Mn Frontline Worker Pay Tax Form

Mn Frontline Worker Pay Tax Form - Under the whats new in 2022 link there is info on the minnesota frontline workers pay it’s says “ minnesota frontline worker pay. Web application period begins for minnesota frontline worker bonus payment program. Report the payment as “other income” using line 8z of federal schedule 1. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. We are reviewing other changes and will. Uncodified sections in 2022 laws, ch. Web up to $40 cash back get the free 2022 minnesota form. Web on june 7, 2022, the state issued guidance on the requirements of the law. The minnesota department of labor and industry has. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue.

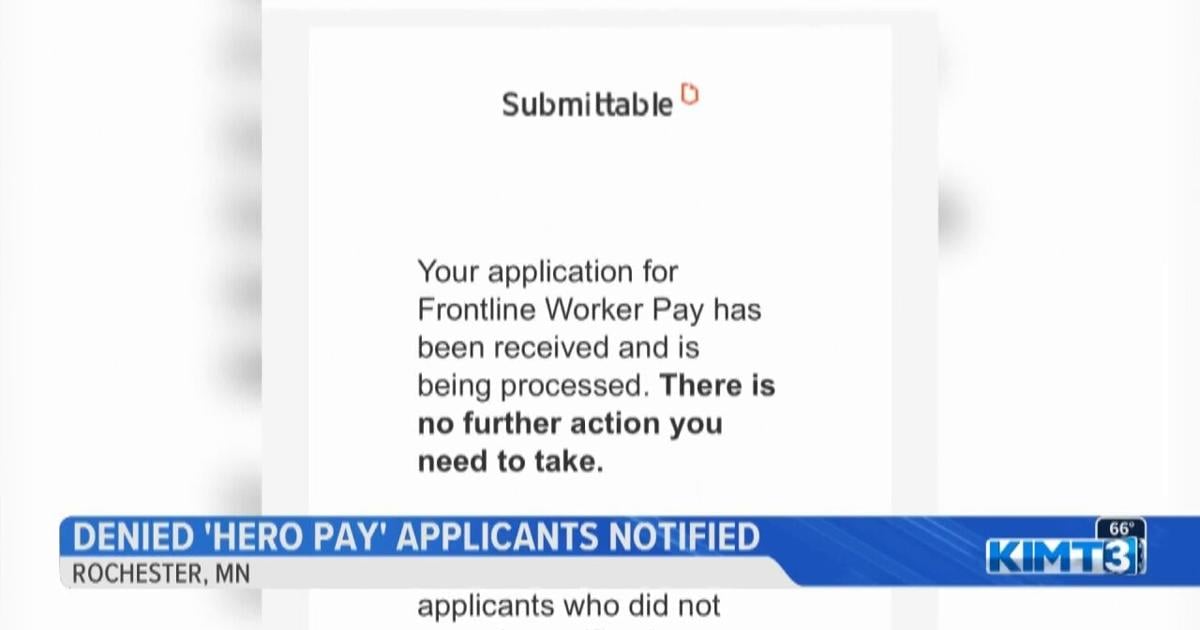

Here's how to enter your minnesota frontline. Web application period begins for minnesota frontline worker bonus payment program. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. Web sign in to your submittable account. Is taxable on your federal income tax return. 2022 w4mn, minnesota withholding allowance/exemption certificate. We are reviewing other changes and will. Web tax considerations for state frontline worker pay august 24, 2021 overview federal taxability of state payments is determined by the internal revenue. Under the whats new in 2022 link there is info on the minnesota frontline workers pay it’s says “ minnesota frontline worker pay.

Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. Report the payment as “other income” using line 8z of federal schedule 1. Web yes it is for minnesota. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Web the frontline worker pay application was open june 8 through july 22, 2022. Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. The minnesota department of labor and industry has. Web for eligibility and other details, go to direct tax rebate payments. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats.

Minnesota Frontline Worker Pay Applications Open

Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. 2022 w4mn, minnesota withholding allowance/exemption certificate. Web the payment is taxable on your federal return, but isn't taxable in minnesota, nor included in your household income. Under the whats new.

How To File Minnesota Property Tax Refund

Web the payment is taxable on your federal return, but isn't taxable in minnesota, nor included in your household income. Under the whats new in 2022 link there is info on the minnesota frontline workers pay it’s says “ minnesota frontline worker pay. Is taxable on your federal income tax return. Eligible workers had 45 days to apply for frontline.

1.1 Million Applications Sent In For Minnesota's Frontline Worker Pay

Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Data submission methods and file formats; The payments will be of approximately $750.00 and the application. Web application period begins for minnesota frontline worker bonus payment program. Web yes it is for minnesota.

MN Frontline Worker Pay Scam Minnesota Frontline Worker Pay Howard

Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. If you received a frontline worker payment of..

The Minnesota Legislature approved 250 million for pandemic worker

Web sign in to your submittable account. Frontline worker payments on minnesota tax return. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. The payments will be of approximately $750.00 and the application. Data submission methods and file formats;

Minnesota pandemic pay panel likely to miss Monday deadline

Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. If you received a frontline worker payment of. Web tax considerations for state frontline worker pay august 24, 2021 overview federal taxability of state payments is determined by the internal revenue. Web for eligibility and other details, go.

[Listen] Farmers Eligible for MN Frontline Worker Pay Program?

Web yes it is for minnesota. The payments will be of approximately $750.00 and the application. Report the payment as “other income” using line 8z of federal schedule 1. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. We.

Minnesota Frontline Worker pay Video

Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Web sign in to your submittable account. Data submission methods and file formats; We are reviewing other changes and will. Frontline worker payments on minnesota tax return.

MN Frontline Worker Pay details expected to be released next week

Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. Frontline worker payments on minnesota tax return. If you received a frontline worker payment of. Covered employers need to take action before june 23, 2022. The payments will be of approximately $750.00 and the application.

Minnesota’s New Frontline Worker Pay Law Requirements for Employers

Frontline worker payments on minnesota tax return. Web tax considerations for state frontline worker pay august 24, 2021 overview federal taxability of state payments is determined by the internal revenue. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Data submission methods and file formats; 2022 w4mn, minnesota withholding allowance/exemption certificate.

Report The Payment As “Other Income” Using Line 8Z Of Federal Schedule 1.

2022 w4mn, minnesota withholding allowance/exemption certificate. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. Web the frontline worker pay application was open june 8 through july 22, 2022. Federal unemployment tax act (futa) credit;.

Under The Whats New In 2022 Link There Is Info On The Minnesota Frontline Workers Pay It’s Says “ Minnesota Frontline Worker Pay.

Eligible workers had 45 days to apply for frontline worker pay. Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Data submission methods and file formats; The payments will be of approximately $750.00 and the application.

Web Tax Considerations For State Frontline Worker Pay August 24, 2021 Overview Federal Taxability Of State Payments Is Determined By The Internal Revenue.

If you received a frontline worker payment of. Web sign in to your submittable account. Covered employers need to take action before june 23, 2022. · applicants whose application was denied, could appeal the decision during a 15.

Web Application Period Begins For Minnesota Frontline Worker Bonus Payment Program.

Web yes it is for minnesota. Web up to $40 cash back get the free 2022 minnesota form. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Web businesses tax professionals governments law change updates we've published new updates about this year's tax law changes.

![[Listen] Farmers Eligible for MN Frontline Worker Pay Program?](https://townsquare.media/site/67/files/2022/01/attachment-GettyImages-117855607.jpg?w=980&q=75)