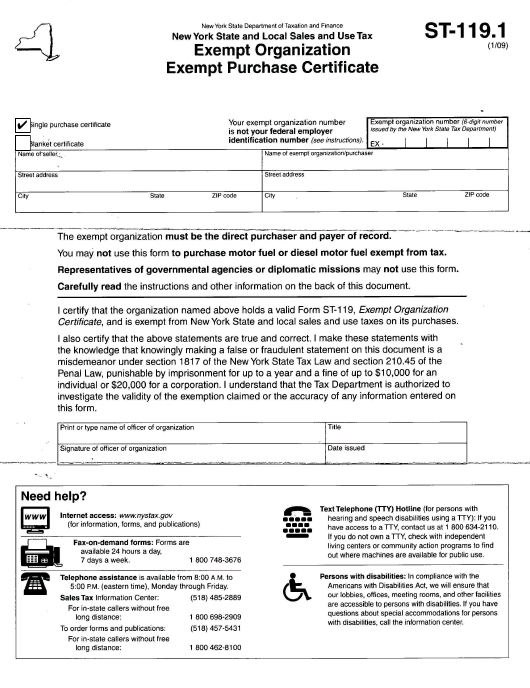

Ny Farm Tax Exempt Form

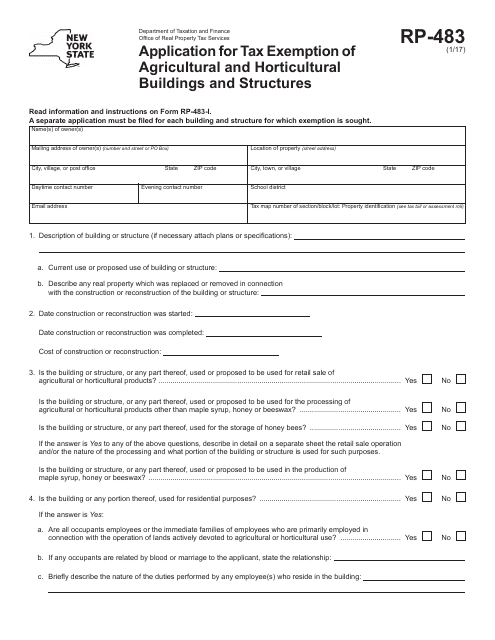

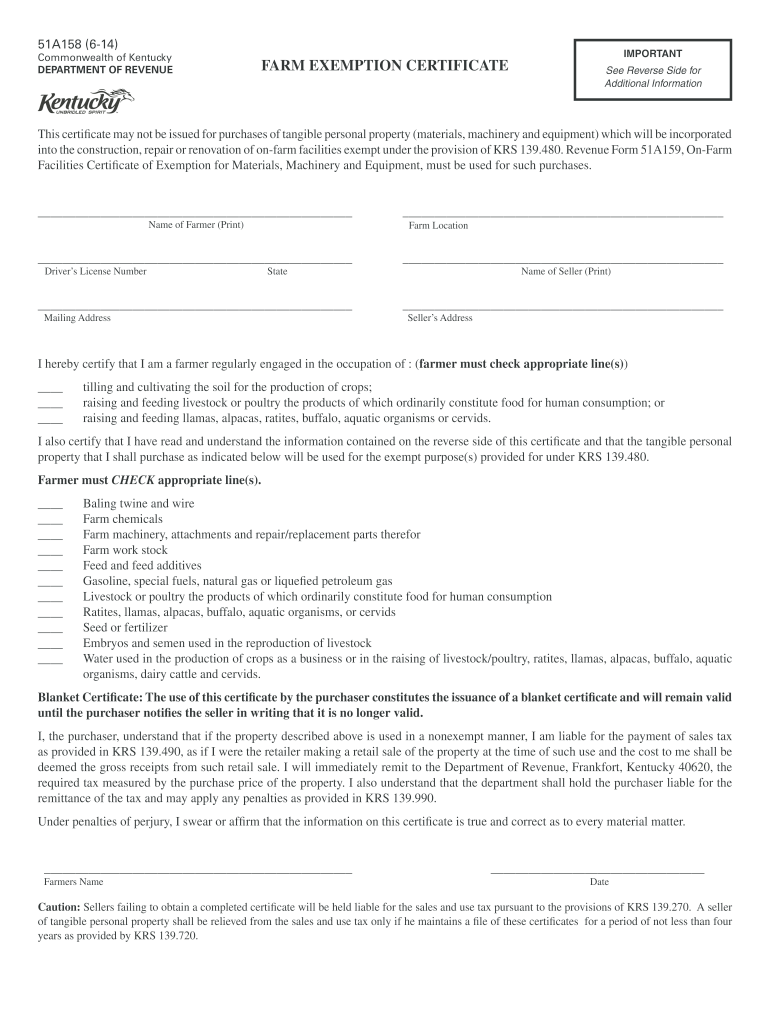

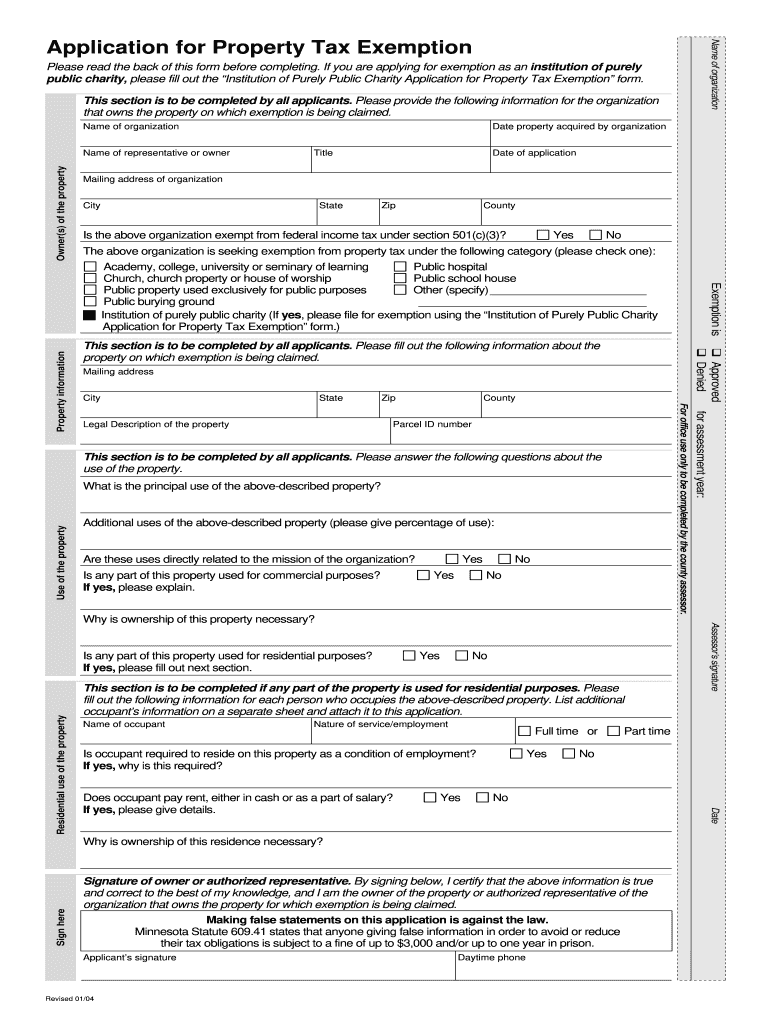

Ny Farm Tax Exempt Form - Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. Of taxation and finance website listed below. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web follow the simple instructions below: Some farm buildings are wholly or partially exempt from. (solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Web (solution found) how to become farm tax exempt in ny? Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Web what are the tax benefits? Web farm building exemption.

These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web 8 rows form title. Certify that i am exempt from payment of sales and use taxes on. Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. This includes most tangible personal. Web follow the simple instructions below: This form is used to report income tax withheld and employer and employee social security. Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. Web (solution found) how to become farm tax exempt in ny? (solution found) to receive the exemption, the landowner must apply for agricultural assessment and.

Web follow the simple instructions below: Web 8 rows form title. Web what are the tax benefits? Web forms are available on the state dept. Of taxation and finance website listed below. This form is used to report income tax withheld and employer and employee social security. Farmers are exempt from paying sales tax on purchases of supplies used in farming. Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Web (solution found) how to become farm tax exempt in ny? Web farm building exemption.

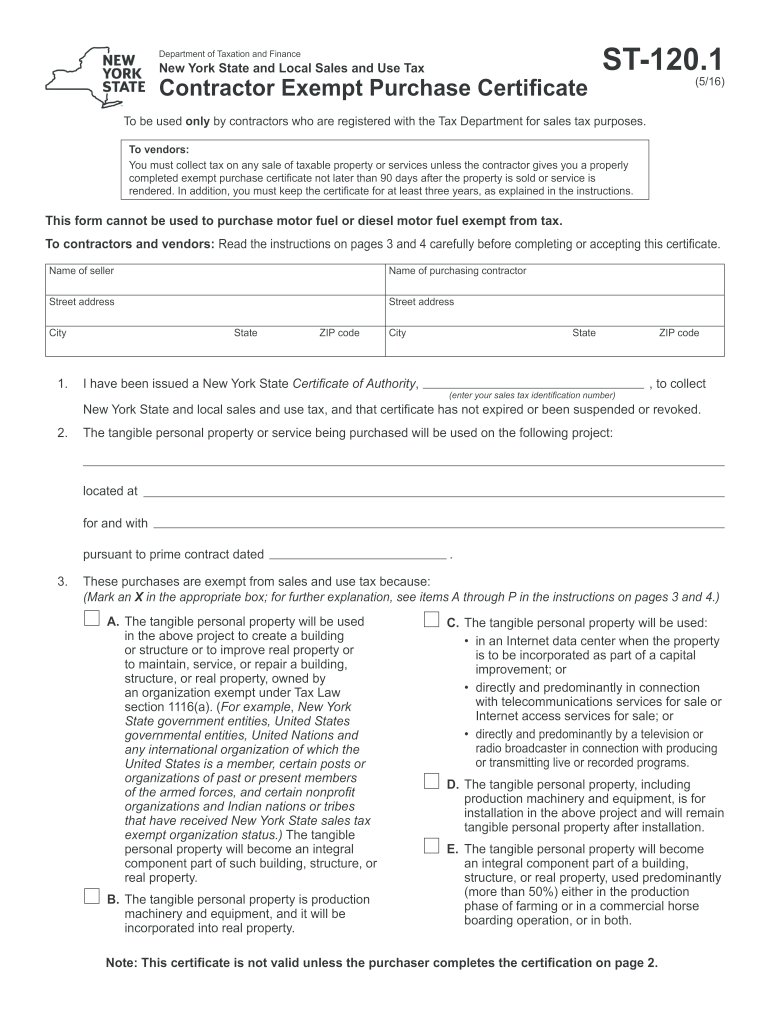

20162020 Form NY DTF ST120.1 Fill Online, Printable, Fillable, Blank

Of taxation and finance website listed below. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web this form illustrates a sample farm work agreement that employers should use to notify each employee in.

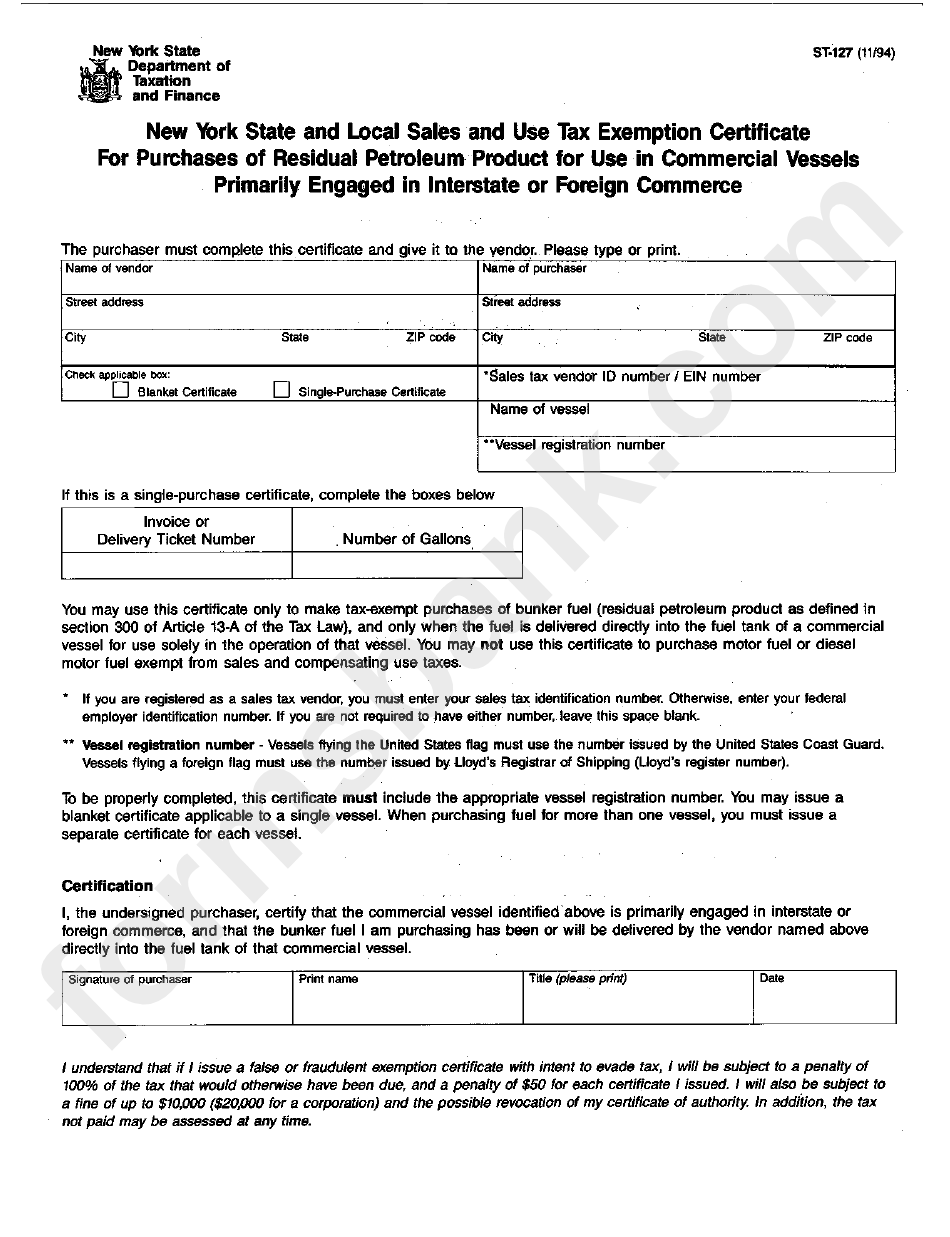

Form St127 New York State And Local Sales And Use Tax Exemption

Web 25 rows farmer’s and commercial horse boarding operator's exemption certificate:. Some farm buildings are wholly or partially exempt from. This form is used to report income tax withheld and employer and employee social security. Farmers are exempt from paying sales tax on purchases of supplies used in farming. (solution found) to receive the exemption, the landowner must apply for.

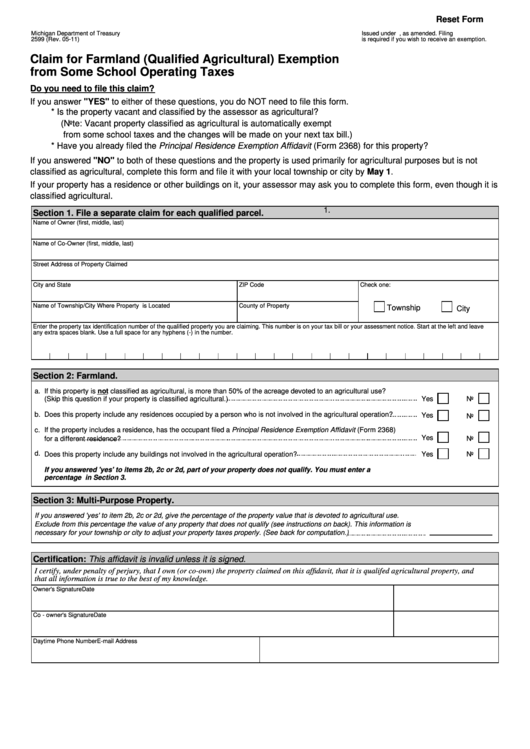

Fillable Form 2599 Claim For Farmland (Qualified Agricultural

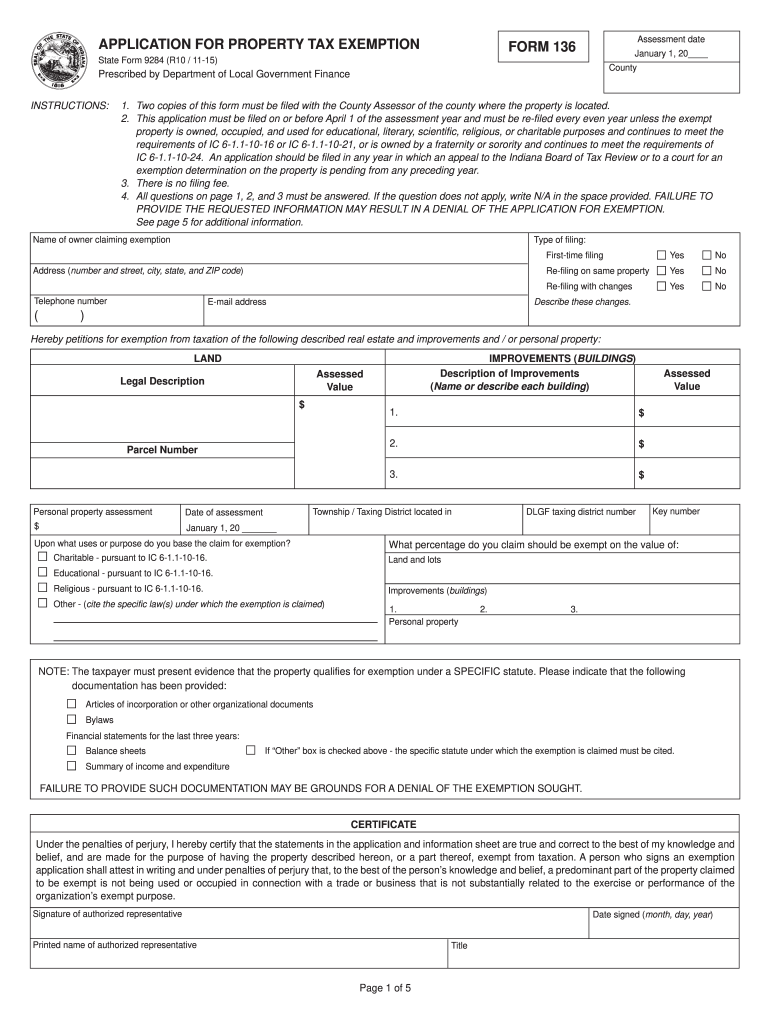

Web (solution found) how to become farm tax exempt in ny? Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. Web farm building exemption. Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. These days, most americans.

Farm Bag Supply Supplier of Agricultural Film

Web the following irs forms and publications relate specifically to farmers: Some farm buildings are wholly or partially exempt from. Web (solution found) how to become farm tax exempt in ny? Web farm building exemption. Please note that the vendor is not.

20152022 IN State Form 9284 Fill Online, Printable, Fillable, Blank

Web 25 rows farmer’s and commercial horse boarding operator's exemption certificate:. Farmers are exempt from paying sales tax on purchases of supplies used in farming. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. Some farm.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at time of commitment to hire. This includes most tangible personal. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web you cannot use this form to.

New York State Tax Exempt Form Farm

Web forms are available on the state dept. Web the following irs forms and publications relate specifically to farmers: Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. Web 8 rows form title. Some farm buildings are wholly or partially exempt from.

Form RP483 Download Fillable PDF or Fill Online Application for Tax

Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at time of commitment to hire. Web follow the simple instructions below: Of taxation and finance website listed below. Web the following irs forms and publications relate specifically to farmers: Web 8 rows form title.

Kentucky Farm Tax Exempt Requirements 2020 Fill and Sign Printable

Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web (solution found) how.

Property Tax Form Pdf Fill Out and Sign Printable PDF Template signNow

Of taxation and finance website listed below. This includes most tangible personal. Web (solution found) how to become farm tax exempt in ny? This form is used to report income tax withheld and employer and employee social security. Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures.

(Solution Found) To Receive The Exemption, The Landowner Must Apply For Agricultural Assessment And.

These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web what are the tax benefits? Of taxation and finance website listed below. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel.

Certify That I Am Exempt From Payment Of Sales And Use Taxes On.

This form is used to report income tax withheld and employer and employee social security. Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. Web (solution found) how to become farm tax exempt in ny? This includes most tangible personal.

Web 25 Rows Farmer’s And Commercial Horse Boarding Operator's Exemption Certificate:.

Web the following irs forms and publications relate specifically to farmers: Farmers are exempt from paying sales tax on purchases of supplies used in farming. Some farm buildings are wholly or partially exempt from. Web farm building exemption.

Web 19 Rows Application For Tax Exemption Of Agricultural And Horticultural Buildings And Structures.

Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at time of commitment to hire. Web follow the simple instructions below: Web 8 rows form title.