Ohio Withholding Tax Form

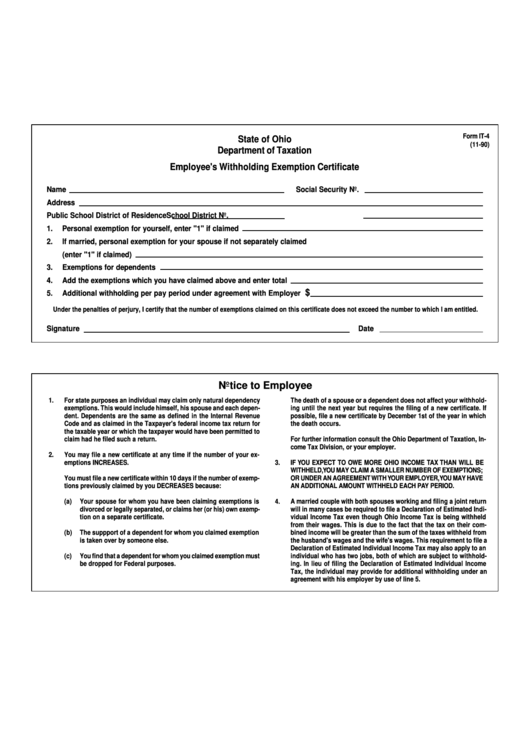

Ohio Withholding Tax Form - This form allows ohio employees to claim income tax. Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Web ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Other tax forms — a. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Snohomish county tax preparer pleads guilty to assisting in the. Web individual income tax forms archive march 31, 2020 | agency. Enter a full or partial form. If possible, file a new certificate by dec.

Web july 20, 2023. Web individual income tax forms archive march 31, 2020 | agency. Other tax forms — a. Snohomish county tax preparer pleads guilty to assisting in the. Web withholding until the next year but requires the filing of a new certificate. The ohio department of taxation provides a searchable repository of individual tax. This form allows ohio employees to claim income tax. Employers must register their business and may apply for an. The form gives a person or agency access to provide info about unemployment taxes. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us.

Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. The forms below are sorted by form number. Web july 20, 2023. If possible, file a new certificate by dec. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. The ohio department of taxation provides a searchable repository of individual tax. Employers must register their business and may apply for an. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. If your income will be $200,000 or less ($400,000 or less if.

Top Ohio Withholding Form Templates free to download in PDF format

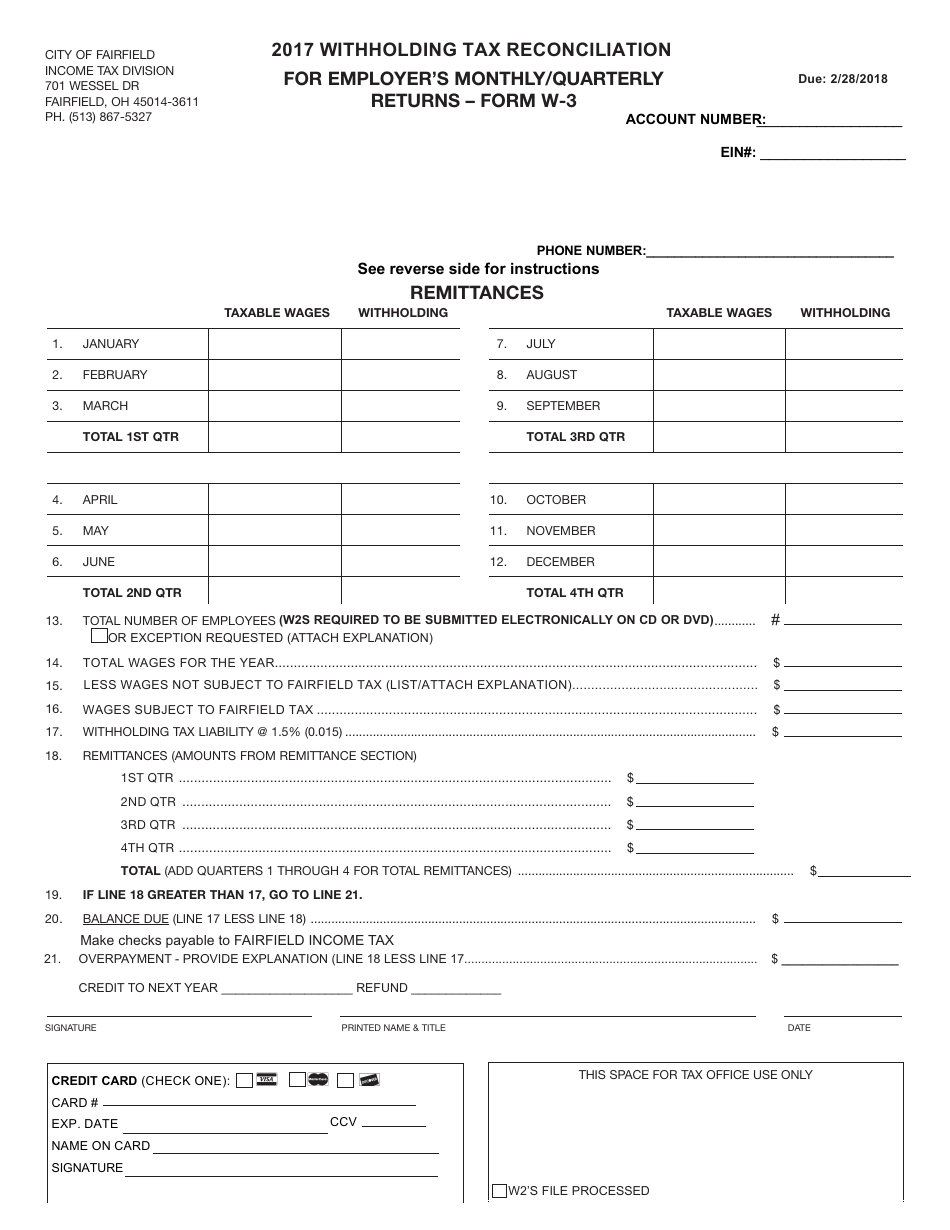

Snohomish county tax preparer pleads guilty to assisting in the. Credit up to 1.8% effective 10/02/20 and 2.1% prior to 10/02/20 will. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be.

Fillable Heap Form Printable Forms Free Online

The forms below are sorted by form number. If possible, file a new certificate by dec. Credit up to 1.8% effective 10/02/20 and 2.1% prior to 10/02/20 will. Web withholding until the next year but requires the filing of a new certificate. Snohomish county tax preparer pleads guilty to assisting in the.

Form W3 Download Printable PDF or Fill Online Withholding Tax

Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Welcome to the individual income tax forms archive. 1st of the year in which the death occurs. This form allows ohio employees to claim income tax. If possible, file a new certificate by dec.

Huber Heights Ohio Withholding Tax Forms

1st of the year in which the death occurs. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Welcome to the individual income tax forms archive. If your income will be $200,000 or less ($400,000 or less if. Snohomish county tax preparer pleads guilty.

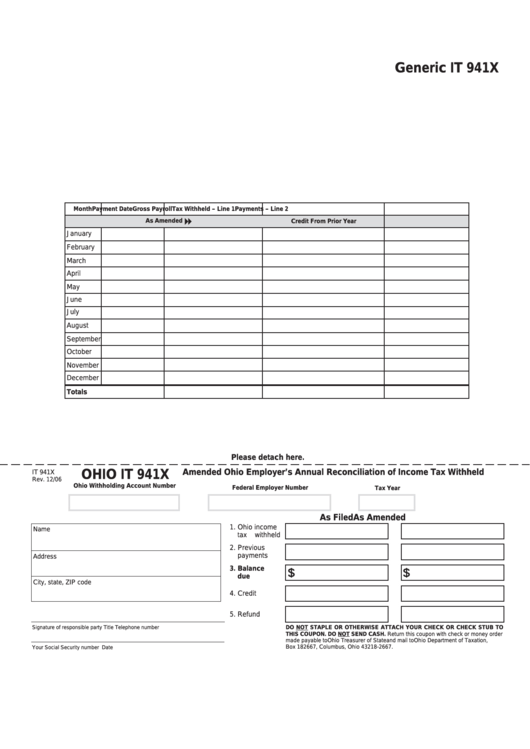

Fillable Ohio Form It 941x Amended Ohio Employer'S Annual

Web ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. Welcome to the individual income tax forms archive. Web the ohio department of taxation only requires 1099.

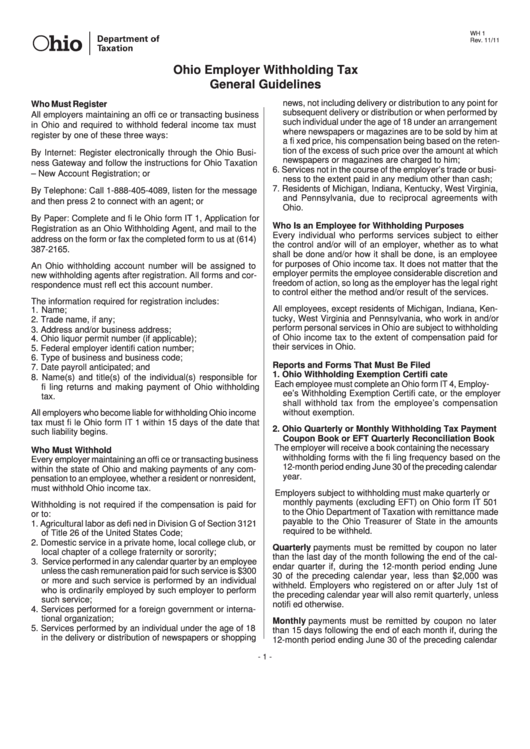

Instructions For Form It 1 Ohio Employer Withholding Tax printable

This form allows ohio employees to claim income tax. Enter a full or partial form. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. If possible, file a new certificate by dec. Web ohio has a state income tax.

State Of Ohio Tax Withholding Tables 2017

Web ohio has a state income tax that ranges between 2.85% and 4.797%. Snohomish county tax preparer pleads guilty to assisting in the. If possible, file a new certificate by dec. Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. The form gives a person or.

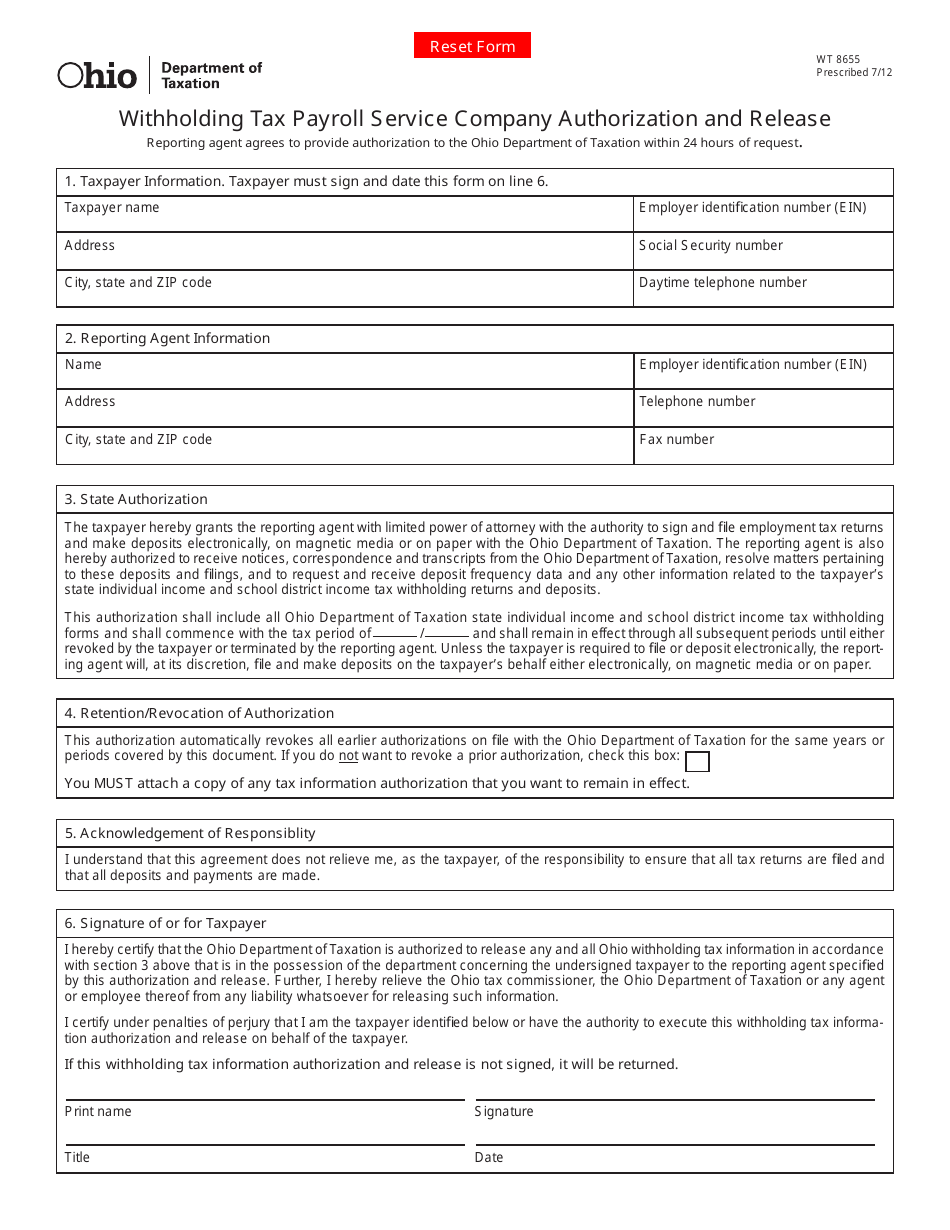

Form WT8655 Download Fillable PDF or Fill Online Withholding Tax

Access the forms you need to file taxes or do business in ohio. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms.

Ohio Withholding Form W 4 2022 W4 Form

Employers must register their business and may apply for an. Web all employers are required to file and pay electronically through ohio business gateway (obg) [o.a.c. The forms below are sorted by form number. Welcome to the individual income tax forms archive. Web get access to the ohio tax withholding forms in order to determine how much income tax should.

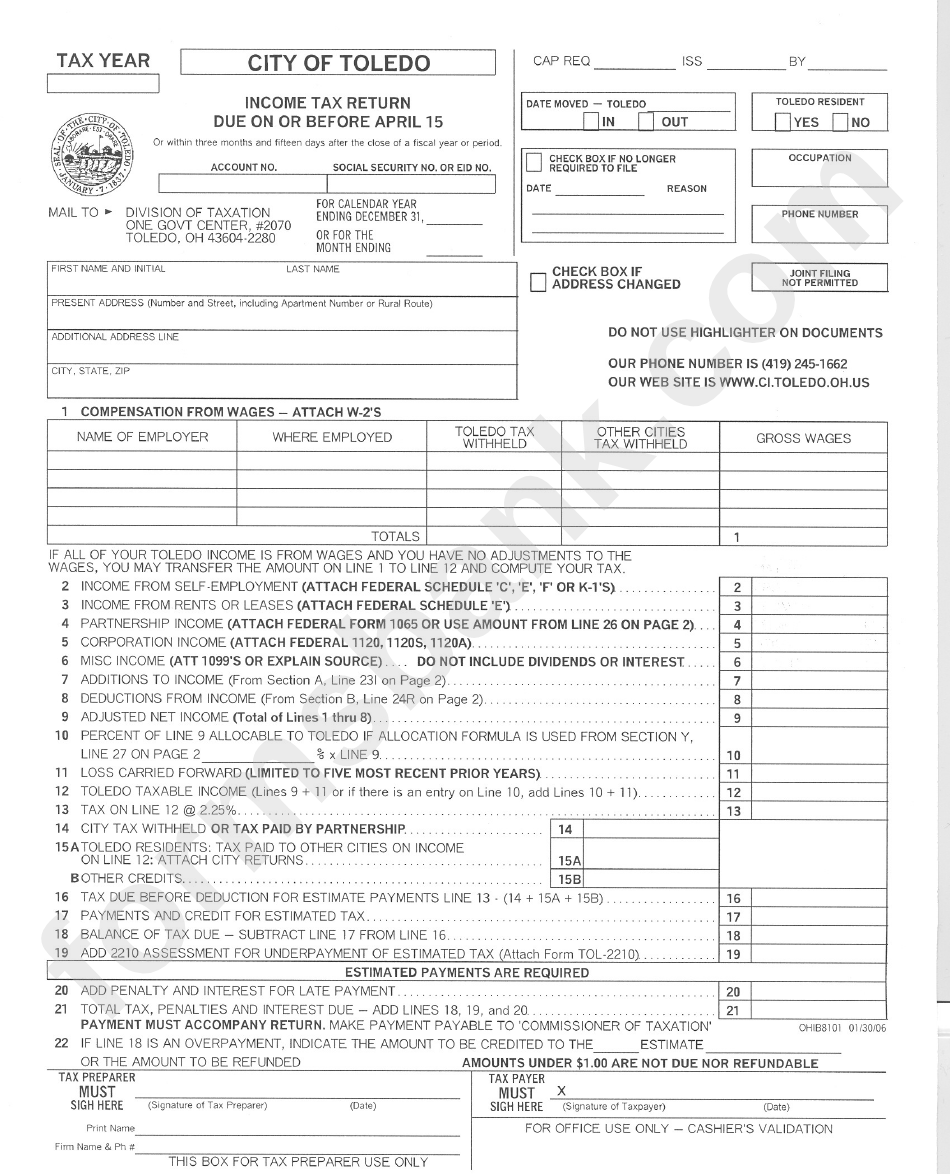

Tax Return Form Toledo Ohio printable pdf download

Employers must register their business and may apply for an. Snohomish county tax preparer pleads guilty to assisting in the. Web individual income tax forms archive march 31, 2020 | agency. Web july 20, 2023. This form allows ohio employees to claim income tax.

Web Withholding Until The Next Year But Requires The Filing Of A New Certificate.

The ohio department of taxation provides a searchable repository of individual tax. Web if your employer did not withhold the local tax at the rates shown, you are required to file a cincinnati tax return. Employers must register their business and may apply for an. Welcome to the individual income tax forms archive.

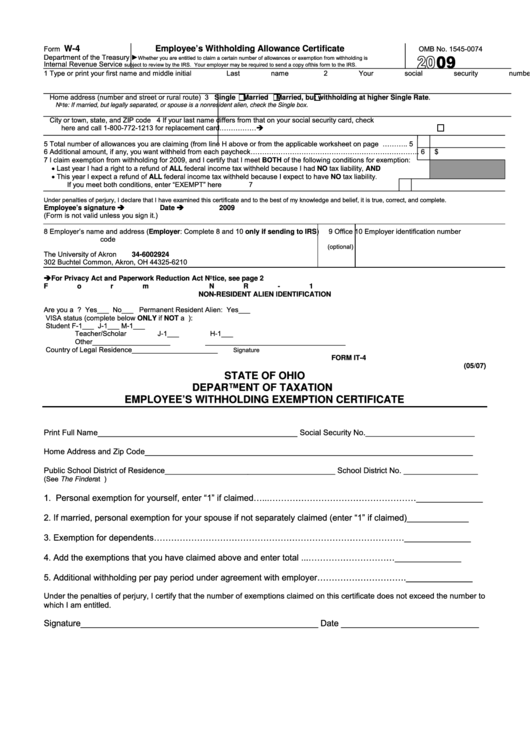

Web Ohio Form It 4, Employee’s Withholding Exemption Certificate, Is A Tax Form Issued By The Ohio Department Of Taxation.

The form gives a person or agency access to provide info about unemployment taxes. Web individual income tax forms archive march 31, 2020 | agency. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500.

If Possible, File A New Certificate By Dec.

Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Enter a full or partial form. Other tax forms — a. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.

Web Ohio Has A State Income Tax That Ranges Between 2.85% And 4.797%.

Web get access to the ohio tax withholding forms in order to determine how much income tax should be withheld from employee's salary. 1st of the year in which the death occurs. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Access the forms you need to file taxes or do business in ohio.