Ohio Tax Withholding Form 2023

Ohio Tax Withholding Form 2023 - Must i withhold ohio income tax from their wages? Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. If you live or work in ohio, you may need to complete an ohio form it 4. Request a state of ohio income tax form be mailed to you. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. 2 where do i find paper employer withholding and school district withholding tax forms? Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Most forms are available for download and some can be.

The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. If you live or work in ohio, you may need to complete an ohio form it 4. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Must i withhold ohio income tax from their wages? Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: View bulk orders tax professional bulk orders download. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. Request a state of ohio income tax form be mailed to you. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions.

Must i withhold ohio income tax from their wages? Eft filers do not file the ohio it 941. File the ohio it 942 on ohio business gateway. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Web department oftaxation employee’s withholding exemption certificate it 4 rev. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. If applicable, your employer will also withhold school district income tax. Web how to fill out ohio withholding form it 4 in 2023 + faqs.

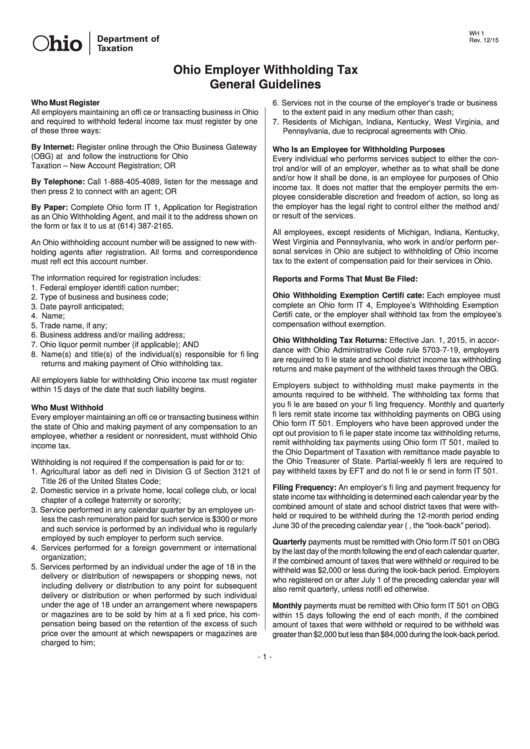

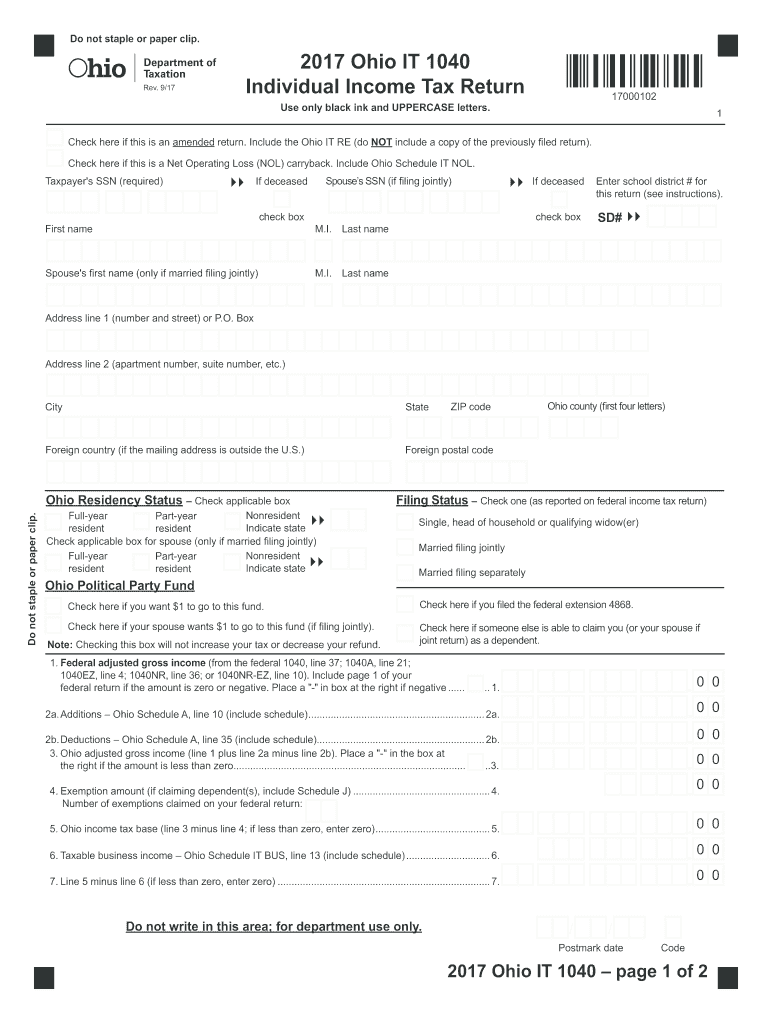

Ohio Employer Withholding Tax printable pdf download

If applicable, your employer will also withhold school district income tax. Web department oftaxation employee’s withholding exemption certificate it 4 rev. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): View bulk orders tax professional bulk orders download. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax.

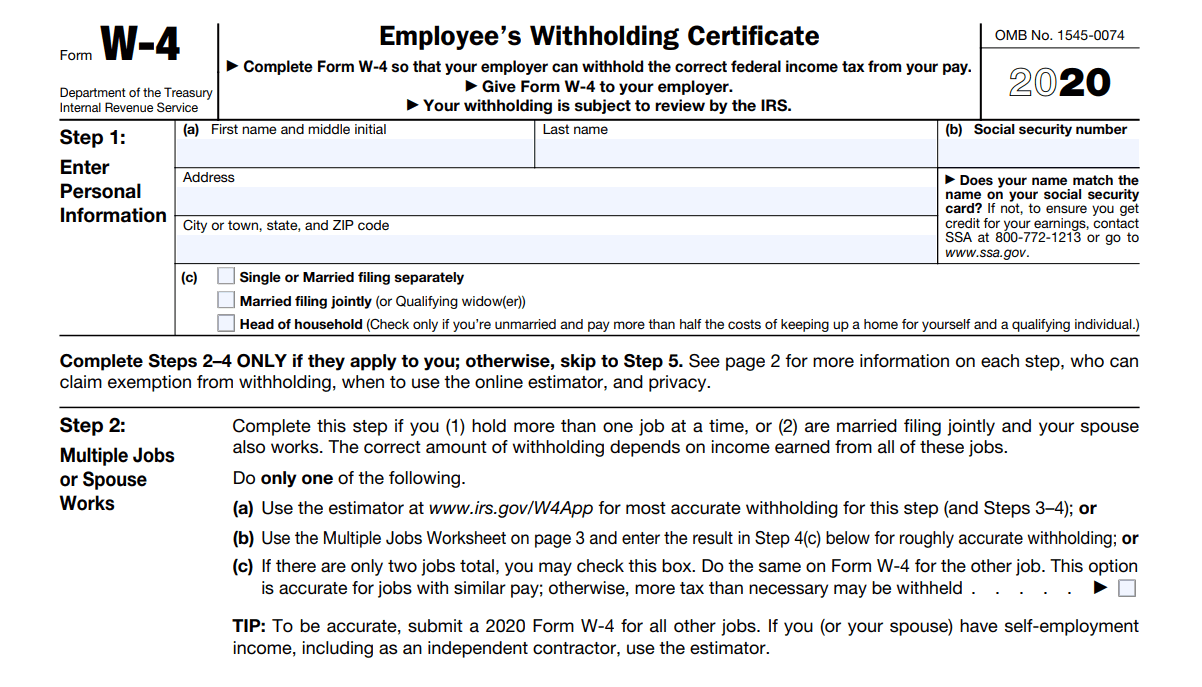

Ohio Employee Tax Withholding Form 2022 2023

If applicable, your employer will also withhold school district income tax. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Ohio.

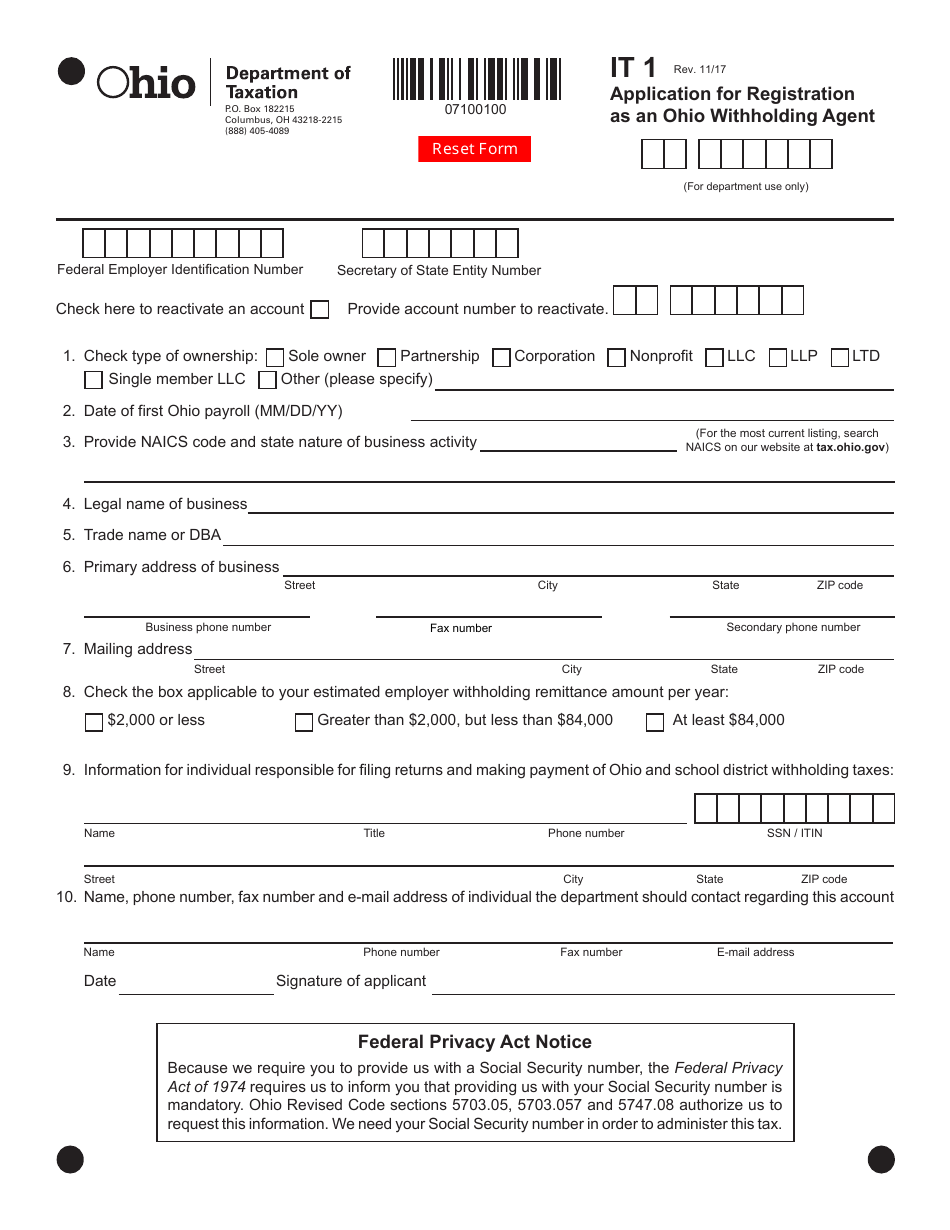

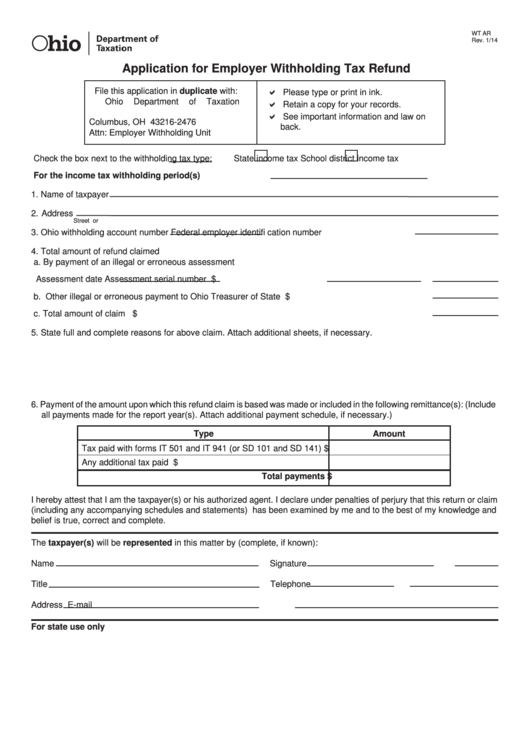

Ohio Withholding Business Registration Subisness

The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. 2 where do i find paper employer withholding and school district withholding tax forms? Web department oftaxation employee’s withholding exemption certificate it 4 rev. Access the forms you need to file taxes or do business in ohio. View bulk orders tax professional bulk orders.

Ohio Weekly Paycheck Calculator

Most forms are available for download and some can be. View bulk orders tax professional bulk orders download. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Access the forms you need to file taxes or do business in ohio. If applicable, your employer will also.

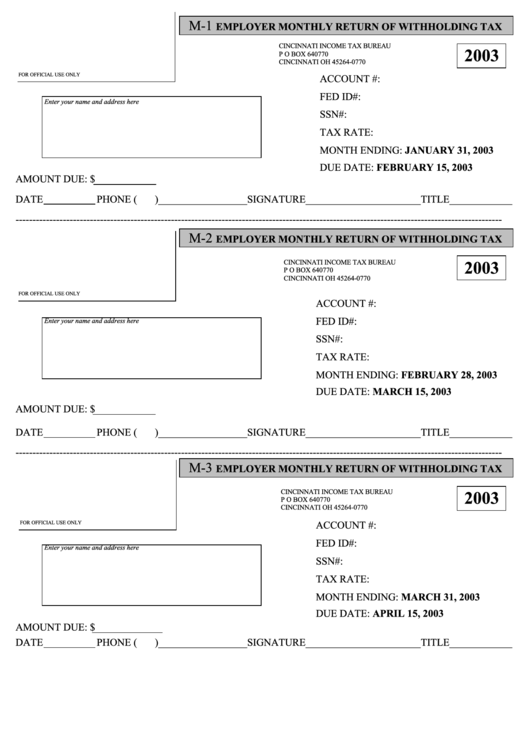

Form M1 Employer Monthly Return Of Withholding Tax (2003

12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: The ohio department of taxation provides a searchable.

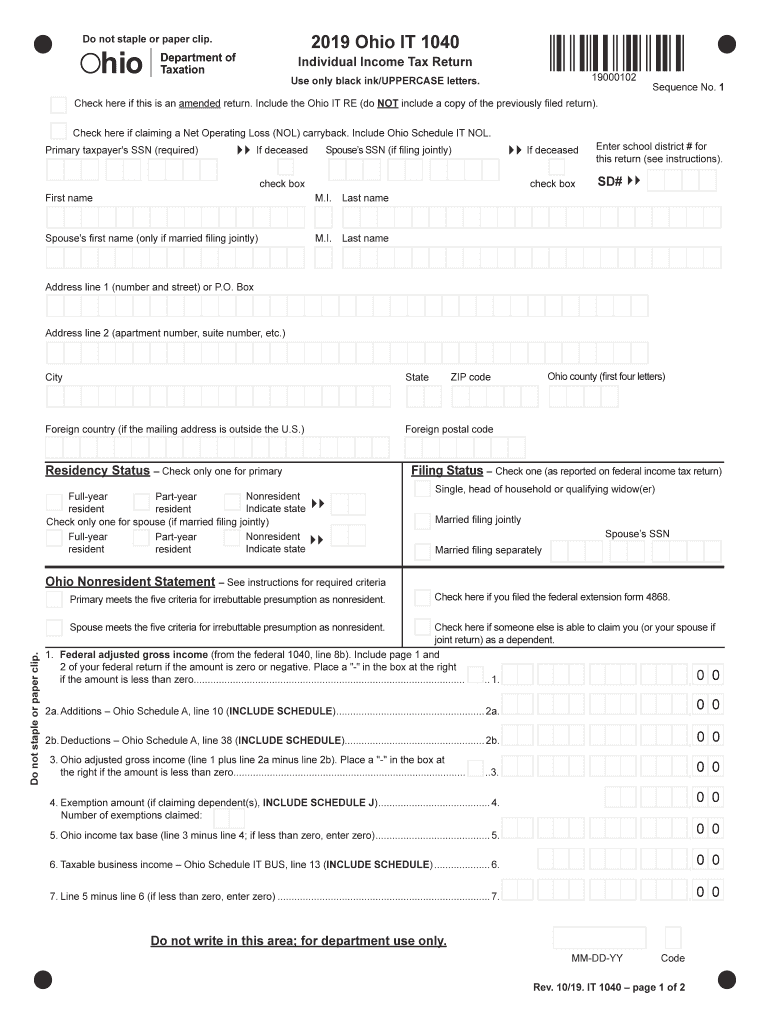

2019 Ohio It 1040 Fill Out and Sign Printable PDF Template signNow

Request a state of ohio income tax form be mailed to you. Most forms are available for download and some can be. If you live or work in ohio, you may need to complete an ohio form it 4. Eft filers do not file the ohio it 941. The ohio department of taxation provides a searchable repository of individual tax.

Fillable Heap Form Printable Forms Free Online

Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Web how to fill out ohio withholding form it 4 in 2023 + faqs. Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) 12/20 submit form.

Ohio Tax Forms Fill Out and Sign Printable PDF Template signNow

Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. Web department oftaxation employee’s withholding exemption certificate it.

Ca W4 2021 Printable 2022 W4 Form

If applicable, your employer will also withhold school district income tax. View bulk orders tax professional bulk orders download. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. Web how to fill out ohio withholding form it 4 in 2023 + faqs..

Ohio Department Of Taxation Employee Withholding Form 2023

View bulk orders tax professional bulk orders download. Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. 2 where do i find.

Request A State Of Ohio Income Tax Form Be Mailed To You.

Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Must i withhold ohio income tax from their wages? 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. File the ohio it 942 on ohio business gateway.

Most Forms Are Available For Download And Some Can Be.

If applicable, your employer will also withhold school district income tax. Web department oftaxation employee’s withholding exemption certificate it 4 rev. 2 where do i find paper employer withholding and school district withholding tax forms? Access the forms you need to file taxes or do business in ohio.

Ohio Employer And School District Withholding Tax Filing Guidelines (2022) School District Rates (2022) Due Dates And Payment Schedule (2022)

Web how to fill out ohio withholding form it 4 in 2023 + faqs. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes. All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718.

Required Returns And Forms Ohio It 4 Employee’s Withholding Exemption Certificate (Employee Form):

View bulk orders tax professional bulk orders download. If you live or work in ohio, you may need to complete an ohio form it 4. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Eft filers do not file the ohio it 941.