Oklahoma Form 504 C

Oklahoma Form 504 C - • the corporate income tax rate was reduced from 6% to 4%. Use fill to complete blank online state of. Web fill online, printable, fillable, blank form 2: Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited liability partnerships (llps) any reference to partnership partners in the instructions and. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. • the pte tax rate was reduced from 6% to. Web of the federal extension must be provided with your oklahoma tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Mail your return to the oklahoma. • instructions for completing the form 511:

This form is for income earned in tax year 2022, with tax returns due in april 2023. Application for extension of time to file an oklahoma income tax return. Mail your return to the oklahoma. • instructions for completing the form 511: • the bank in lieu tax rate was reduced from 6% to 4%. Use fill to complete blank online state of. Web use a oklahoma form 504 c template to make your document workflow more streamlined. • the corporate income tax rate was reduced from 6% to 4%. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. Mail your return to the.

Web fill online, printable, fillable, blank form 2: Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited liability partnerships (llps) any reference to partnership partners in the instructions and. Use fill to complete blank online state of. Web use a oklahoma form 504 c template to make your document workflow more streamlined. Web what’s new in the 2022 oklahoma partnership tax packet? Show details how it works open the ok form 504 c and follow the instructions easily. • instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales tax relief. • the corporate income tax rate was reduced from 6% to 4%. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web of the federal extension must be provided with your oklahoma tax return.

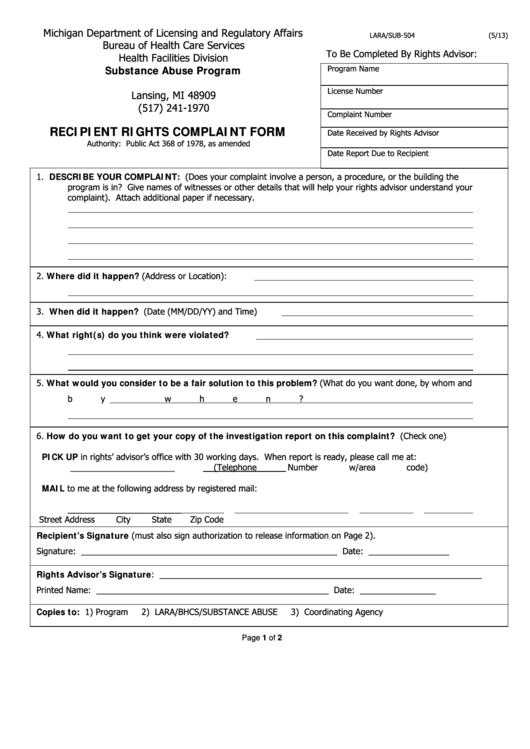

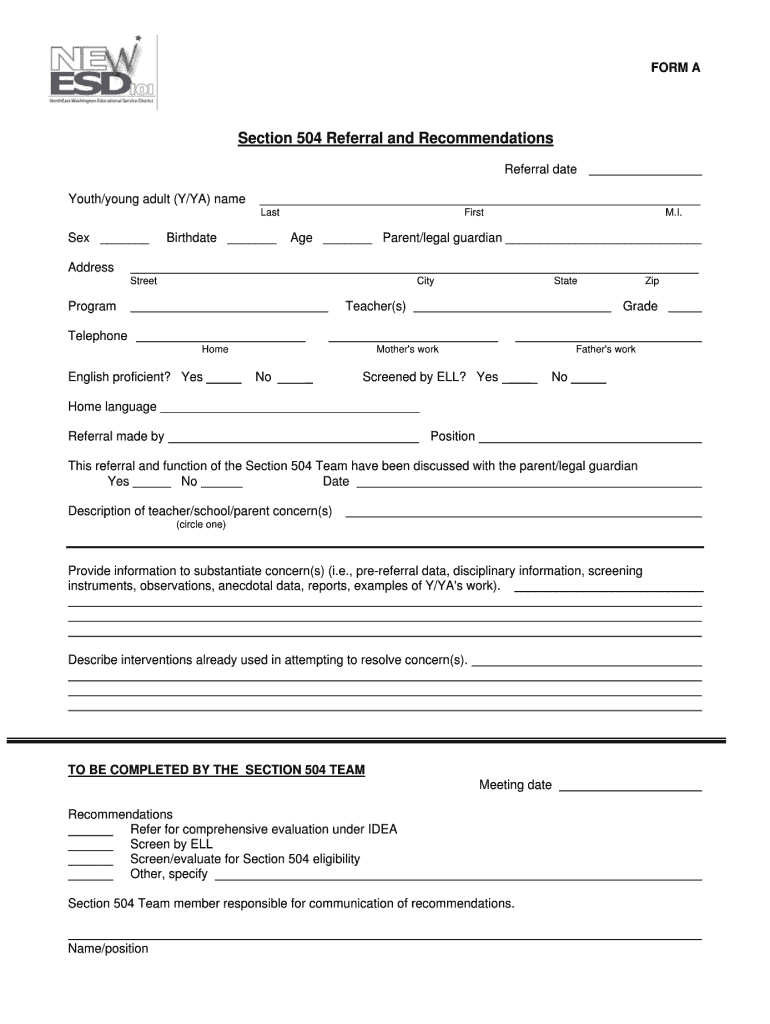

Fillable Form 504 Recipient Rights Complaint Form printable pdf download

Mail your return to the oklahoma. Web fill online, printable, fillable, blank form 2: Web what’s new in the 2022 oklahoma tax packet? Sales tax relief credit •. • the corporate income tax rate was reduced from 6% to 4%.

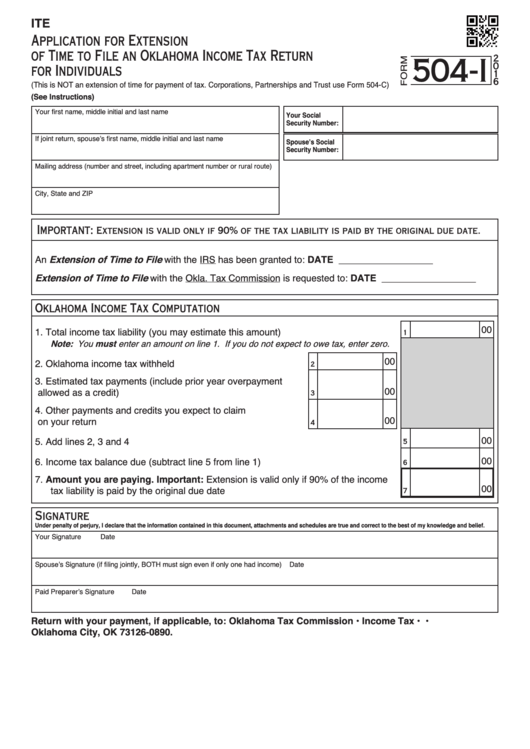

Fillable Form 504I Application For Extension Of Time To File An

• the bank in lieu tax rate was reduced from 6% to 4%. Web what’s new in the 2022 oklahoma tax packet? Show details how it works open the ok form 504 c and follow the instructions easily. Use fill to complete blank online state of. Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited.

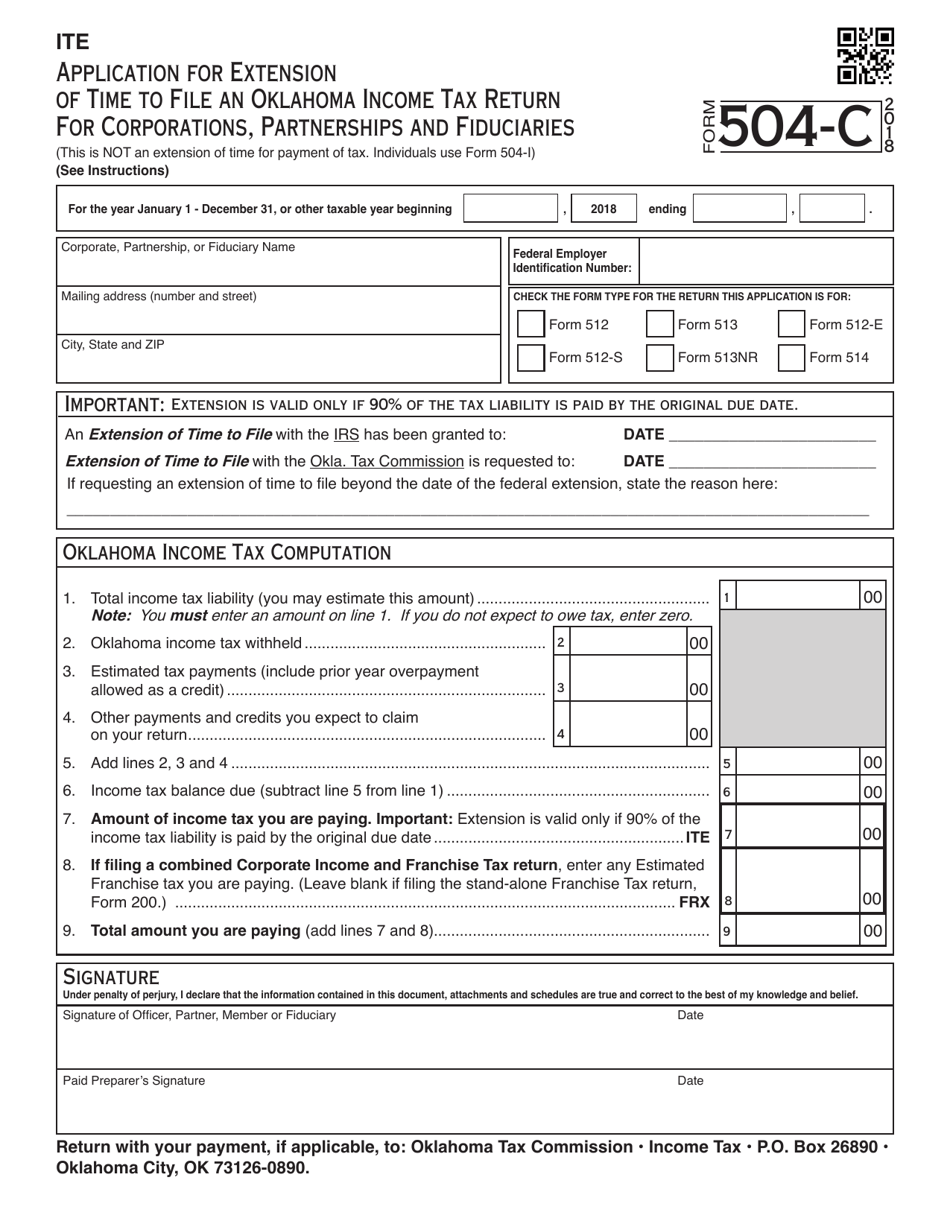

OTC Form 504C Download Fillable PDF or Fill Online Application for

Use fill to complete blank online state of. Web of the federal extension must be provided with your oklahoma tax return. Web what’s new in the 2022 oklahoma tax packet? • the corporate income tax rate was reduced from 6% to 4%. Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited liability partnerships (llps) any.

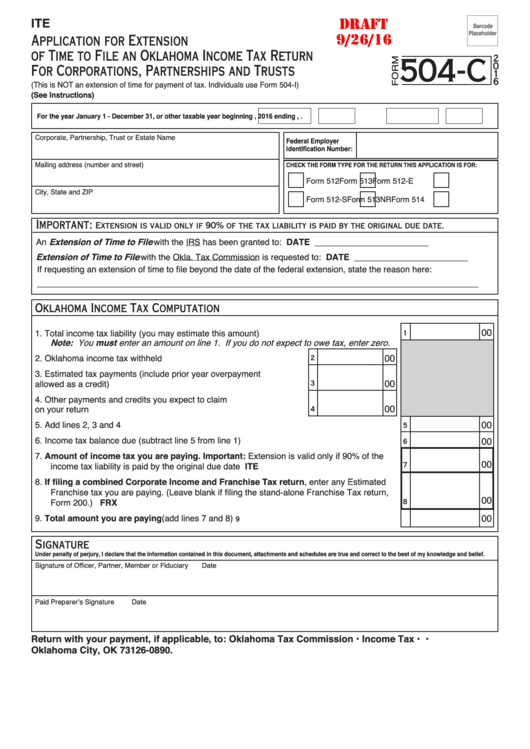

Form 504C Draft Application For Extension Of Time To File An

At least 90% of the tax liability. Web we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. Show details how it works open the ok form 504 c and follow the instructions easily. • instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales.

Printable 504 Form Fill Out and Sign Printable PDF Template signNow

Web what’s new in the 2022 oklahoma partnership tax packet? Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited liability partnerships (llps) any reference to partnership partners in the instructions and. Show details how it works open the ok form 504 c and follow the instructions easily. Web fill online, printable, fillable, blank form 2:.

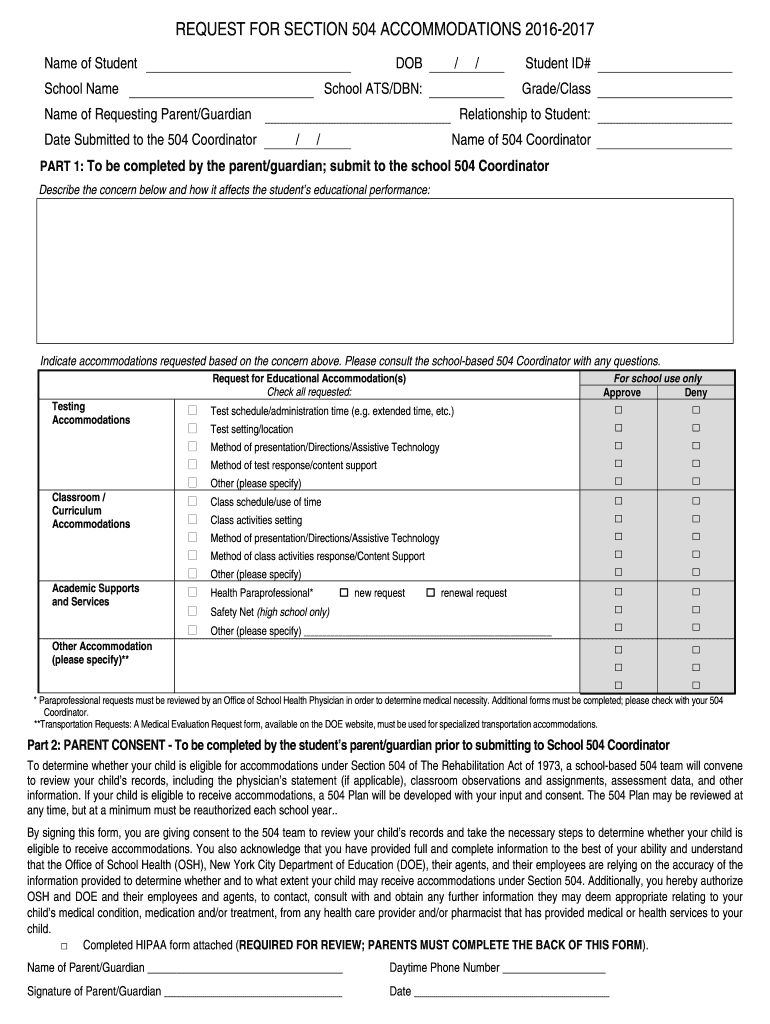

Section 504 Plan Fill Online, Printable, Fillable, Blank pdfFiller

Mail your return to the. Web fill online, printable, fillable, blank form 2: Web what’s new in the 2022 oklahoma tax packet? • instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales tax relief. • the bank in lieu tax rate was reduced from 6% to 4%.

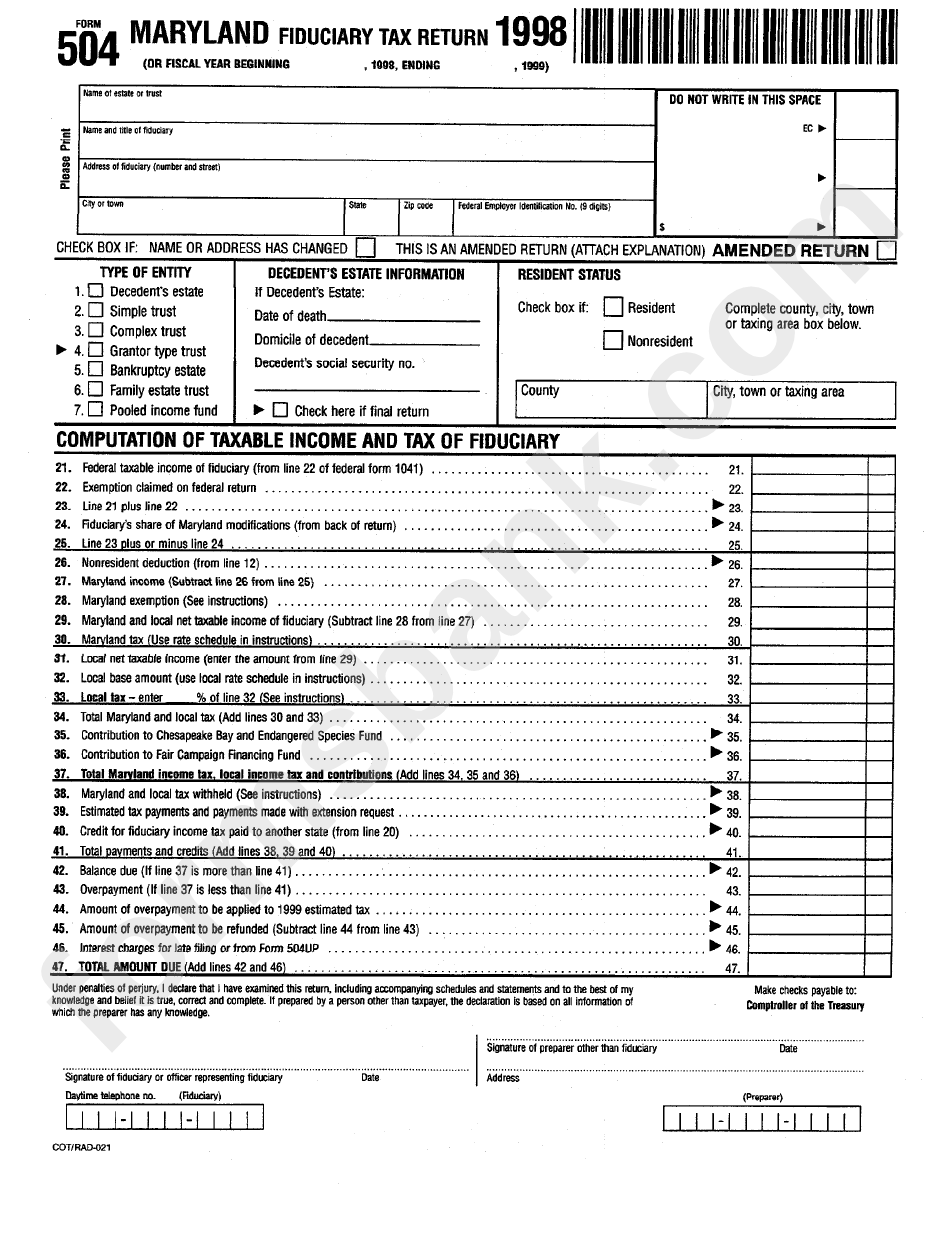

Fillable Form 504 Maryland Fiduciary Tax Return 1998 printable pdf

• the bank in lieu tax rate was reduced from 6% to 4%. Web fill online, printable, fillable, blank form 2: Use fill to complete blank online state of. • instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales tax relief. This form is for income earned in.

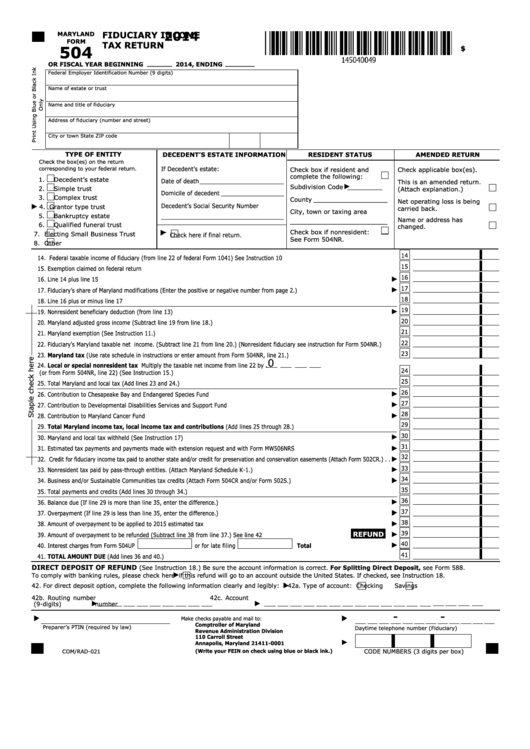

Fillable Maryland Form 504 Fiduciary Tax Return/schedule K1

Web use a oklahoma form 504 c template to make your document workflow more streamlined. Sales tax relief credit •. • the pte tax rate was reduced from 6% to. At least 90% of the tax liability. Web what’s new in the 2022 oklahoma partnership tax packet?

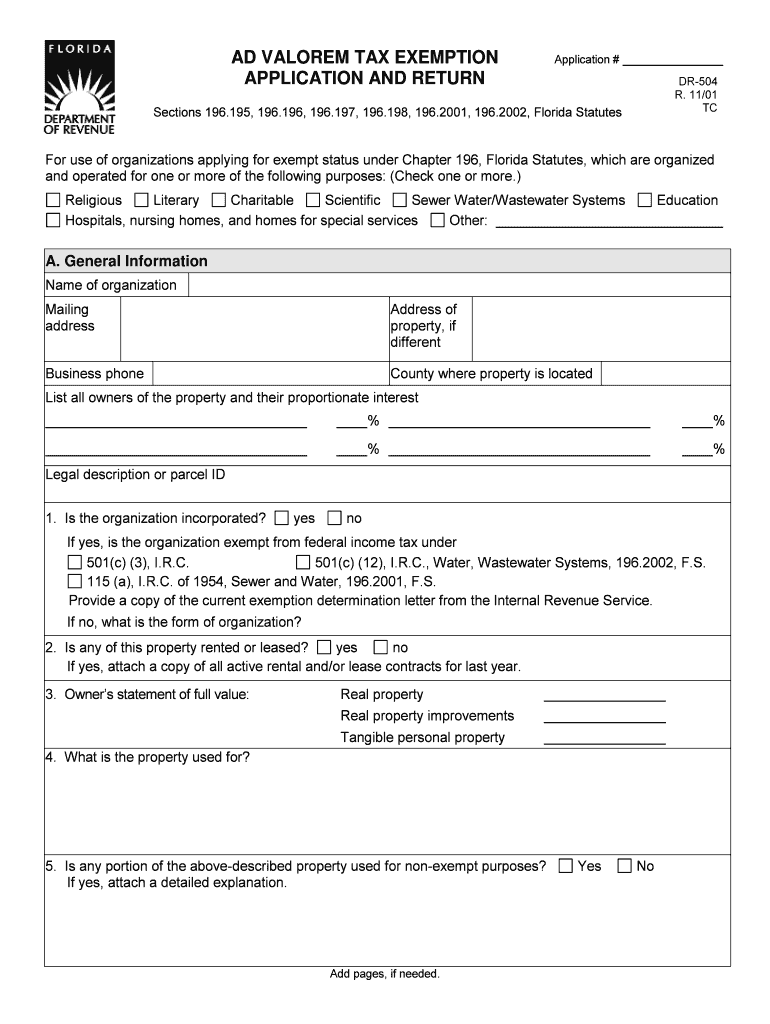

FL DR504 2001 Fill out Tax Template Online US Legal Forms

• the corporate income tax rate was reduced from 6% to 4%. • instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales tax relief. Use fill to complete blank online state of. Web of the federal extension must be provided with your oklahoma tax return. Web what’s new.

504 SW 161st St OKLAHOMA CITY, OK 73170 Nested Tours

Web fill online, printable, fillable, blank form 2: Web title 68 oklahoma statutes (os) returns by partnerships returns by llcs and limited liability partnerships (llps) any reference to partnership partners in the instructions and. Sales tax relief credit •. Mail your return to the oklahoma. Web use a oklahoma form 504 c template to make your document workflow more streamlined.

Web What’s New In The 2022 Oklahoma Tax Packet?

Mail your return to the. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. • instructions for completing the form 511: • the bank in lieu tax rate was reduced from 6% to 4%.

Show Details How It Works Open The Ok Form 504 C And Follow The Instructions Easily.

• instructions for completing the oklahoma resident income tax return form 511 • oklahoma resident income tax return form 511 • sales tax relief. Sales tax relief credit •. Web use a oklahoma form 504 c template to make your document workflow more streamlined. • the corporate income tax rate was reduced from 6% to 4%.

Web The Taxslayer Pro Desktop Program Supports The Following Oklahoma Business Forms.

Web fill online, printable, fillable, blank form 2: At least 90% of the tax liability. Web of the federal extension must be provided with your oklahoma tax return. Web we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission.

Mail Your Return To The Oklahoma.

Web what’s new in the 2022 oklahoma partnership tax packet? • the corporate income tax rate was reduced from 6% to 4%. • the pte tax rate was reduced from 6% to. This form is for income earned in tax year 2022, with tax returns due in april 2023.