Maryland 1099 Form

Maryland 1099 Form - Ad success starts with the right supplies. File the state copy of form 1099 with the maryland taxation agency by. Ad use readymade templates to report your payments without installing any software. This refund, offset or credit may be taxable income. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. Web maryland department of labor Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. It is not a bill.

Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Which forms does maryland require? Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:. Web file the following forms with the state of maryland: Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. Our secure, confidential website will provide your form 1099. If you received ui benefits in maryland, the 1099. This refund, offset or credit may be taxable income. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit.

Upload, modify or create forms. The comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. It is not a bill. Which forms does maryland require? Try it for free now! Learn more about how to simplify your businesses 1099 reporting. Web file the following forms with the state of maryland: Web maryland department of labor Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

When is tax form 1099MISC due to contractors? GoDaddy Blog

Web file the following forms with the state of maryland: Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. Which forms does maryland require? Web to get a refund of maryland income taxes withheld, you must.

What is a 1099Misc Form? Financial Strategy Center

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web maryland continues to participate in the combined federal/state filing program for forms 1099. Try it for free now! Ad use readymade templates to report your payments without installing any software. Find them all in one convenient place.

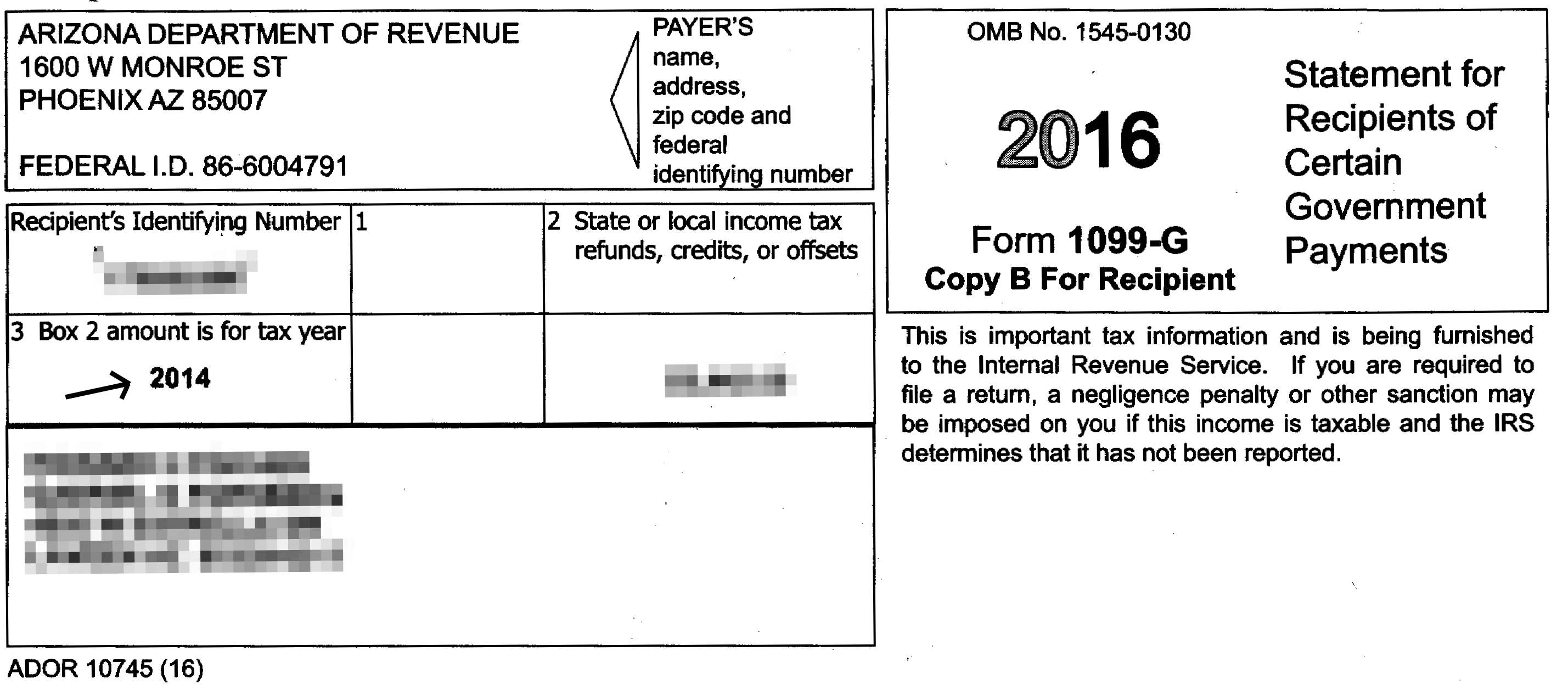

Hold up on doing your taxes; Arizona tax form 1099G is flawed The

Prior to your submission to combined federal/state filing, the 1099 file must. If you received ui benefits in maryland, the 1099. Learn more about how to simplify your businesses 1099 reporting. Our secure, confidential website will provide your form 1099. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

How To File Form 1099NEC For Contractors You Employ VacationLord

The comptroller of maryland is encouraging you to sign up to go paperless this tax season. The fastest way to obtain a. Web maryland department of labor Prior to your submission to combined federal/state filing, the 1099 file must. Web file the following forms with the state of maryland:

Printable 1099 Tax Forms Free Printable Form 2022

Maryland also mandates the filing of form mw508, annual. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Ad use readymade templates to report your payments without installing any software. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Try it for.

How Not To Deal With A Bad 1099

Find them all in one convenient place. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Maryland also mandates the filing of form mw508, annual. Upload, modify or create forms. Prior to your submission to combined federal/state filing, the 1099 file must.

Free Printable 1099 Misc Forms Free Printable

Our secure, confidential website will provide your form 1099. Maryland also mandates the filing of form mw508, annual. Find them all in one convenient place. Web i got form 1099g. Prior to your submission to combined federal/state filing, the 1099 file must.

1099 Misc Downloadable Form Universal Network

Try it for free now! If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. If.

Businesses have Feb. 1 deadline to provide Forms 1099MISC and 1099NEC

Which forms does maryland require? Web maryland continues to participate in the combined federal/state filing program for forms 1099. It is not a bill. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland.

1099 S Form Fill Online, Printable, Fillable, Blank pdfFiller

Which forms does maryland require? Web maryland department of labor Web maryland continues to participate in the combined federal/state filing program for forms 1099. The comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via.

Which Forms Does Maryland Require?

If you received a maryland income tax refund last year, we're required by federal law to send. Upload, modify or create forms. Ad success starts with the right supplies. The fastest way to obtain a.

Web For Assistance, Users May Contact The Taxpayer Service Section Monday Through Friday From 8:30 Am Until 4:30 Pm Via Email At Taxhelp@Marylandtaxes.gov Or By Phone At 410.

Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Prior to your submission to combined federal/state filing, the 1099 file must. Web file the following forms with the state of maryland: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

Web Form 1099G Is A Report Of Income You Received From Your Maryland State Taxes As A Refund, Offset Or Credit.

Learn more about how to simplify your businesses 1099 reporting. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. It is not a bill.

Find Them All In One Convenient Place.

This refund, offset or credit may be taxable income. If you received ui benefits in maryland, the 1099. Web maryland continues to participate in the combined federal/state filing program for forms 1099. Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:.