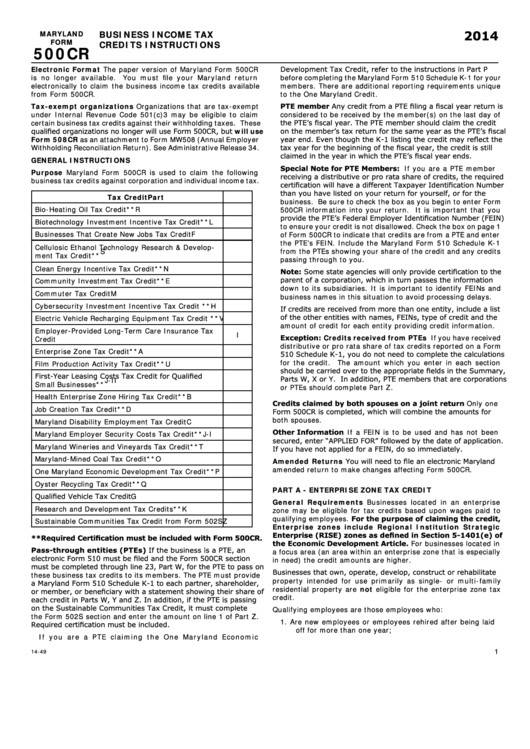

Maryland Form 510 Instructions

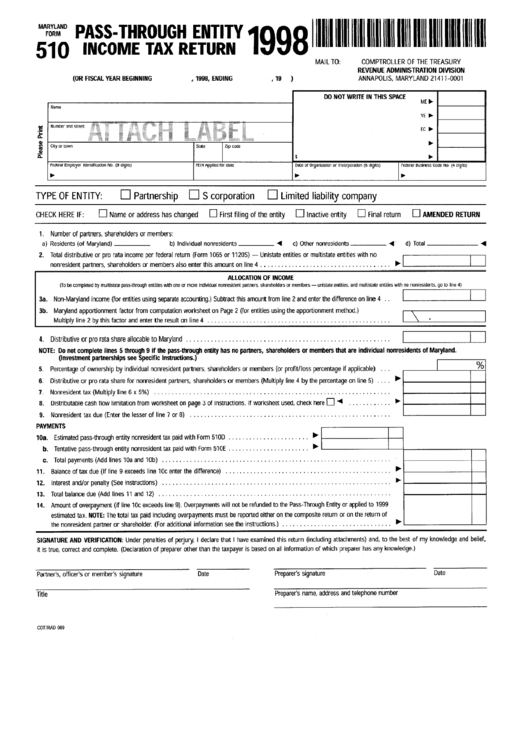

Maryland Form 510 Instructions - Web entities required to file every maryland pte must file form 510, even if it has no income or the entity is inactive. Form 510 is a maryland corporate income tax form. Web forms are available for downloading in the resident individuals income tax forms section below. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web (investment partnerships see specific instructions.) 5. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in.

Web forms are available for downloading in the resident individuals income tax forms section below. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Web (investment partnerships see specific instructions.) 5. Web income tax, also file form 510. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Form 510 is a maryland corporate income tax form. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Every other pte that is subject to maryland income tax law also.

Easily fill out pdf blank, edit, and sign them. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web forms are available for downloading in the resident individuals income tax forms section below. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web (investment partnerships see specific instructions.) 5. Every other pte that is subject to maryland income tax law also. This form is for income earned in tax year 2022, with tax returns due in. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Form 510 is a maryland corporate income tax form. Web income tax, also file form 510.

elliemeyersdesigns Maryland Form 510

Form 510 is a maryland corporate income tax form. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Every other pte that is subject to maryland income tax law also. Web entities required to file every maryland pte must file form 510, even if it has no income or the entity is inactive. Web.

Fillable Maryland Form 510 PassThrough Entity Tax Return

Web (investment partnerships see specific instructions.) 5. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Save or instantly send your ready documents. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Easily fill out pdf blank, edit, and sign them.

maryland form 510 instructions 2021

Easily fill out pdf blank, edit, and sign them. Web forms are available for downloading in the resident individuals income tax forms section below. Every other pte that is subject to maryland income tax law also. Web entities required to file every maryland pte must file form 510, even if it has no income or the entity is inactive. Percentage.

2013 Form MD MW506FR Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in. Easily fill out pdf blank, edit, and sign them. Web income tax, also file form 510. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Form 510 is a maryland corporate income tax form.

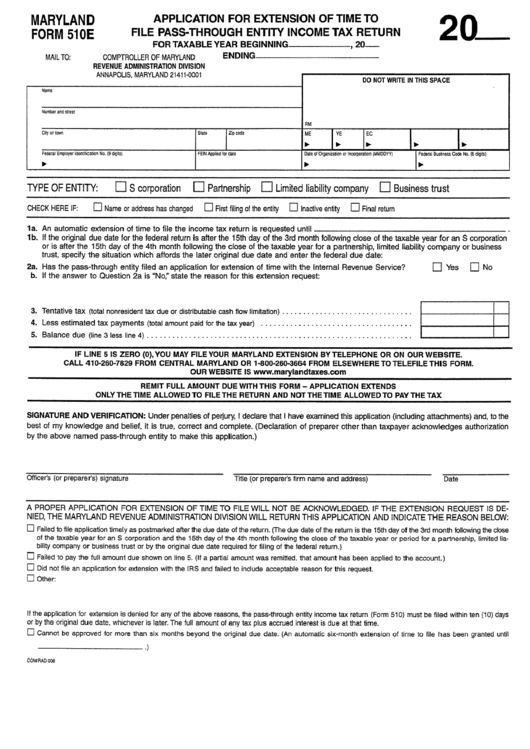

Maryland Form 510e Application For Extension Of Time To File Pass

Form 510 is a maryland corporate income tax form. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in. Web (investment partnerships see specific instructions.) 5. Web income tax, also file form 510.

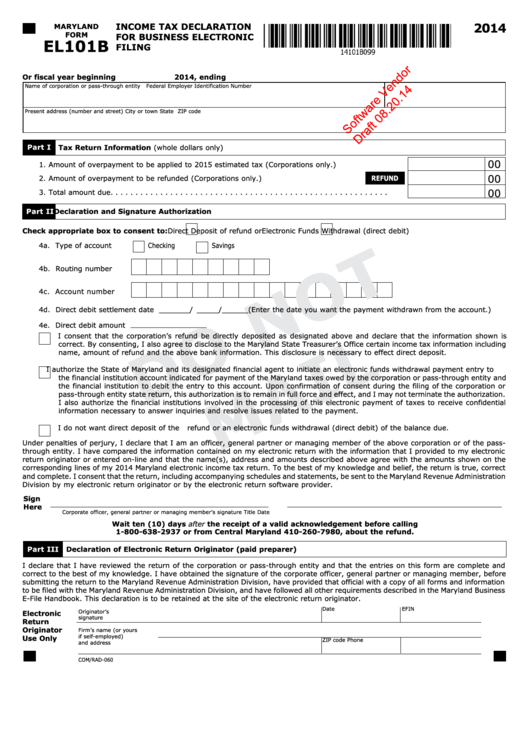

Maryland Form El101b Draft Tax Declaration For Business

Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web income tax, also file form 510. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. Web forms are available for downloading in the resident individuals income tax forms section below. Web entities.

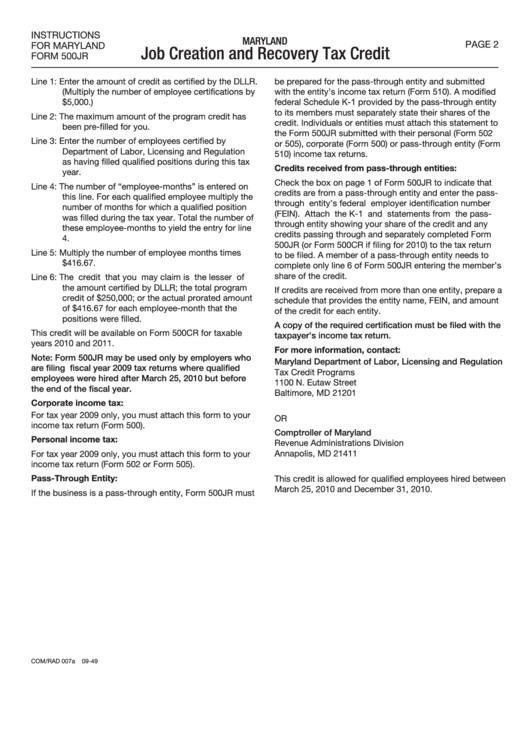

Form Com/rad 007a Instructions For Maryland Form 500jr Job Creation

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web forms are available for downloading in the resident individuals income tax forms section below. Form 510 is a maryland corporate income tax form. This form is for income earned in tax year 2022, with tax returns due in. Percentage of ownership by individual.

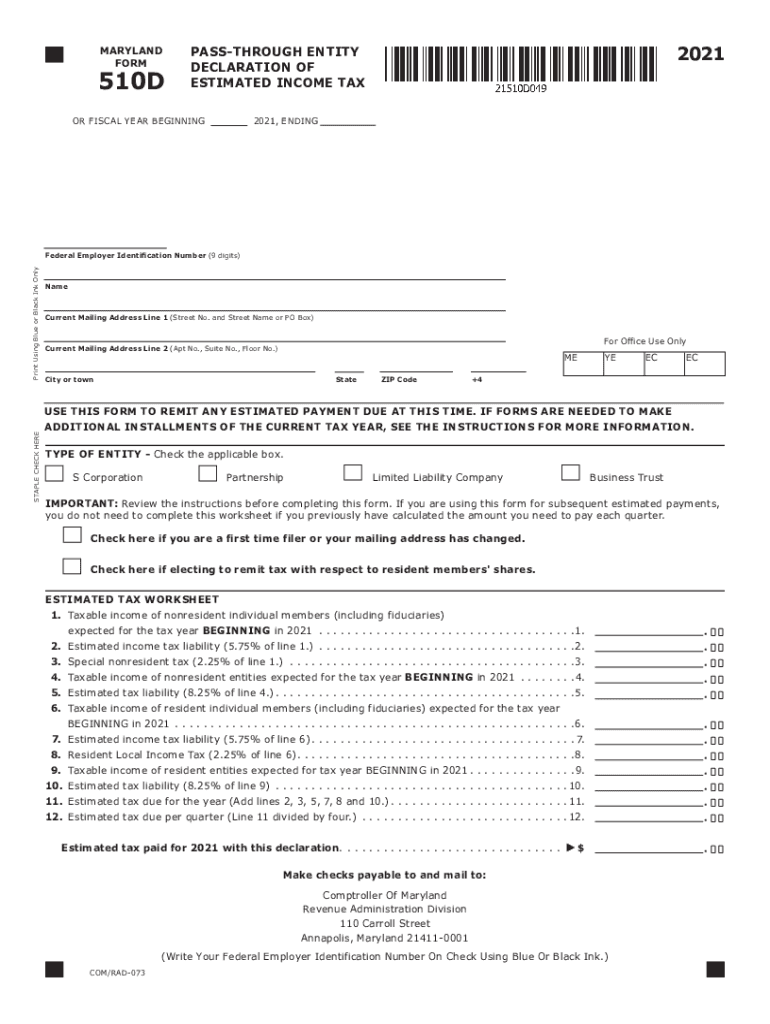

Md 510D Fill Out and Sign Printable PDF Template signNow

Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Web income tax, also file form 510. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web (investment partnerships see specific instructions.) 5. This form is for income earned in tax year 2022, with tax returns due in.

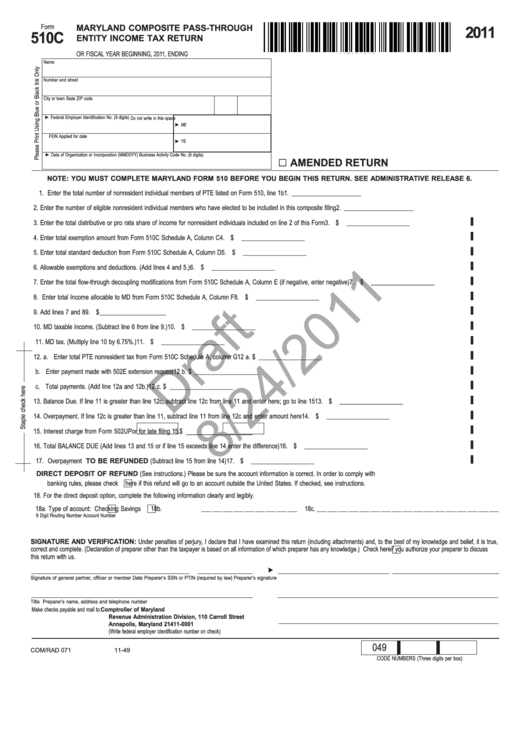

Form 510c Maryland Composite PassThrough Entity Tax Return

Every other pte that is subject to maryland income tax law also. Form 510 is a maryland corporate income tax form. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Easily fill out pdf blank, edit, and sign.

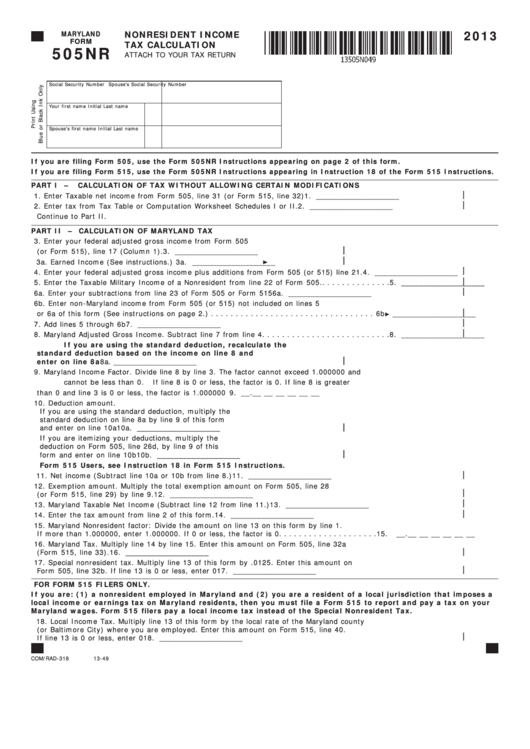

Fillable Maryland Form 505nr Nonresident Tax Calculation

Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Web forms are available for downloading in the resident individuals income tax forms section below. Form 510 is a maryland corporate income tax form. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Percentage of ownership by individual.

Web Income Tax, Also File Form 510.

Form 510 is a maryland corporate income tax form. Web (2021) for subsequently enacted clarifying legislation], the maryland comptroller of the treasury released updated 2023 pte estimated income tax form instructions providing. This form is for income earned in tax year 2022, with tax returns due in. Every other pte that is subject to maryland income tax law also.

Save Or Instantly Send Your Ready Documents.

Web we last updated maryland form 510 from the comptroller of maryland in january 2023. Web (investment partnerships see specific instructions.) 5. Web forms are available for downloading in the resident individuals income tax forms section below. Easily fill out pdf blank, edit, and sign them.

Percentage Of Ownership By Individual Nonresident Members Shown On Line 1B (Or Profit/Loss.

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web entities required to file every maryland pte must file form 510, even if it has no income or the entity is inactive.