Net Present Value Excel Template

Net Present Value Excel Template - You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web how do you calculate net present value in excel? Web what is net present value (npv)? Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. This template helps you to. It’s widely used in the financial world and is. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Alternatively, you can use the excel formula. Web pv, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate.you can use pv with either periodic, constant.

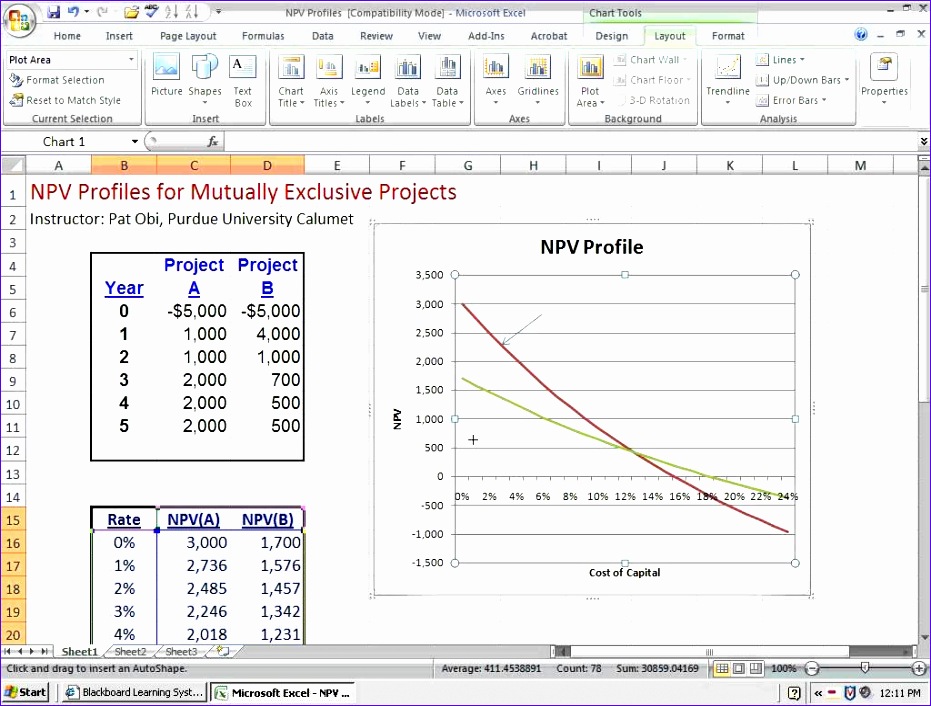

For example, project a requires. Alternatively, you can use the excel formula. Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web what is net present value (npv)? Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. It’s widely used in the financial world and is. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web excel templates calculating net present value (npv) using excel calculating net present value (npv) using excel in finance, it is simply not enough to compare the total.

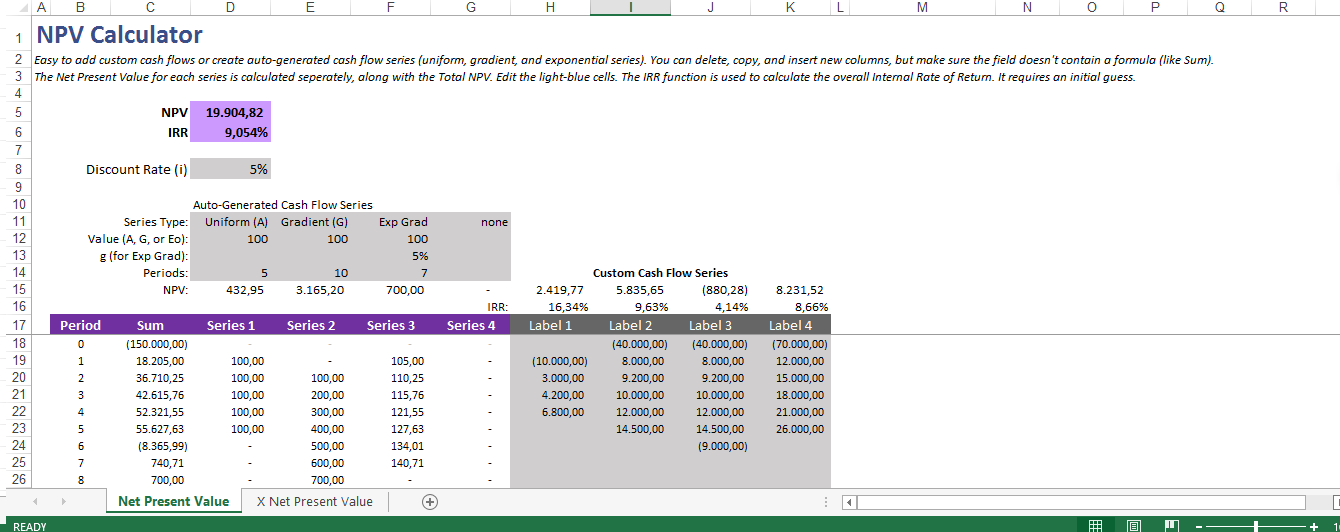

Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Web a net present value that is positive signifies that the projected earnings of a project or investment are due to exceed the expected costs. Web what is net present value (npv)? To calculate the net present. The formula for npv is: Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. It’s widely used in the financial world and is. For example, project a requires. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows.

Net Present Value Calculator »

You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. This template helps you to. Where n is the number of. Web pv, one of the financial functions, calculates.

Net Present Value Calculator Template Templates at

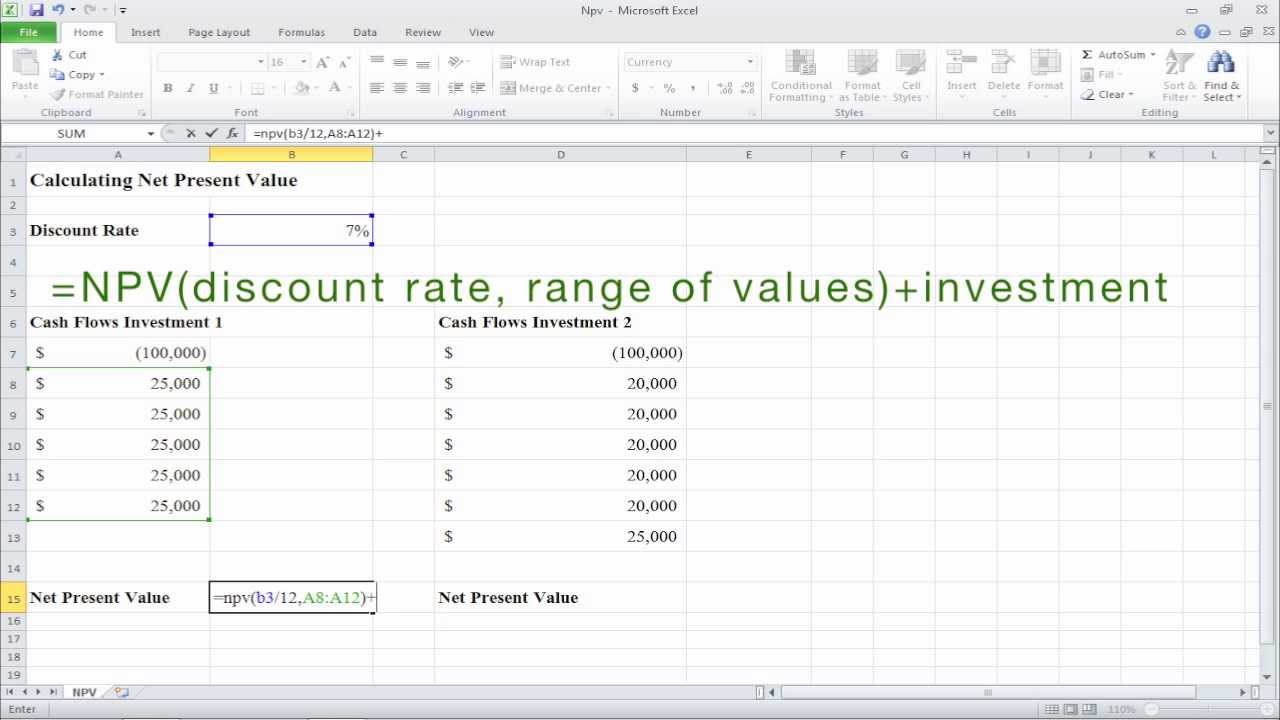

Web excel templates calculating net present value (npv) using excel calculating net present value (npv) using excel in finance, it is simply not enough to compare the total. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web understanding the npv function the npv function simply calculates the present value.

Net Present Value Calculator Excel Template SampleTemplatess

Web how to use the npv formula in excel. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. It’s widely used in the financial world and is..

Professional Net Present Value Calculator Excel Template Excel TMP

Usually, a project that has a positive. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. For example, project a requires. Web how do you calculate net present value in excel? This template helps you to.

How to Calculate Net Present Value (Npv) in Excel YouTube

To calculate the net present. Where n is the number of. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web pv, one of the financial.

Best Net Present Value Formula Excel transparant Formulas

Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web what is net present value (npv)? You can use our free npv calculator to calculate the net present value of up to 10 cash flows. This is not rocket science. Web how do you calculate net.

Net Present Value Calculator Excel Templates

Web how to use the npv formula in excel. Web excel templates calculating net present value (npv) using excel calculating net present value (npv) using excel in finance, it is simply not enough to compare the total. Web a net present value that is positive signifies that the projected earnings of a project or investment are due to exceed the.

10 Excel Net Present Value Template Excel Templates

This template helps you to. Web how to use the npv formula in excel. For example, project a requires. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web you can use our free npv calculator to calculate the net present value of up to 10.

8 Npv Calculator Excel Template Excel Templates

This template helps you to. To calculate the net present. Alternatively, you can use the excel formula. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows.

Net Present Value Formula Examples With Excel Template

Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. Web a net present value that is positive signifies that the projected earnings of a project or investment are due to exceed the expected costs. The formula for npv is: Web excel templates calculating net present value (npv).

The Formula For Npv Is:

It’s widely used in the financial world and is. Web excel templates calculating net present value (npv) using excel calculating net present value (npv) using excel in finance, it is simply not enough to compare the total. Web how do you calculate net present value in excel? Web what is net present value (npv)?

Where N Is The Number Of.

Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. To calculate the net present.

For Example, Project A Requires.

This is not rocket science. Alternatively, you can use the excel formula. Web pv, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate.you can use pv with either periodic, constant. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows.

Web A Net Present Value That Is Positive Signifies That The Projected Earnings Of A Project Or Investment Are Due To Exceed The Expected Costs.

This template helps you to. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not.