Michigan 1099 Form 2022

Michigan 1099 Form 2022 - 1, 2022, the sales, use and withholding taxes annual return (form 5081) is still due on feb. Web deceased spouse benefits do not include benefits from a spouse who died in 2022. Each individual statement will be available to view or. Forms will be mailed by january 31, 2023, and can also be retrieved in your mymers account once they have been issued. News sports autos entertainment advertise obituaries enewspaper legals Web traditionally, the filing deadlines for michigan are as follows: The irs determines the type of federal form required and the state of michigan follows these federal guidelines. You will receive an email acknowledging your delivery preference. Web 1:10 michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. While certain wage statements and income record forms are due on or before feb.

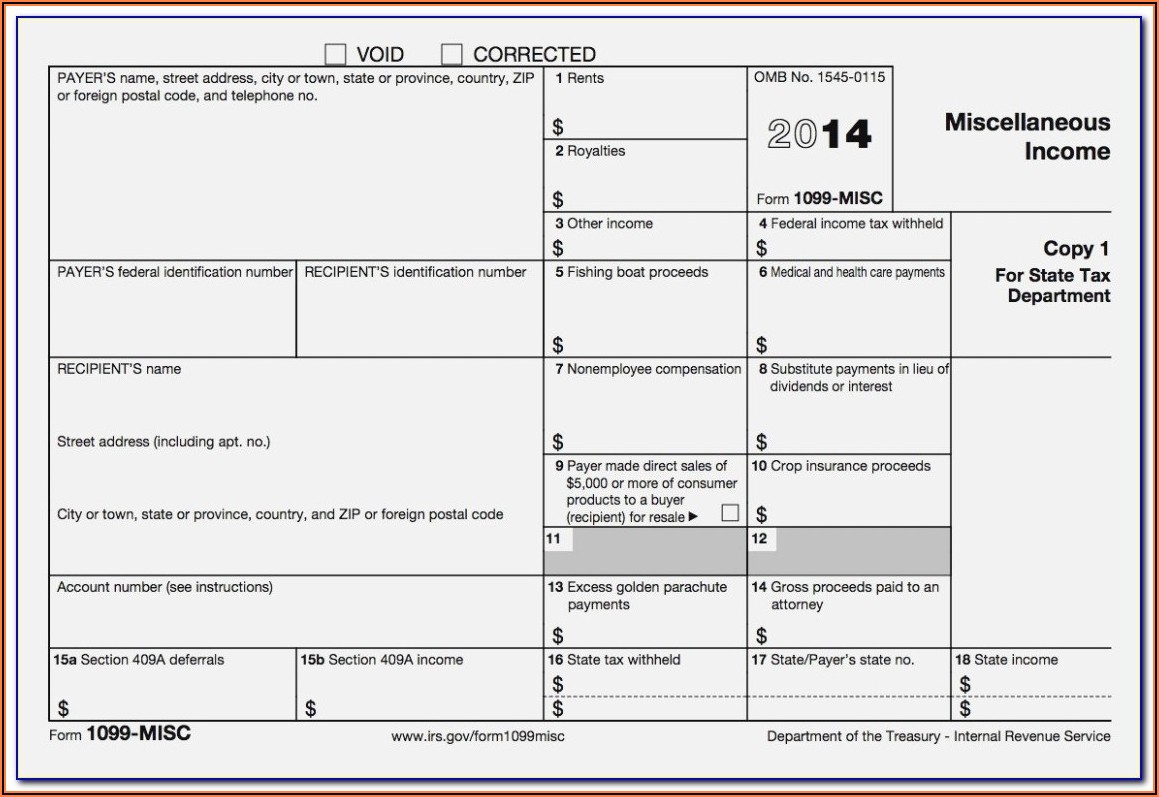

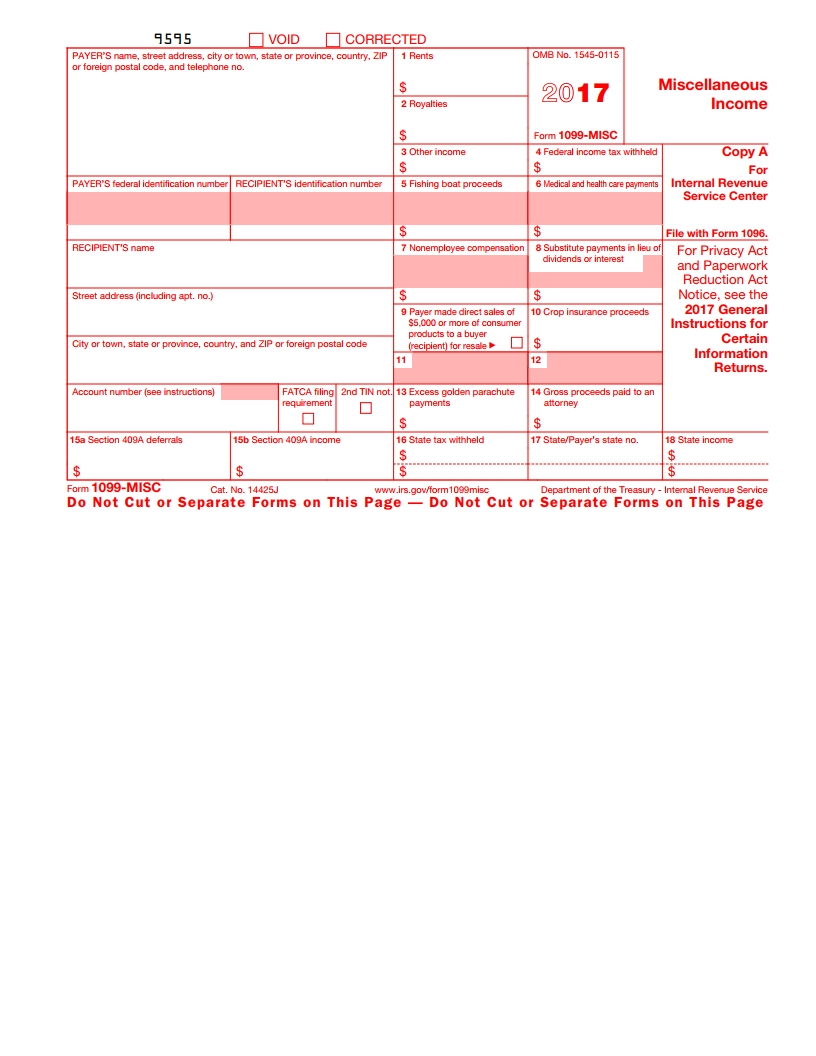

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Treasury tax form search previous year tax forms and instructions 2021 individual income tax 2020 individual income tax 2019. Forms will be mailed by january 31, 2023, and can also be retrieved in your mymers account once they have been issued. Web deceased spouse benefits do not include benefits from a spouse who died in 2022. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. If you or your spouse received pension benefits from a deceased spouse, see form 4884, michigan pension schedule instructions. This means anyone who received benefits in. The statements are prepared by uia and report how much individuals received in unemployment benefits and income tax withheld the past year. You will receive an email acknowledging your delivery preference. Web traditionally, the filing deadlines for michigan are as follows:

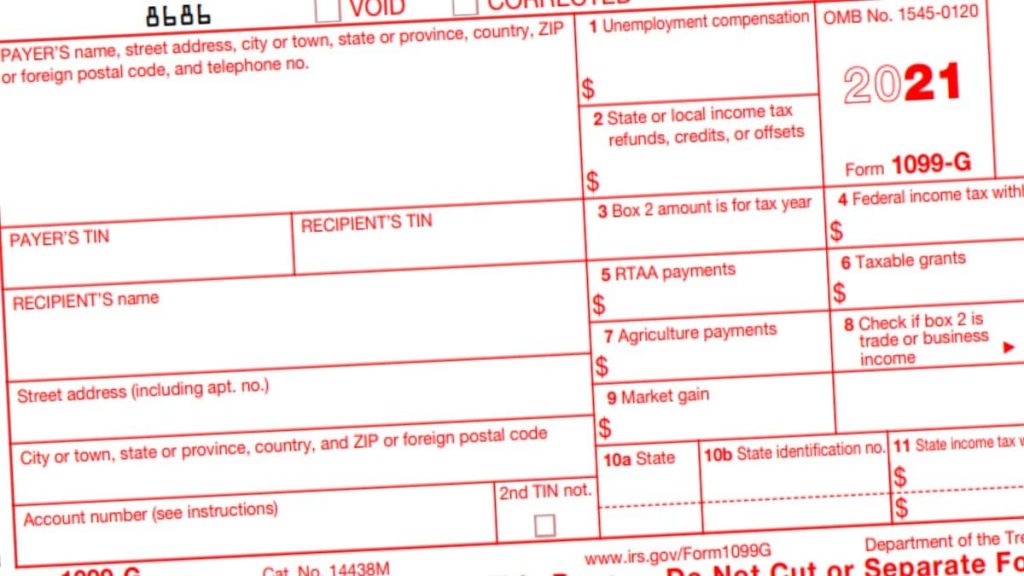

1, 2022, the sales, use and withholding taxes annual return (form 5081) is still due on feb. If these deadlines fall on a weekend or legal holiday, then the due date is typically the following business day. Forms will be mailed by january 31, 2023, and can also be retrieved in your mymers account once they have been issued. Web traditionally, the filing deadlines for michigan are as follows: The forms are needed to complete a tax return. Your email address will be displayed. This means anyone who received benefits in. The statements are prepared by uia and report how much individuals received in unemployment benefits and income tax withheld the past year. Irs approved tax1099 allows you to efile michigan forms. Taxbandits supports filing form 1099 with both the federal and state of michigan.

Michigan 1099 Form 2020 Form Resume Examples Pw1gJzDo8Y

News sports autos entertainment advertise obituaries enewspaper legals Forms will be mailed by january 31, 2023, and can also be retrieved in your mymers account once they have been issued. Treasury provides forms in adobe acrobat pdf format for downloading and use. The statements are prepared by uia and report how much individuals received in unemployment benefits and income tax.

Michigan Substitute Form 1099 G Form Resume Examples qeYzMGNR98

Web traditionally, the filing deadlines for michigan are as follows: Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Each individual statement will be available to view or. Web 1:10 michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits.

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

Irs approved tax1099 allows you to efile michigan forms. While certain wage statements and income record forms are due on or before feb. If these deadlines fall on a weekend or legal holiday, then the due date is typically the following business day. Treasury provides forms in adobe acrobat pdf format for downloading and use. (for the 2022 tax year.

Do You Get A 1099 R For A Rollover Armando Friend's Template

Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find forms by keyword, form number or year. Each individual statement will be available to view or. Treasury provides forms in adobe acrobat pdf format for downloading and use. Irs approved tax1099 allows.

Printable 2022 1099 Form March Calendar Printable 2022

Treasury tax form search previous year tax forms and instructions 2021 individual income tax 2020 individual income tax 2019. Taxbandits supports filing form 1099 with both the federal and state of michigan. While certain wage statements and income record forms are due on or before feb. News sports autos entertainment advertise obituaries enewspaper legals Irs approved tax1099 allows you to.

Heintzelman Accounting Services

If these deadlines fall on a weekend or legal holiday, then the due date is typically the following business day. There is no computation, validation, or verification of the information you enter. While certain wage statements and income record forms are due on or before feb. See your tax return instructions for where to report. You will receive an email.

The New 1099NEC Form in 2021 Business education, Photography

Web deceased spouse benefits do not include benefits from a spouse who died in 2022. This means anyone who received benefits in. Web 1:10 michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. Irs approved tax1099 allows you to efile michigan forms. While certain wage statements and.

Michigan Form 1099 G Form Resume Examples 7NYA0gLR9p

While certain wage statements and income record forms are due on or before feb. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. (for the 2022 tax year the due date will be january 31, 2023 for e. If these deadlines fall on a weekend or legal holiday, then the due date is typically.

1099 NEC Form 2022

Treasury tax form search previous year tax forms and instructions 2021 individual income tax 2020 individual income tax 2019. What are the 1099 penalties for michigan? Each individual statement will be available to view or. See the instructions for form 8938. Web deceased spouse benefits do not include benefits from a spouse who died in 2022.

Peoples Choice Tax Tax Documents To Bring We provide Tax

Each individual statement will be available to view or. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. The statements are prepared by uia and report how much individuals received in unemployment benefits and income tax withheld the past year. While certain wage statements and income record forms are due on or before feb..

Your Email Address Will Be Displayed.

Taxbandits supports filing form 1099 with both the federal and state of michigan. If you or your spouse received pension benefits from a deceased spouse, see form 4884, michigan pension schedule instructions. (for the 2022 tax year the due date will be january 31, 2023 for e. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax.

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

You will receive an email acknowledging your delivery preference. See your tax return instructions for where to report. Web deceased spouse benefits do not include benefits from a spouse who died in 2022. 1, 2022, the sales, use and withholding taxes annual return (form 5081) is still due on feb.

What Are The 1099 Penalties For Michigan?

The statements are prepared by uia and report how much individuals received in unemployment benefits and income tax withheld the past year. Web 1:10 michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. There is no computation, validation, or verification of the information you enter. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and michigan department of revenue, both electronically and on paper.our 1099 software can import michigan 1099 amounts from quickbooks, excel and other tax software.

Irs Approved Tax1099 Allows You To Efile Michigan Forms.

Each individual statement will be available to view or. The irs determines the type of federal form required and the state of michigan follows these federal guidelines. Treasury tax form search previous year tax forms and instructions 2021 individual income tax 2020 individual income tax 2019. You may also have a filing requirement.