Maryland Form 505 Instructions 2022

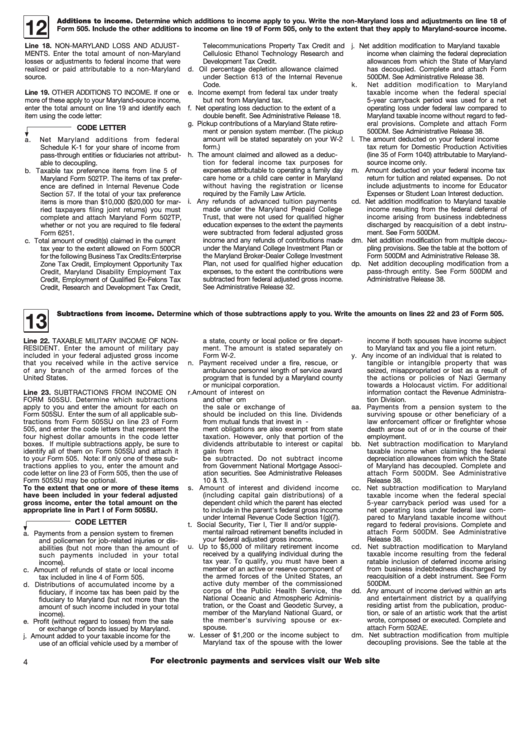

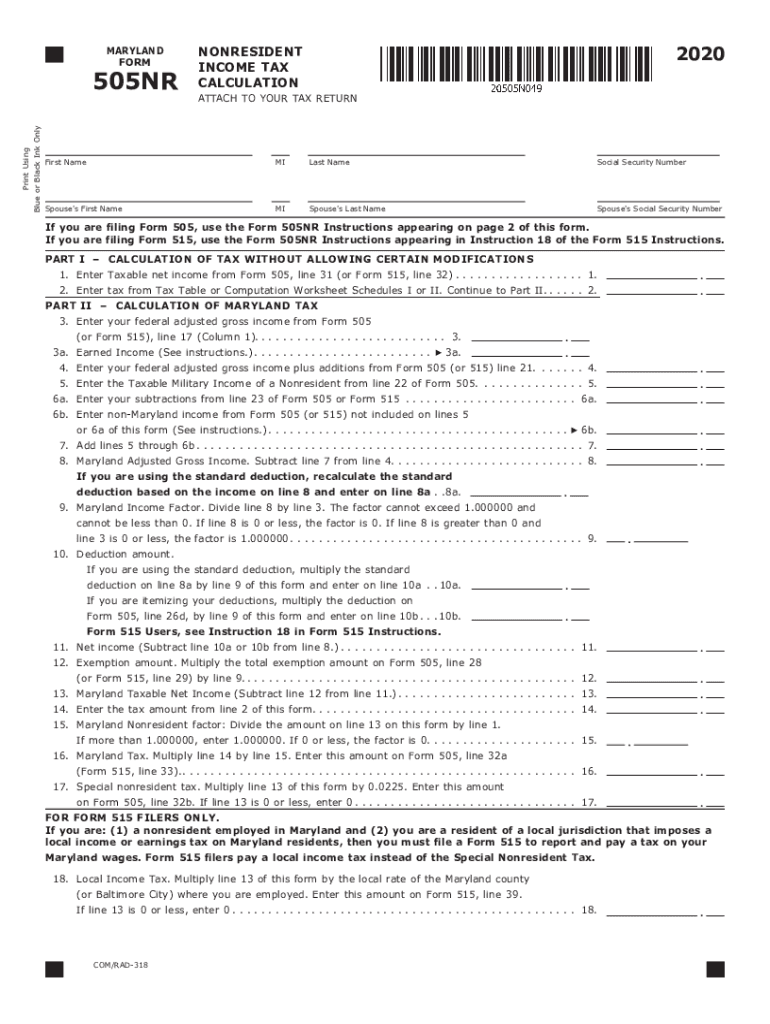

Maryland Form 505 Instructions 2022 - Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. If you are requesting direct deposit of your refund, complete the following. Maryland resident income tax return. Enter the taxable net income from form 505, line 31. Maryland tax forms for nonresidents. Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. For splitting direct deposit, use form 588. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments.

Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. For splitting direct deposit, use form 588. Find the income range in the tax table that Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. What's new this tax year. Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web filing requirements for 2022 tax year file for free in person Enter the taxable net income from form 505, line 31. You can print other maryland tax forms here. 2022 business income tax forms popular.

You can download tax forms using the links listed below. 2022 business income tax forms popular. Maryland tax forms for nonresidents. Find the income range in the tax table that Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. For splitting direct deposit, use form 588. If you are requesting direct deposit of your refund, complete the following. If you are requesting direct deposit of your refund, complete the following. Web filing requirements for 2022 tax year file for free in person Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments.

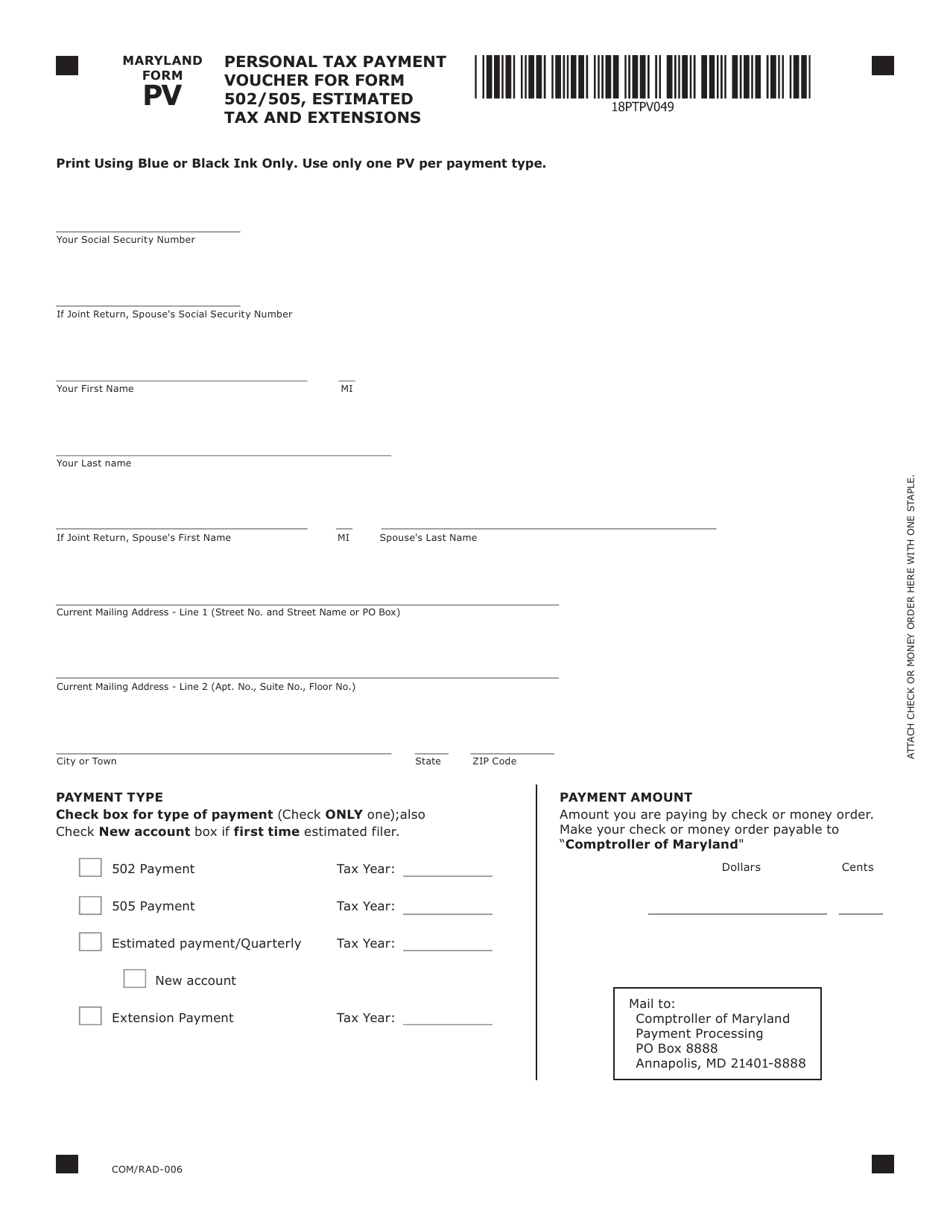

Maryland Form PV Download Fillable PDF or Fill Online

If you are requesting direct deposit of your refund, complete the following. If you are requesting direct deposit of your refund, complete the following. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments. Maryland state and local tax.

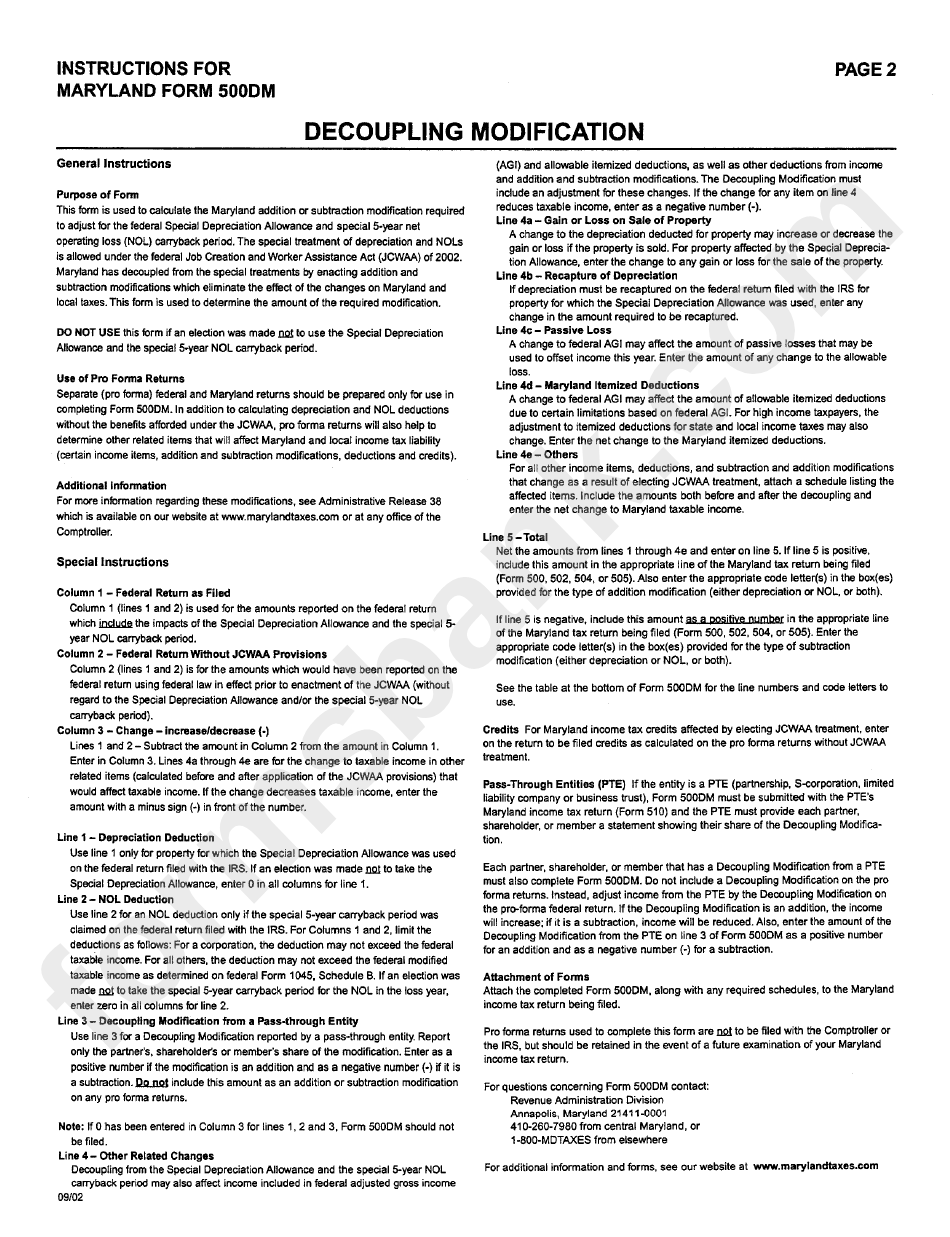

Instructions For Maryland Form 500dm printable pdf download

Maryland resident income tax return. Web 2022 individual income tax instruction booklets. Enter the taxable net income from form 505, line 31. For splitting direct deposit, use form 588. Maryland tax forms for nonresidents.

Md 502up form Fill out & sign online DocHub

Web filing requirements for 2022 tax year file for free in person What's new this tax year. You can print other maryland tax forms here. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Maryland state and local tax forms and instructions.

Instruction For Form 505 Maryland Nonresident Tax Return

Find the income range in the tax table that Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Maryland state and local tax forms and instructions. Web filing requirements.

2012 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments. For splitting direct deposit, use form 588. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Maryland resident income tax return. Web overview.

2020 Form MD 505NR Fill Online, Printable, Fillable, Blank pdfFiller

Enter the taxable net income from form 505, line 31. Maryland tax forms for nonresidents. Direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. 2022 business income tax forms popular. For splitting direct deposit, use form 588.

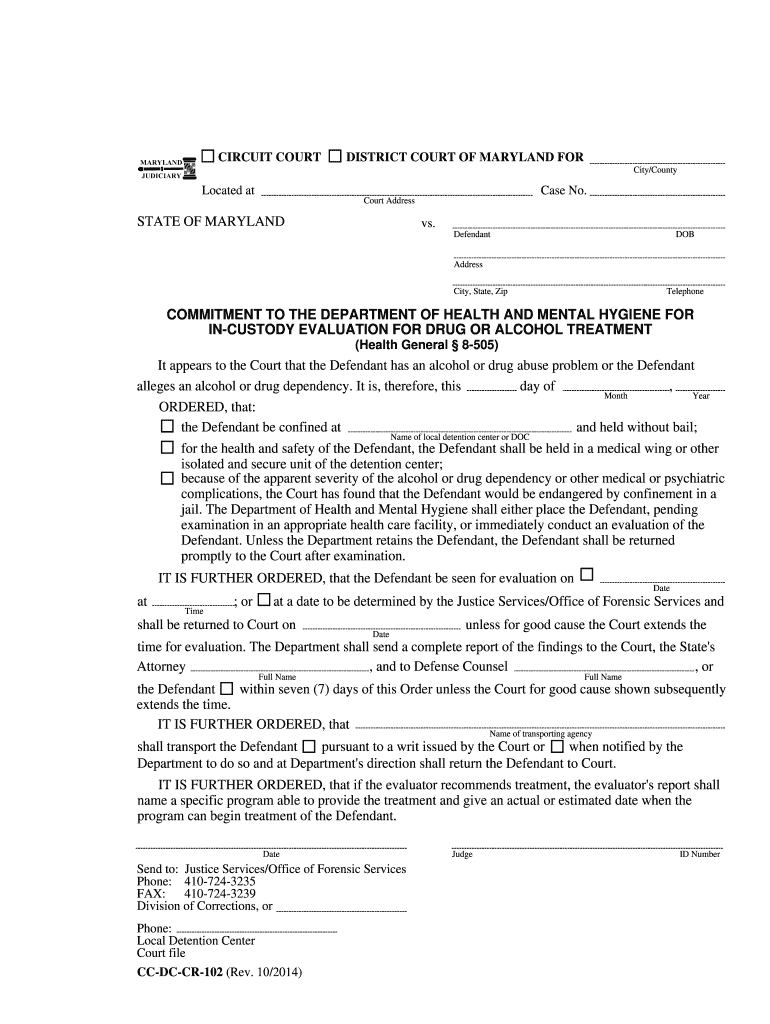

8505 Inmate Program Form Fill Out and Sign Printable PDF Template

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments. Visit any of our taxpayer service offices to obtain forms. You can print other maryland tax forms here. Find the income range in the tax table that Web 2022.

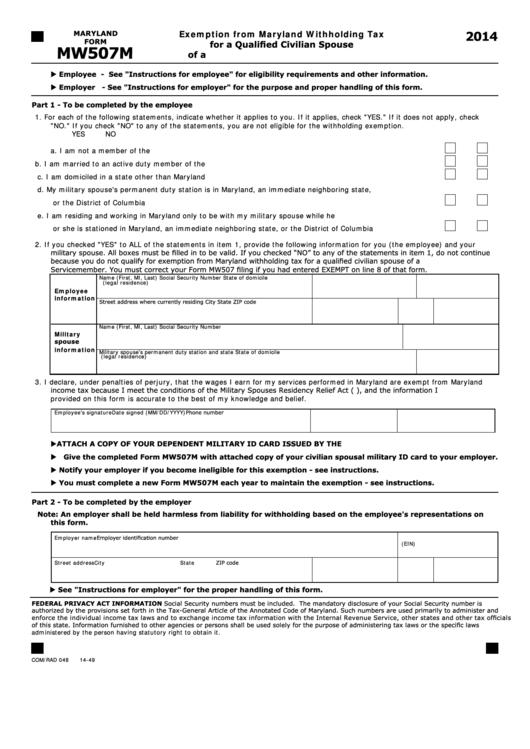

Fillable Maryland Form Mw507m Exemption From Maryland Withholding Tax

Web 2022 individual income tax instruction booklets. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. What's new this tax year. Web filing requirements for 2022 tax year file for free in person Direct deposit of refund (see instruction 22.) verify.

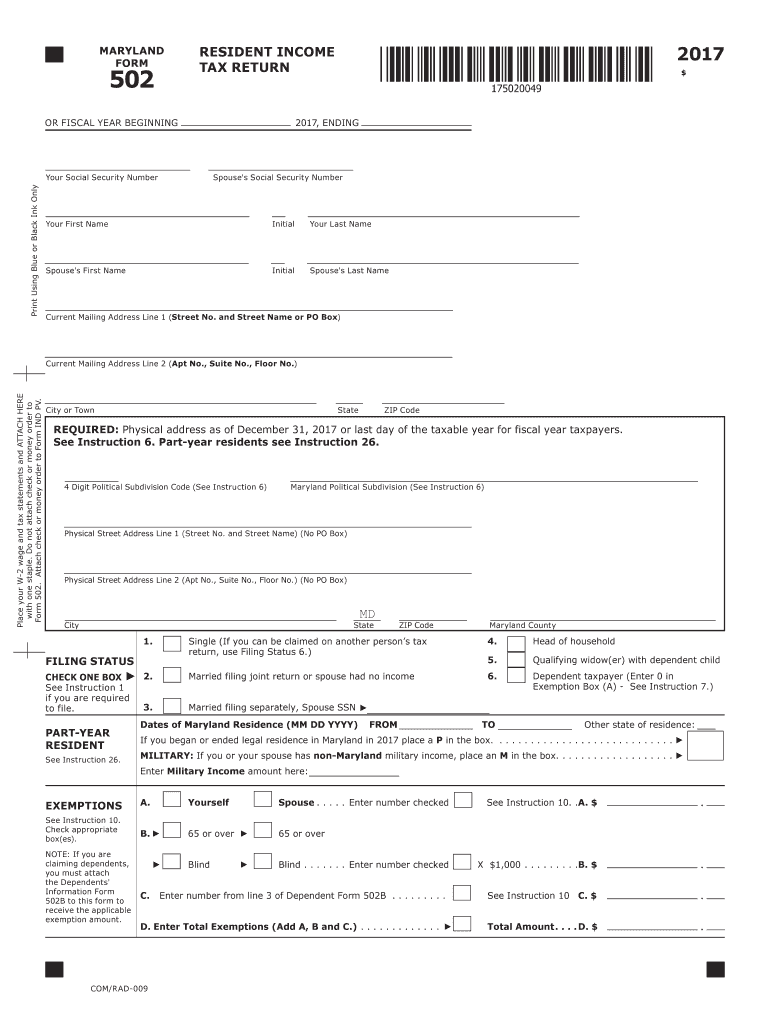

Maryland 502 Instructions 2017 Fill Out and Sign Printable PDF

Enter the taxable net income from form 505, line 31. For splitting direct deposit, use form 588. 2022 business income tax forms popular. Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Maryland resident income tax return.

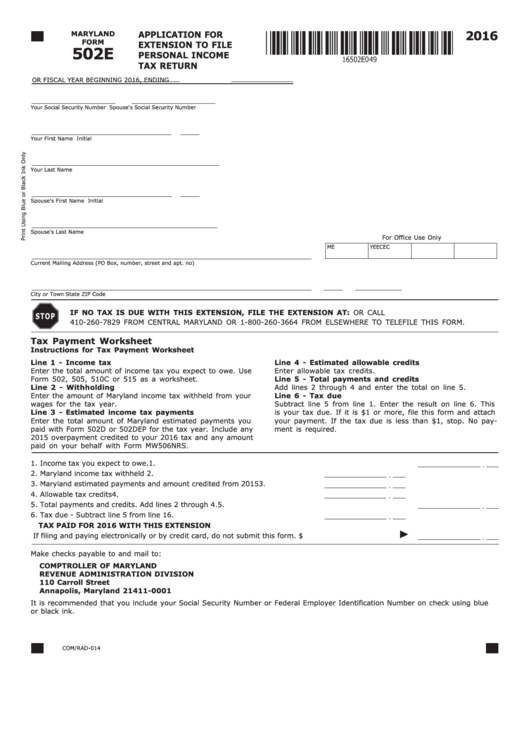

502e Maryland Tax Forms And Instructions printable pdf download

Maryland tax forms for nonresidents. Web 2022 individual income tax instruction booklets. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. 2022 business income tax forms popular. What's new this tax year.

Web We Offer Several Ways For You To Obtain Maryland Tax Forms, Booklets And Instructions:

Visit any of our taxpayer service offices to obtain forms. Enter the taxable net income from form 505, line 31. Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or extension payments.

2022 Business Income Tax Forms Popular.

Web 2022 individual income tax instruction booklets. If you are requesting direct deposit of your refund, complete the following. Maryland resident income tax return. If you are requesting direct deposit of your refund, complete the following.

What's New This Tax Year.

You can download tax forms using the links listed below. Maryland tax forms for nonresidents. For splitting direct deposit, use form 588. Business tax instructions businesses file for free online.

Web Comptroller Of Maryland's Www.marylandtaxes.gov All The Information You Need For Your Tax Paying Needs.

Direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. For splitting direct deposit, use form 588. You can print other maryland tax forms here. Find the income range in the tax table that