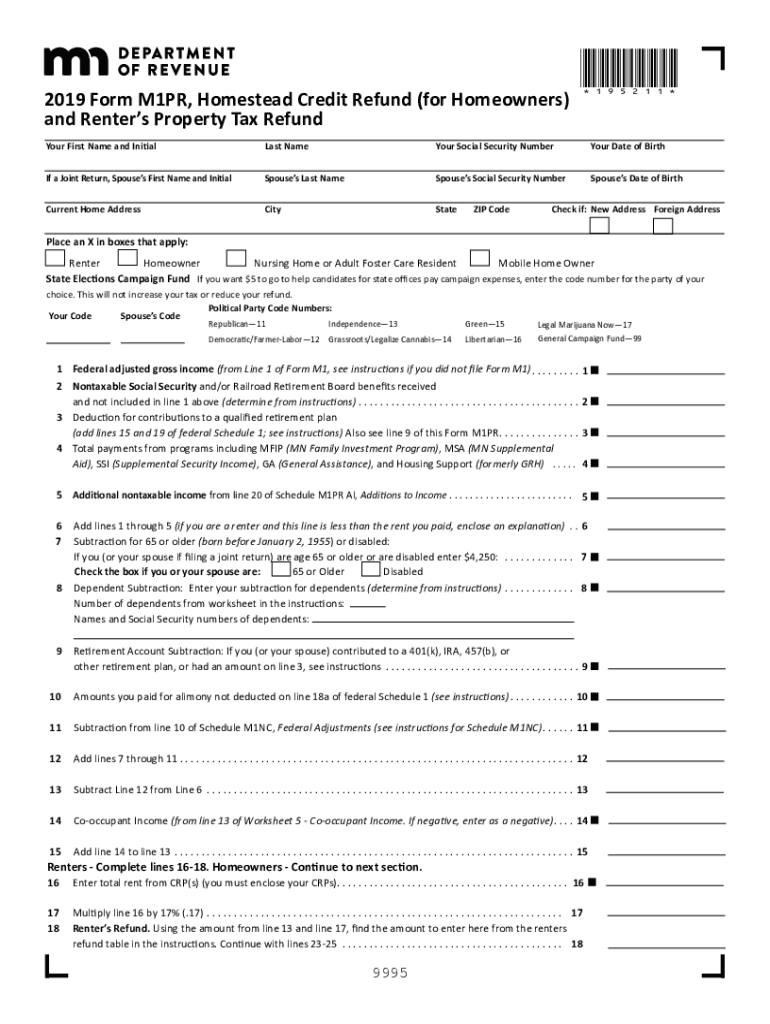

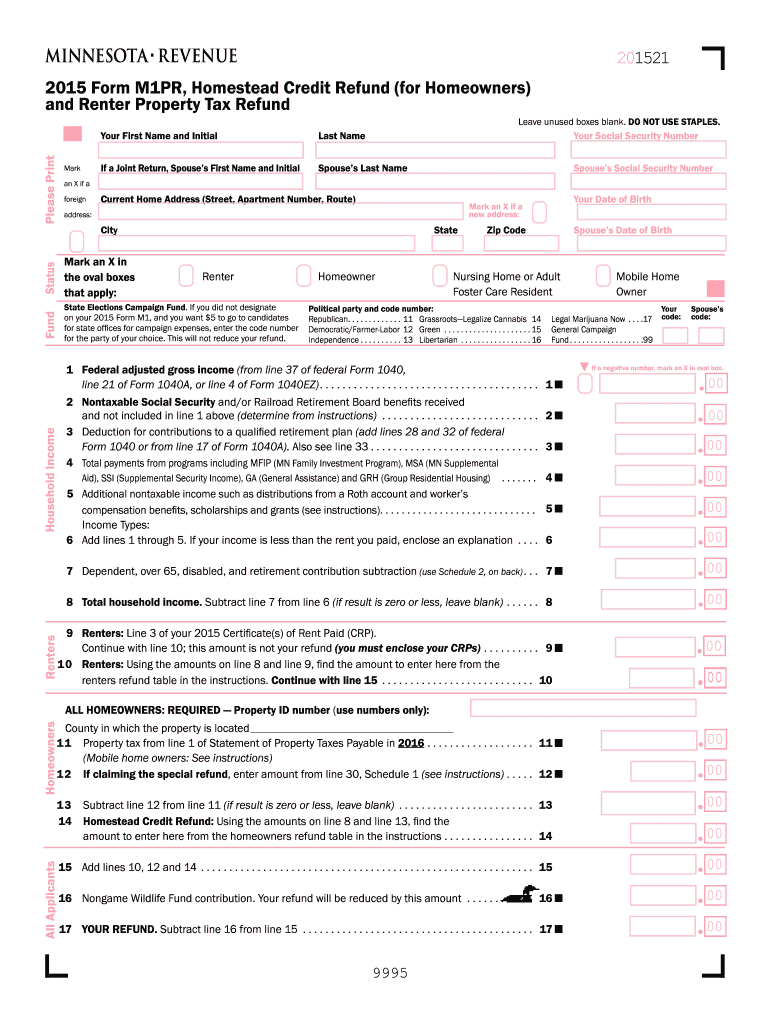

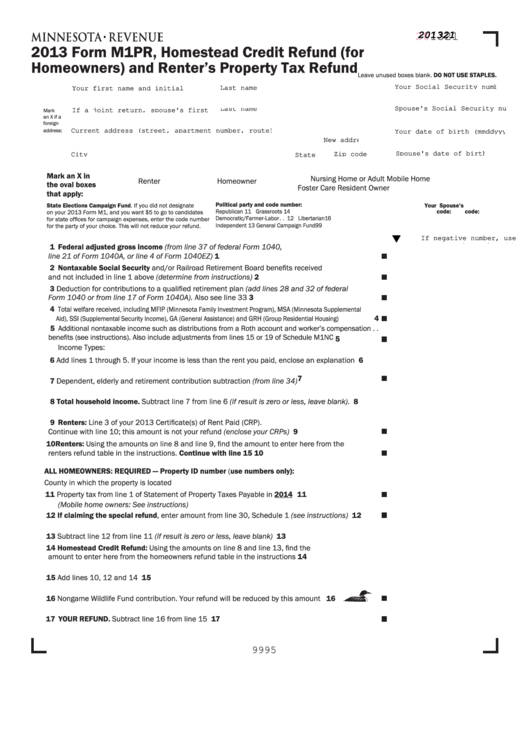

M1Pr Form 2021

M1Pr Form 2021 - Enter the full amount from line 1 of your 2021 statement of. If want your refund directly deposited. If you are filing as a renter, include any certificates of. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Electronically filed, postmarked, or dropped off by august 15, 2022. We'll make sure you qualify, calculate your minnesota property tax refund,. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web your 2021 return should be. For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210. Web up to $40 cash back the m1pr form, also known as the minnesota property tax refund form, requires the reporting of the following information:

Electronically filed, postmarked, or dropped off by august 15, 2022. Web up to $40 cash back the m1pr form, also known as the minnesota property tax refund form, requires the reporting of the following information: For example, if your property tax refund return is due august 15, 2021, then your. The final deadline to claim the 2021 refund is august 15, 2023. The refund is not shown within the refund calculator on the main screen. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web click on the form m1pr link to enter any additional information like your federal agi, dependents or additional income that you received. This form is for income earned in tax year 2022, with tax returns. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.

If want your refund directly deposited. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. The refund provides property tax relief depending on your income and property taxes. The last day you can file your 2021 m1pr return. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: We'll make sure you qualify, calculate your minnesota property tax refund,. The refund is not shown within the refund calculator on the main screen. Web your 2021 return should be. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210. The refund provides property tax relief depending on your income and property taxes. Web we last updated minnesota form m1pr.

Fill Free fillable American Immigration Lawyers Association PDF forms

Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. Web your 2021 return should be. Electronically filed, postmarked, or dropped off by august 15, 2022. Web click on the form m1pr link to enter any additional information like your federal agi, dependents or additional income that you received. Web the deadline for filing.

Property Tax Refund State Of Minnesota WOPROFERTY

Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Electronically filed, postmarked, or dropped off by august 15, 2022. For example, if your property tax refund return is due august 15, 2021, then your. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as.

Fill Free fillable Minnesota Department of Revenue PDF forms

Enter the full amount from line 1 of your 2021 statement of. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. The refund is not shown within the refund calculator on the main screen. Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with.

Child Tax Credit 2022 Schedule Payments

Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. The final deadline to claim the 2021 refund is august 15, 2023. Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or.

Fill Free fillable 2020 Form M1PR, Homestead Credit Refund (for

The refund provides property tax relief depending on your income and property taxes. Web your 2021 return should be. Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. For example, if your property tax refund return is due august 15, 2021, then your. Minnesota allows a property tax credit to renters and homeowners.

Fill Free fillable 2020 Form M1PR, Homestead Credit Refund (for

Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. For example, if your property tax refund return is due august 15, 2021, then your. The final deadline to claim the 2021 refund is august 15, 2023. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as.

M1PR Broyce Control, UK

Web what are the maximums? Web your 2021 return should be. The refund provides property tax relief depending on your income and property taxes. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. The last day you can file your 2021 m1pr return.

M1pr 2015 form Fill out & sign online DocHub

Web click on the form m1pr link to enter any additional information like your federal agi, dependents or additional income that you received. Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web up to $40 cash back the m1pr form, also known as the.

Fillable Form M1pr Homestead Credit Refund (For Homeowners) And

Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner.

Web Up To $40 Cash Back The M1Pr Form, Also Known As The Minnesota Property Tax Refund Form, Requires The Reporting Of The Following Information:

Web 2021 m1pr instruction booklet filing deadlines for the m1pr the last day you can file your 2022 m1pr return is august 15, 2024. If want your refund directly deposited. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: This form is for income earned in tax year 2022, with tax returns.

We'll Make Sure You Qualify, Calculate Your Minnesota Property Tax Refund,.

Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web what are the maximums? Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. The final deadline to claim the 2021 refund is august 15, 2023.

The Last Day You Can File Your 2021 M1Pr Return.

Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web your 2021 return should be. Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner for the home. Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr.

Enter The Full Amount From Line 1 Of Your 2021 Statement Of.

If you are filing as a renter, include any certificates of. The refund provides property tax relief depending on your income and property taxes. You will not receive a refund. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: