New Mexico Pit-1 Form

New Mexico Pit-1 Form - The rates vary depending upon your filing status and income. 2 if amending use form 2016. Worksheet for computation of allowable credit for. If you are a new mexico resident, you must file if you meet any of the following conditions: The feature saves you the time. Taxes paid to other states by new mexico residents. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. • every person who is a new mexi co resident. All others must file by april 18, 2023.

If you are a new mexico resident, you must file if you meet any of the following conditions: 2 if amending use form 2021. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. As a new mexico resident, you are required to fill it out and file it annually. 2 if amending use form 2016. • every person who is a new mexi co resident. Taxes paid to other states by new mexico residents. The top tax bracket is 4.9% the. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. The feature saves you the time.

The feature saves you the time. • every person who is a new mexi co resident. As a new mexico resident, you are required to fill it out and file it annually. Taxes paid to other states by new mexico residents. The form records your income. If you are a new mexico resident, you must file if you meet any of the following conditions: All others must file by april 18, 2023. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. The rates vary depending upon your filing status and income. The document has moved here.

NM PITB 20192022 Fill out Tax Template Online US Legal Forms

Web fill, print & go. If you are a new mexico resident, you must file if you meet any of the following conditions: 2 if amending use form 2016. As a new mexico resident, you are required to fill it out and file it annually. Worksheet for computation of allowable credit for.

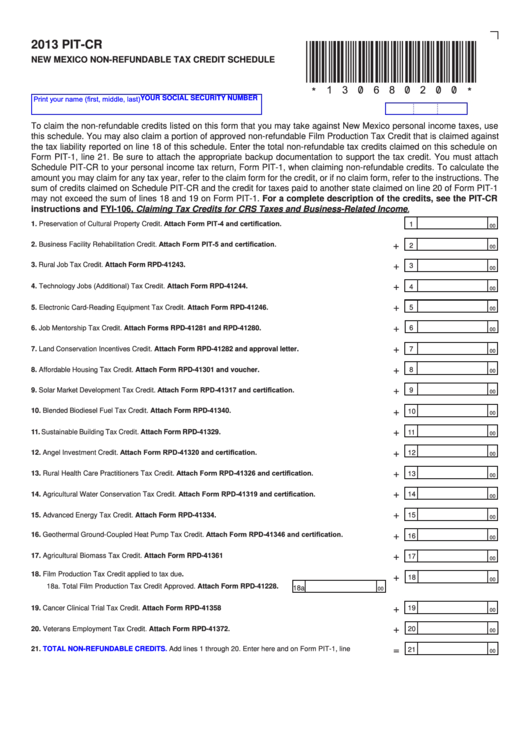

Fillable Form PitCr New Mexico NonRefundable Tax Credit Schedule

2 if amending use form 2021. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. If you are a new mexico resident, you must file if you meet any of the following conditions: The document has moved here. The top tax bracket is 4.9% the.

“The Pit” Renovation The University of New Mexico ChavezGrieves

If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. If you are a new mexico resident, you must file if you meet any of the following conditions: 2 if amending use form 2021. All others must file by april 18, 2023. Web fill, print &.

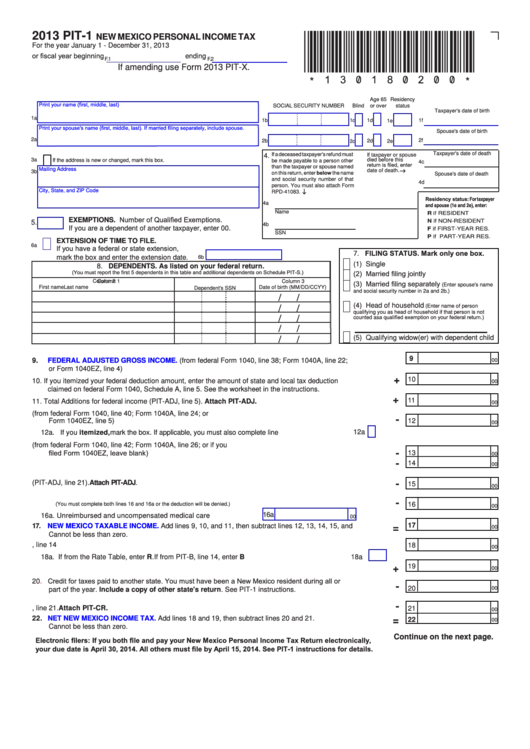

Fillable Form Pit1 New Mexico Personal Tax 2013 printable

Worksheet for computation of allowable credit for. The top tax bracket is 4.9% the. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. The form records your income. This form is for income earned in tax year 2022, with tax.

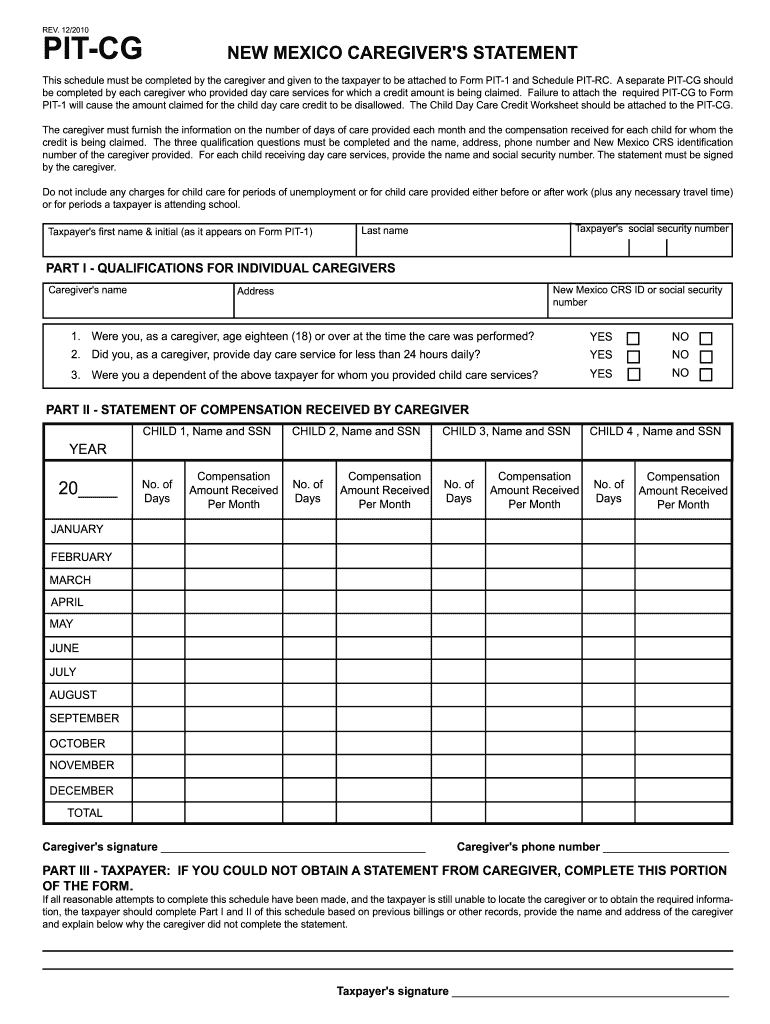

Download Pit Cg Form Tax Fill Out and Sign Printable PDF Template

Taxes paid to other states by new mexico residents. The rates vary depending upon your filing status and income. Web fill, print & go. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. • every person who is a new mexi co resident.

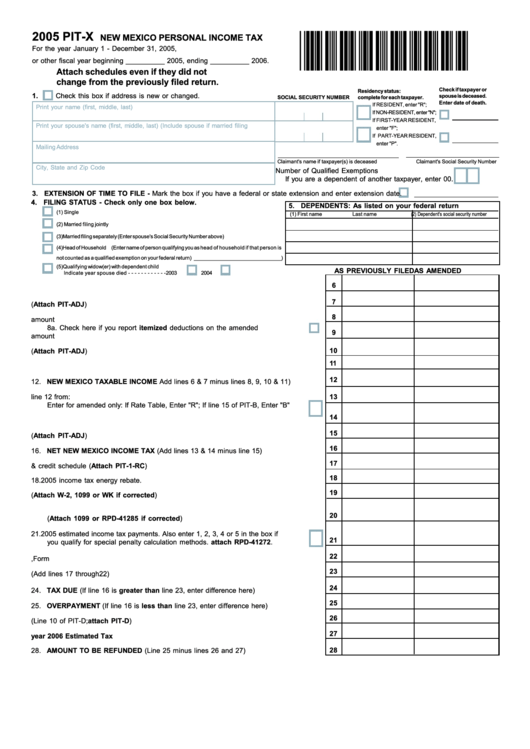

Form PitX New Mexico Personal Tax 2005 printable pdf download

The document has moved here. As a new mexico resident, you are required to fill it out and file it annually. This form is for income earned in tax year 2022, with tax. The feature saves you the time. Web fill, print & go.

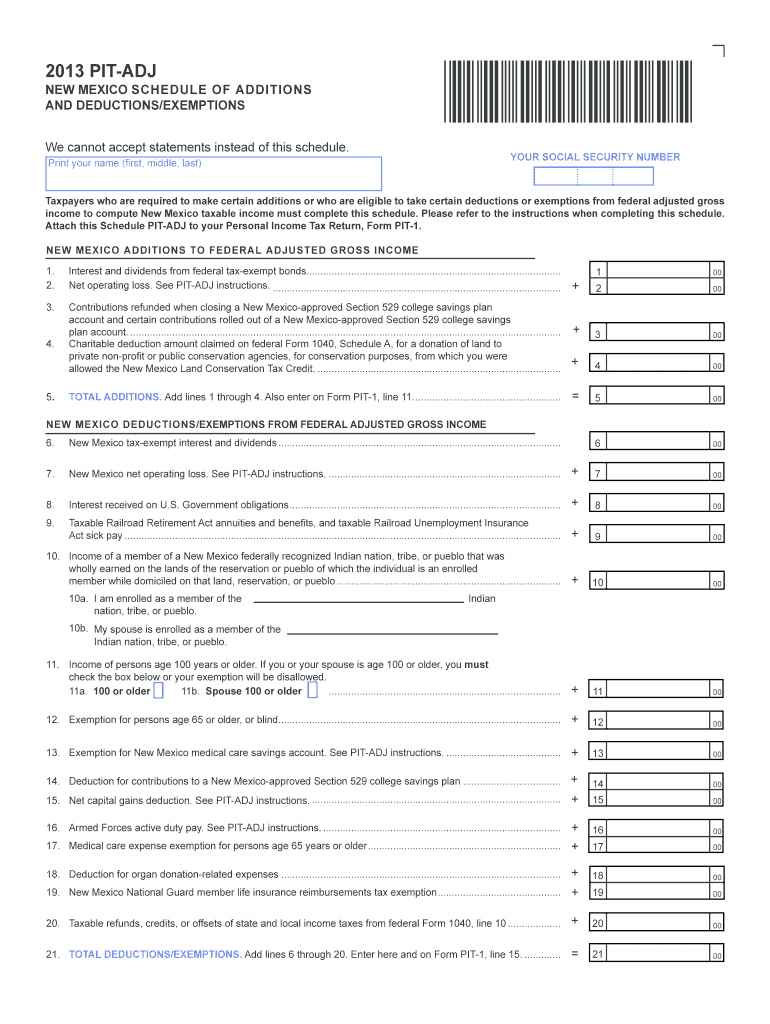

Pit adj 20132019 form Fill out & sign online DocHub

2 if amending use form 2016. Worksheet for computation of allowable credit for. The document has moved here. All others must file by april 18, 2023. The rates vary depending upon your filing status and income.

HD Time Lapse The Pit (Univ. of New Mexico) YouTube

If you are a new mexico resident, you must file if you meet any of the following conditions: The rates vary depending upon your filing status and income. • every person who is a new mexi co resident. As a new mexico resident, you are required to fill it out and file it annually. 2 if amending use form 2021.

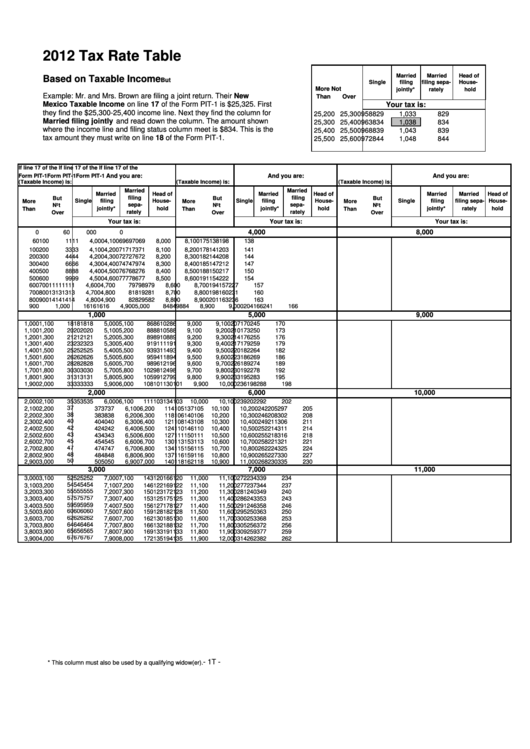

Tax Rate Table Form Based On Taxable State Of New Mexico

This form is for income earned in tax year 2022, with tax. All others must file by april 18, 2023. The feature saves you the time. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. 2 if amending use form 2016.

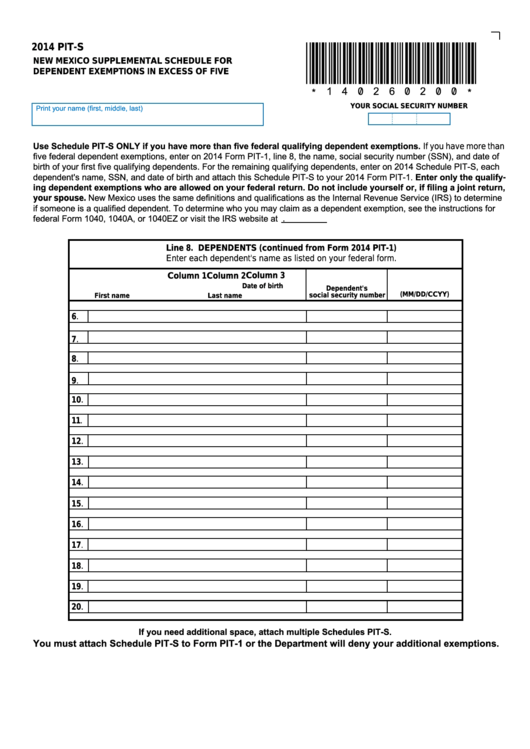

Form PitS New Mexico Supplemental Schedule For Dependent Exemptions

The document has moved here. Worksheet for computation of allowable credit for. 2 if amending use form 2016. If you are a new mexico resident, you must file if you meet any of the following conditions: This form is for income earned in tax year 2022, with tax.

All Others Must File By April 18, 2023.

If you are a new mexico resident, you must file if you meet any of the following conditions: The feature saves you the time. As a new mexico resident, you are required to fill it out and file it annually. 2 if amending use form 2021.

• Every Person Who Is A New Mexi Co Resident.

The form records your income. The document has moved here. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. This form is for income earned in tax year 2022, with tax.

Worksheet For Computation Of Allowable Credit For.

Web fill, print & go. 2 if amending use form 2016. The top tax bracket is 4.9% the. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.

Taxes Paid To Other States By New Mexico Residents.

The rates vary depending upon your filing status and income.