Mileage Form 2023

Mileage Form 2023 - For 2023, it's been raised to $0.655. Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: The irs and general services administration initiated this revision. This rate is adjusted for inflation each year. 14 cents per mile driven in service of. Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. 65.5 cents per mile driven for business use. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks.

1984 to present buyer's guide to fuel efficient cars and trucks. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. Web the mileage figures of the 2023 kia seltos facelift have been officially revealed. Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023 in wisconsin is also 65.5 cents per mile. It indicates a way to close an interaction, or. For 2023, it's been raised to $0.655. Two crossed lines that form an 'x'. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half.

It indicates a way to close an interaction, or. It indicates the ability to send an email. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). This rate is adjusted for inflation each year. 14 cents per mile driven in service of. For 2023, it's been raised to $0.655. 22 cents per mile driven for medical, or moving purposes. This website revision is forwarded for information purposes. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

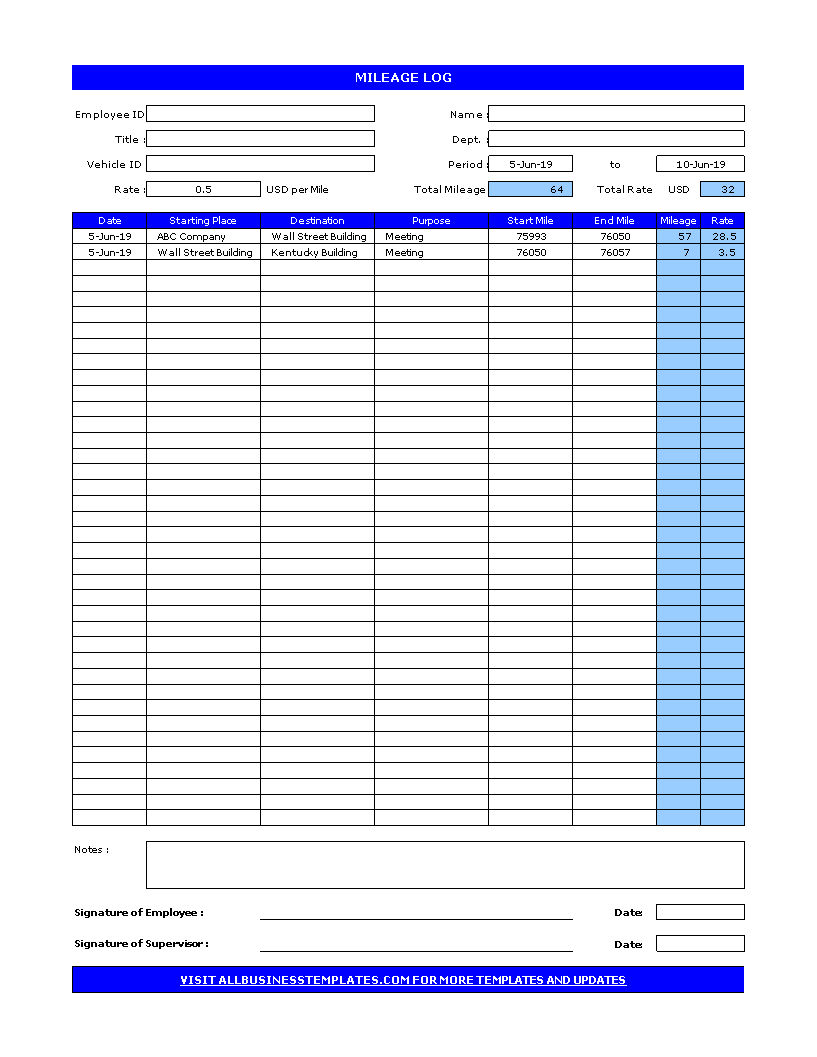

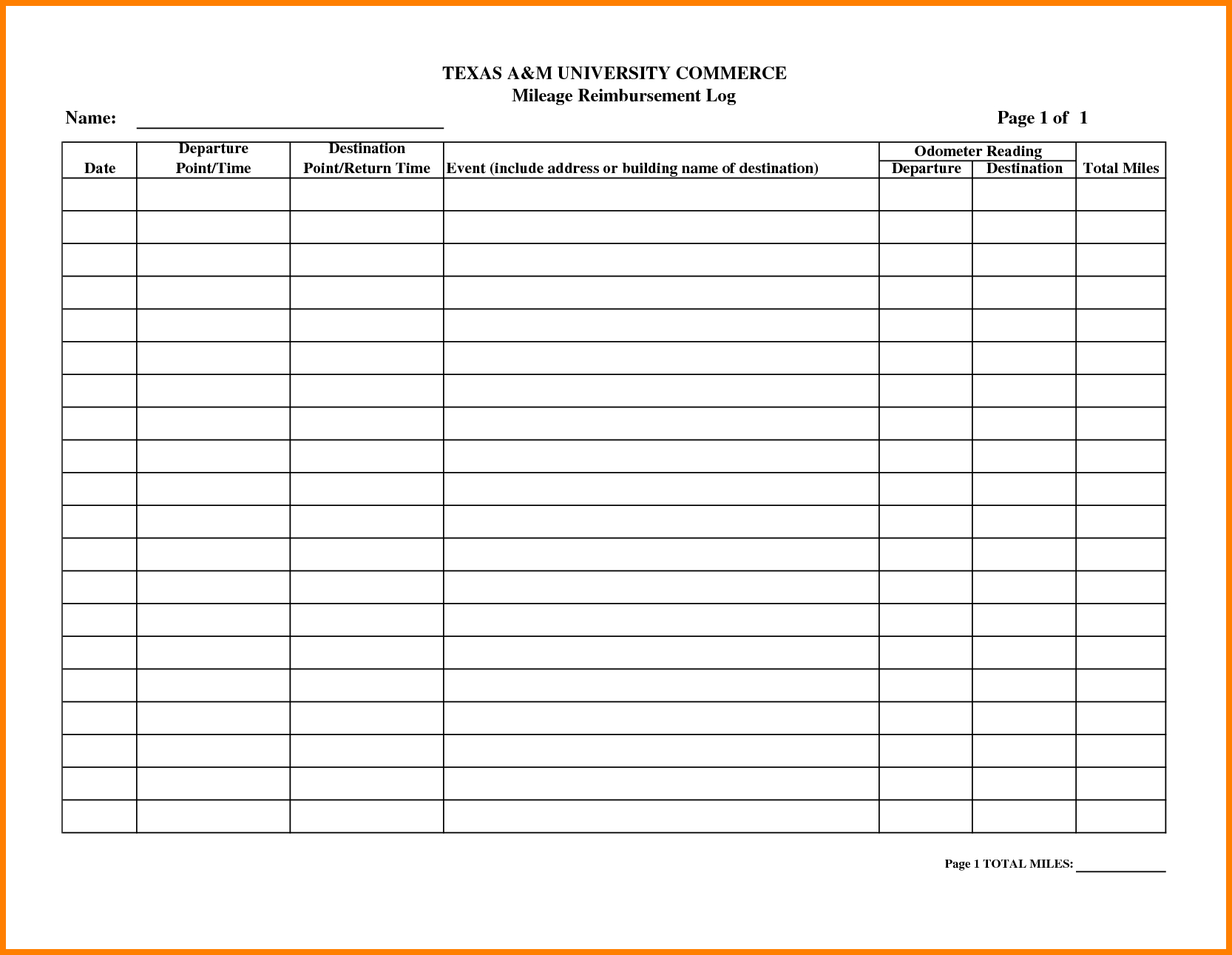

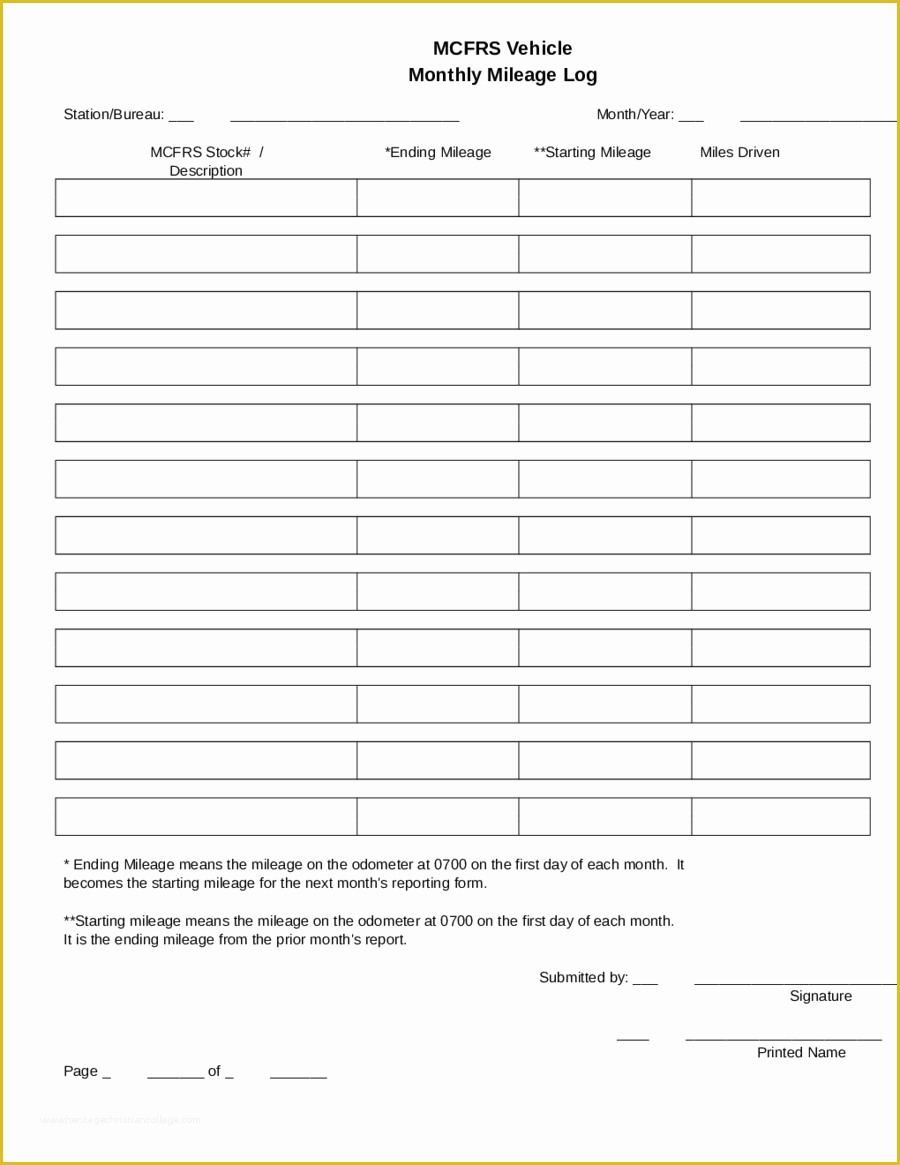

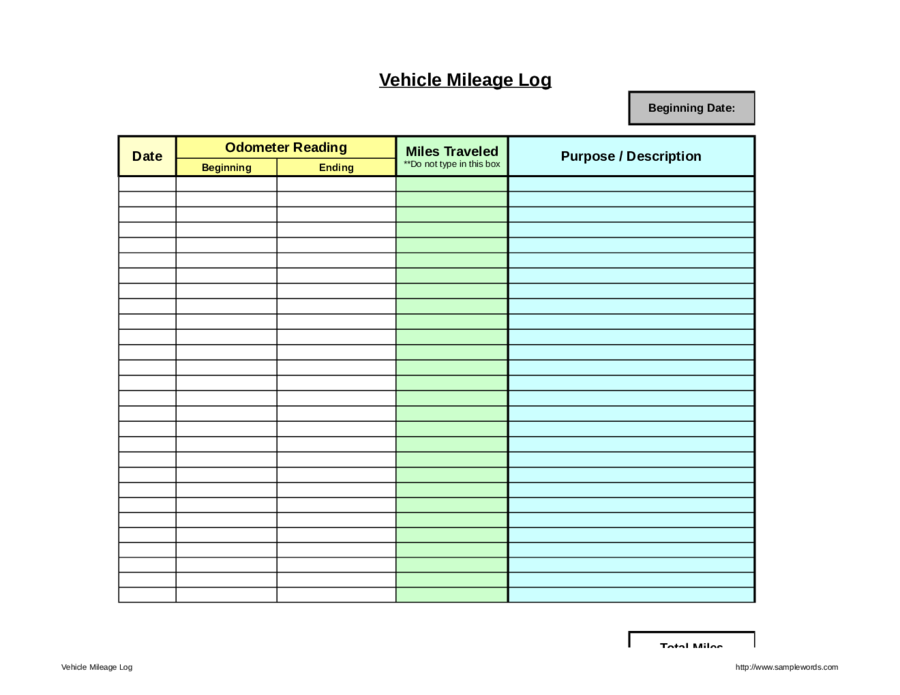

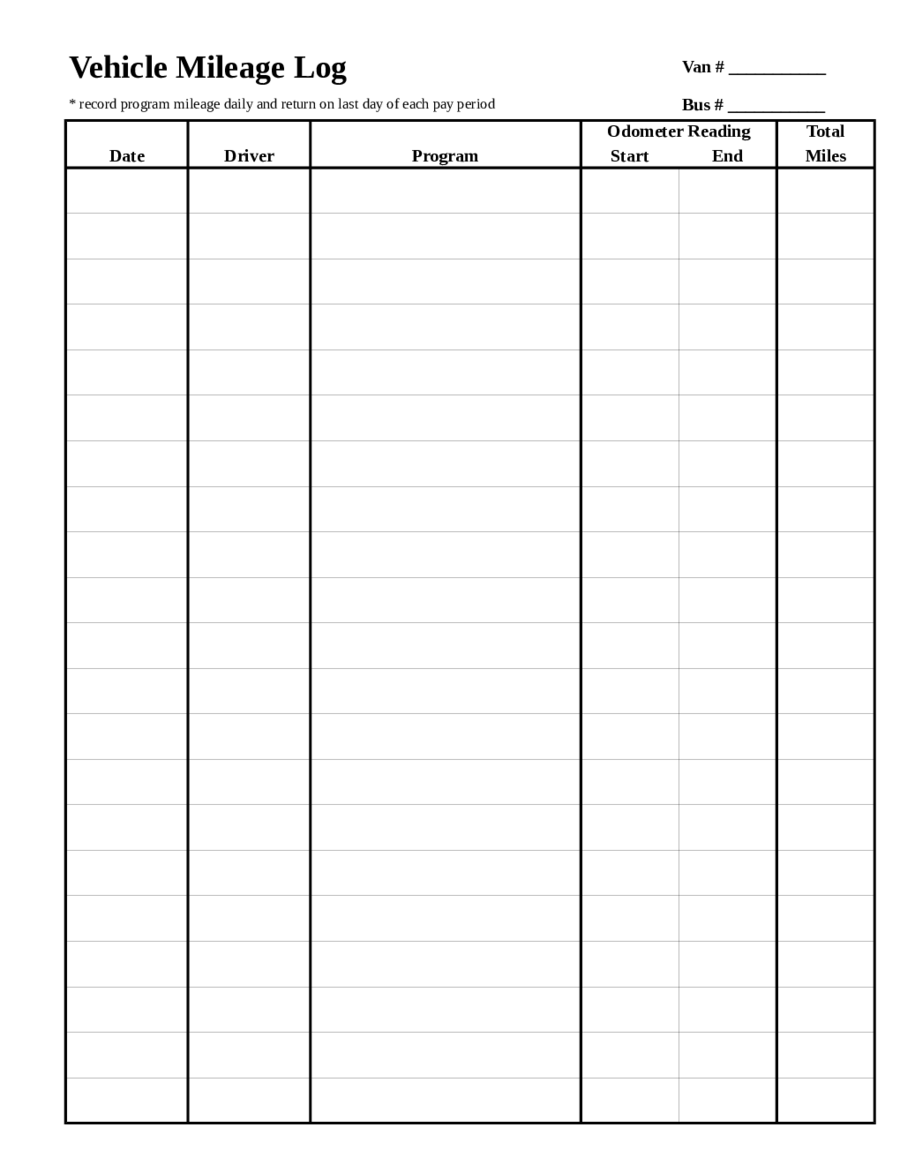

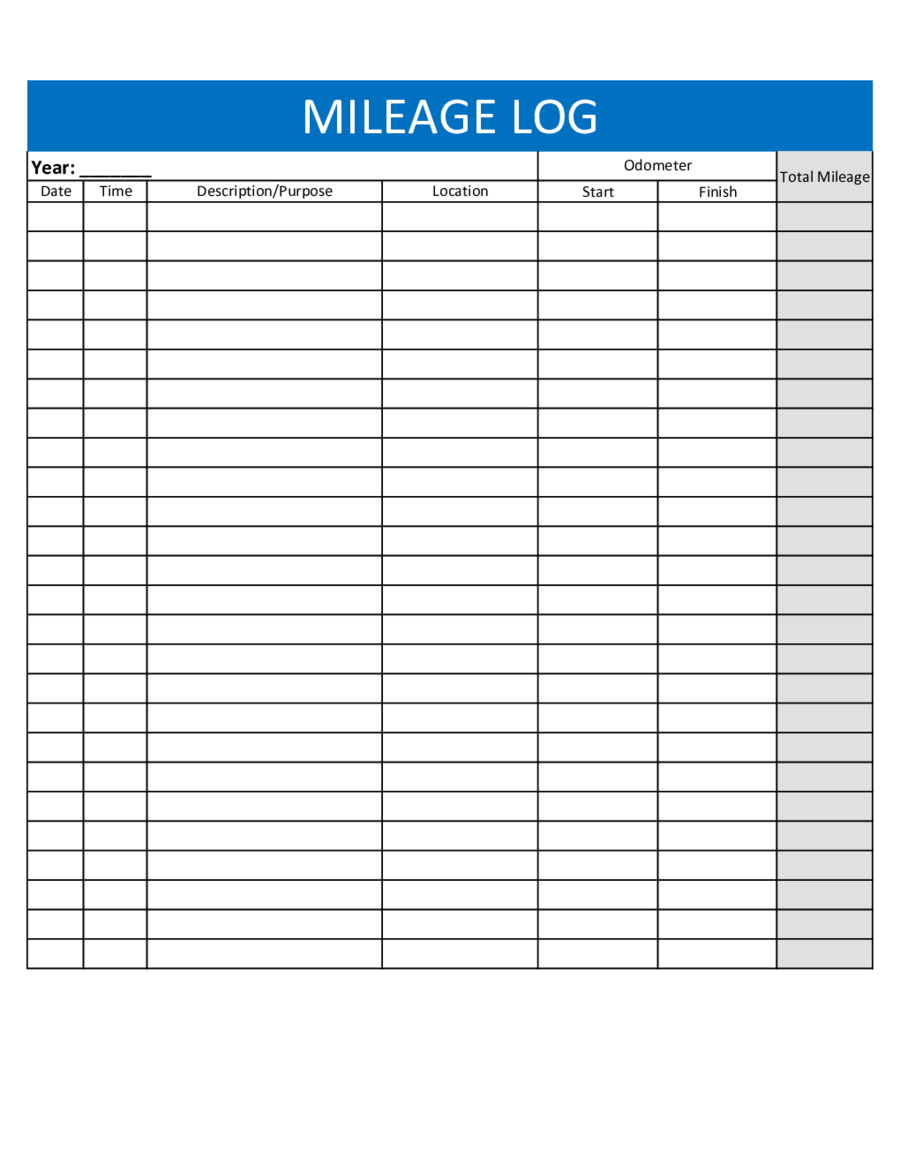

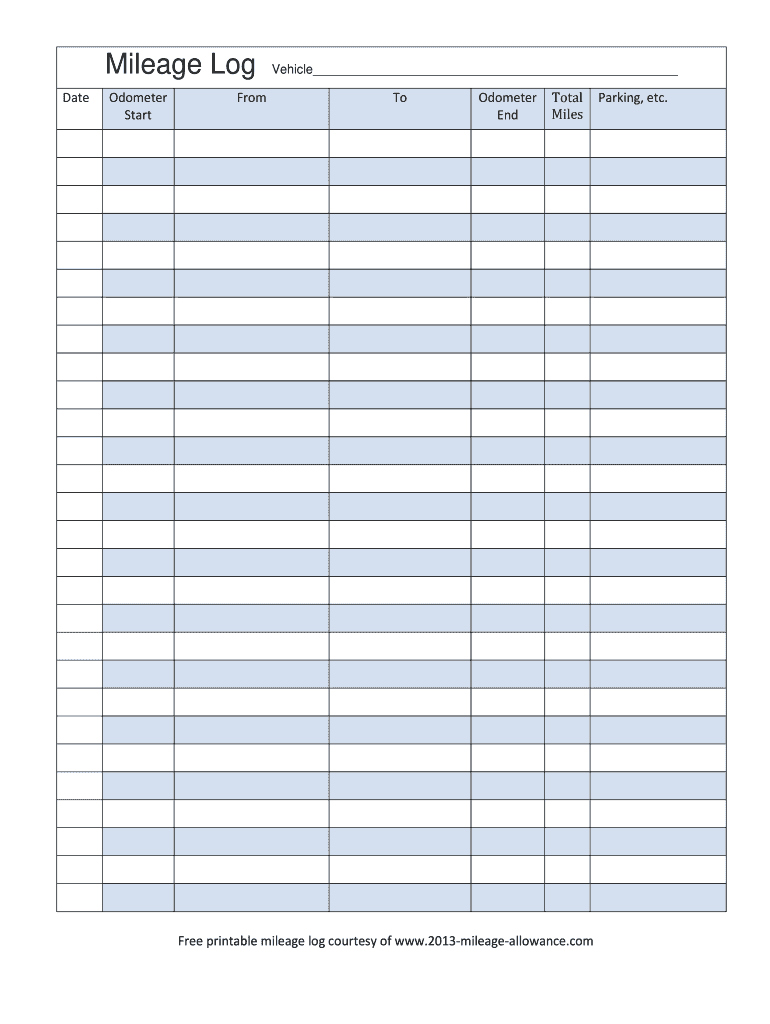

Mileage Log Templates at

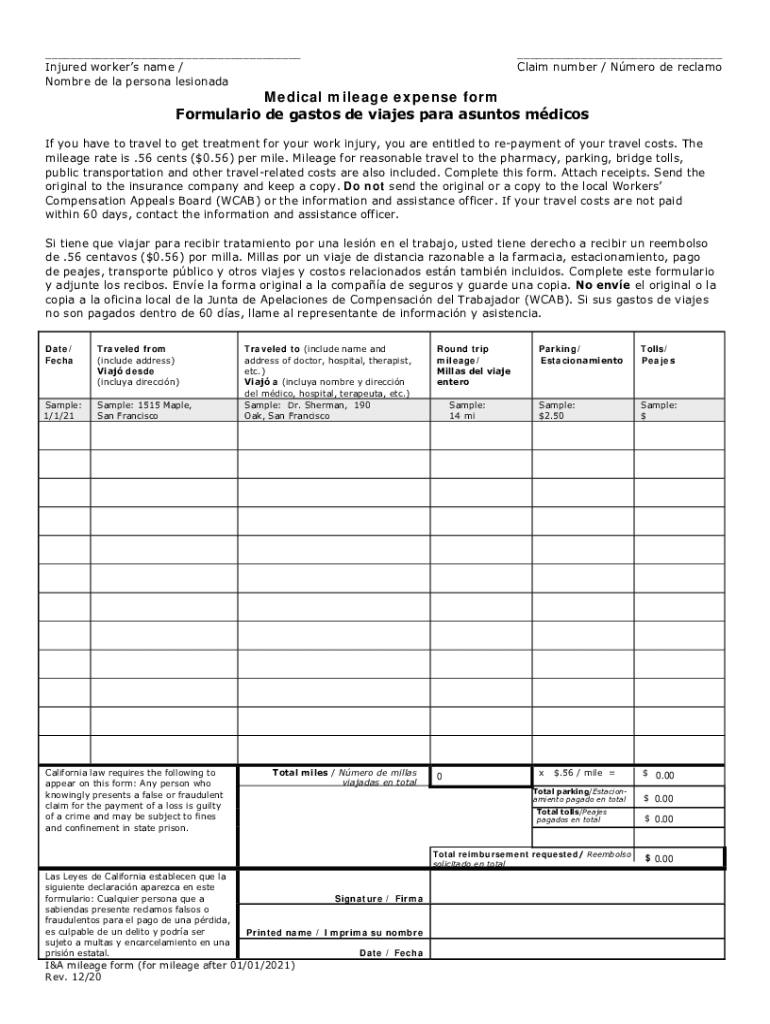

Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023 in wisconsin is also 65.5 cents per mile. 22 cents per mile driven for medical, or moving purposes. The irs and general services administration initiated this revision. Web dwc medical mileage expense form medical mileage expense form if you need a medical.

Printable Mileage Reimbursement Form Printable Form 2022

Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). This website revision is forwarded for information purposes. Two crossed lines that form an 'x'. 22 cents per mile driven for medical, or moving purposes. 65.5 cents per mile driven for business use.

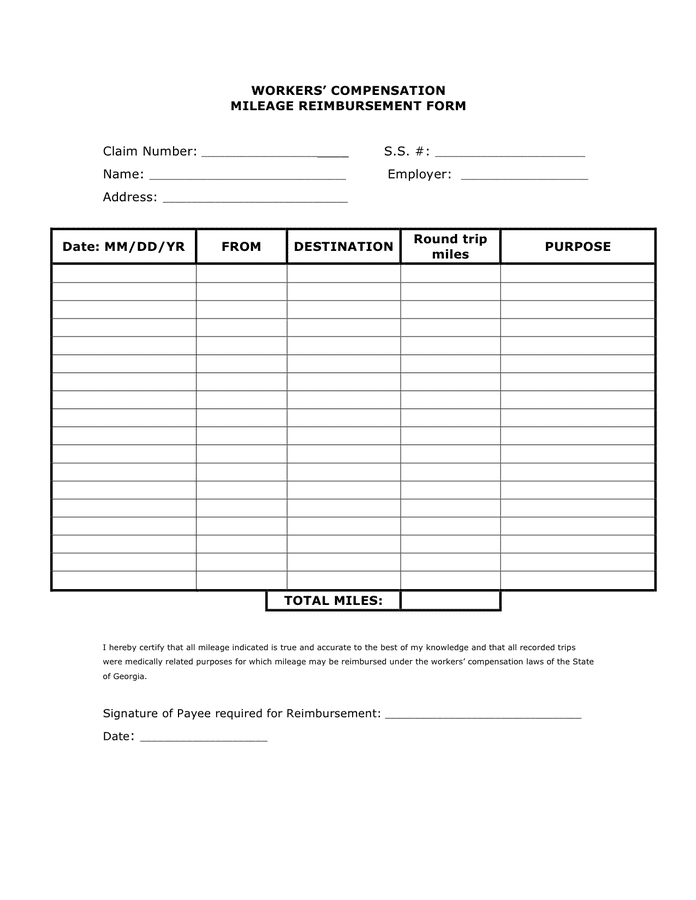

Workers' compensation mileage reimbursement form in Word and Pdf formats

The irs and general services administration initiated this revision. This website revision is forwarded for information purposes. This rate is adjusted for inflation each year. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs). 1984 to present buyer's guide to fuel efficient cars and trucks.

Vehicle Mileage Log Template Free Of 2019 Mileage Log Fillable

Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023 in wisconsin is also 65.5 cents per mile. For 2023, it's been raised to $0.655. It indicates a.

Irs Business Mileage Form Armando Friend's Template

14 cents per mile driven in service of. Web the irs mileage rates for 2023 are: 1984 to present buyer's guide to fuel efficient cars and trucks. It indicates the ability to send an email. 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

Sample Mileage Log The Document Template

65.5 cents per mile driven for business use. Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. Web the irs mileage rates for 2023 are: Two crossed lines that form an 'x'. The irs and general services.

2023 Mileage Log Fillable, Printable PDF & Forms Handypdf

It indicates a way to close an interaction, or. Two crossed lines that form an 'x'. Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this.

Mileage verification form Fill out & sign online DocHub

This website revision is effective on january 1,. For 2022, that’s $0.585 for the first half of the year, and $0.625 for the second half. This website revision is forwarded for information purposes. The irs and general services administration initiated this revision. Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023.

2023 Mileage Log Fillable, Printable PDF & Forms Handypdf

It indicates the ability to send an email. For 2023, it's been raised to $0.655. Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. 65.5 cents per mile driven for business use. 1984 to present buyer's guide to fuel efficient cars and trucks.

Mileage Reimbursement 2021 Pa

Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board..

Web The Irs Mileage Rates For 2023 Are:

Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. This rate is adjusted for inflation each year. 14 cents per mile driven in service of. This website revision is effective on january 1,.

22 Cents Per Mile Driven For Medical, Or Moving Purposes.

65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022. It indicates a way to close an interaction, or. Web dwc medical mileage expense form medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web the mileage figures of the 2023 kia seltos facelift have been officially revealed.

For 2022, That’s $0.585 For The First Half Of The Year, And $0.625 For The Second Half.

It indicates the ability to send an email. The irs and general services administration initiated this revision. 65.5 cents per mile driven for business use. Web the ct mileage rate for 2023 is 65.5 cents per mile, and the mileage rate for 2023 in wisconsin is also 65.5 cents per mile.

This Website Revision Is Forwarded For Information Purposes.

Web beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Colorado mileage reimbursement for example, for 2023 the irs rate is 65.5 cents per mile, so the colorado mileage reimbursement is set at 90% of this rate, or 59 cents per mile. Estimates of gas mileage, greenhouse gas emissions, safety ratings, and air pollution ratings for new and used cars and trucks. Web website to reflect revised calendar year (cy) 2023 standard mileage rates established by the internal revenue service (irs).