North Dakota Tax Form

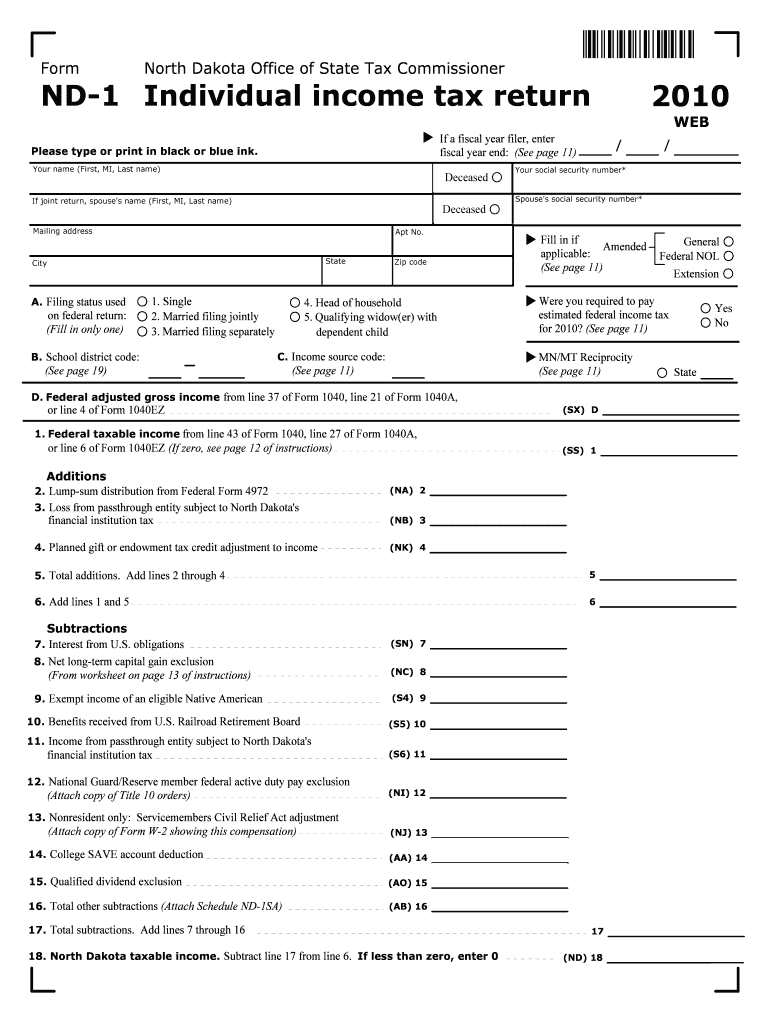

North Dakota Tax Form - Web forms amendment attention: Taxformfinder provides printable pdf copies of 45 current north dakota income tax forms. Forms library over 480,000 individual income tax returns were filed in north dakota for tax year 2020. If zero, enter zero b. All forms are printable and downloadable. You can print other north dakota tax forms here. The current tax year is 2022, with tax returns due in april 2023. Web north dakota usually releases forms for the current tax year between january and april. If zero, see instructions (sx) 1a (ss) 1b additions subtractions 6. (see instructions) / / a.

(see instructions) / / a. The current tax year is 2022, with tax returns due in april 2023. Web north dakota usually releases forms for the current tax year between january and april. Use fill to complete blank online state of north dakota (nd) pdf forms for free. Show sources > about the individual income tax Web printable north dakota state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web manage your north dakota business tax accounts with taxpayer access point (tap). The north dakota income tax rate for tax year 2022 is progressive from a low of 1.1% to a high of 2.9%. This form is for income earned in tax year 2022, with tax returns due in april 2023. These 2021 forms and more are available:

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the full use tax to north dakota regardless of whether you paid any tax to that country on the purchase. The north dakota income tax rate for tax year 2022 is progressive from a low of 1.1% to a high of 2.9%. Gross receipts tax is applied to sales of: Details on how to only prepare and print a current tax year north dakota tax return. If zero, enter zero b. Taxformfinder provides printable pdf copies of 45 current north dakota income tax forms. Forms are listed below by tax type in the current tax year. Items subject to use tax (line 4 on return) enter the total purchase price of tangible personal property or taxable services purchased by you for your own use on which you did not pay sales tax to your suppliers. If you owe use tax to north dakota, you must file a north dakota use tax return using theone time remittance form.

North Dakota State Tax Calculator Community Tax

If zero, see instructions (sx) 1a (ss) 1b additions subtractions 6. Web printable north dakota state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in north.

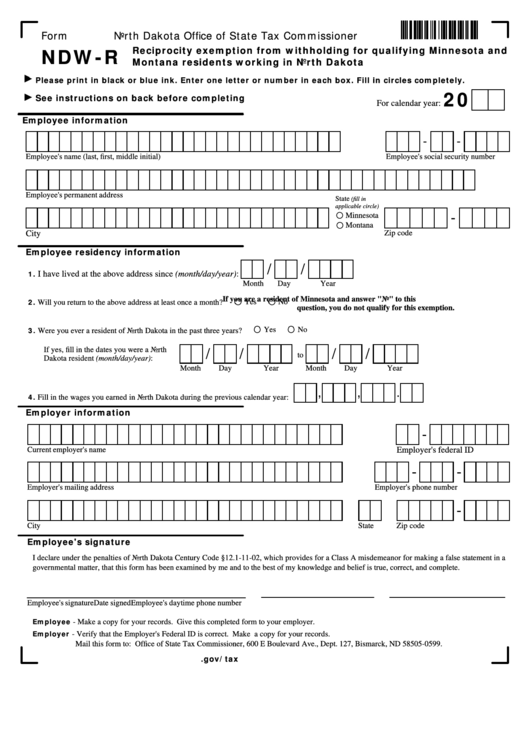

NdwR North Dakota Tax Forms Reciprocity Exemption From Withholding For

All forms are printable and downloadable. This form is for income earned in tax year 2022, with tax returns due in april 2023. If zero, enter zero b. (see instructions) / / a. Web forms amendment attention:

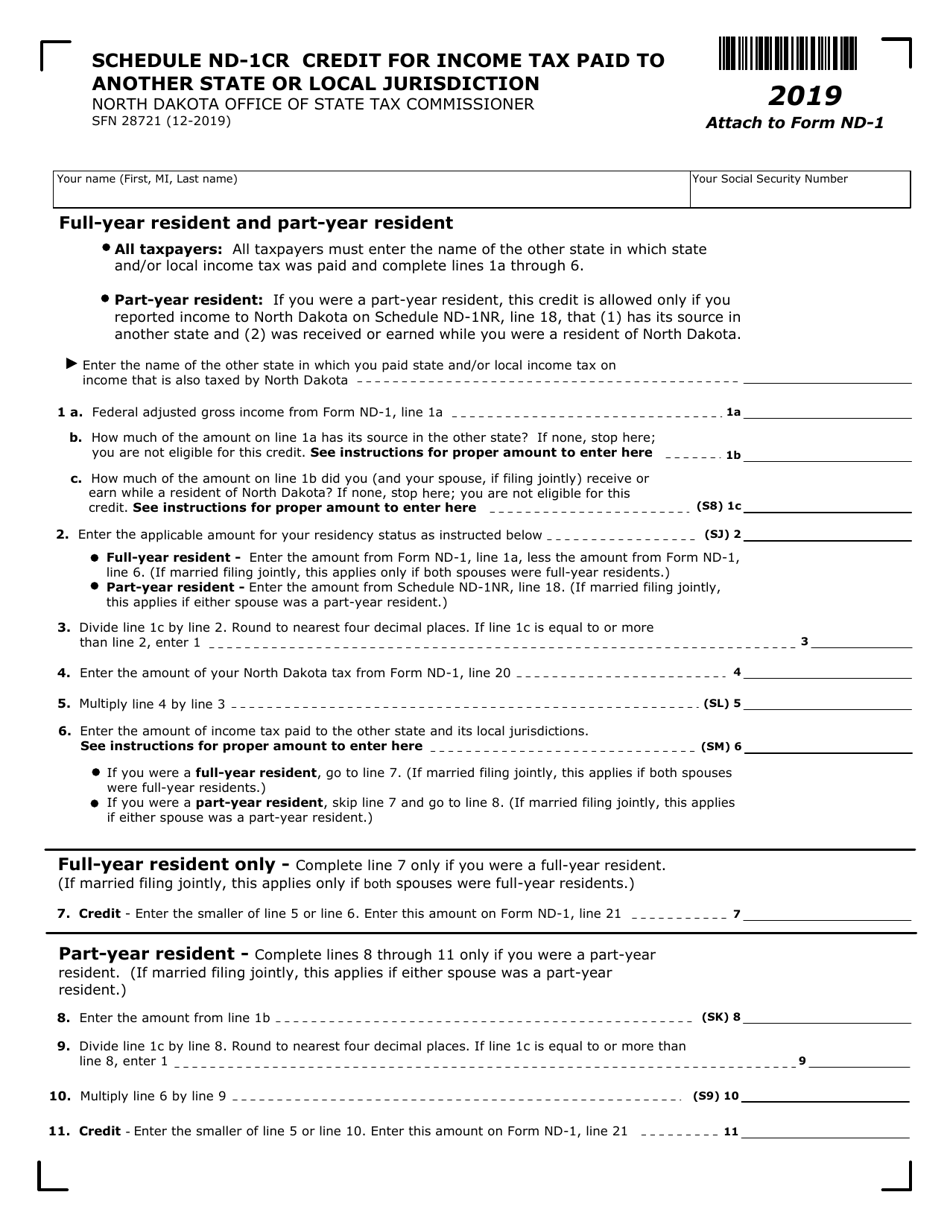

Form ND1 (SFN28721) Schedule ND1CR Download Fillable PDF or Fill

You can print other north dakota tax forms here. For more information about the north dakota income tax, see the north dakota income tax page. The north dakota income tax rate for tax year 2022 is progressive from a low of 1.1% to a high of 2.9%. Find irs or federal tax return deadline details. Forms library over 480,000 individual.

Form NDWM Download Fillable PDF or Fill Online Exemption From

If zero, enter zero b. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in north dakota during calendar year 2023. This form is for income earned in tax year 2022, with tax returns due in april 2023. Items subject to use tax (line 4 on return) enter.

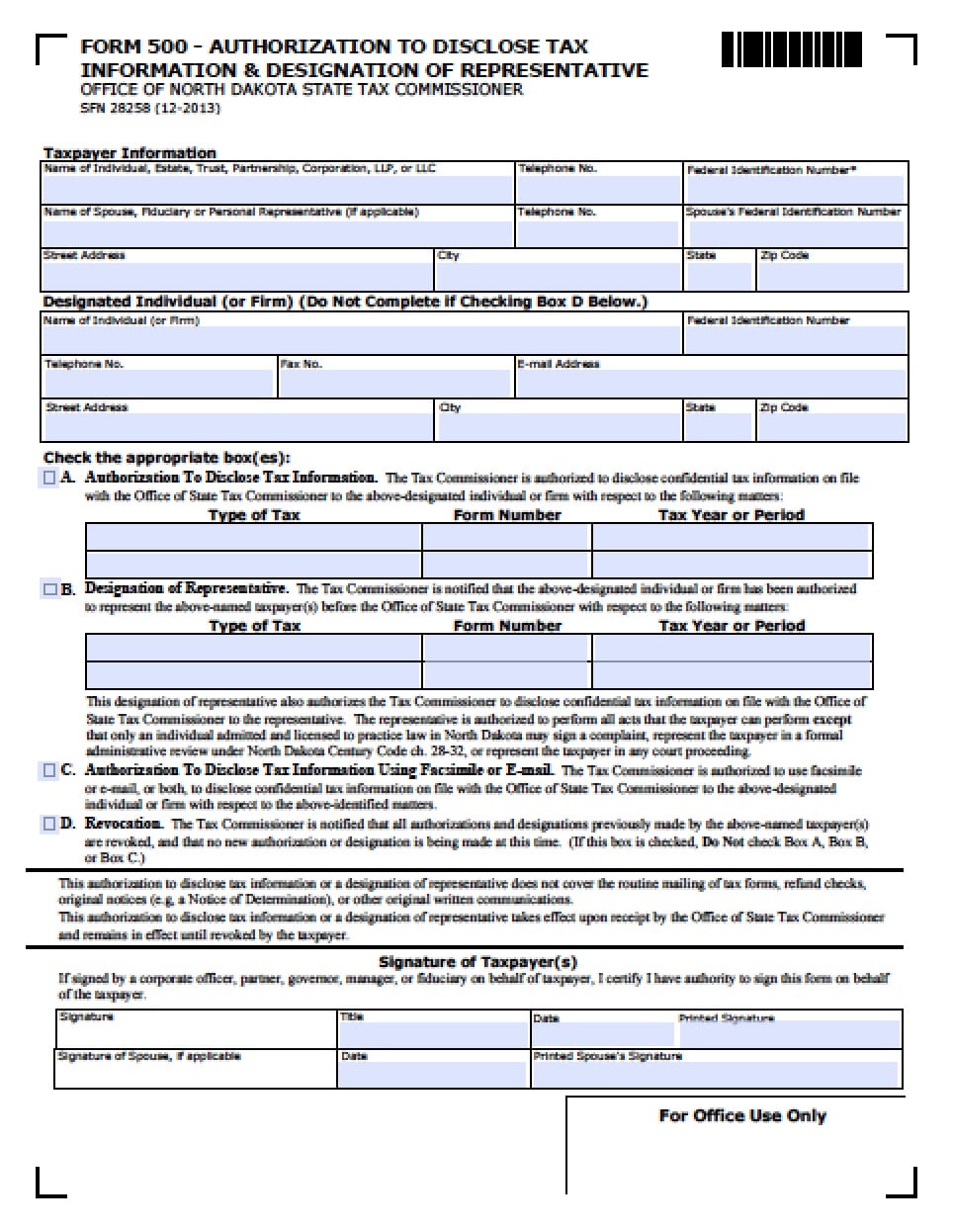

North Dakota Tax Power of Attorney Form Power of Attorney Power of

Web north dakota income tax forms north dakota printable income tax forms 45 pdfs north dakota has a state income tax that ranges between 1.1% and 2.9% , which is administered by the north dakota office of state tax commissioner. These 2021 forms and more are available: If you owe use tax to north dakota, you must file a north.

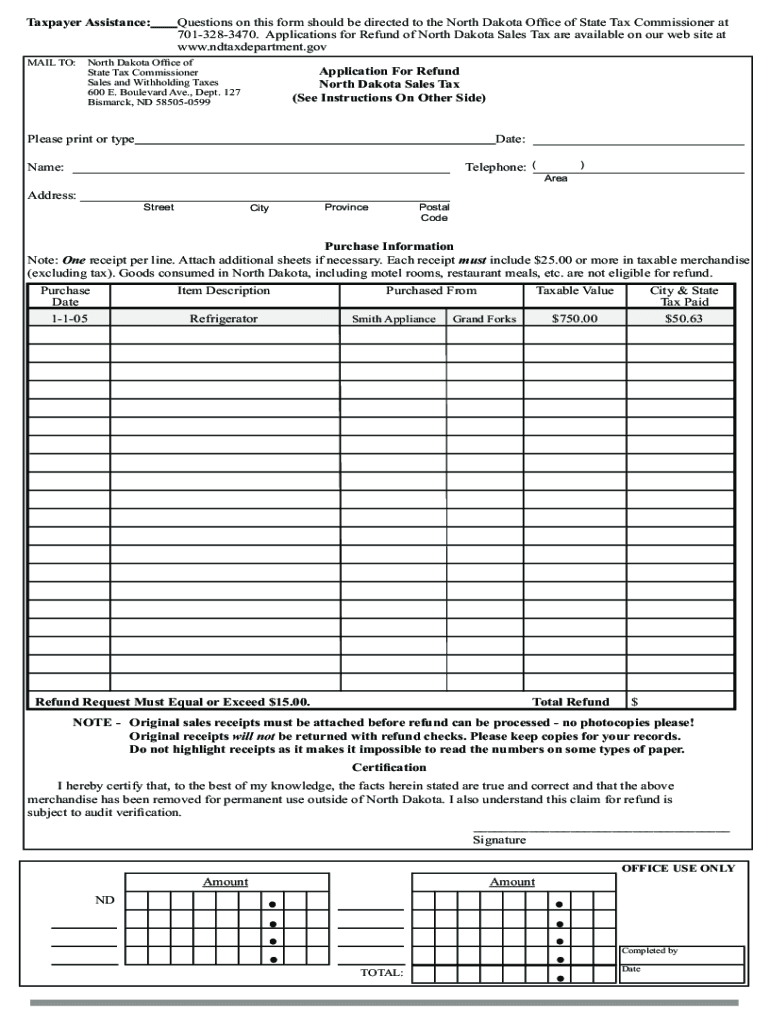

North Dakota Tax Refund Canada Form Fill Out and Sign Printable PDF

Web to find tax forms for the current and previous tax years, visit our forms library where you can search by form name, tax type, tax year, and sfn. Web north dakota usually releases forms for the current tax year between january and april. Individual income tax return (state of north dakota) form. For more information about the north dakota.

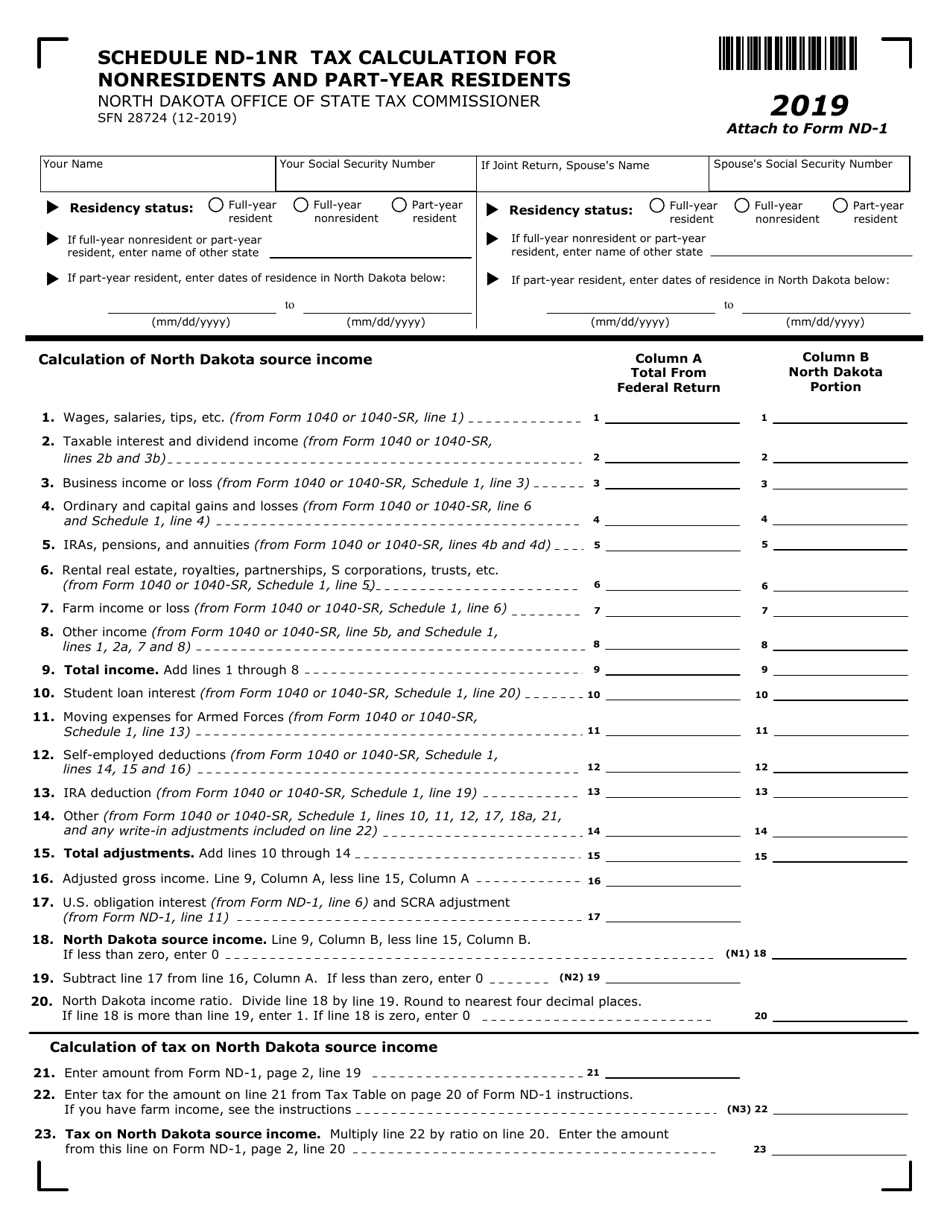

Form ND1 (SFN28724) Schedule NDN1NR Download Fillable PDF or Fill

Web forms amendment attention: Web north dakota usually releases forms for the current tax year between january and april. Gross receipts tax is applied to sales of: Show sources > about the individual income tax Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in north dakota during.

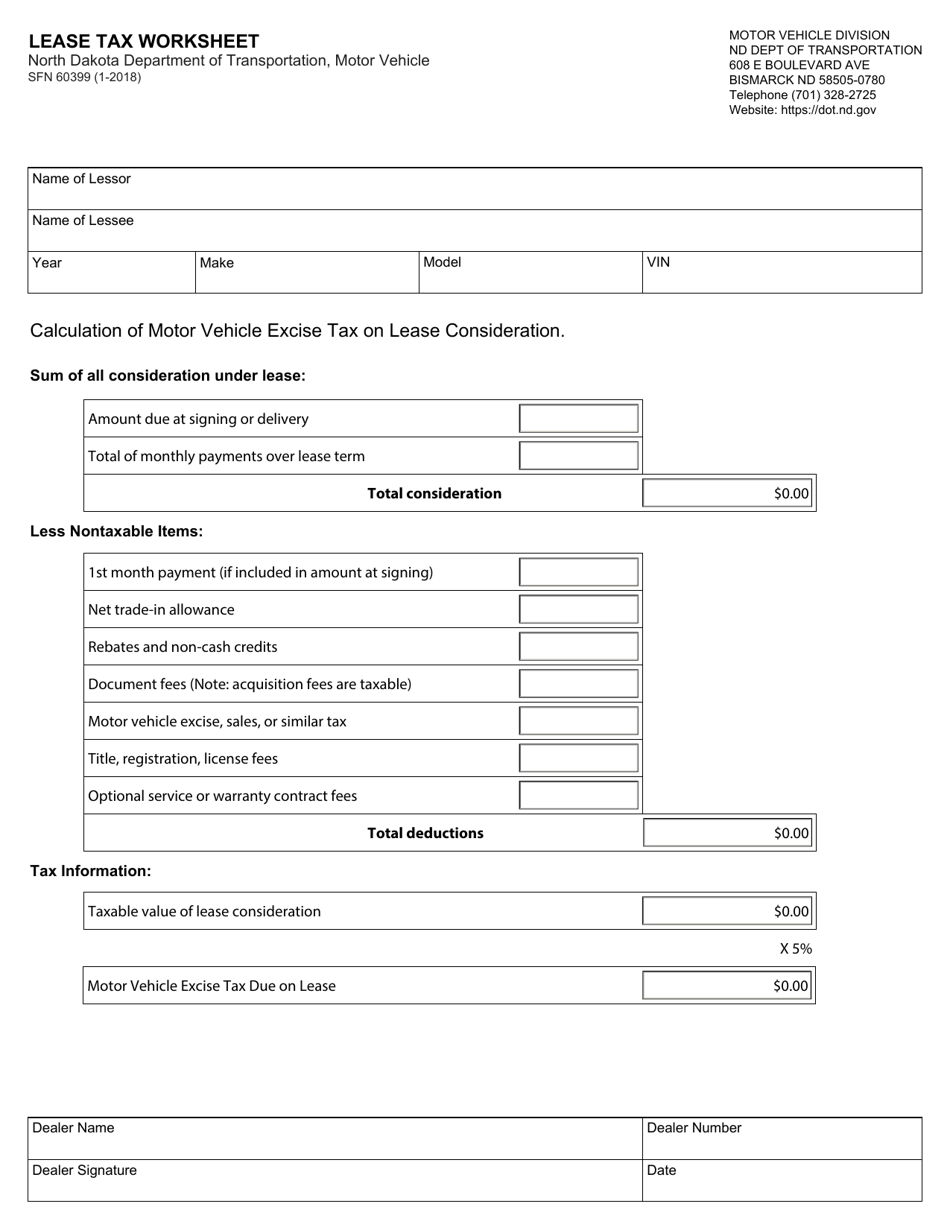

Form SFN60399 Download Fillable PDF or Fill Online Lease Tax Worksheet

Show sources > about the individual income tax Web north dakota income tax forms north dakota printable income tax forms 45 pdfs north dakota has a state income tax that ranges between 1.1% and 2.9% , which is administered by the north dakota office of state tax commissioner. Forms are listed below by tax type in the current tax year..

Nd Fillable Forms Fill Out and Sign Printable PDF Template signNow

If zero, enter zero b. For more information about the north dakota income tax, see the north dakota income tax page. The current tax year is 2022, with tax returns due in april 2023. (see instructions) / / a. Once completed you can sign your fillable form or send for signing.

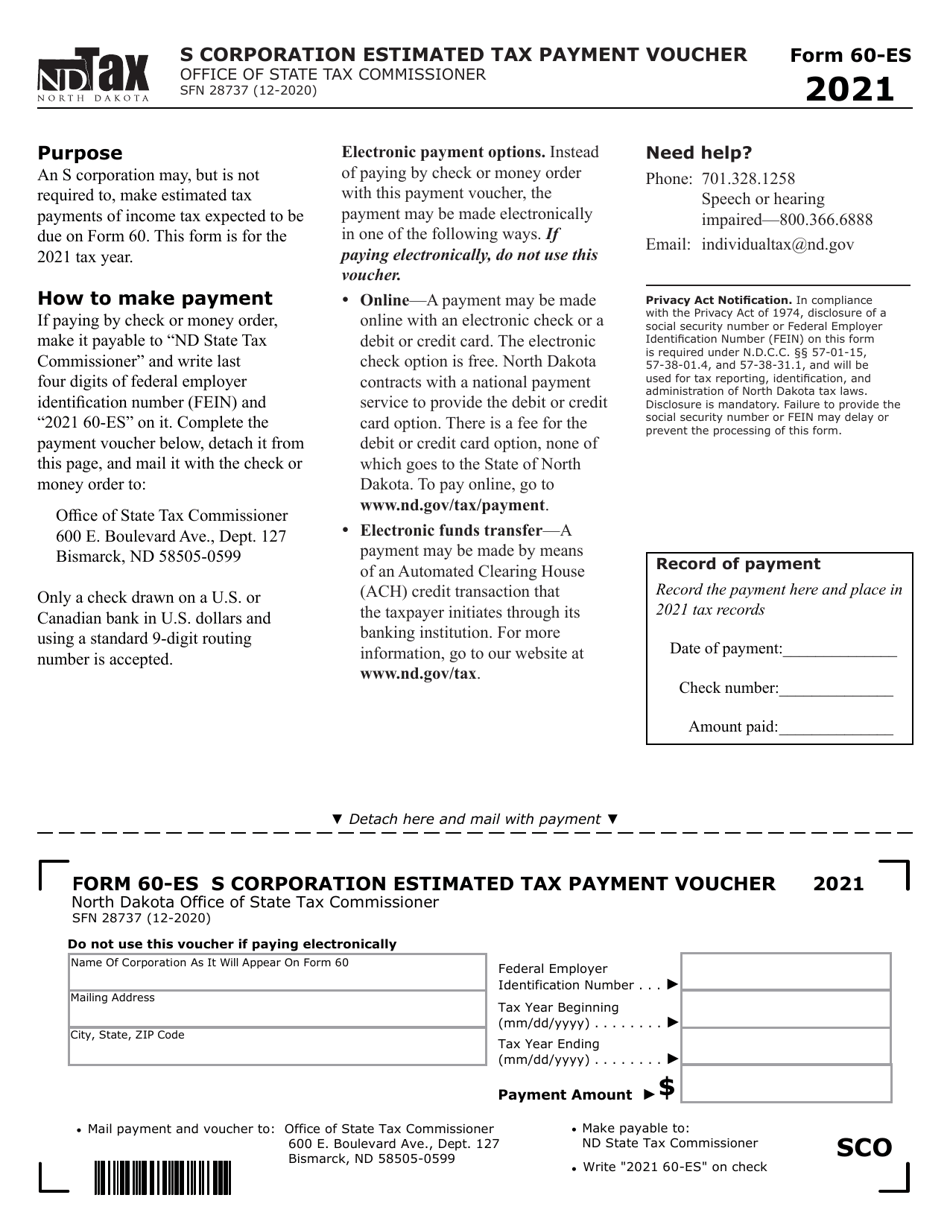

Form 60ES (SFN28737) Download Fillable PDF or Fill Online S

The north dakota state tax return and payment deadline is april 18, 2023. Use fill to complete blank online state of north dakota (nd) pdf forms for free. If zero, enter zero b. Web printable income tax forms. Web north dakota income tax forms north dakota printable income tax forms 45 pdfs north dakota has a state income tax that.

Web Forms Amendment Attention:

North dakota has a state income tax that ranges between 1.1% and 2.9%. The current tax year is 2022, with tax returns due in april 2023. Gross receipts tax is applied to sales of: If zero, see instructions (sx) 1a (ss) 1b additions subtractions 6.

Web To Find Tax Forms For The Current And Previous Tax Years, Visit Our Forms Library Where You Can Search By Form Name, Tax Type, Tax Year, And Sfn.

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in north dakota during calendar year 2023. Web north dakota income tax forms north dakota printable income tax forms 45 pdfs north dakota has a state income tax that ranges between 1.1% and 2.9% , which is administered by the north dakota office of state tax commissioner. Find irs or federal tax return deadline details. Web printable income tax forms.

The North Dakota State Tax Return And Payment Deadline Is April 18, 2023.

Use fill to complete blank online state of north dakota (nd) pdf forms for free. Forms are listed below by tax type in the current tax year. The north dakota income tax rate for tax year 2022 is progressive from a low of 1.1% to a high of 2.9%. For more information about the north dakota income tax, see the north dakota income tax page.

Details On How To Only Prepare And Print A Current Tax Year North Dakota Tax Return.

If you owe use tax to north dakota, you must file a north dakota use tax return using theone time remittance form. If zero, enter zero b. Once completed you can sign your fillable form or send for signing. Taxformfinder provides printable pdf copies of 45 current north dakota income tax forms.