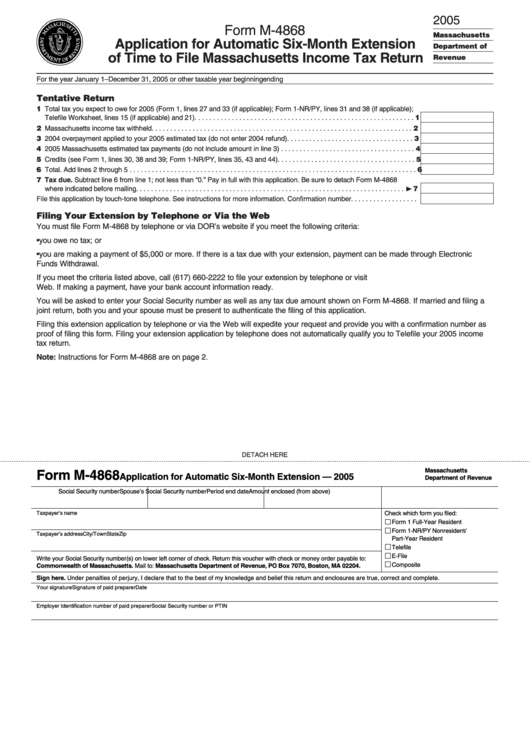

Ma Form 4868

Ma Form 4868 - Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). If line 7 is “0” or you are making a payment of $5,000 or more,. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web form 4868 (2019) page. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 4868 (2020) page. Web revised march 5, 2021; Web form 4868 (2018) page. Web there are several ways to submit form 4868.

2 when to file form 4868 file form 4868 by april 15, 2021. Fiscal year taxpayers file form. Explore more file form 4868 and extend your 1040 deadline up to 6. Citizen or resident files this form to request. Web form 4868 (2019) page. This form is for income earned in tax year 2022, with tax returns. 2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web there are several ways to submit form 4868. You must file form 4868 by.

Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023. Citizen or resident files this form to request. Your state extension pdf is free. You must file form 4868 by. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. 2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). If line 7 is “0” or you are making a payment of $5,000 or more,. Interest rates on lines 21 and 23 updated. Web form 4868 (2018) page. Web 2021 form efo:

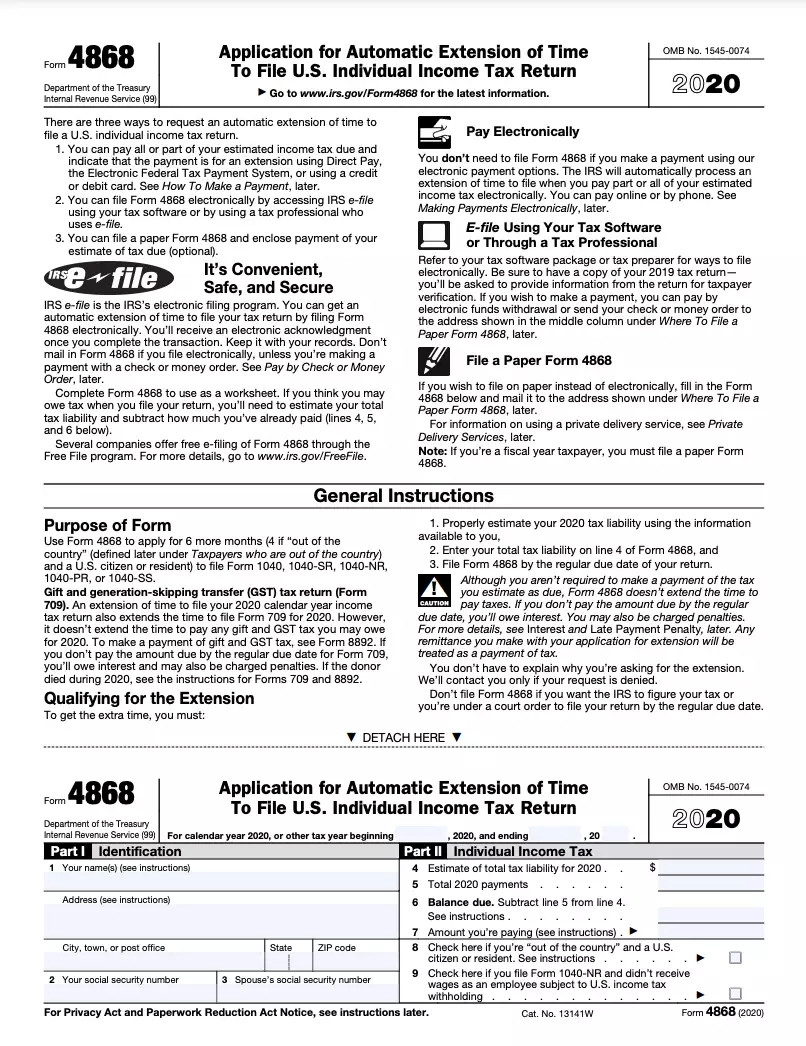

Form 4868 Application for Automatic Extension of Time to File U.S

You must file form 4868 by. Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web revised march 5, 2021; Ad get ready for tax season.

Know about IRS tax extension Form 4868 TaxEz

Your state extension pdf is free. Web revised march 5, 2021; Explore more file form 4868 and extend your 1040 deadline up to 6. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals.

File IRS Form 4868 Online EFile IRS 4868 for 2021 Tax Year

Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Explore more file form 4868 and extend your 1040 deadline up to 6. Web form 4868 (2019) page. See page 1 for more information. If line 7 is “0” or you are making a payment of $5,000 or more,.

Form M4868 Application For Automatic SixMonth Extension Of Time To

Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to.

Form 4868 Application for Automatic Extension of Time to File U.S

Anyone that misses the deadline to file should make payment of any tax due via a return payment. If line 7 is “0” or you are making a payment of $5,000 or more,. Fiscal year taxpayers file form. Web form 4868 (2020) page. Web 8 rows these where to file addresses are to be used only by taxpayers and tax.

Form 4868 Application for Automatic Extension of Time to File U.S

2 when to file form 4868 file form 4868 by april 15, 2021. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web form 4868 (2019) page. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web 8 rows these where to file addresses.

Top 10 Us Tax Forms In 2022 Explained Pdf Co Gambaran

Interest rates on lines 21 and 23 updated. This form is for income earned in tax year 2022, with tax returns. See page 1 for more information. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Your state extension pdf is free.

E File Tax Form 4868 Online Universal Network

Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. 2 when to file form 4868 file form 4868 by april 15, 2021. Web revised march 5, 2021; Underpayment of massachusetts estimated income tax for fiduciaries. Web form 4868 (2020) page.

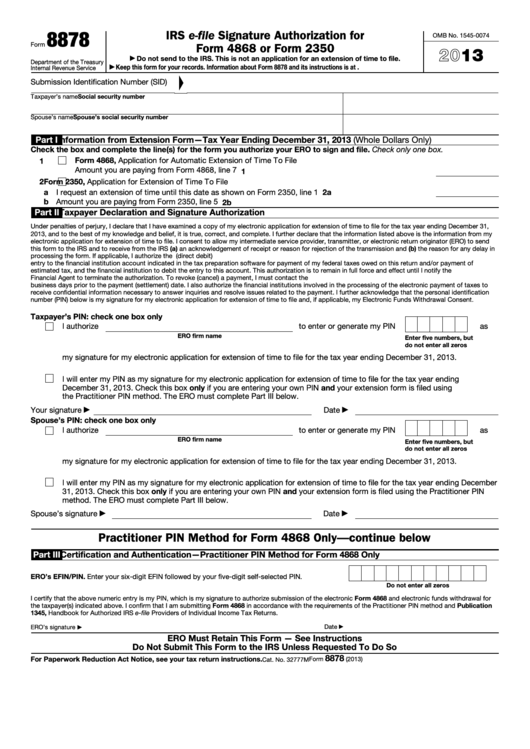

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web revised march 5, 2021; Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals.

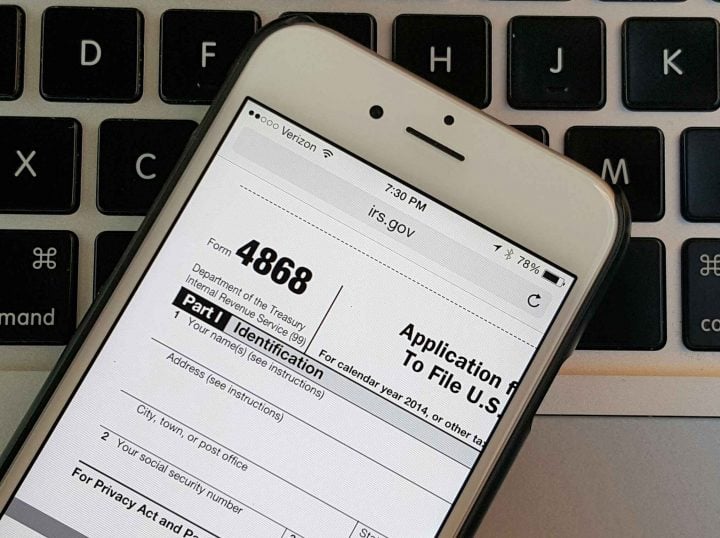

How to File a 2016 Tax Extension (IRS Form 4868) on iPhone, iPad or

2 when to file form 4868 file form 4868 by april 15, 2020. Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. 2 when to file.

Web There Are Several Ways To Submit Form 4868.

Citizen or resident files this form to request. Web form 4868 (2020) page. Anyone that misses the deadline to file should make payment of any tax due via a return payment. 2 when to file form 4868 file form 4868 by april 15, 2020.

Interest Rates On Lines 21 And 23 Updated.

2 when to file form 4868 file form 4868 by april 15, 2021. Web revised march 5, 2021; This form is for income earned in tax year 2022, with tax returns. Ad get ready for tax season deadlines by completing any required tax forms today.

If Line 7 Is “0” Or You Are Making A Payment Of $5,000 Or More,.

Explore more file form 4868 and extend your 1040 deadline up to 6. Underpayment of massachusetts estimated income tax for fiduciaries. You must file form 4868 by. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return.

Taxpayers Can File Form 4868 By Mail, But Remember To Get Your Request In The Mail By Tax Day.

Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. See page 1 for more information. 2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). Web form 4868 (2018) page.