Missouri 941 Form 2023

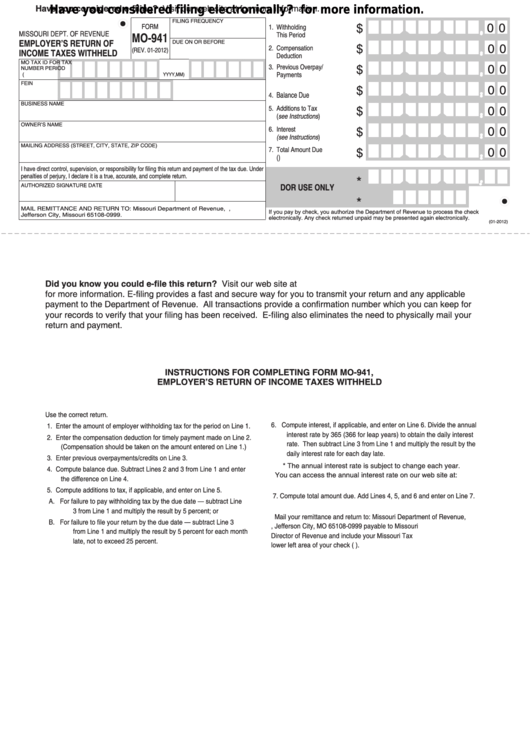

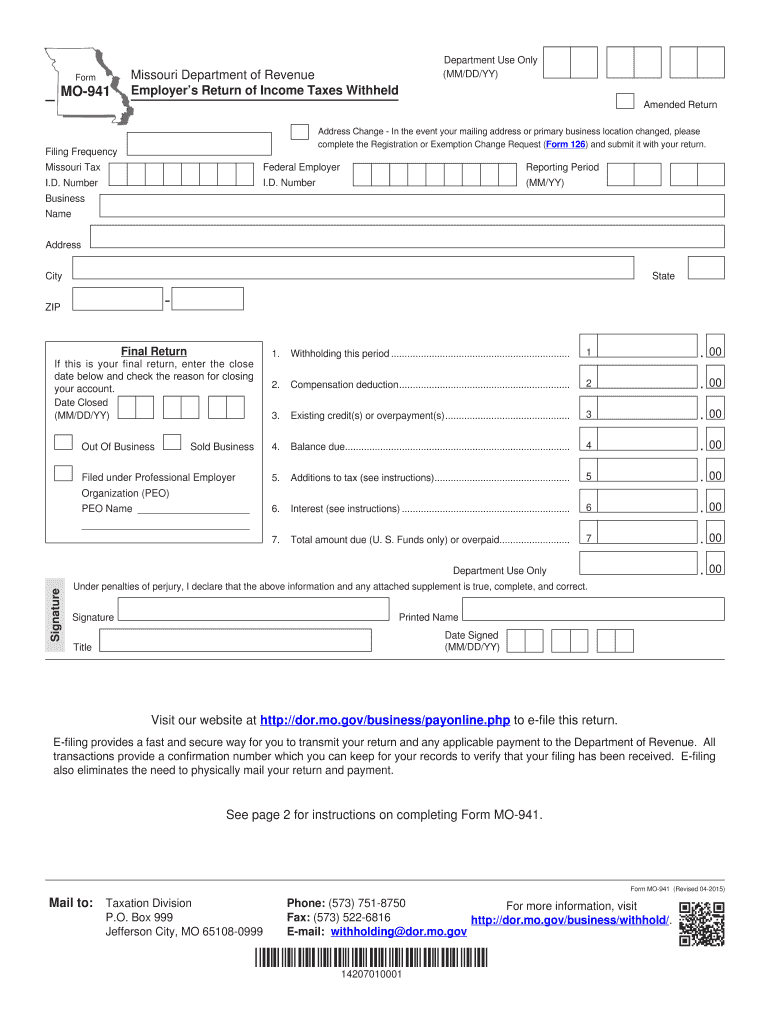

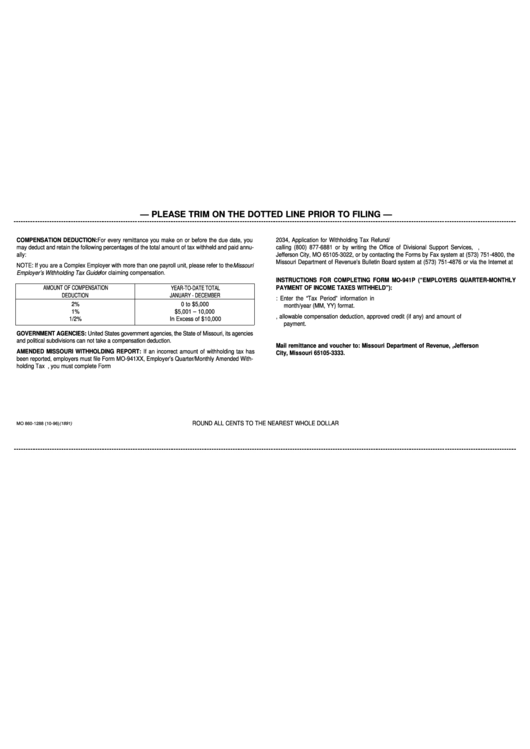

Missouri 941 Form 2023 - For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Snohomish county tax preparer pleads guilty to assisting in the. Web include your missouri tax i.d. Don't use an earlier revision to report taxes for 2023. After the employer enters or uploads wage data, uinteract will automatically. Employer's return of income taxes withheld (note: Enter the compensation deduction for timely payment made on line 2. Form 941 is used by employers. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; These days, most americans would rather do their own taxes and, furthermore, to fill out forms digitally.

These days, most americans would rather do their own taxes and, furthermore, to fill out forms digitally. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages. Number in the lower left area of your check (u.s. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Internet reporting quarterly contribution and wage reports may be filed online using uinteract. Web include your missouri tax i.d. Web follow the simple instructions below: Web alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska,. Web driver license motor vehicle resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a category.

The request for mail order forms may be used to order one copy or. After the employer enters or uploads wage data, uinteract will automatically. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Save or instantly send your ready documents. Internet reporting quarterly contribution and wage reports may be filed online using uinteract. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. These days, most americans would rather do their own taxes and, furthermore, to fill out forms digitally. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web what's new social security and medicare tax for 2023. Form 941 is used by employers.

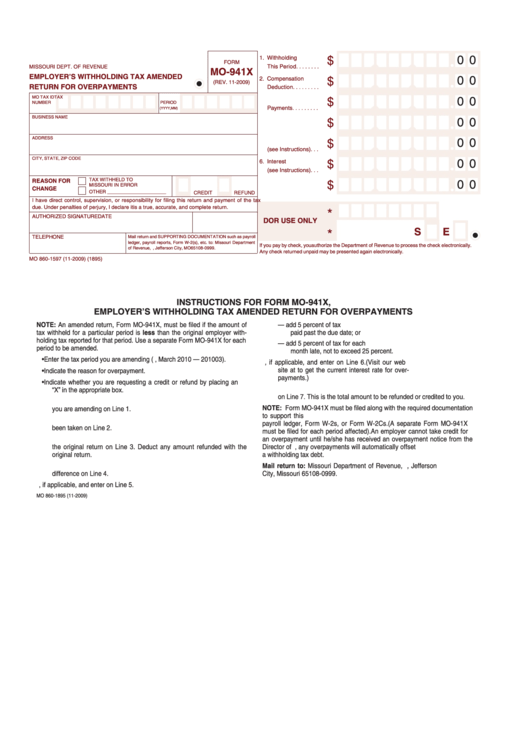

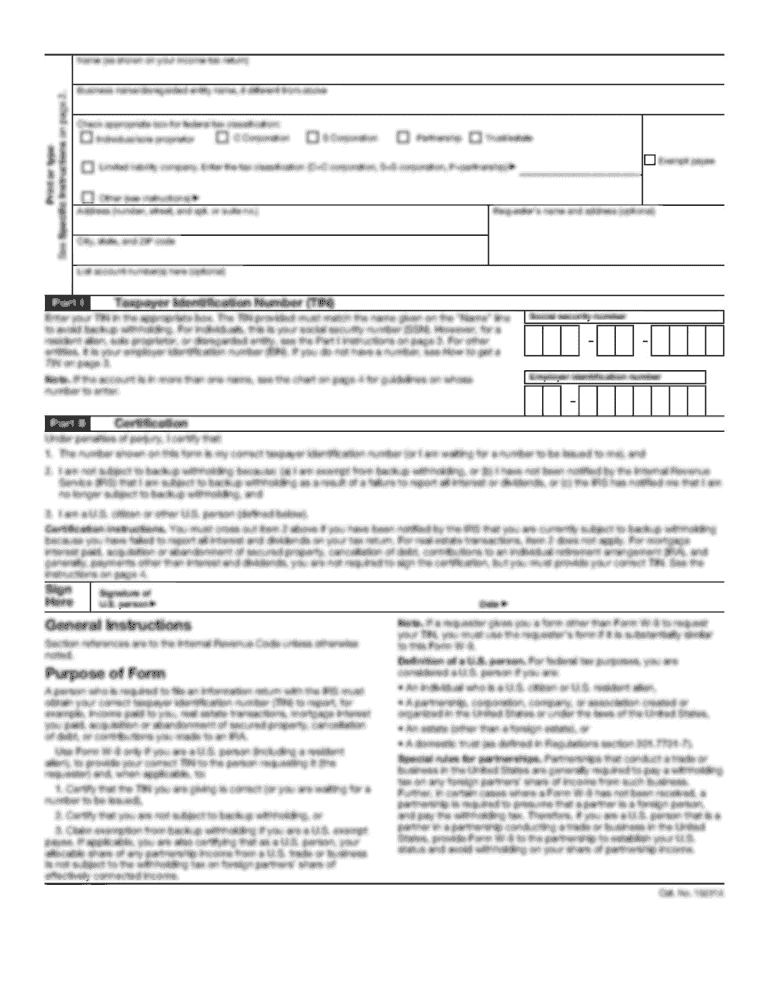

Top Mo941 X Form Templates free to download in PDF format

Snohomish county tax preparer pleads guilty to assisting in the. Enter the compensation deduction for timely payment made on line 2. Save or instantly send your ready documents. Number business amended return address change. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023;

ezPaycheck Payroll How to Prepare Quarterly Tax Report

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska,. For optimal functionality, save the form to your computer before completing.

Fillable Form Mo941 Employer'S Return Of Taxes Withheld

Form 941 is used by employers. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: After the employer enters or uploads wage data, uinteract will automatically. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages.

Missouri Department of Revenue Form Mo 941 Fill Out and Sign

Enter the compensation deduction for timely payment made on line 2. Web alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska,. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages. Rock hill, sc / accesswire / july 28, 2023 / the next.

9 Missouri Mo941 Forms And Templates free to download in PDF

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages. Don't use an earlier revision to report taxes for 2023. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Web alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri,.

Department of Labor 941 Withholding Tax Economy Of The United States

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. Easily fill out pdf blank, edit, and sign them. Web include your missouri tax i.d. Form 941 is used by employers. Web use the march 2023 revision of form 941 to report.

New Revised 941 IRS Form

The request for mail order forms may be used to order one copy or. After the employer enters or uploads wage data, uinteract will automatically. Save or instantly send your ready documents. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. March 2023) employer’s quarterly federal tax return.

20152020 Form MO MO941 Fill Online, Printable, Fillable, Blank

Easily fill out pdf blank, edit, and sign them. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web what's new social security and medicare tax for 2023. Web driver license motor vehicle resources new to missouri forms and manuals find your form to search, type a keyword.

Where To File Form 941?

Don't use an earlier revision to report taxes for 2023. Number in the lower left area of your check (u.s. After the employer enters or uploads wage data, uinteract will automatically. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. These.

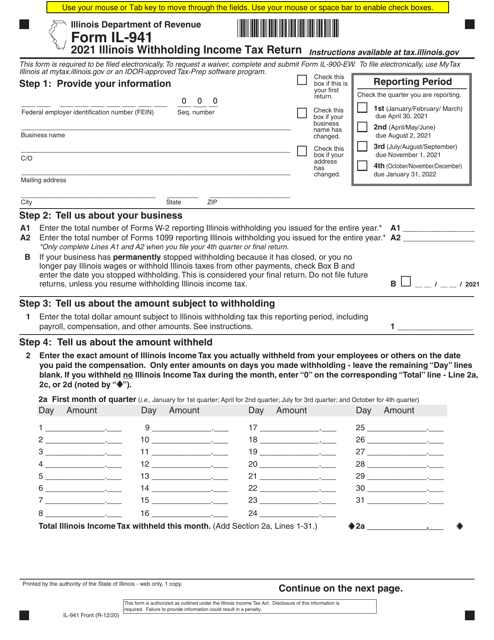

Form IL941 Download Fillable PDF or Fill Online Illinois Withholding

After the employer enters or uploads wage data, uinteract will automatically. Web include your missouri tax i.d. Employer's return of income taxes withheld (note: Web what's new social security and medicare tax for 2023. Number in the lower left area of your check (u.s.

Web What's New Social Security And Medicare Tax For 2023.

Snohomish county tax preparer pleads guilty to assisting in the. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Number business amended return address change. Employer's return of income taxes withheld (note:

Web Follow The Simple Instructions Below:

Easily fill out pdf blank, edit, and sign them. Form 941 is used by employers. Web alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska,. Number in the lower left area of your check (u.s.

Internet Reporting Quarterly Contribution And Wage Reports May Be Filed Online Using Uinteract.

Web include your missouri tax i.d. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Employer's return of income taxes withheld (note: For optimal functionality, save the form to your computer before completing and utilize adobe reader.).

Web July 20, 2023.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages. Save or instantly send your ready documents.