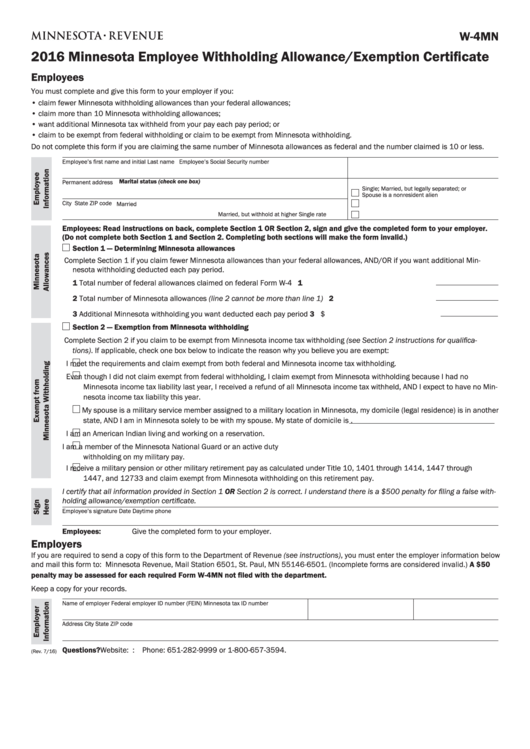

Mn W 4 Form

Mn W 4 Form - What happens to my lock in letter? December 2020) department of the treasury internal revenue service. What if i am exempt from minnesota withholding? Web you must complete and give this form to your employer if you do any of the following: •ewer minnesota withholding allowances than your federal allowances claim f • claim more than 10 minnesota withholding allowances •ant additional minnesota tax withheld from your pay each pay period w What happens if i only fill out step 1 and then sign the form? Keep all forms in your records. For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. Minnesota requires nonresident aliens to claim single with no withholding allowances. Anything agency employees can use as a reference tool?

Keep all forms in your records. What if i am exempt from minnesota withholding? Anything agency employees can use as a reference tool? Minnesota requires nonresident aliens to claim single with no withholding allowances. •ewer minnesota withholding allowances than your federal allowances claim f • claim more than 10 minnesota withholding allowances •ant additional minnesota tax withheld from your pay each pay period w Complete this form to calculate the amount of minnesota income tax to be withheld from your payments or distributions. Your withholding is subject to review by the irs. For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. Web you must complete and give this form to your employer if you do any of the following: What happens to my lock in letter?

Web you must complete and give this form to your employer if you do any of the following: For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. What if i am exempt from minnesota withholding? Anything agency employees can use as a reference tool? How do i fix this? •ewer minnesota withholding allowances than your federal allowances claim f • claim more than 10 minnesota withholding allowances •ant additional minnesota tax withheld from your pay each pay period w Minnesota requires nonresident aliens to claim single with no withholding allowances. December 2020) department of the treasury internal revenue service. Keep all forms in your records. Your withholding is subject to review by the irs.

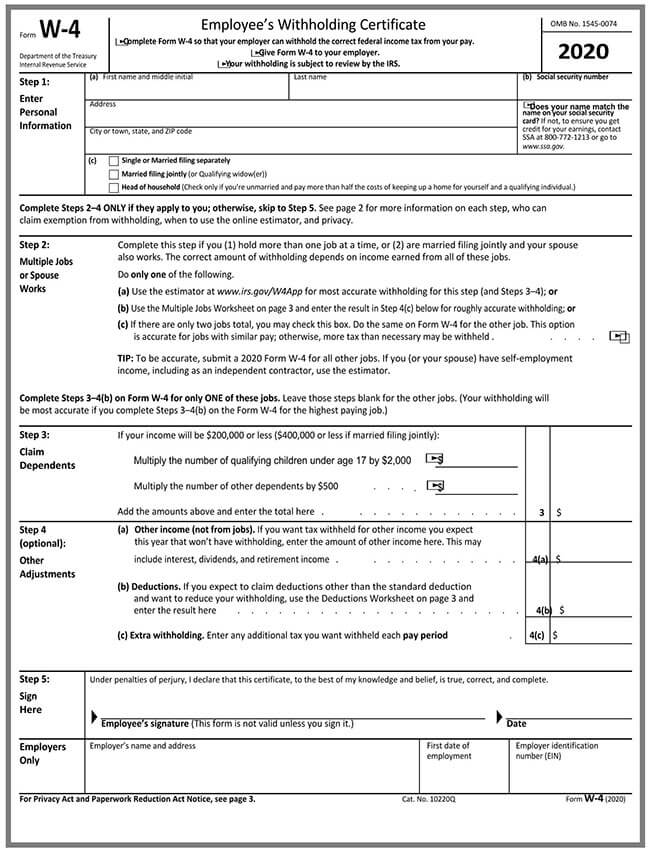

A New Form W4 for 2020 Alloy Silverstein

Anything agency employees can use as a reference tool? What happens if i only fill out step 1 and then sign the form? Web you must complete and give this form to your employer if you do any of the following: What if i am exempt from minnesota withholding? Complete this form to calculate the amount of minnesota income tax.

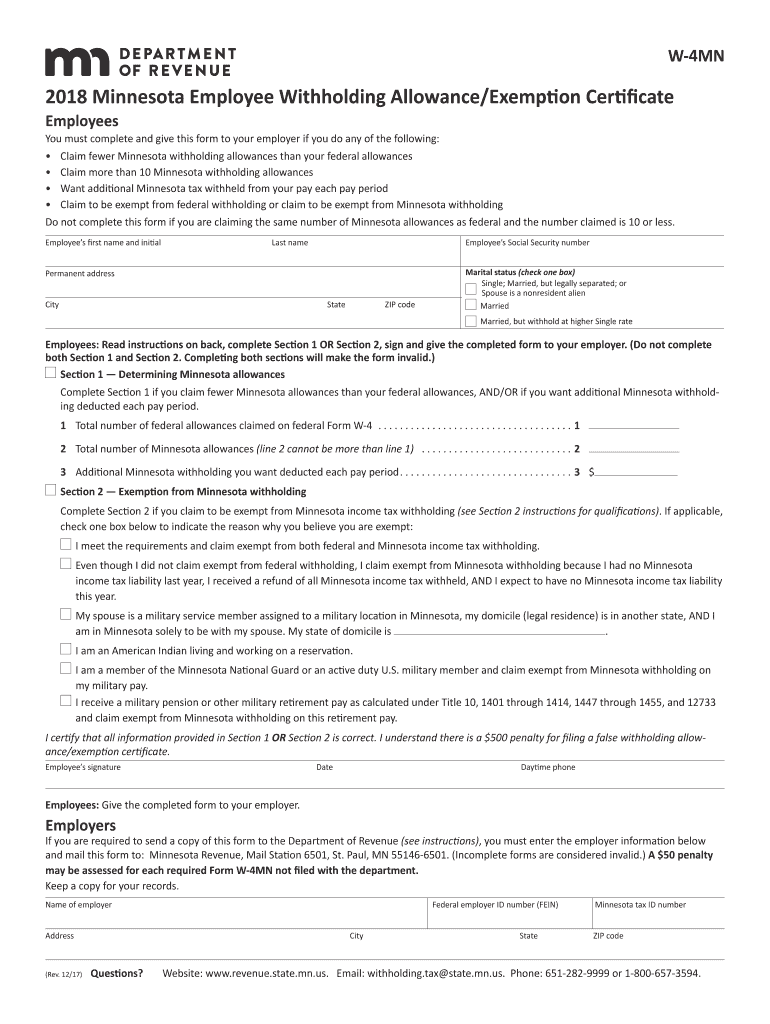

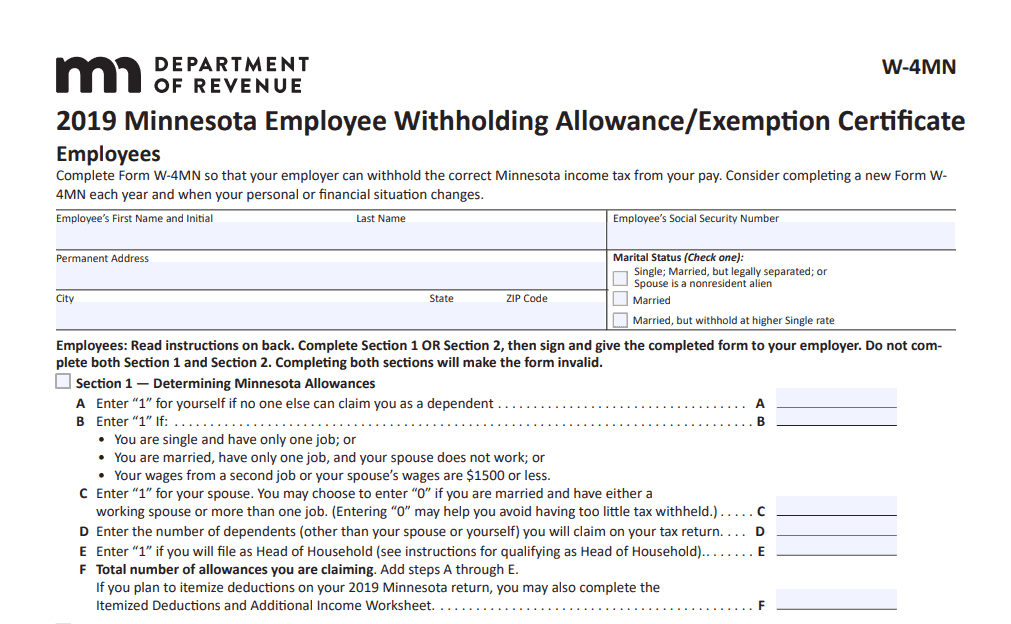

Fillable W4mn, Minnesota Employee Withholding Form printable pdf download

What happens if i only fill out step 1 and then sign the form? Your withholding is subject to review by the irs. Complete this form to calculate the amount of minnesota income tax to be withheld from your payments or distributions. How do i fix this? For each withholding allowance you claim, you reduce the amount of income tax.

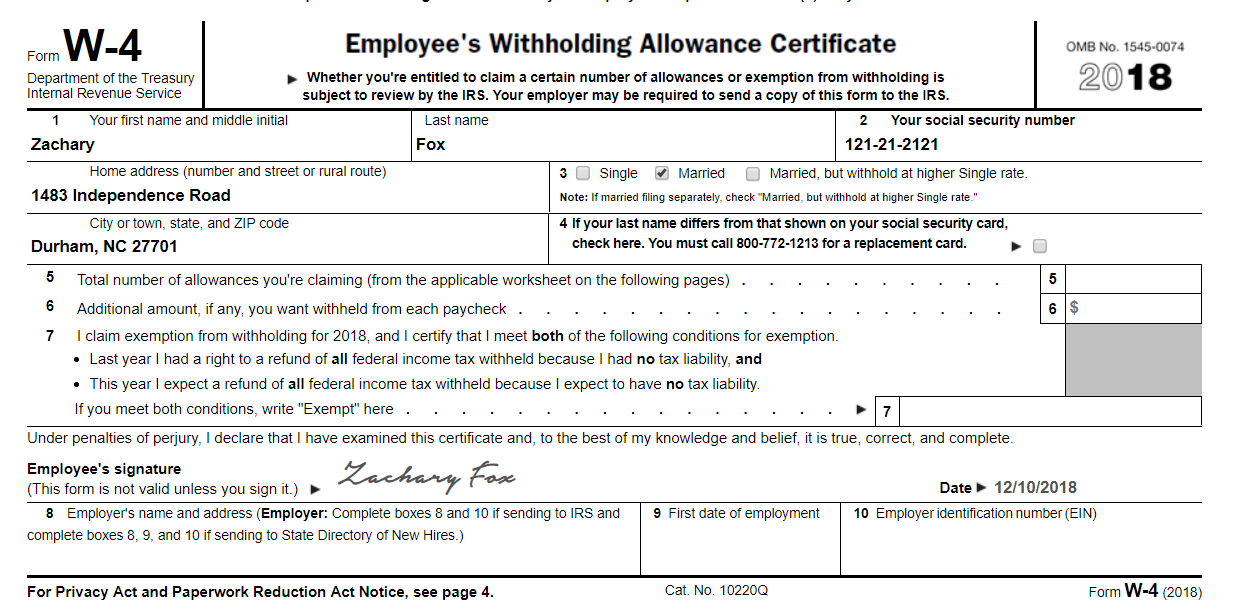

W4 Form Complete The W4 Form For Zachary Fox, A

What happens if i only fill out step 1 and then sign the form? What if i am exempt from minnesota withholding? How do i fix this? Web you must complete and give this form to your employer if you do any of the following: Your withholding is subject to review by the irs.

Form W 4MN, Minnesota Employee Withholding Allowance Fill Out and

•ewer minnesota withholding allowances than your federal allowances claim f • claim more than 10 minnesota withholding allowances •ant additional minnesota tax withheld from your pay each pay period w For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. Your withholding is subject to review by the irs. Keep all forms in.

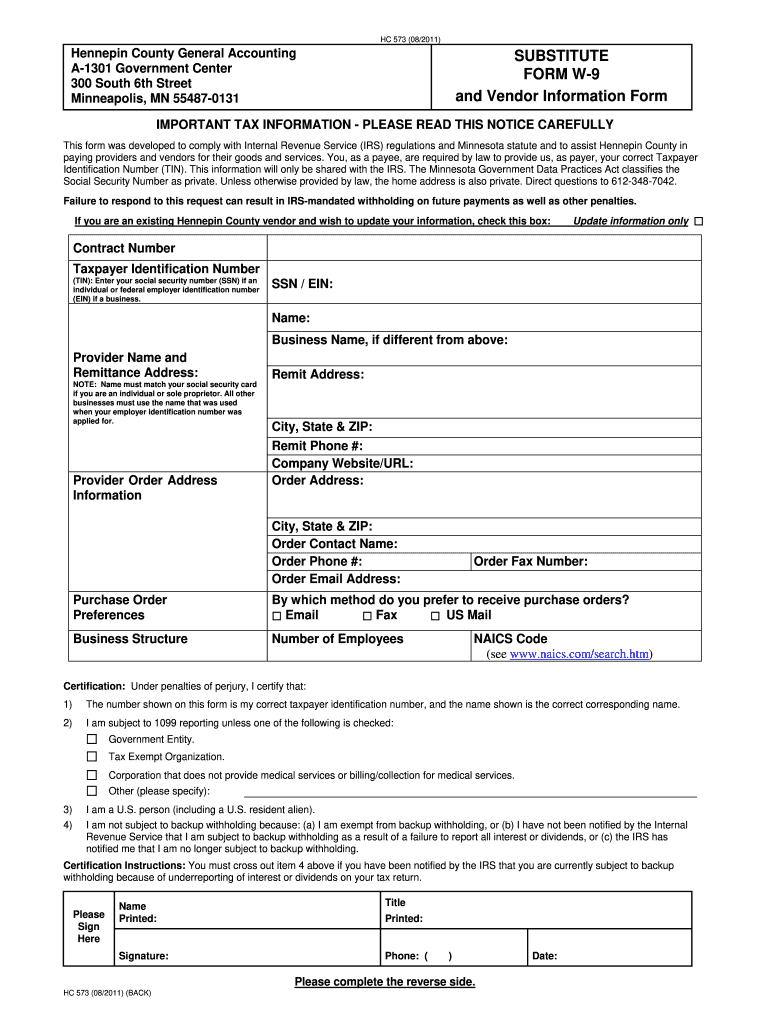

Minnesota W 9 2020 Fill Out and Sign Printable PDF Template signNow

Anything agency employees can use as a reference tool? What happens if i only fill out step 1 and then sign the form? Your withholding is subject to review by the irs. Minnesota requires nonresident aliens to claim single with no withholding allowances. Keep all forms in your records.

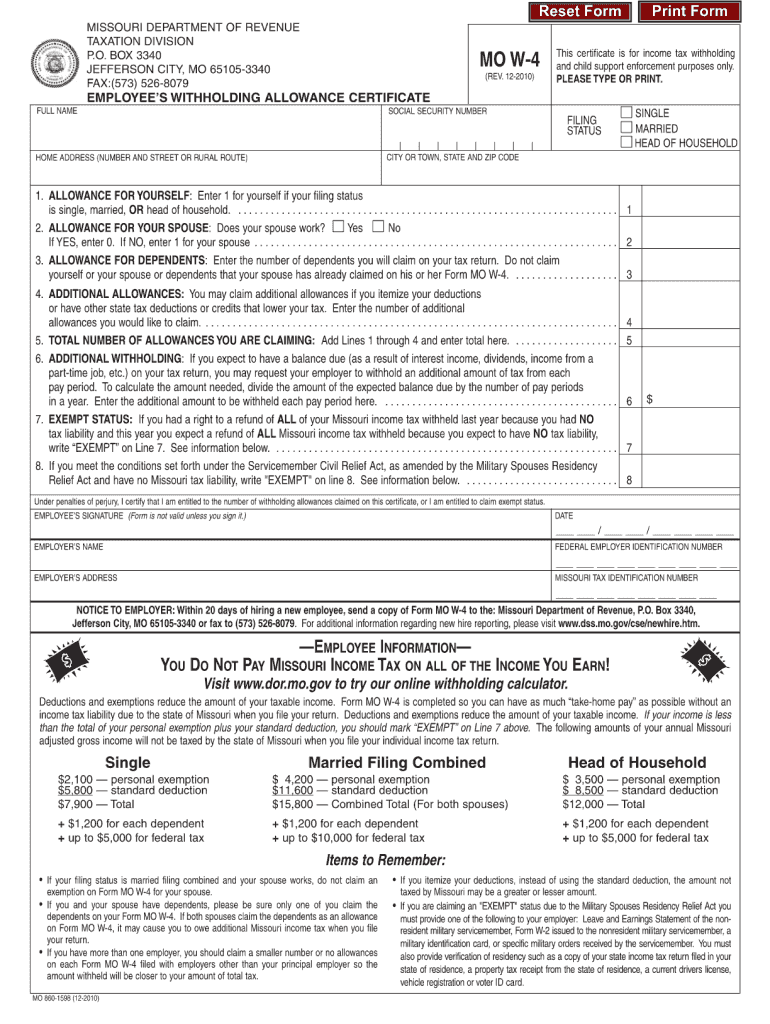

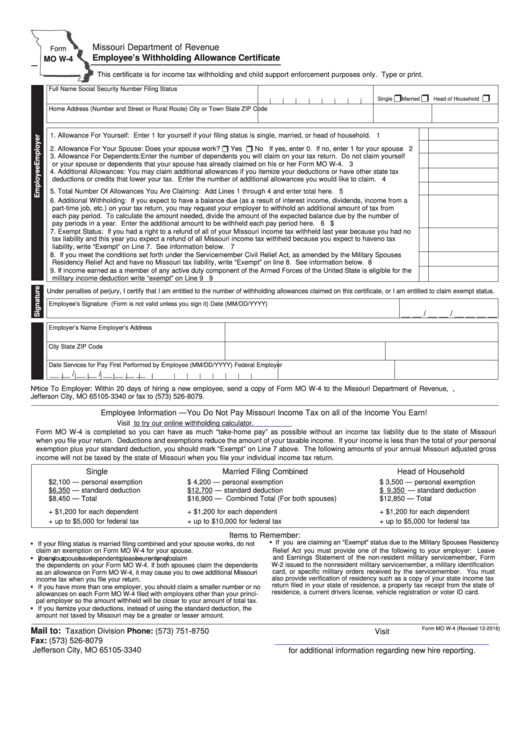

Mo W4 2021 Form 2022 W4 Form

How do i fix this? Anything agency employees can use as a reference tool? Minnesota requires nonresident aliens to claim single with no withholding allowances. What happens if i only fill out step 1 and then sign the form? December 2020) department of the treasury internal revenue service.

Fillable Form Mo W4 Employee'S Withholding Allowance Certificate

What happens to my lock in letter? December 2020) department of the treasury internal revenue service. Your withholding is subject to review by the irs. What if i am exempt from minnesota withholding? Minnesota requires nonresident aliens to claim single with no withholding allowances.

W 4 Form 2021 Printable Form 2021

Anything agency employees can use as a reference tool? •ewer minnesota withholding allowances than your federal allowances claim f • claim more than 10 minnesota withholding allowances •ant additional minnesota tax withheld from your pay each pay period w What if i am exempt from minnesota withholding? For each withholding allowance you claim, you reduce the amount of income tax.

How to Fill a W4 Form (with Guide)

Complete this form to calculate the amount of minnesota income tax to be withheld from your payments or distributions. What happens if i only fill out step 1 and then sign the form? For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. December 2020) department of the treasury internal revenue service. How.

W 4 Mn Form 2021 2022 W4 Form

Anything agency employees can use as a reference tool? For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages. December 2020) department of the treasury internal revenue service. How do i fix this? Your withholding is subject to review by the irs.

Keep All Forms In Your Records.

Complete this form to calculate the amount of minnesota income tax to be withheld from your payments or distributions. Web you must complete and give this form to your employer if you do any of the following: Anything agency employees can use as a reference tool? For each withholding allowance you claim, you reduce the amount of income tax withheld from your wages.

Your Withholding Is Subject To Review By The Irs.

How do i fix this? December 2020) department of the treasury internal revenue service. What happens to my lock in letter? Minnesota requires nonresident aliens to claim single with no withholding allowances.

•Ewer Minnesota Withholding Allowances Than Your Federal Allowances Claim F • Claim More Than 10 Minnesota Withholding Allowances •Ant Additional Minnesota Tax Withheld From Your Pay Each Pay Period W

What happens if i only fill out step 1 and then sign the form? What if i am exempt from minnesota withholding?