Mailing Address For Form 943

Mailing Address For Form 943 - Employer identification number (ein) trade. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web you have two options for filing form 943: And indian tribal governmental entities; Web the employee retention credit under section 3134 of the internal revenue code, as enacted by the arp and amended by the infrastructure investment and jobs act, was limited to. Web special filing address for exempt organizations; Web 5 rows internal revenue service. Form 943, is the employer's. Web the employee retention credit under section 3134 of the internal revenue code, as enacted by the arp and amended by the infrastructure investment and jobs act, was. Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year.

Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. Form 943 has about 29 lines for the 2022 tax year. 4043 county road 259, fulton, mo is a single family home that contains 2,067 sq ft and was built in 2006. How to fill out form 943 for 2022? Web you have two options for filing form 943: Select the mailing address listed on the webpage that is. If you use a private delivery service to send your. Name, ein, and address 2. The following information is needed before filing the form 943. The irs states agricultural employers are subject to.

Employer identification number (ein), name, trade name, and address. Select the mailing address listed on the webpage that is. It contains 3 bedrooms and 2. Must be removed before printing. Web for the irs mailing address to use if you’re using a pds, go to irs.gov/pdsstreetaddresses. The following information is needed before filing the form 943. Web address to mail form to irs: The irs states agricultural employers are subject to. Web you have two options for filing form 943: Web special filing address for exempt organizations;

2018 Form IRS 943 Fill Online, Printable, Fillable, Blank PDFfiller

Must be removed before printing. And indian tribal governmental entities; Web for the irs mailing address to use if you’re using a pds, go to irs.gov/pdsstreetaddresses. Form 943 has about 29 lines for the 2022 tax year. Web file form 943 before the due date for 2022 and get to know the form 943 mailing address with &.

Form BR001 Download Fillable PDF or Fill Online Employer Designated

4043 county road 259, fulton, mo is a single family home that contains 2,067 sq ft and was built in 2006. Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: If you use a private delivery service to send your. If you don't have an ein,.

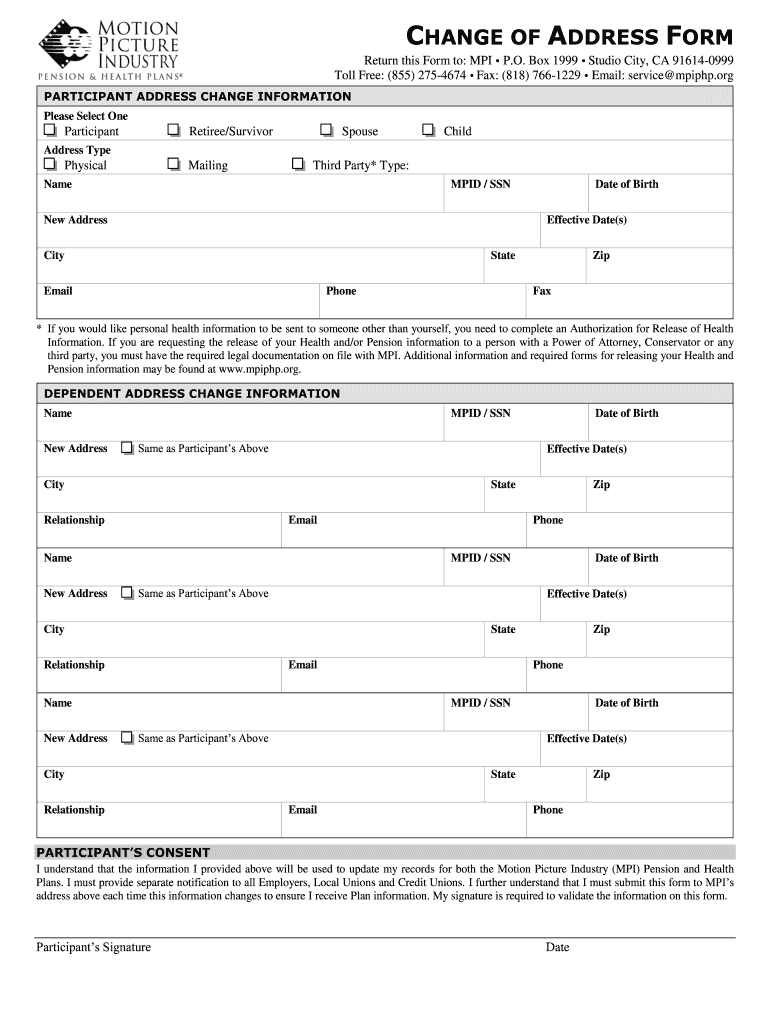

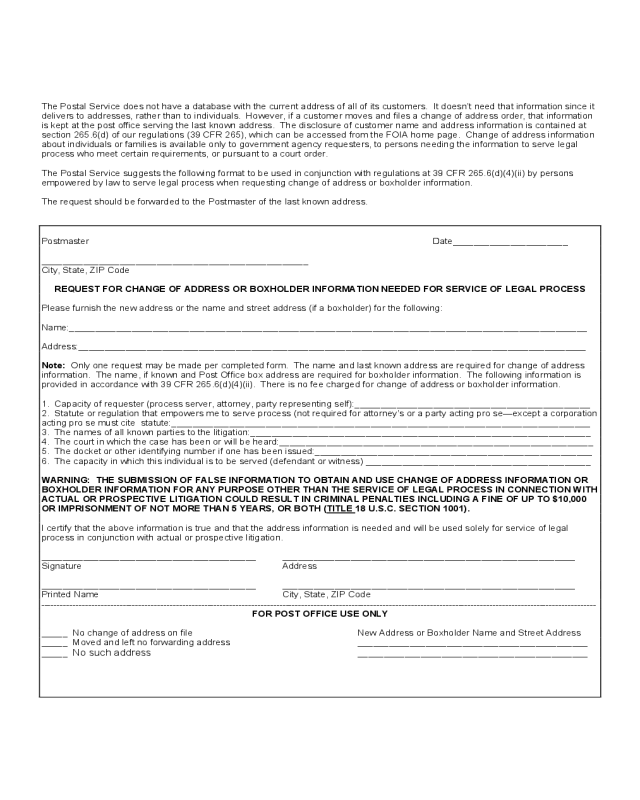

Post Office Change Of Address Form Fill Online, Printable, Fillable

If you use a private delivery service to send your. Must be removed before printing. Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees.

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

If you want to file online, you can either search for a tax professional to guide you through the. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Medicare and social security taxes iii. Employer identification number (ein), name, trade name, and address. Web.

FREE 9+ Sample Address Request Forms in MS Word PDF

Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. Web the employee retention credit under section 3134 of the internal revenue code, as enacted by the arp and amended by the infrastructure investment and jobs act, was. Web special filing address for exempt organizations; Web.

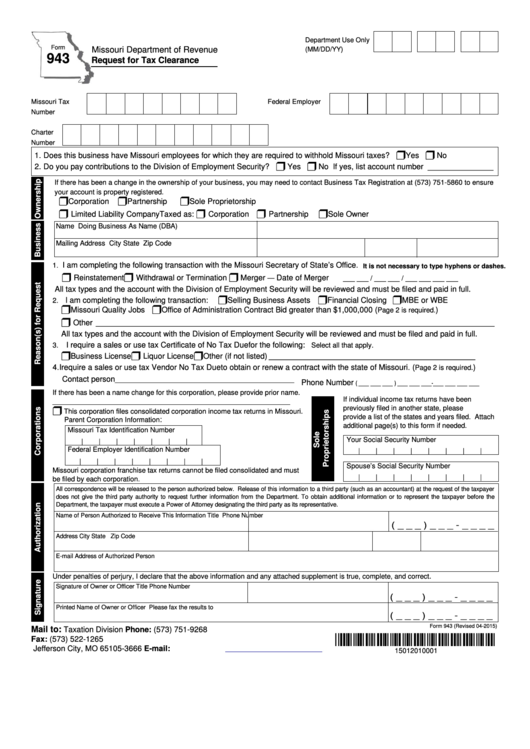

Fillable Form 943 Request For Tax Clearance printable pdf download

How to fill out form 943 for 2022? Form 943 has about 29 lines for the 2022 tax year. Web for the irs mailing address to use if you’re using a pds, go to irs.gov/pdsstreetaddresses. Name, ein, and address 2. If you use a private delivery service to send your.

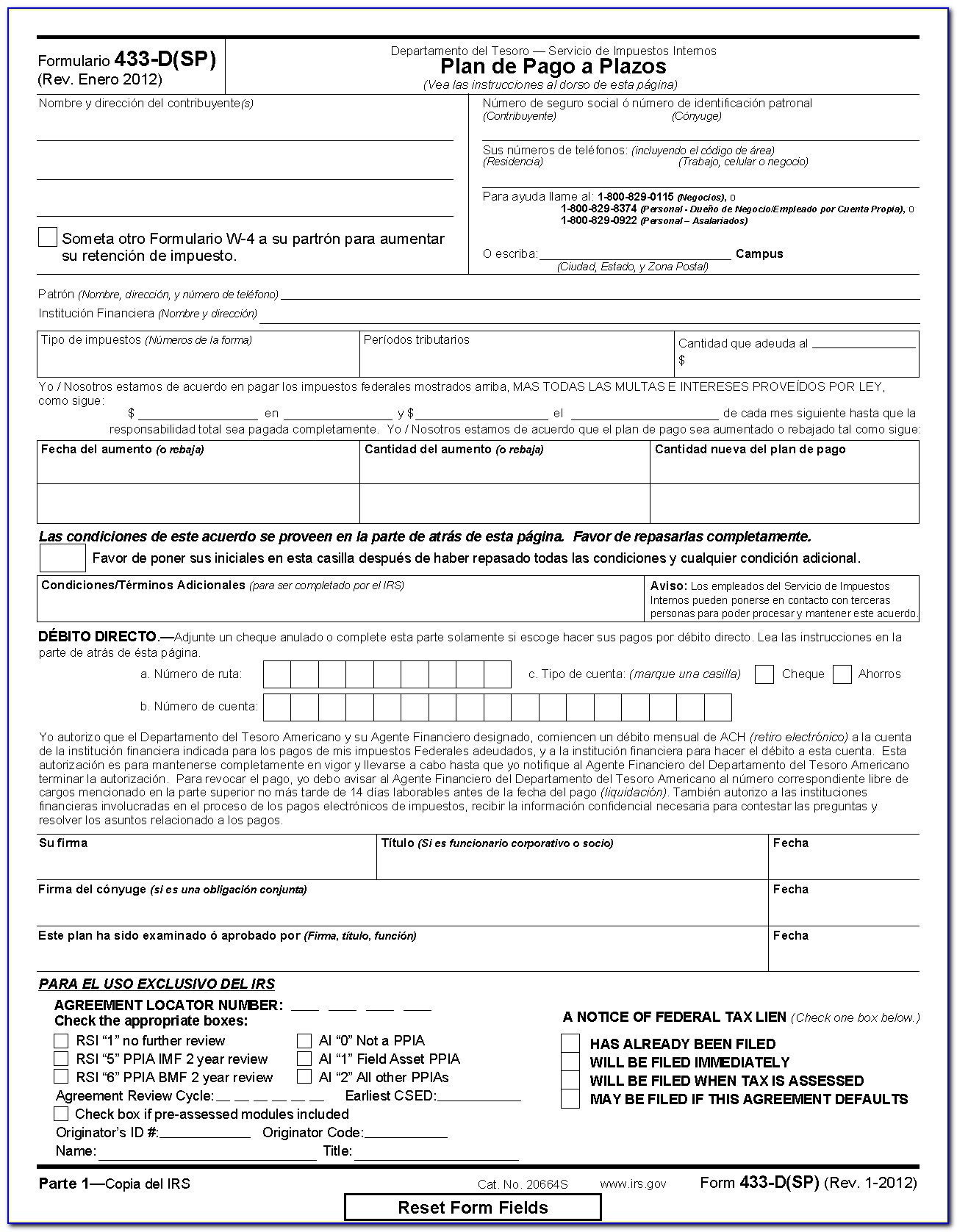

Irs Installment Agreement Form 433 D Mailing Address Form Resume

Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. Select the mailing address listed on the webpage that is. 4043 county road 259, fulton, mo is a single family home that contains 2,067 sq ft and was built in 2006. Web special filing address for.

2022 Postal Service Change of Address Form Fillable, Printable PDF

Select the mailing address listed on the webpage that is. Medicare and social security taxes iii. Web file form 943 before the due date for 2022 and get to know the form 943 mailing address with &. Must be removed before printing. Employer identification number (ein), name, trade name, and address.

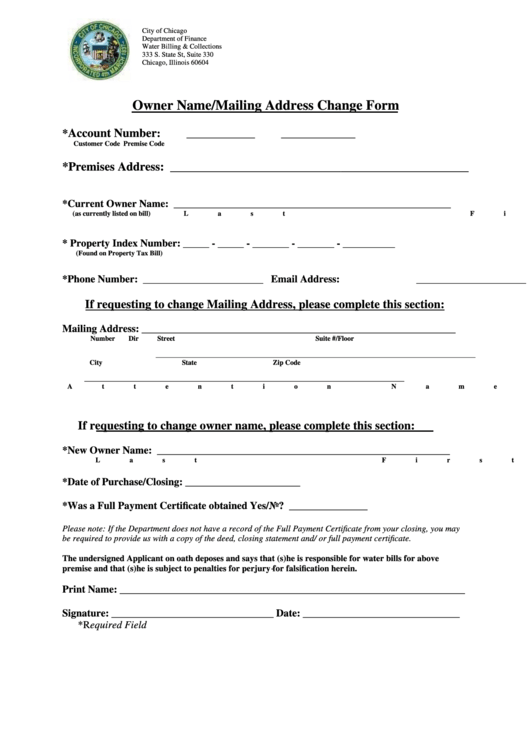

Fillable Owner Name Mailing Address Change Form printable pdf download

Form 943, is the employer's. Web special filing address for exempt organizations; Web file form 943 before the due date for 2022 and get to know the form 943 mailing address with &. Name, ein, and address 2. Web 5 rows internal revenue service.

Web How To Complete A Form 943 (Step By Step) To Complete A Form 943, You Will Need To Provide The Following Information:

Web special filing address for exempt organizations; And indian tribal governmental entities; Web address to mail form to irs: Name, ein, and address 2.

It Contains 3 Bedrooms And 2.

If you use a private delivery service to send your. The following information is needed before filing the form 943. The irs states agricultural employers are subject to. Form 943 has about 29 lines for the 2022 tax year.

Select The Mailing Address Listed On The Webpage That Is.

Web file form 943 before the due date for 2022 and get to know the form 943 mailing address with &. If you want to file online, you can either search for a tax professional to guide you through the. Web the employee retention credit under section 3134 of the internal revenue code, as enacted by the arp and amended by the infrastructure investment and jobs act, was. Web trade name, and address irs instructions:

Must Be Removed Before Printing.

Employer identification number (ein) trade. Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. Web 5 rows internal revenue service. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to.