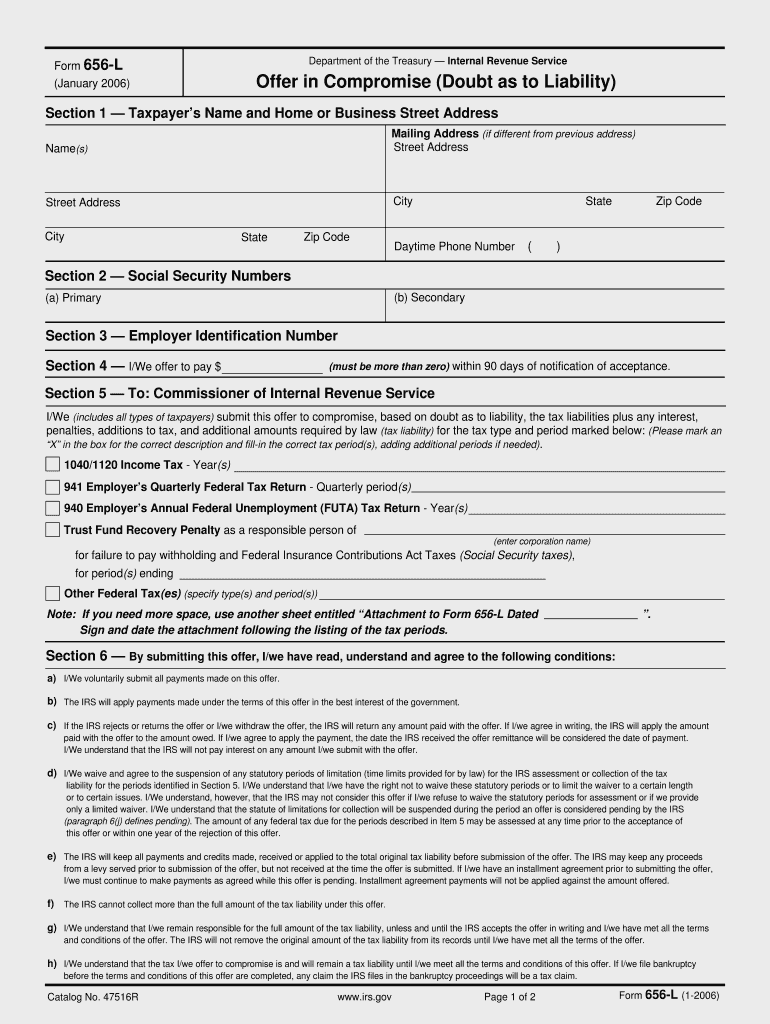

Offer Of Compromise Form

Offer Of Compromise Form - Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. • your income is 125% of the federal poverty. Enter your financial information and tax filing status to calculate a. Web vladimir putin's forces have launched another wave of attacks on odesa. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Web an offer in compromise is an agreement between you and the government to settle a tax debt for less than the amount you are legally obligated to pay. If you do not comply.

Web an offer in compromise is an agreement that, if accepted by the irs, permits you to pay them less than you owe and will settle the tax debt that you included. If you do not comply. And poland is beefing up its border forces after belarus violated its airspace. Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web vladimir putin's forces have launched another wave of attacks on odesa. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Enter your financial information and tax filing status to calculate a. Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. • your income is 125% of the federal poverty.

If you do not comply. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. And poland is beefing up its border forces after belarus violated its airspace. Web you may be eligible for the offer in compromise short form for low income taxpayers based on one of the reasons listed below. Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Web vladimir putin's forces have launched another wave of attacks on odesa. Web what forms do taxpayers need? Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full.

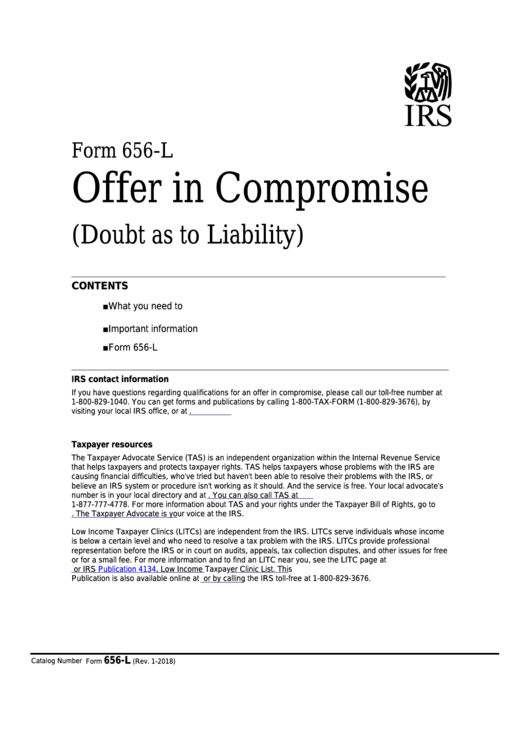

Fillable Form 656L Offer In Compromise (Doubt As To Liability

And poland is beefing up its border forces after belarus violated its airspace. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. If the irs accepts your offer. Web select from one of the.

Irs Offer In Compromise Form 433 A (oic) Universal Network

Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an.

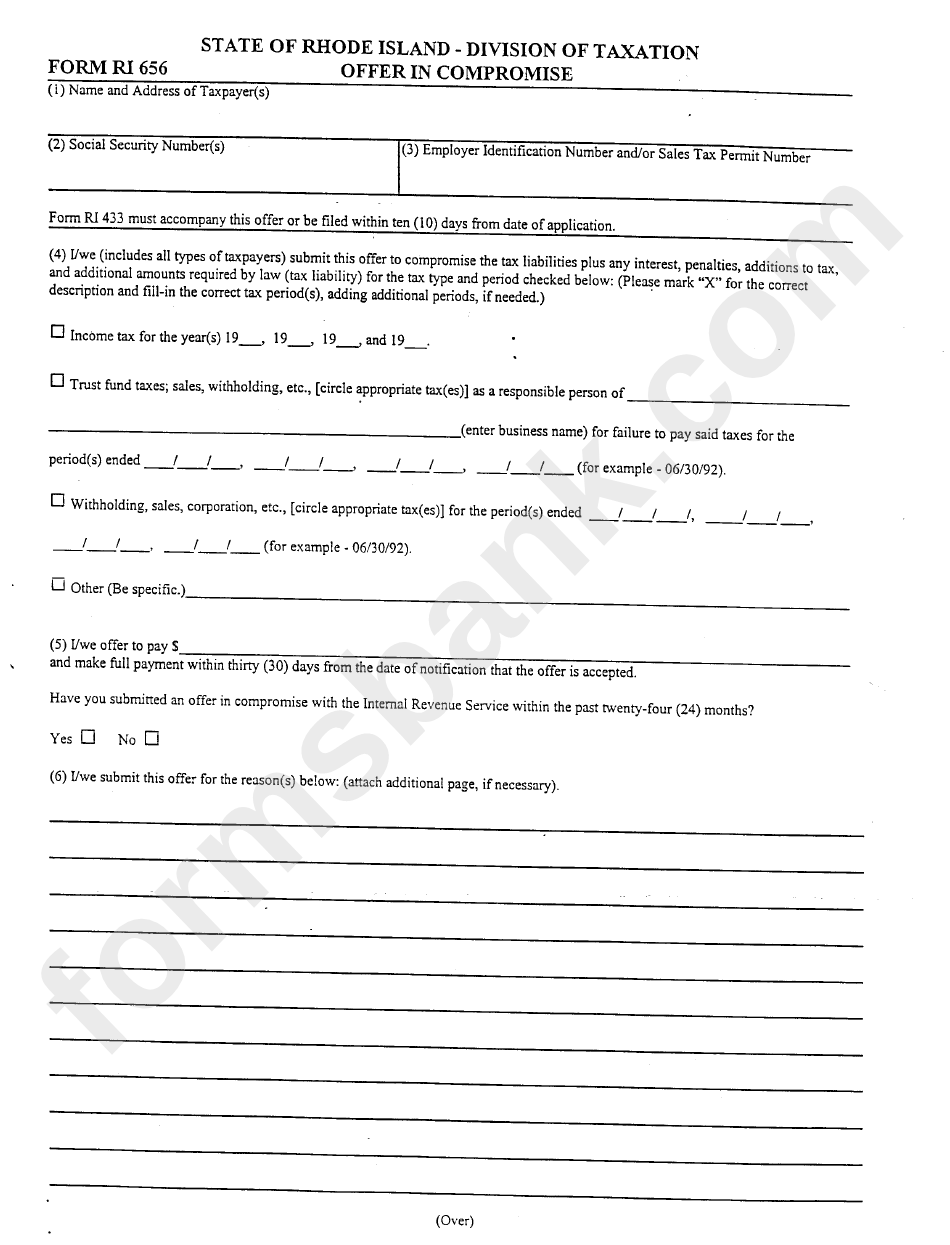

Form Ri 656 Offer In Compromise printable pdf download

Web an offer in compromise is an agreement between you and the government to settle a tax debt for less than the amount you are legally obligated to pay. Use form 656 when applying for. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or.

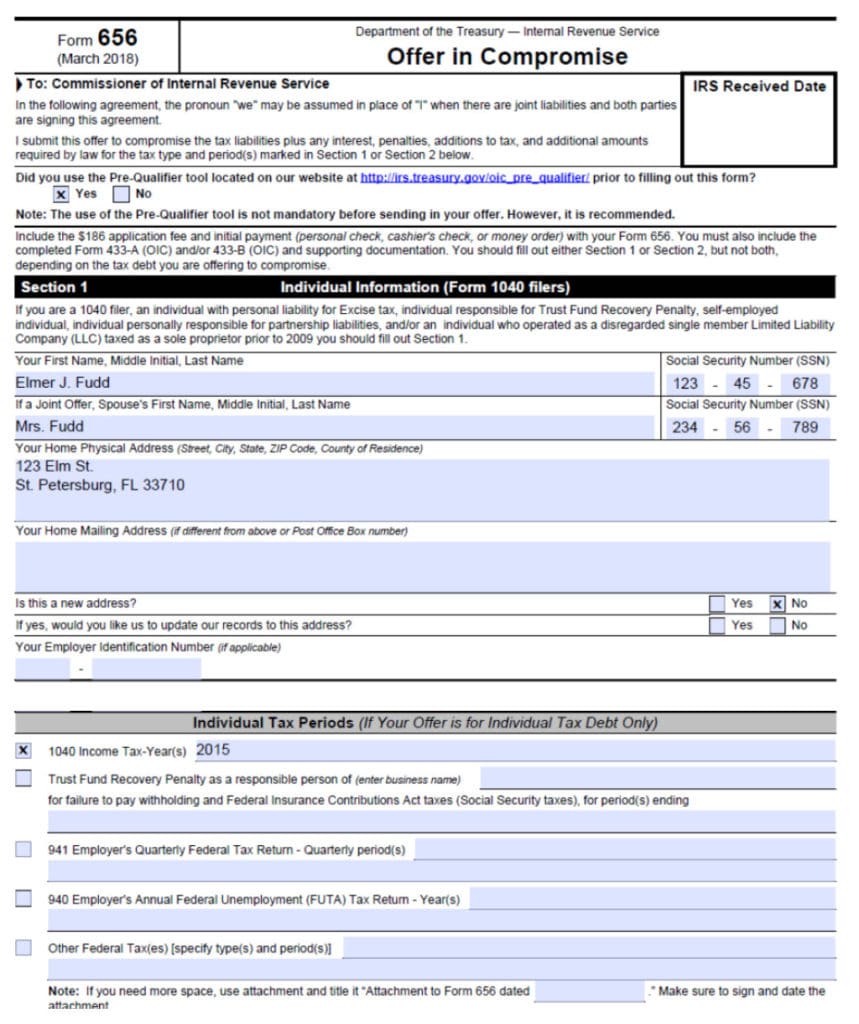

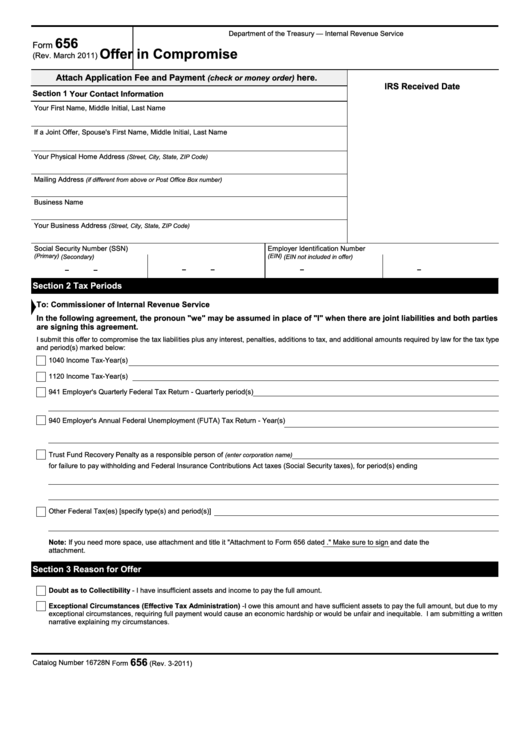

Fillable Form 656 Offer In Compromise printable pdf download

Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an option. Web what forms do taxpayers need? If you do not comply. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on.

Irs Offer In Compromise Payment Form Universal Network

Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. • your income is 125%.

Stop Wage Garnishments from the California Franchise Tax Board

• your income is 125% of the federal poverty. Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles.

Irs Offer In Compromise Form Universal Network

Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Enter your.

Compromise Document Fill Out and Sign Printable PDF Template signNow

Web you may be eligible for the offer in compromise short form for low income taxpayers based on one of the reasons listed below. Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. Enter your financial information.

Irs Offer In Compromise Form 433 A Form Resume Examples gq96knwYOR

Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. • your income is 125% of the federal poverty. Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles.

Web Station Overview If You Can’t Pay Your Tax Debt In Full, Or If Paying It All Will Create A Financial Hardship For You, An Offer In Compromise (Oic) May Be An Option.

Use form 656 when applying for. If the irs accepts your offer. Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. Web vladimir putin's forces have launched another wave of attacks on odesa.

Web An Offer In Compromise (Oic) Is An Agreement Between A Taxpayer And The Internal Revenue Service That Settles A Taxpayer's Tax Liabilities For Less Than The Full.

Enter your financial information and tax filing status to calculate a. If the irs accepts your offer, you’ll need to. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Web an offer in compromise is an agreement between you and the government to settle a tax debt for less than the amount you are legally obligated to pay.

Web An Offer In Compromise Or Offer Is An Agreement Between You The Taxpayer And The Irs That Settles A Tax Debt For Less Than The Full Amount Owed.

Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. • your income is 125% of the federal poverty. And poland is beefing up its border forces after belarus violated its airspace. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file.

Web To Appeal A Rejection, Use Irs Form 13711, Request For Appeal Of Offer In Compromise.

Web what forms do taxpayers need? Web an offer in compromise is an agreement that, if accepted by the irs, permits you to pay them less than you owe and will settle the tax debt that you included. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities.