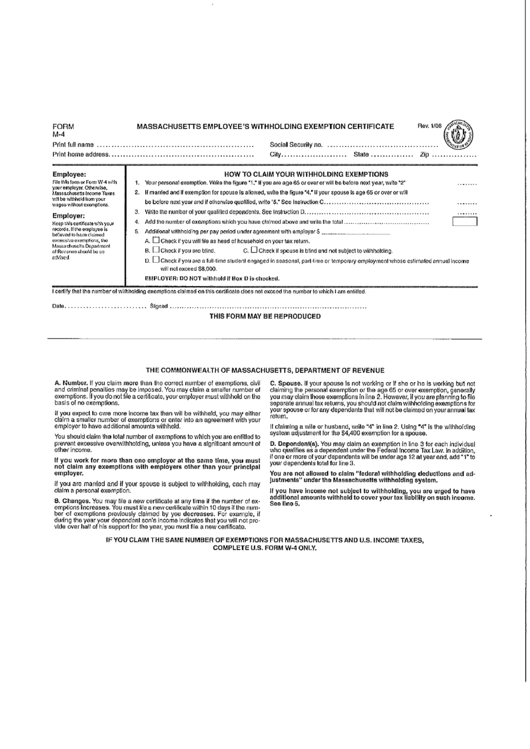

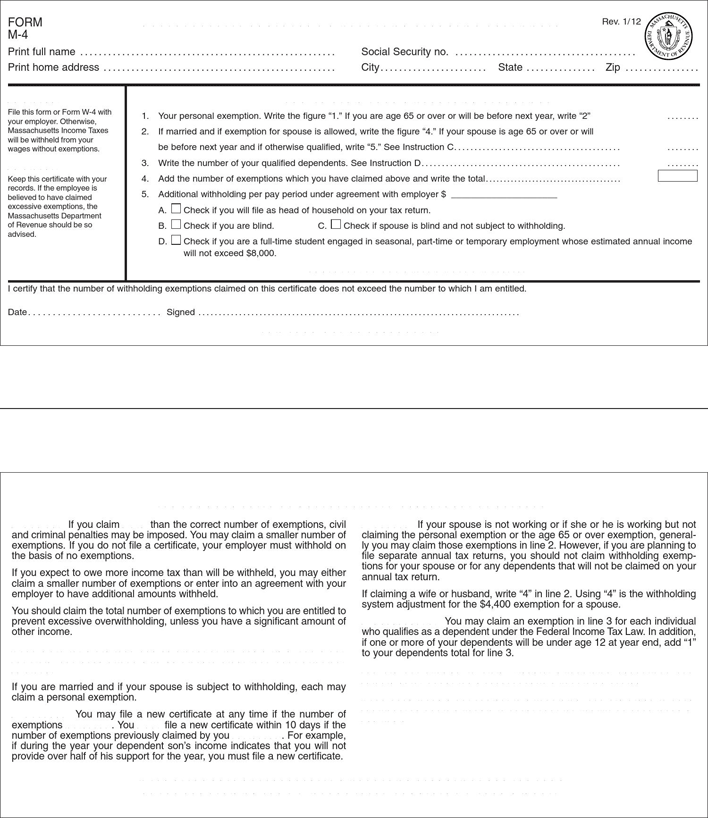

M 4 Form

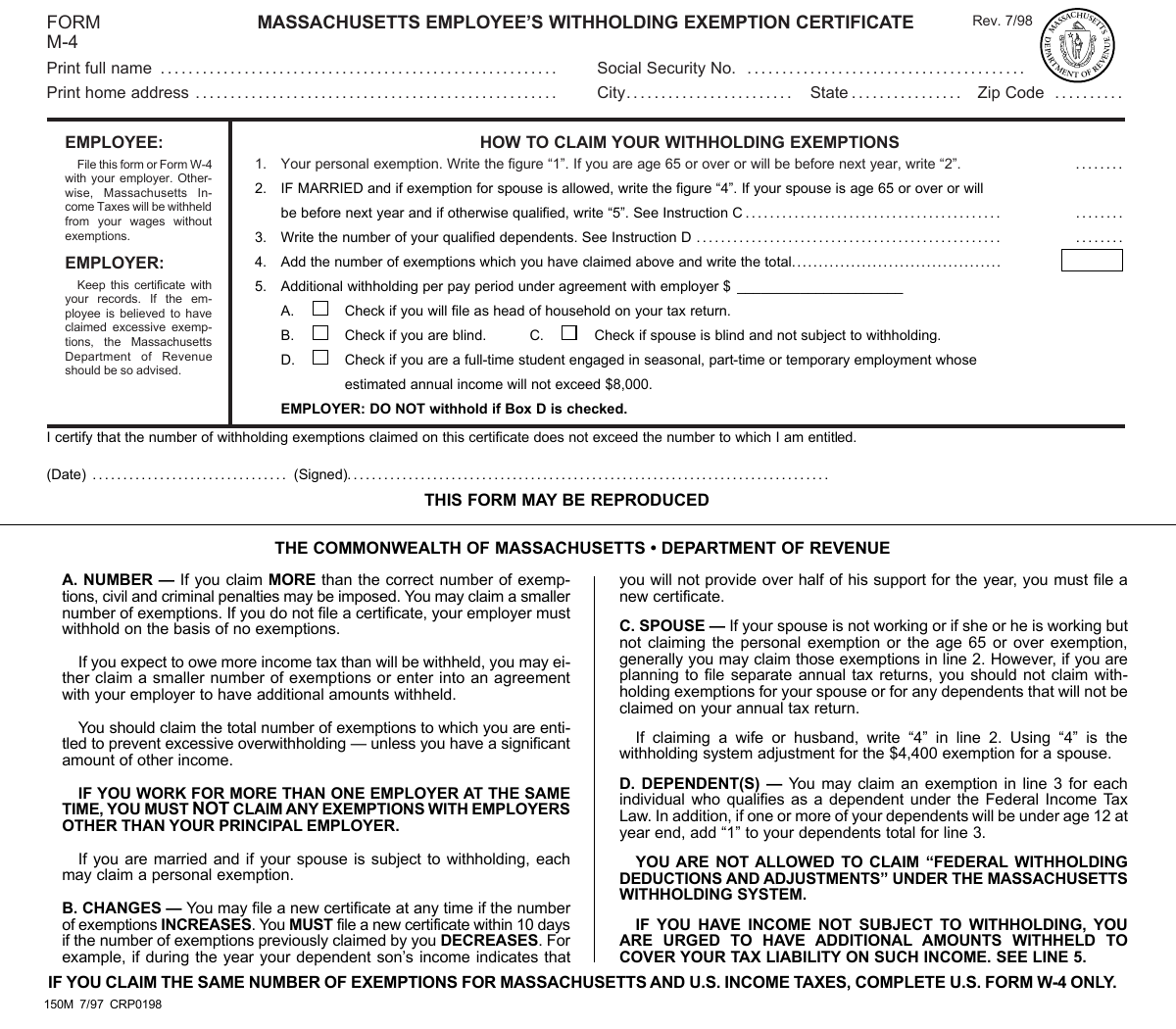

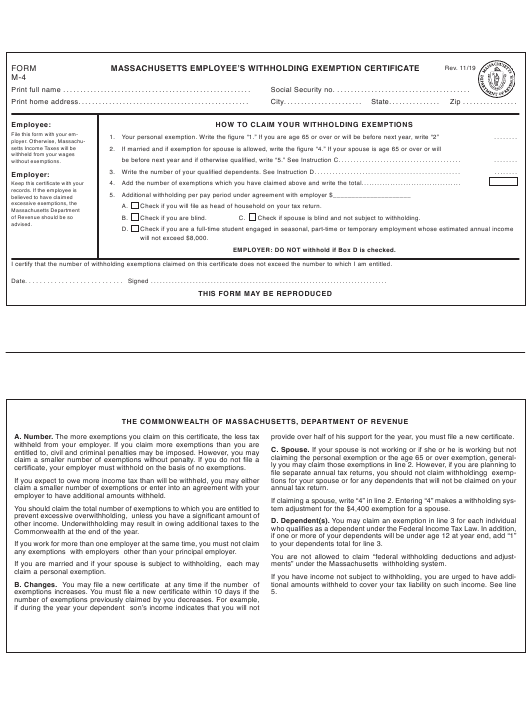

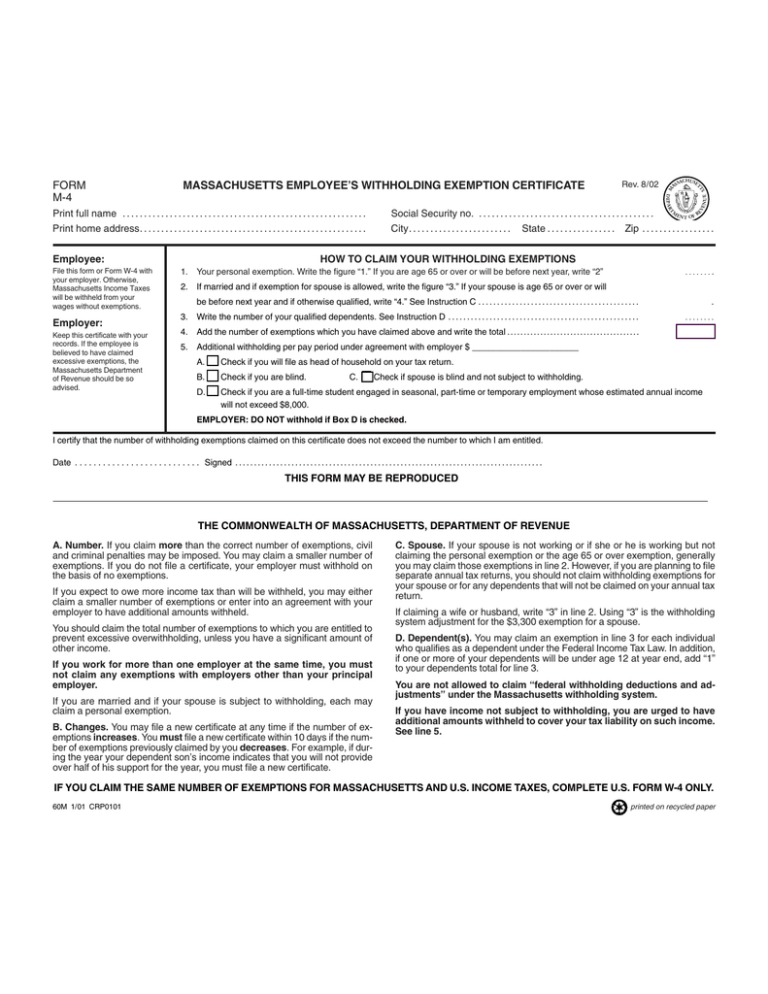

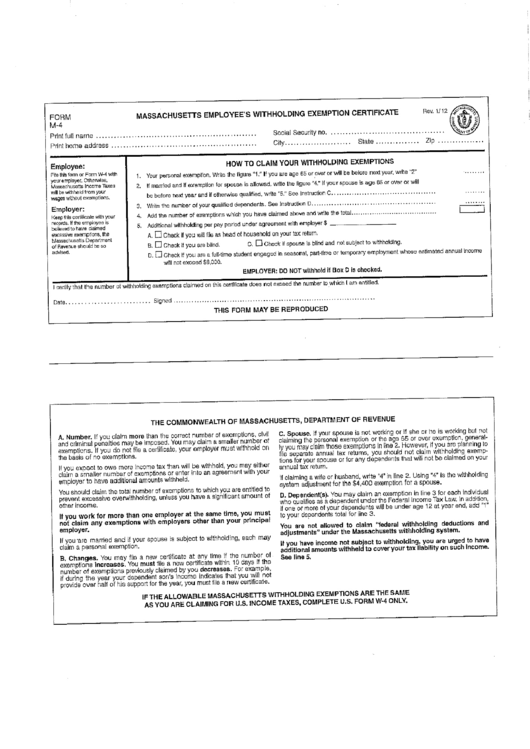

M 4 Form - Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. Continued next page check if filing a combined income return is this your final c corporation return? Enter on form m4, line 1. Check if this corporation (place an x in the. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. Web month after the end of the calendar or fiscal year. 2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: Web enter on form m4, line 1. Web this form may be reproduced the commonwealth of massachusetts, department of revenue if you claim the same number of exemptions. Web it on form m4x.

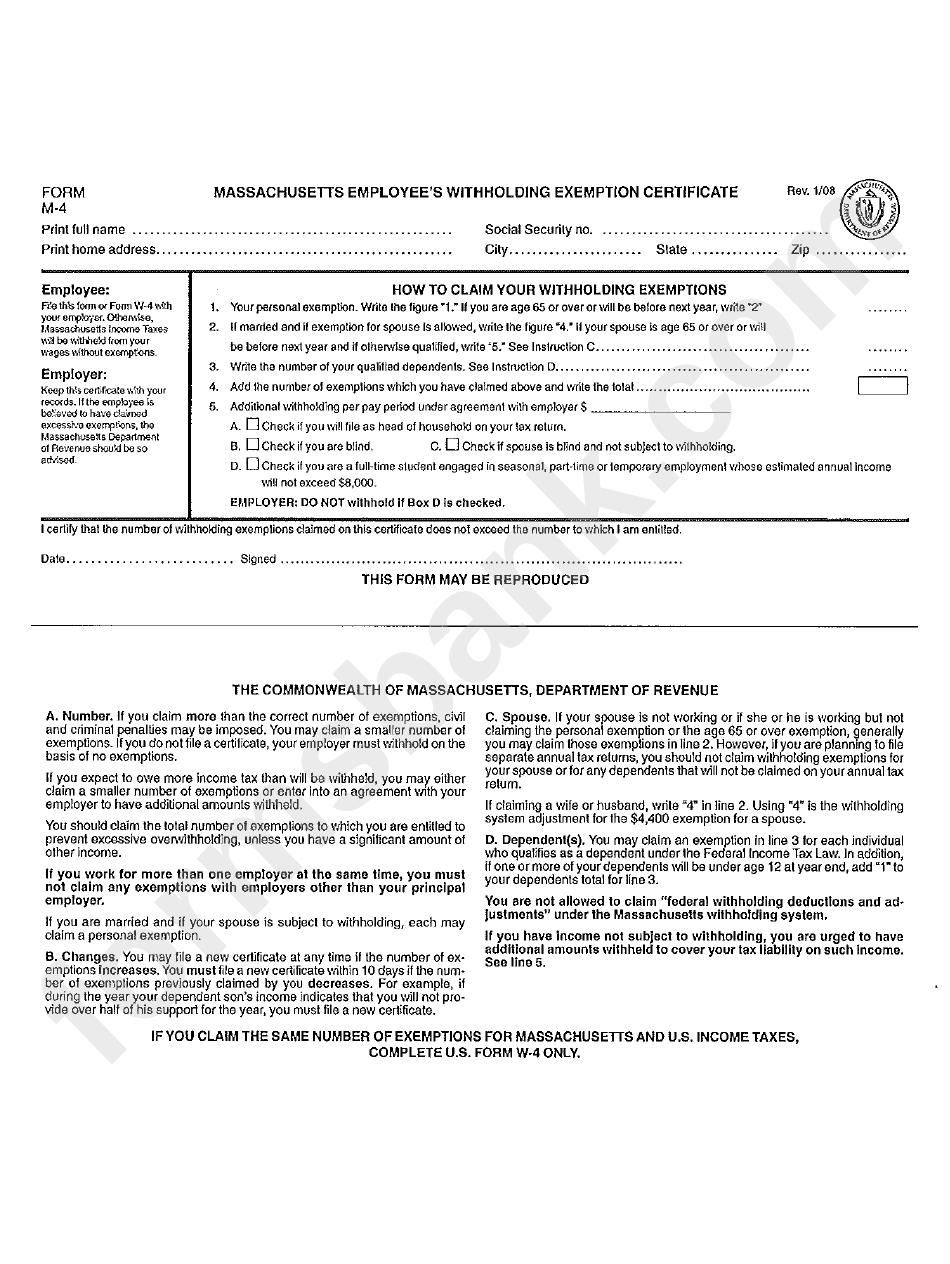

Continued next page check if filing a combined income return check if reporting tax position disclosure (enclose form tpd). If you need an extension. 2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. Web it on form m4x. Web month after the end of the calendar or fiscal year. Check if this corporation (place an x in the. Web massachusetts employee's withholding allowance certificate. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. Web it on form m4x.

Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. Web massachusetts employee's withholding allowance certificate. Web this form may be reproduced the commonwealth of massachusetts, department of revenue if you claim the same number of exemptions. Check if this corporation (place an x in the. Web it on form m4x. Continued next page check if filing a combined income return check if reporting tax position disclosure (enclose form tpd). If your spouse is age 65+ or will be before next year and is otherwise. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. Withholding affidavit for missouri residents. Web month after the end of the calendar or fiscal year.

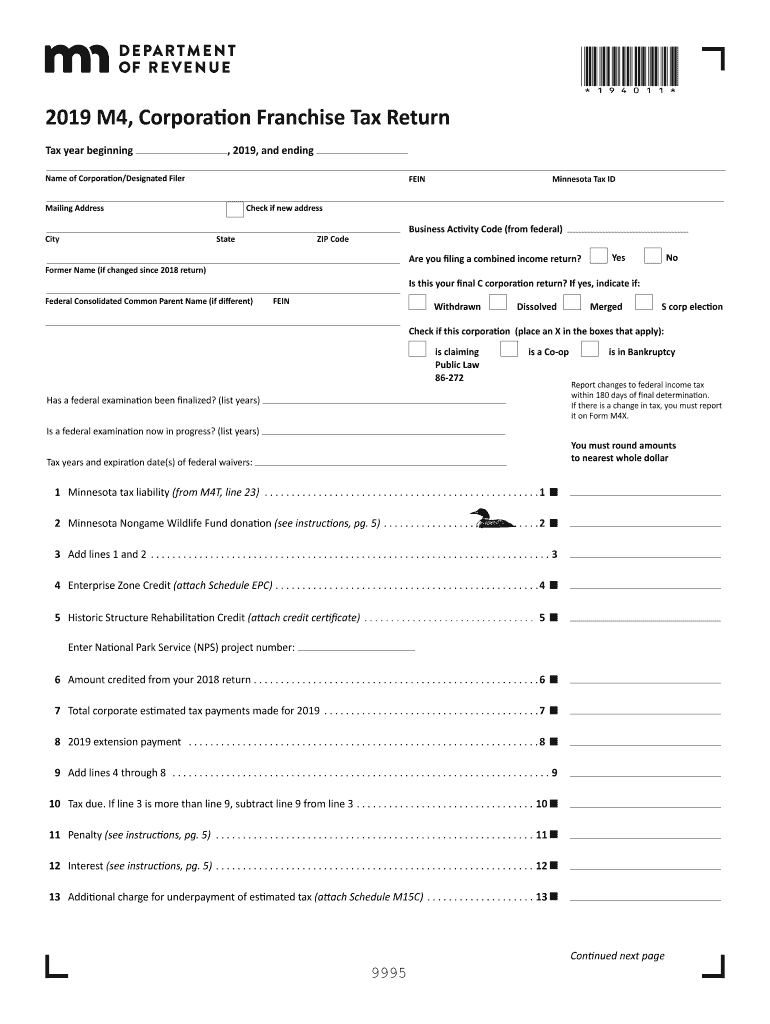

2019 Form MN DoR M4 Fill Online, Printable, Fillable, Blank pdfFiller

Web massachusetts employee's withholding allowance certificate. Check if this corporation (place an x in the. Enter on form m4, line 1. Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. Web it on form m4x.

MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE FORM M4

Continued next page check if filing a combined income return is this your final c corporation return? If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. If your spouse is age 65+ or will be before next year and is otherwise..

Form M4 Massachusetts Employee'S Withholding Exemption Certificate

Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. Web it on form m4x. Enter on form m4, line 1. Web massachusetts employee's withholding allowance certificate. Web it on form m4x.

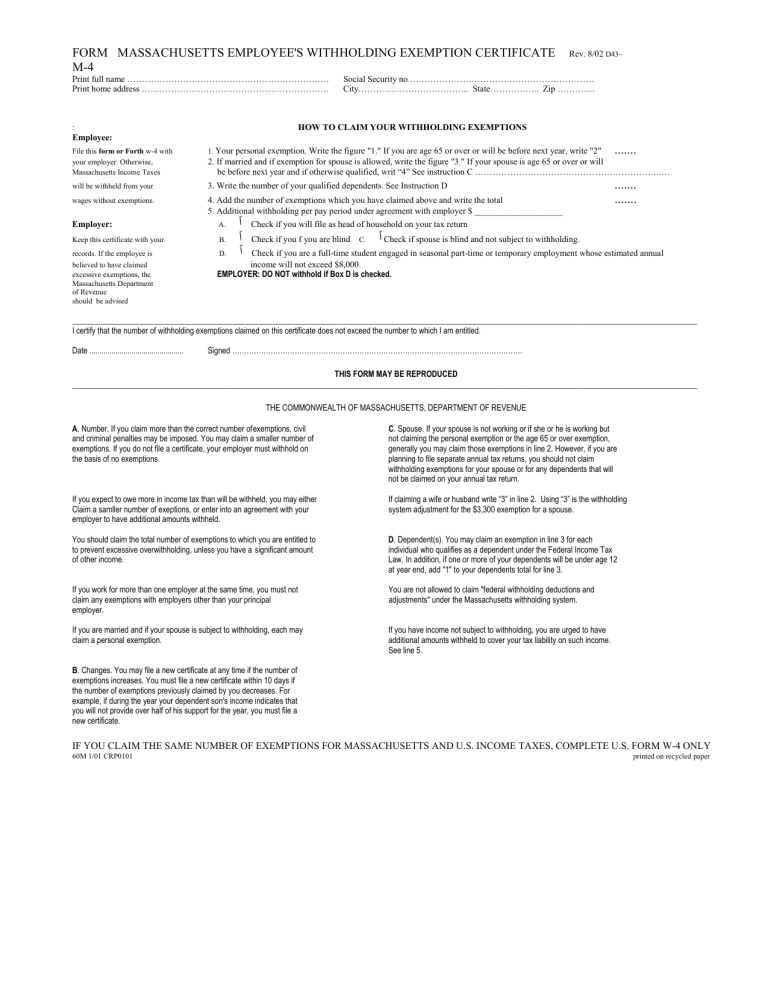

FORM MASSACHUSETTS EMPLOYEE'S WITHHOLDING

Continued next page check if filing a combined income return is this your final c corporation return? Check if this corporation (place an x in the. Web month after the end of the calendar or fiscal year. Web massachusetts employee's withholding allowance certificate. Withholding affidavit for missouri residents.

Form M4 Massachusetts Employee'S Withholding Exemption Certificate

Check if this corporation (place an x in the. Web massachusetts employee's withholding allowance certificate. Web enter on form m4, line 1. Web it on form m4x. If you need an extension.

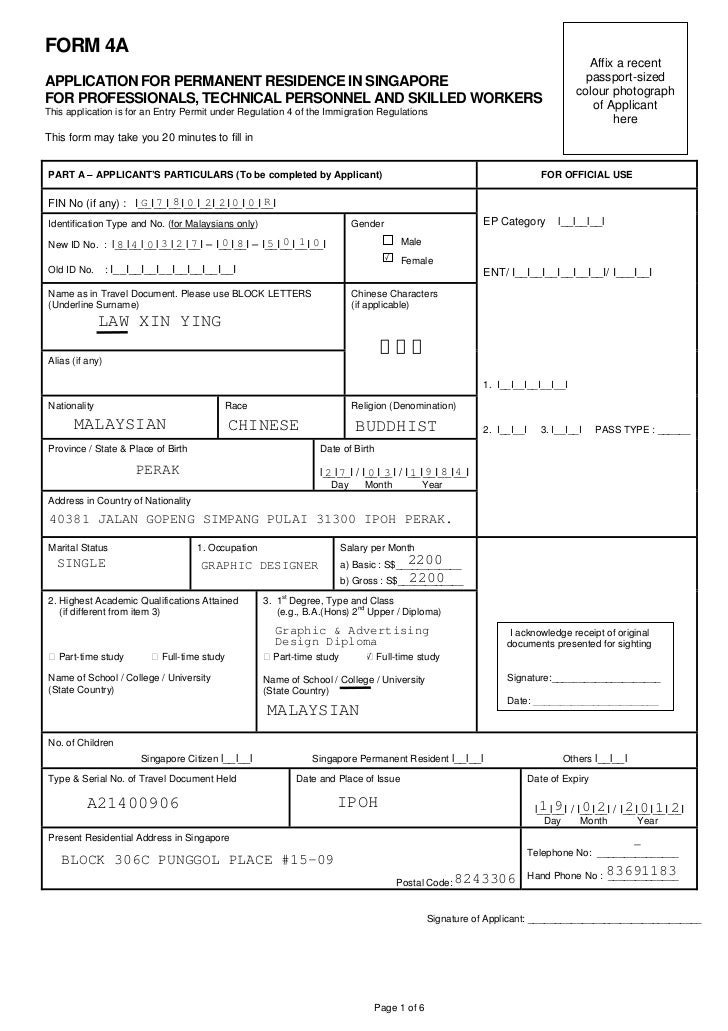

Form4 a 4

If you need an extension. 2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. Continued next page check if filing a.

Massachusetts Employee Withholding Form 2022 W4 Form

Withholding affidavit for missouri residents. Web this form may be reproduced the commonwealth of massachusetts, department of revenue if you claim the same number of exemptions. Web if claiming a wife or husband, enter “4” for a withholding system adjustment of $4,400 exemption. If you need an extension. If you expect to owe more income tax than will be withheld,.

MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE FORM M4

Web it on form m4x. Continued next page check if filing a combined income return is this your final c corporation return? Web this form may be reproduced the commonwealth of massachusetts, department of revenue if you claim the same number of exemptions. Web it on form m4x. Withholding affidavit for missouri residents.

Free Massachusetts Form M PDF 46KB 1 Page(s)

2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: Web month after the end of the calendar or fiscal year. If your spouse is age 65+ or will be before next year and is otherwise. Withholding affidavit for missouri residents. Web massachusetts employee's withholding allowance certificate.

Form M4 Massachusetts Employee'S Withholding Exemption Certificate

If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your. 2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: Web month after the end of the calendar or fiscal year. Continued.

Web If Claiming A Wife Or Husband, Enter “4” For A Withholding System Adjustment Of $4,400 Exemption.

Web it on form m4x. Web month after the end of the calendar or fiscal year. Web massachusetts employee's withholding allowance certificate. Web enter on form m4, line 1.

Web It On Form M4X.

Withholding affidavit for missouri residents. If you need an extension. If your spouse is age 65+ or will be before next year and is otherwise. Web this form may be reproduced the commonwealth of massachusetts, department of revenue if you claim the same number of exemptions.

Enter On Form M4, Line 1.

Continued next page check if filing a combined income return is this your final c corporation return? 2021 m4t, page 2 corporation name fein minnesota tax id b 1 b 2 b 3 single/designated filer *214321* title: Check if this corporation (place an x in the. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or enter into an agreement with your.