Mailing Instructions Form 940

Mailing Instructions Form 940 - Fill in the first box accurately with your business’s information and employer identification. Connecticut, delaware, district of columbia, georgia,. Web irs form 940 instructions. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue. If you believe that this page should be taken down, please follow our dmca take down processhere. Web 940 form 2020 instructions; Line by line form 940 instructions for 2022 tax year. Employers must submit the form to the irs. When do you have to pay your futa tax?

Line by line form 940 instructions for 2022 tax year. Where to mail form 940 for 2022 & 2021 tax year? Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. When do you have to pay your futa tax? Web use schedule a (form 940) to figure the credit reduction. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Connecticut, delaware, district of columbia, georgia,. When filing paper copies, employers must mail form 940 to the irs. Web when and where should the payment be sent? Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue.

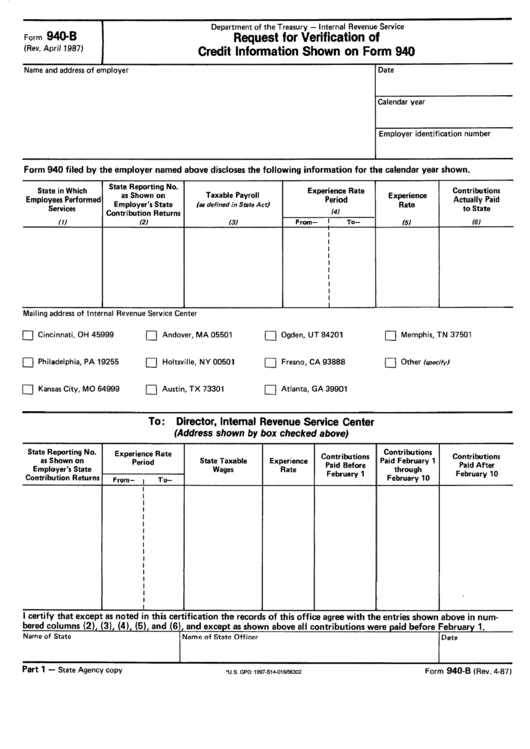

Web 5 rows mailing addresses for forms 940. Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue. ( for a copy of a form, instruction, or publication) address to mail form to irs: If you believe that this page should be taken down, please follow our dmca take down processhere. Fill in the first box accurately with your business’s information and employer identification. What is form 940's purpose? Where to mail form 940 for 2022 & 2021 tax year? Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Where you file depends on whether. For more information, see the schedule a (form 940) instructions or visit irs.gov.

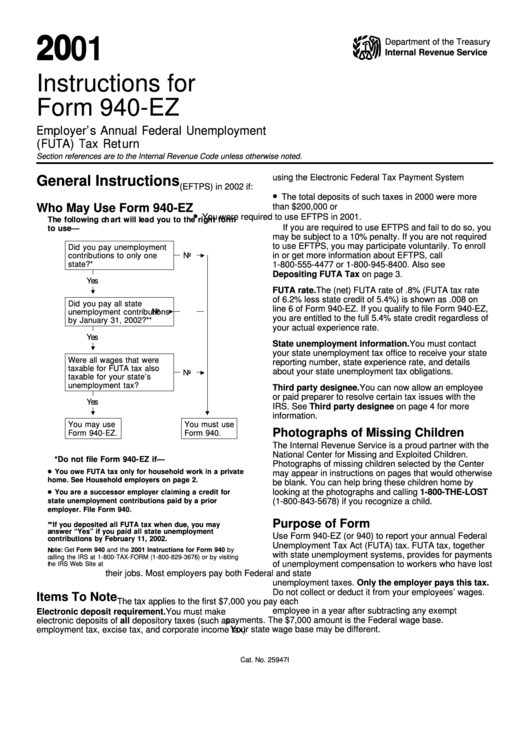

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

Web irs form 940 instructions. Web when and where should the payment be sent? To complete the form, follow the form 940 instructions listed below: What is form 940's purpose? If you believe that this page should be taken down, please follow our dmca take down processhere.

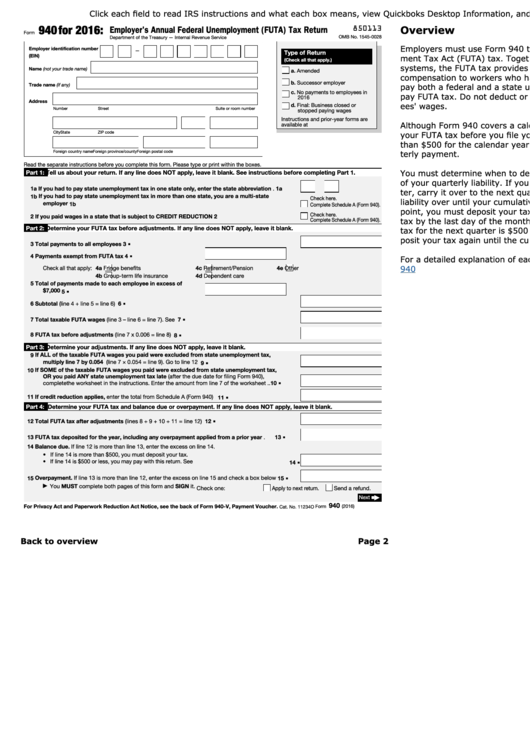

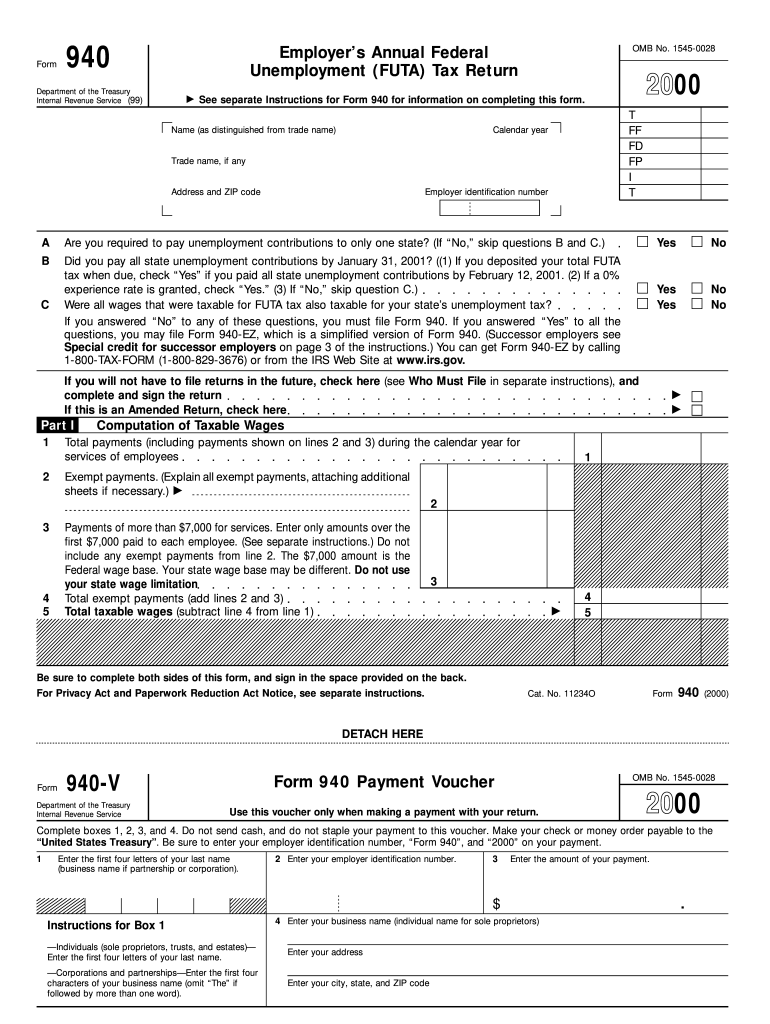

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

What is form 940's purpose? Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue. Web up to $32 cash back form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of.

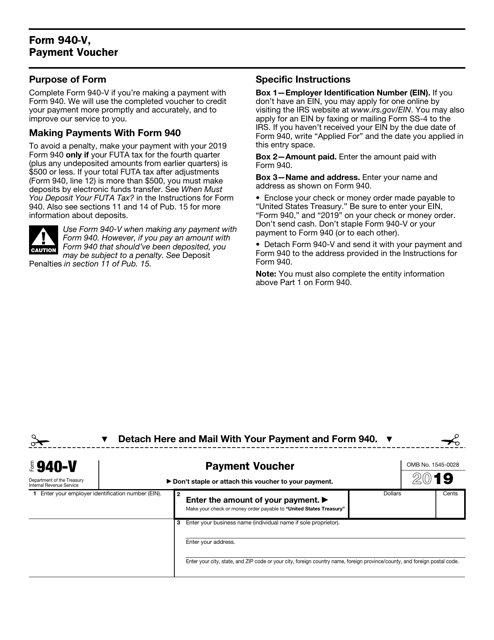

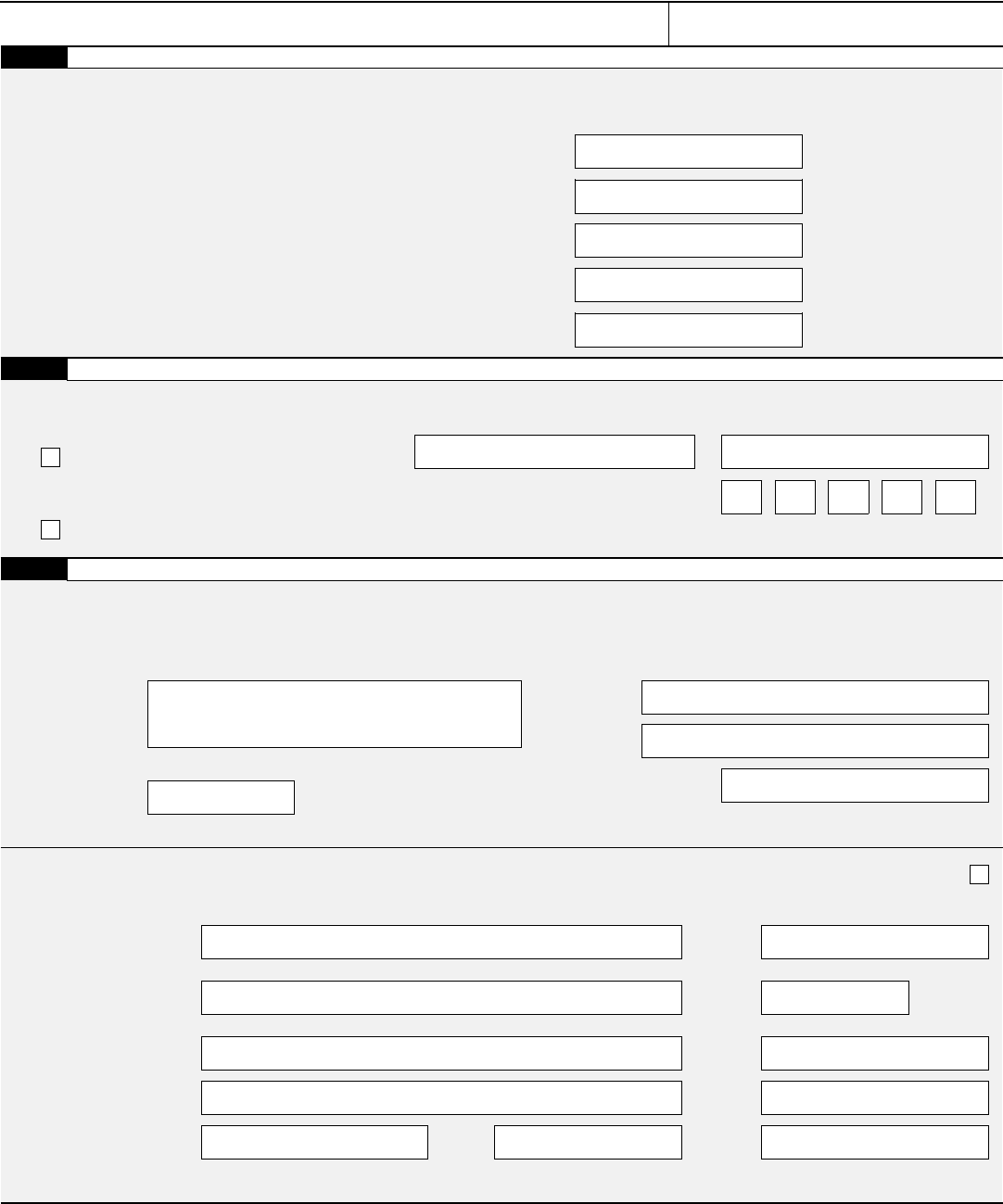

IRS Form 940V Download Fillable PDF or Fill Online Payment Voucher

Web 22 rows addresses for forms beginning with the number 9. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Web about form 940, employer's annual federal unemployment (futa) tax return. Web up to $32 cash back form 940 needs to be filed annually by.

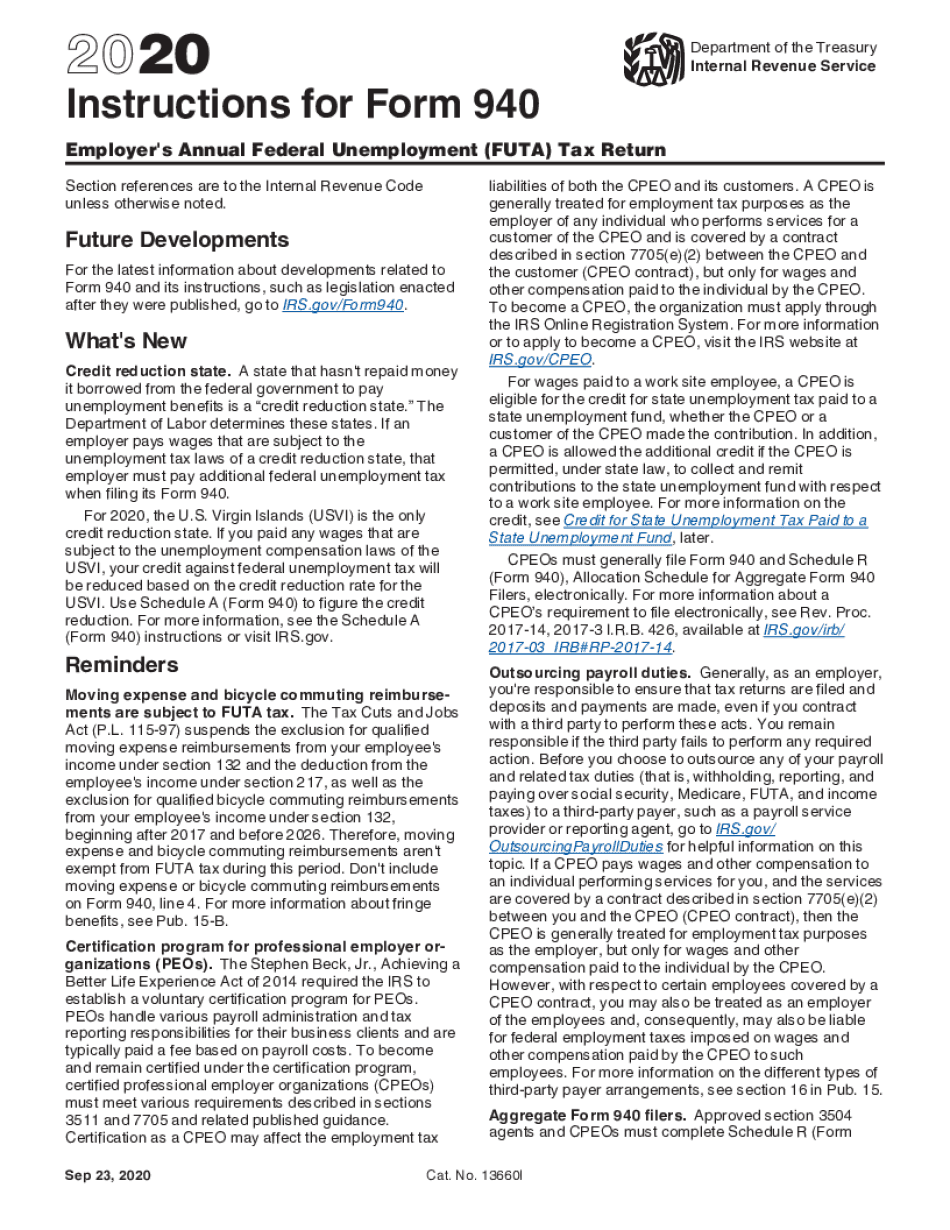

form 940 mailing address 2020 Fill Online, Printable, Fillable Blank

Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. (however, if you’re up to date on all your futa payments, you can take an additional ten days and. Web mailing addresses for forms 941. When do you have to pay your.

940 Form Fill Out and Sign Printable PDF Template signNow

Where to mail form 940 for 2022 & 2021 tax year? (however, if you’re up to date on all your futa payments, you can take an additional ten days and. Web irs form 940 instructions. Web form 940 instructions. Connecticut, delaware, district of columbia, georgia,.

Form 940 Edit, Fill, Sign Online Handypdf

Employers must submit the form to the irs. Line by line form 940 instructions for 2022 tax year. Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue. Connecticut, delaware, district of columbia, georgia,. ( for a copy of a form, instruction,.

Form 940B Request For Verification Of Credit Information Shown On

Web use schedule a (form 940) to figure the credit reduction. Fill in the first box accurately with your business’s information and employer identification. Web form 940 for 2022: Connecticut, delaware, district of columbia, georgia,. Where to mail form 940 for 2022 & 2021 tax year?

IRS Form 940 Filling Instructions to Save Your Time

For more information, see the schedule a (form 940) instructions or visit irs.gov. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. What is form 940's purpose? Where you file depends on whether. Web the due date for filing form 940 for 2021 is january 31, 2022.

Barbara Johnson Blog Form 940 Instructions How to Fill It Out and Who

Fill in the first box accurately with your business’s information and employer identification. Web 22 rows addresses for forms beginning with the number 9. To complete the form, follow the form 940 instructions listed below: How do you calculate your quarterly futa tax liability?. Web use schedule a (form 940) to figure the credit reduction.

Form 940 Instructions StepbyStep Guide Fundera

Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). When do you have to pay your futa tax? Web mailing addresses for forms 941. (however, if you’re up to date on all your futa payments, you can take an additional ten days and. Use form.

Web Irs Form 940 Is Used To Report Unemployment Taxes That Employers Pay To The Federal Government Under The Federal Unemployment Tax Act (Futa).

Where you file depends on whether. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web use schedule a (form 940) to figure the credit reduction. Fill in the first box accurately with your business’s information and employer identification.

What Is Form 940'S Purpose?

Web form 940 for 2022: How do you calculate your quarterly futa tax liability?. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Employers must submit the form to the irs.

Where To Mail Form 940 For 2022 & 2021 Tax Year?

Line by line form 940 instructions for 2022 tax year. Web 5 rows mailing addresses for forms 940. For more information, see the schedule a (form 940) instructions or visit irs.gov. Web mailing addresses for forms 941.

Web Up To $32 Cash Back Form 940 Needs To Be Filed Annually By Employers If They Paid Wages Of $1,500 Or More In Any Quarter Of A Calendar Year, Or If They Had One.

Web about form 940, employer's annual federal unemployment (futa) tax return. Web 940 mailing address my qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal revenue. Web when and where should the payment be sent? ( for a copy of a form, instruction, or publication) address to mail form to irs: