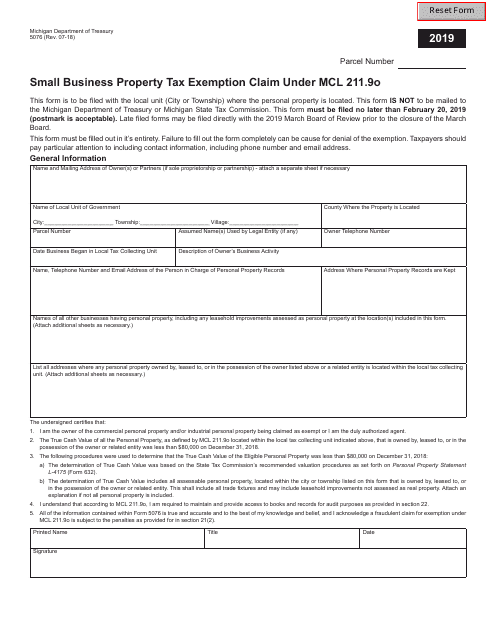

Mi Form 5076

Mi Form 5076 - Web $80,000, then you do not need to file this form if the property is classified as commercial. Web all qualified business taxpayers must file form 5076, small business personal property. Web michigan department of treasury 5076 (rev. Web welcome to michigan treasury online (mto)! Web businesses with less than $80,000 combined true cash value of personal property. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Web the exemption is only for commercial and industrial personal property. Web michigan forms and schedules.

Web disclosure forms and information. Web michigan forms and schedules. Web $80,000, then you do not need to file this form if the property is classified as commercial. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web all qualified business taxpayers must file form 5076, small business personal property. Web businesses with less than $80,000 combined true cash value of personal property. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Web michigan form 5076 document seq 0.00 file:226. Web taxpayers who file form 5076 are not required to file a personal property statement. Check out how easy it is to complete and esign.

Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web michigan department of treasury 5076 (rev. Check out how easy it is to complete and esign. Web the exemption is only for commercial and industrial personal property. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web welcome to michigan treasury online (mto)! Web $80,000, then you do not need to file this form if the property is classified as commercial. Web michigan forms and schedules. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web michigan form 5076 document seq 0.00 file:226.

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Web tax house bill 5351, approved by michigan governor gretchen whitmer. Mto is the michigan department of. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web all qualified business taxpayers must file form 5076, small business personal property. Web complete the michigan form 5076 the form you use to apply for this.

MiForms Sever version 9.5 Setup and Configuration Tutorial YouTube

Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Mto is the michigan department of. Web disclosure forms and information. Web to claim the exemption a taxpayer must file form 5076 small business property tax.

Biến hoá thời trang cùng áo sơ mi form rộng để tươi trẻ mỗi ngày

Web tax house bill 5351, approved by michigan governor gretchen whitmer. Mto is the michigan department of. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web welcome to michigan treasury online (mto)! Web michigan department of treasury 5076 (rev.

Biến hoá thời trang cùng áo sơ mi form rộng để tươi trẻ mỗi ngày

Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web the exemption is only for commercial and industrial personal property. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web 2021 michigan form exemption. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form.

2020 Form MI 5076 Fill Online Printable Fillable Blank PDFfiller

Web welcome to michigan treasury online (mto)! Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web the exemption is only for commercial and industrial personal property. Web $80,000, then you do not need to file this form if.

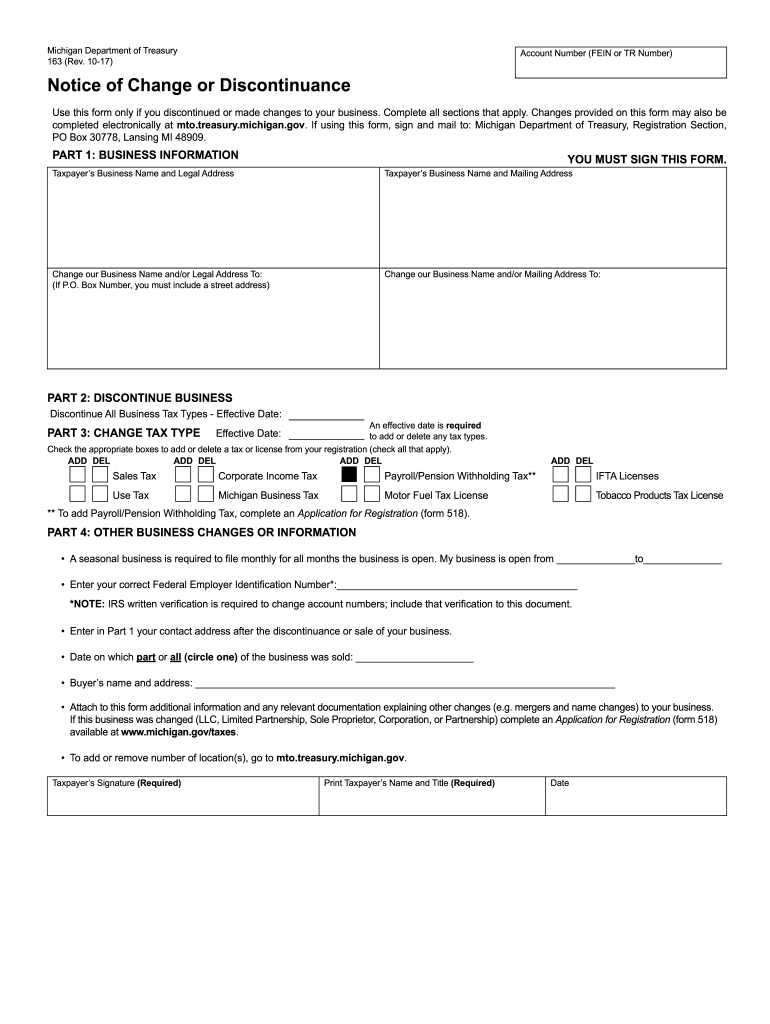

2017 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Web businesses with less than $80,000 combined true cash value of personal property. Web $80,000, then you do not need to file this form if the property is classified as commercial. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web disclosure forms and information. Web michigan forms and schedules.

고객상담이력관리 프로그램(특정일자 알림 기능) 엑셀자동화

Web complete the michigan form 5076 the form you use to apply for this exemption is a. Check out how easy it is to complete and esign. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web 2021 michigan form exemption. Web all qualified business taxpayers must file form 5076, small business personal property.

MI Form 1019 20202021 Fill out Tax Template Online US Legal Forms

Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web michigan form 5076 document seq 0.00 file:226. Web the exemption is only for commercial and industrial personal property. Web complete the michigan form 5076 the form you use to apply for this exemption is a. Web to claim this exemption, the business must file.

MI LCMW811 2014 Fill out Tax Template Online US Legal Forms

Web the exemption is only for commercial and industrial personal property. Web michigan department of treasury 5076 (rev. Mto is the michigan department of. Web businesses with less than $80,000 combined true cash value of personal property. Web complete the michigan form 5076 the form you use to apply for this exemption is a.

Web Tax House Bill 5351, Approved By Michigan Governor Gretchen Whitmer.

Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Check out how easy it is to complete and esign. Mto is the michigan department of. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form.

Web All Qualified Business Taxpayers Must File Form 5076, Small Business Personal Property.

Web 2021 michigan form exemption. Web $80,000, then you do not need to file this form if the property is classified as commercial. Web michigan forms and schedules. Web the exemption is only for commercial and industrial personal property.

Web Michigan Department Of Treasury 5076 (Rev.

Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web taxpayers who file form 5076 are not required to file a personal property statement. Web businesses with less than $80,000 combined true cash value of personal property. Web disclosure forms and information.

Web Welcome To Michigan Treasury Online (Mto)!

Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web michigan form 5076 document seq 0.00 file:226. Web complete the michigan form 5076 the form you use to apply for this exemption is a.