Michigan State Tax Withholding Form 2022

Michigan State Tax Withholding Form 2022 - If you enter the word “income” in the form. Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web the michigan department of treasury march 1 published 2022 withholding tax forms for corporate income, individual income, and sales and use tax purposes. Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. Web 2022 employer withholding tax. You can download or print. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. Be sure to verify that the form you are. Distribute the all set variety by. Complete, edit or print tax forms instantly.

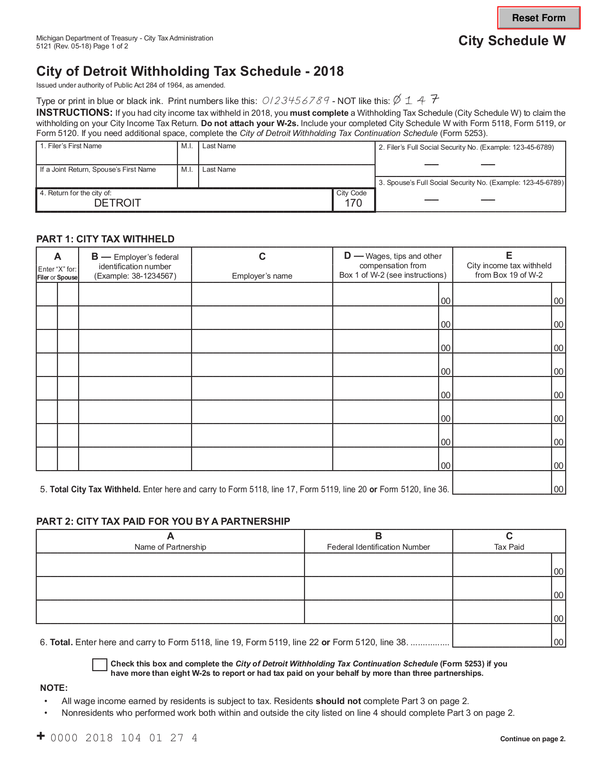

Once the form is completed, push finished. Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. Complete, edit or print tax forms instantly. Web 2022 tax year dear taxpayer: Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Complete, edit or print tax forms instantly. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block.

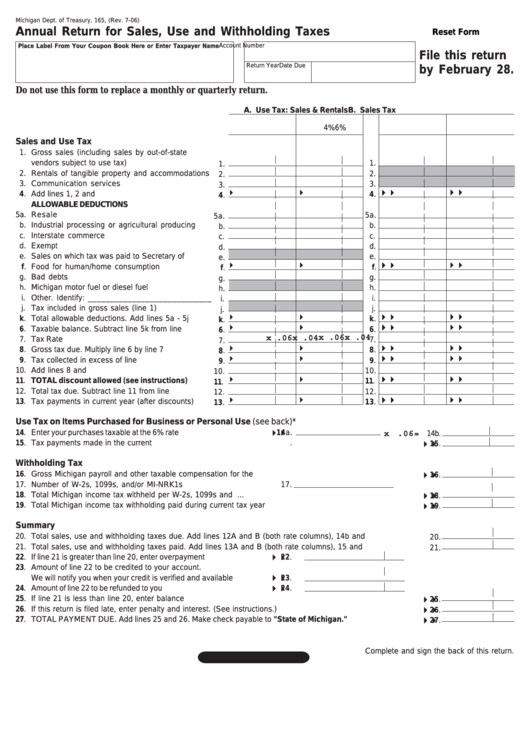

Web 2022 sales, use and withholding taxes annual return: This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits,. Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. 2022 sales, use and withholding taxes. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Once the form is completed, push finished. Web instructions included on form: Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web withholding formula >(michigan effective 2022) <. If you fail or refuse to submit.

Printable W4 Forms 2022 April Calendar Printable 2022

Web 2022 sales, use and withholding taxes annual return: If you make $70,000 a year living in arkansas you will be taxed $11,683. Complete if your company is making required withholding payments on. Complete, edit or print tax forms instantly. Once the form is completed, push finished.

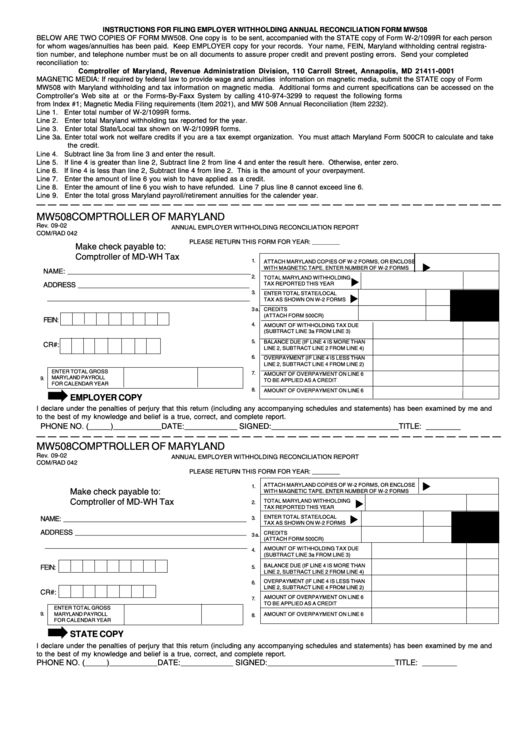

Maryland Withholding Form 2021 2022 W4 Form

If you fail or refuse to submit. Complete, edit or print tax forms instantly. Web 2022 sales, use and withholding taxes annual return: Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. 2022 sales, use and withholding taxes.

2020 Form MO W4 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 sales, use and withholding taxes annual return: Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You can download or print. Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Web 2022 tax year dear taxpayer:

20202023 Form MI MIW4 Fill Online, Printable, Fillable, Blank pdfFiller

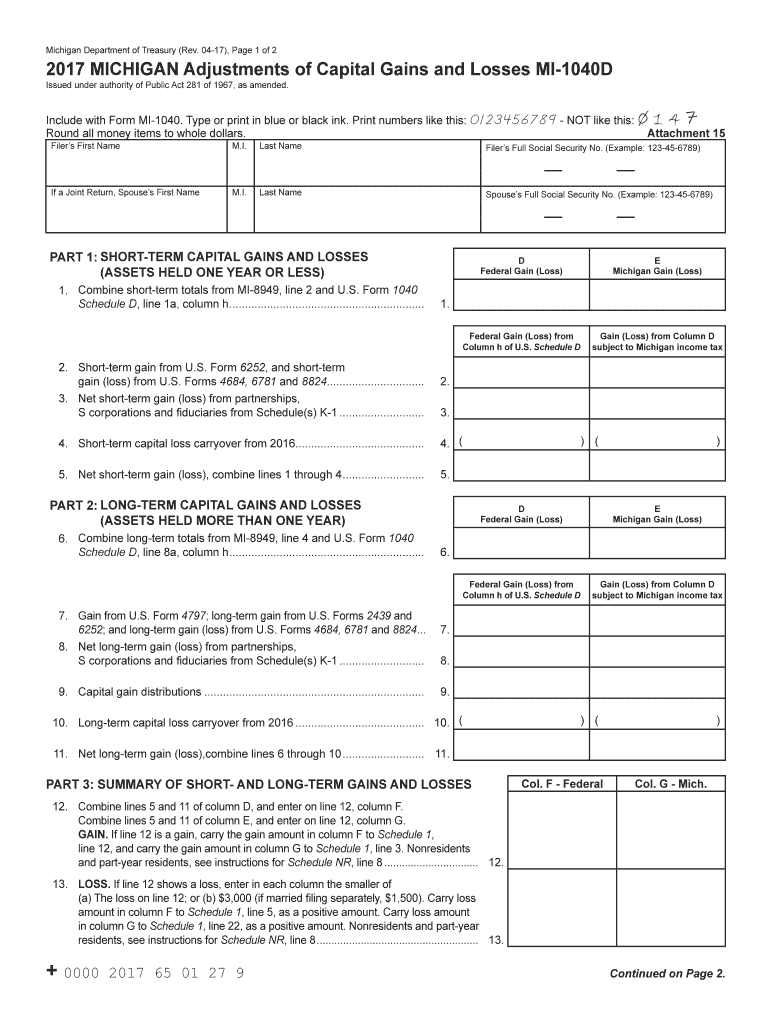

If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Complete, edit or print tax forms instantly. Be sure to verify that the form you are. Web withholding formula >(michigan effective 2022) <. Web 2022 tax year dear taxpayer:

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

Complete if your company is making required withholding payments on. Web withholding formula >(michigan effective 2022) <. If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. If you fail or refuse to submit. Michigan state income tax forms for current and previous tax years.

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

If you make $70,000 a year living in arkansas you will be taxed $11,683. Be sure to verify that the form you are. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block. If you had michigan income tax withheld in 2022, you must complete a.

2017 Form MS DoR 89350 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. Web 2022 employer withholding tax. Web 2022 tax year dear taxpayer: Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Web find out which michigan income tax forms.

Mi 1040 Fill Out and Sign Printable PDF Template signNow

Web 2022 employer withholding tax. This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Web 2022 sales, use and withholding taxes annual return: This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits,. If you fail or refuse to submit.

Michigan 2022 Annual Tax Withholding Form

Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. If you make $70,000 a year living in arkansas you will be taxed $11,683. Michigan state income tax forms for current and previous tax years. Complete, edit or print tax forms instantly..

Michigan W 4 2021 2022 W4 Form

If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. 2022 sales, use and withholding taxes. Complete, edit or print tax forms instantly. Web 2022 employer withholding.

Complete, Edit Or Print Tax Forms Instantly.

Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Be sure to verify that the form you are. 2022 sales, use and withholding taxes. Statement to determine state of domicile:

Complete, Edit Or Print Tax Forms Instantly.

If you make $70,000 a year living in arkansas you will be taxed $11,683. Web 2022 sales, use and withholding taxes annual return: Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block.

This Revenue Administrative Bulletin (Rab) Sets Forth The Sales Tax Prepayment Rates Applicable To The Purchase Or Receipt Of.

Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Once the form is completed, push finished. You can download or print. Web withholding formula >(michigan effective 2022) <.

Distribute The All Set Variety By.

Complete if your company is making required withholding payments on. If you fail or refuse to submit. Web the michigan department of treasury march 1 published 2022 withholding tax forms for corporate income, individual income, and sales and use tax purposes. If you enter the word “income” in the form.