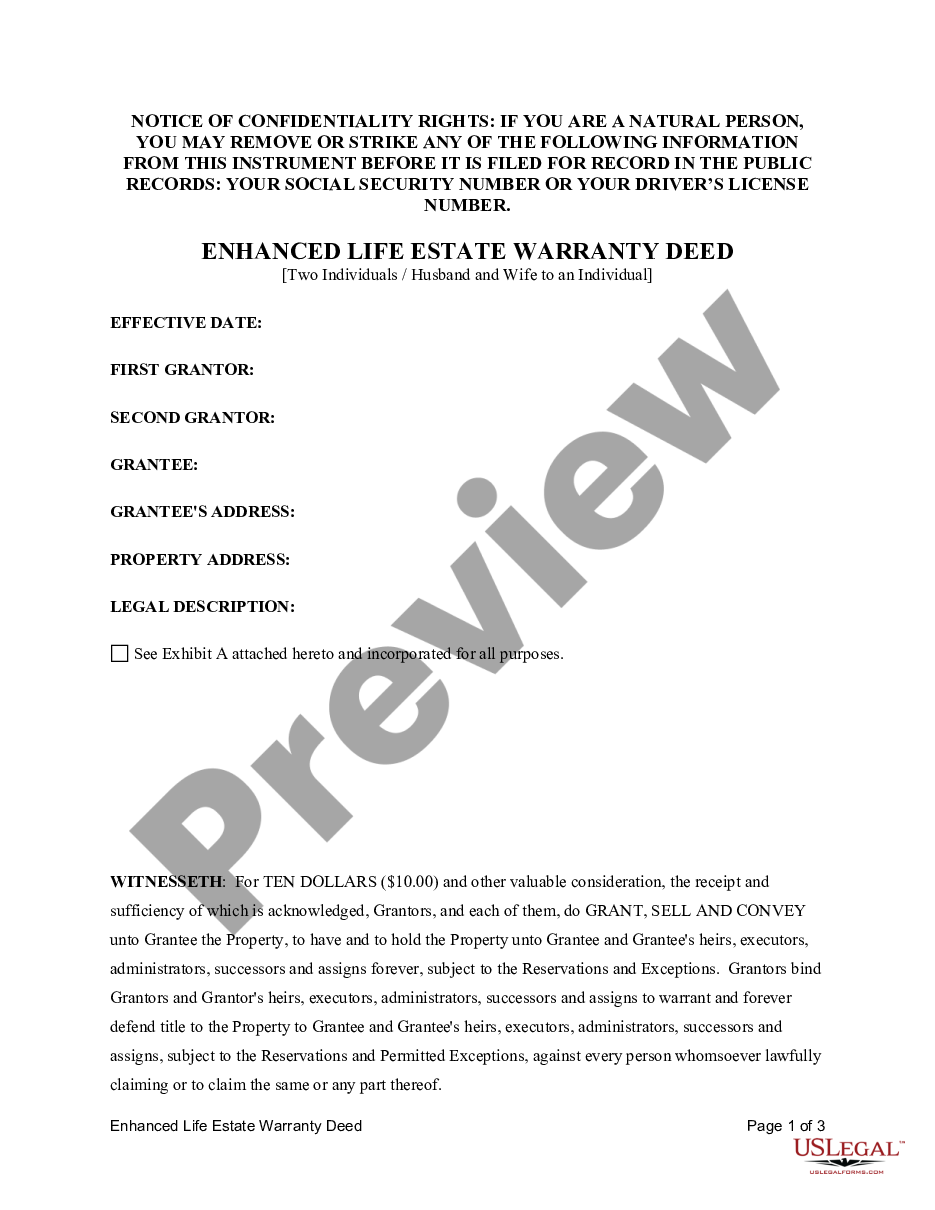

Texas Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals

A texas lady bird deed, or “enhanced life estate deed,” enables a grantor to transfer real estate to a beneficiary without probate. The deed allows for an efficient way for the designated beneficiaries to receive real property while avoiding probate. Updated on august 9th, 2022. Web a lady bird (ladybird) deed goes by a variety of names, including an enhanced.

What is a Florida Lady Bird Deed? Law Offices of Daily, Montfort & Toups

Web a michigan lady bird deed form allows a property owner to retain control over michigan real estate during his or her life and automatically transfer the real estate at his or her death. Web texas lady bird deed form. Web a florida lady bird deed is an estate planning instrument that provides property owners with a means of passing.

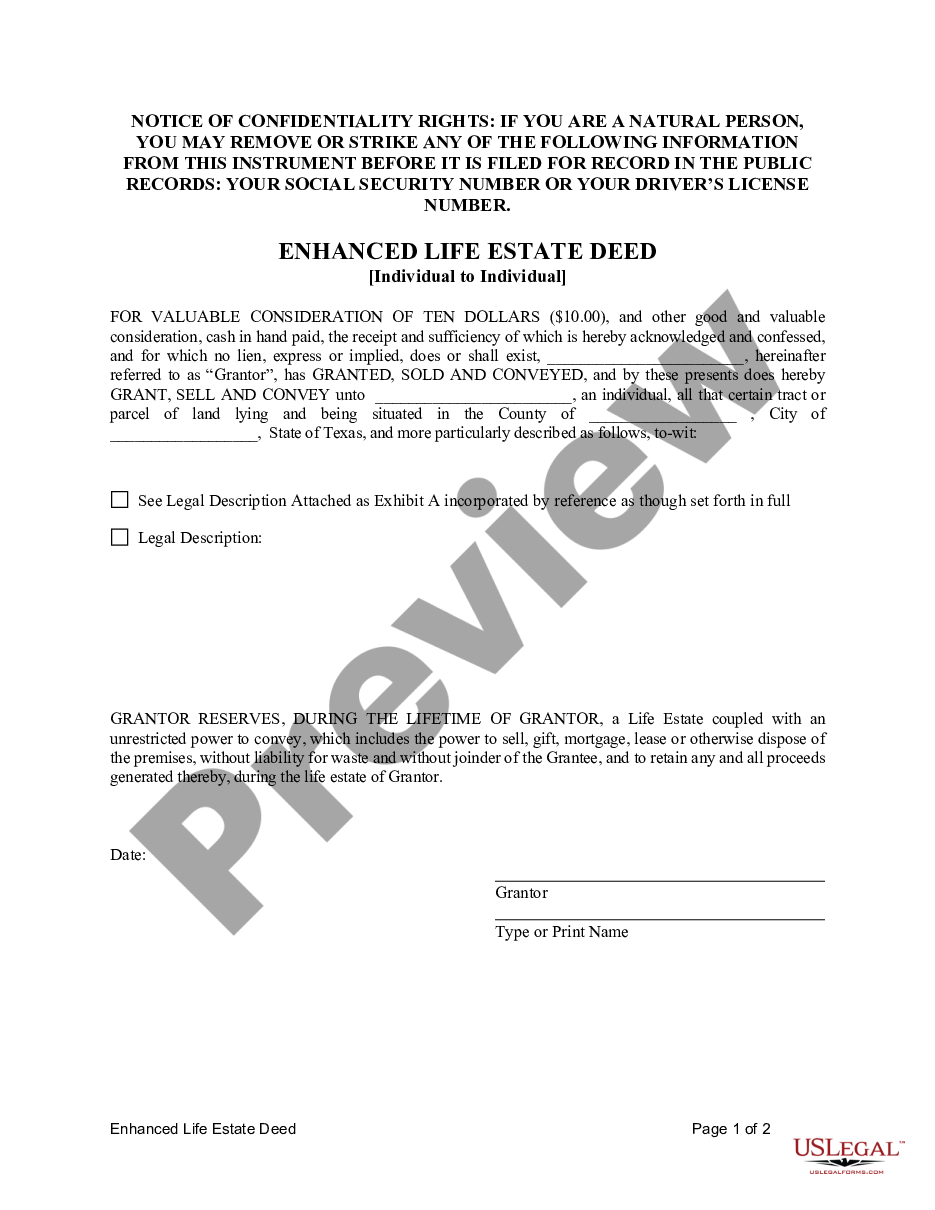

Lady Bird Deed US Legal Forms

Lady bird deeds allow texas property owners to avoid probate at death without sacrificing control over the property during life. The advantages of lady bird deed include: Create and print online now. Create a free high quality lady bird deed online now! A lady bird deed allows a property to transfer on death to named beneficiaries without probate.

A Texas Lady Bird Deed, Or “Enhanced Life Estate Deed,” Enables A Grantor To Transfer Real Estate To A Beneficiary Without Probate.

Web lady bird deed this deed is made on this day of _______________, 20__, between the grantor ______________________________ of address __________________________________________________ and the grantee beneficiary ______________________________ of address. Web texas lady bird deed form. Web a lady bird (ladybird) deed goes by a variety of names, including an enhanced life estate deed, lady bird trust, and a transfer on death deed. Web what is a lady bird deed?

Regardless Of Name, It Is A Type Of Life Estate Deed.

Web a florida lady bird deed is an estate planning instrument that provides property owners with a means of passing on real estate to family or friends upon their death. Web a texas lady bird deed form is a type of life estate deed designed specifically for estate planning. A lady bird deed allows a property to transfer on death to named beneficiaries without probate. The property transfer occurs automatically at the owner’s death, avoiding probate.

Updated On August 9Th, 2022.

Lady bird deeds allow texas property owners to avoid probate at death without sacrificing control over the property during life. Web a lady bird deed allows a property owner to transfer property upon death while avoiding probate. Web a michigan lady bird deed form allows a property owner to retain control over michigan real estate during his or her life and automatically transfer the real estate at his or her death. A ladybird deed is a legal document used for passing down property without requiring the beneficiary (grantee) to go through probate.

Web A Lady Bird Deed Is A Type Of Life Estate Deed That Lets The Owner Maintain Control Of A Property Until Their Death, When The Property Automatically Transfers To A Beneficiary Without Going Through.

The advantages of lady bird deed include: The deed is inexpensive, revocable, and simple compared to a trust. The deed allows for an efficient way for the designated beneficiaries to receive real property while avoiding probate. Web the property taxes paid by the beneficiaries can skyrocket because of uncapping after the initial holder’s death.