Oklahoma Tax Form 511

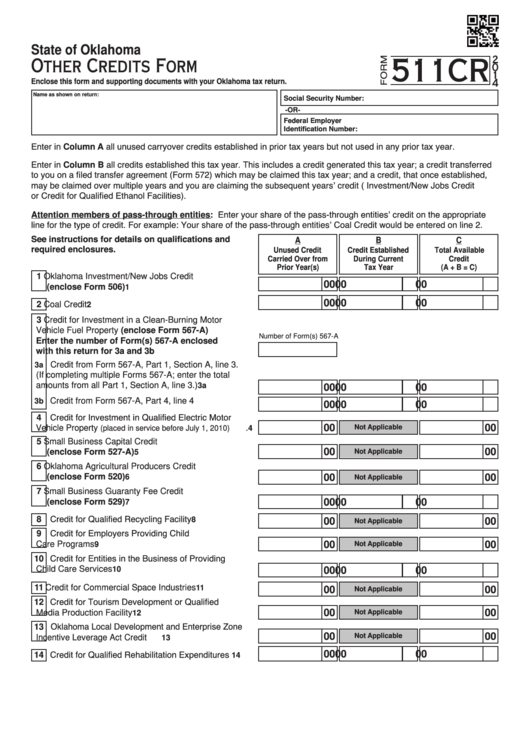

Oklahoma Tax Form 511 - File your form 2290 online & efile with the irs. Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending. For more information about the oklahoma. Oklahoma resident income tax return • form 511: Form 511 can be efiled, or a paper copy can be filed via mail. Easily sign the 2019 oklahoma tax form 511 with your finger. Sign, mail form 511 or 511nr to. Web single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the boxes 4 head of household with qualifying. Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. Web more about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission.

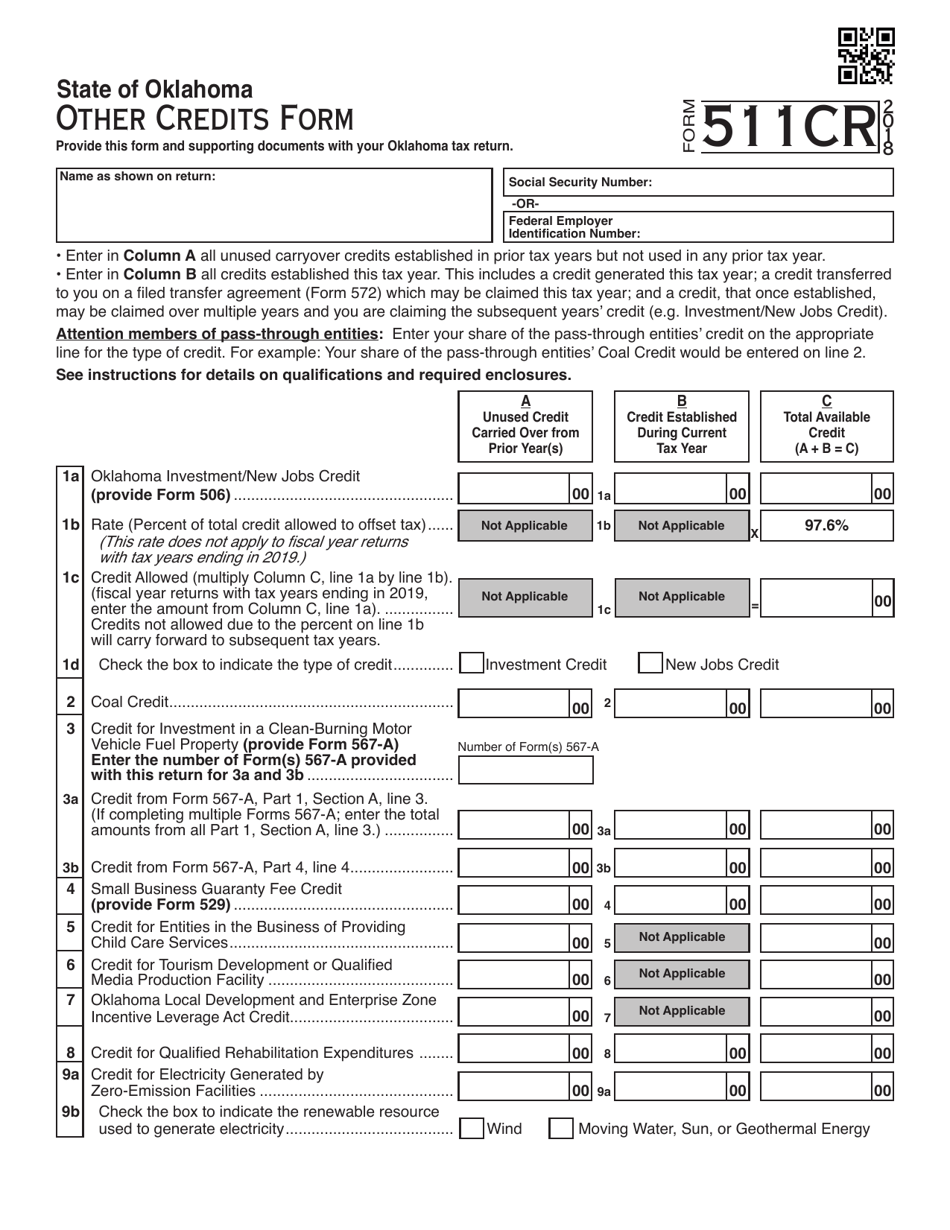

Name as shown on return: Easily fill out pdf blank, edit, and sign them. Web form 511 is the general income tax return for oklahoma residents. Web form 511ef is the oklahoma individual income tax declaration for electronic filing form. • instructions for completing the form 511: If your return contains any of the forms or supporting schedules. Web single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the boxes 4 head of household with qualifying. Web provide this form and supporting documents with your oklahoma tax return. Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending. File your form 2290 online & efile with the irs.

Get irs approved instant schedule 1 copy. Ad download or email ok form 511 & more fillable forms, register and subscribe now! Name as shown on return: File your form 2290 today avoid the rush. Web more about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. If your return contains any of the forms or supporting schedules. Web form 511ef is the oklahoma individual income tax declaration for electronic filing form. This form is for income earned in. Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending. Send filled & signed 2019.

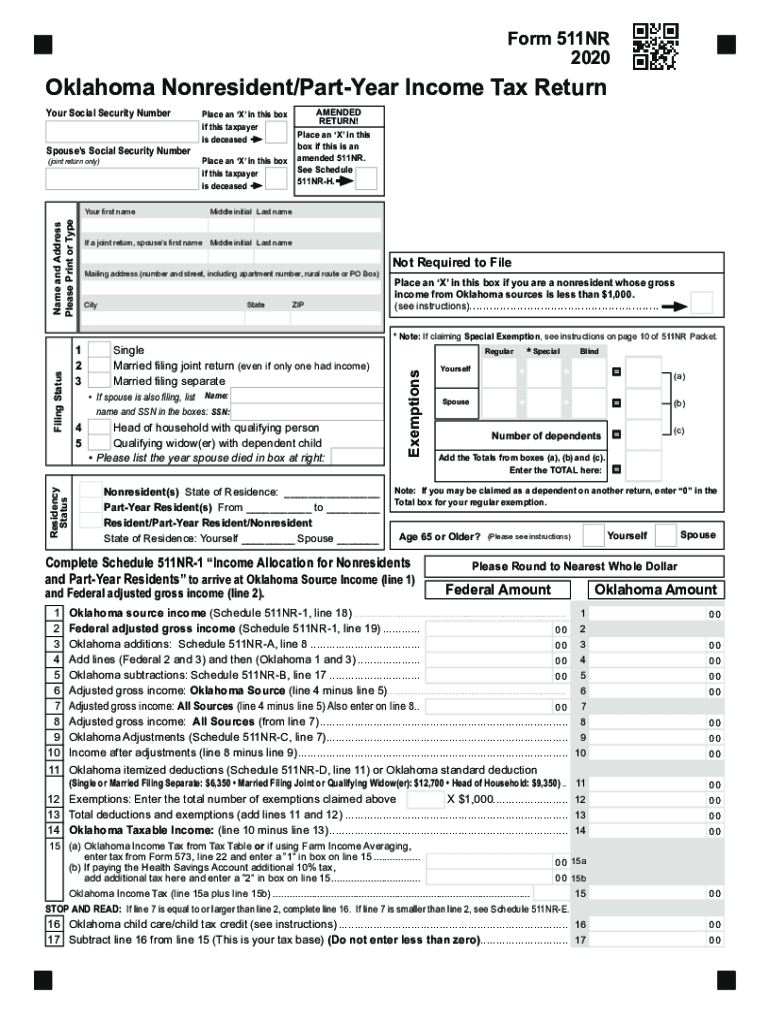

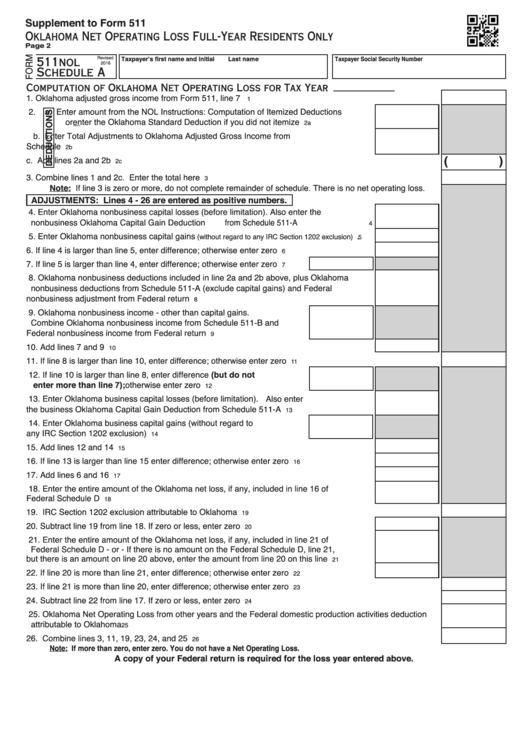

2018 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. Web more about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Ad don't leave it to the last minute. You can.

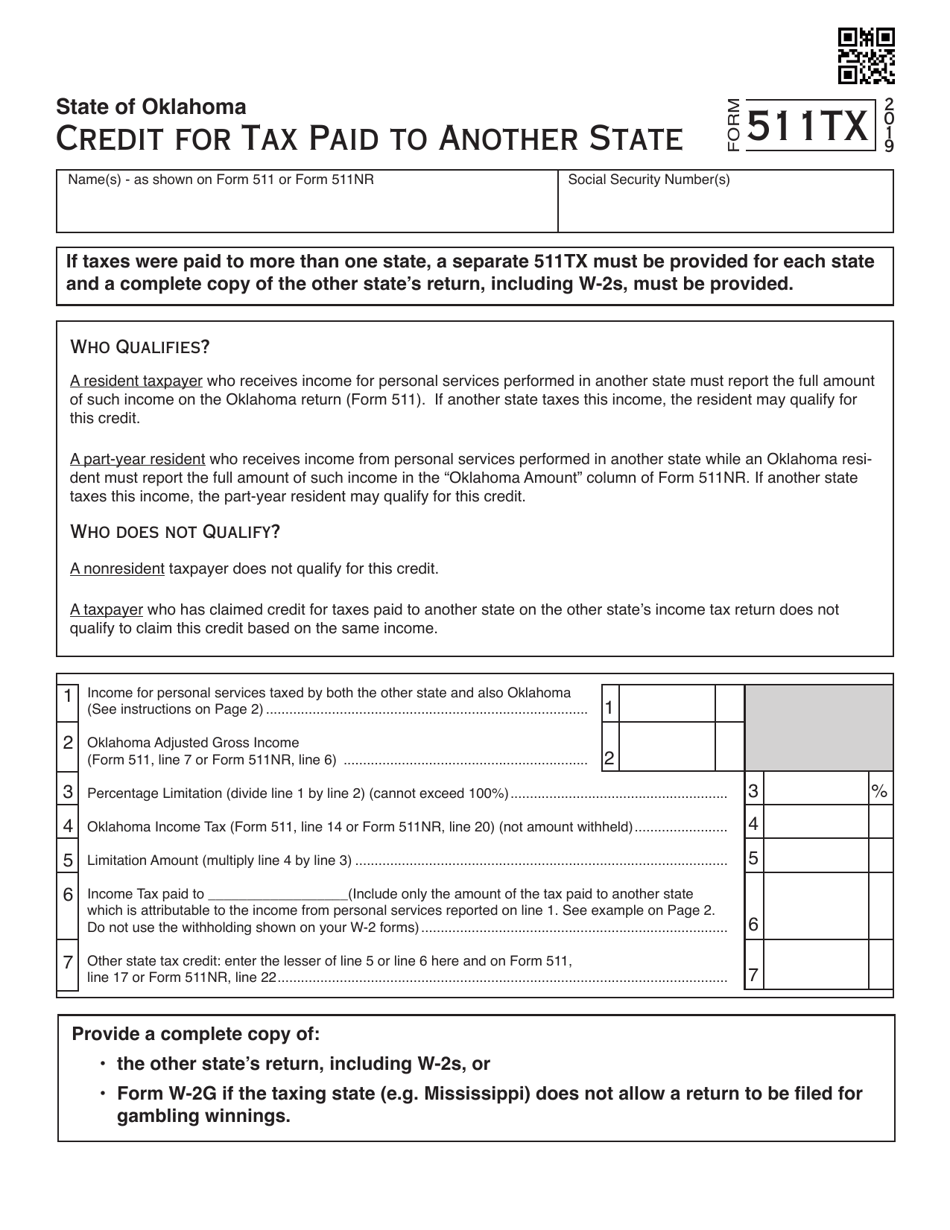

Form 511TX Download Fillable PDF or Fill Online Oklahoma Credit for Tax

Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web up to $40 cash back printable oklahoma tax forms can be found on the oklahoma tax commission website. (oklahoma resident income tax return and sales tax relief. If you have already filed your return, either.

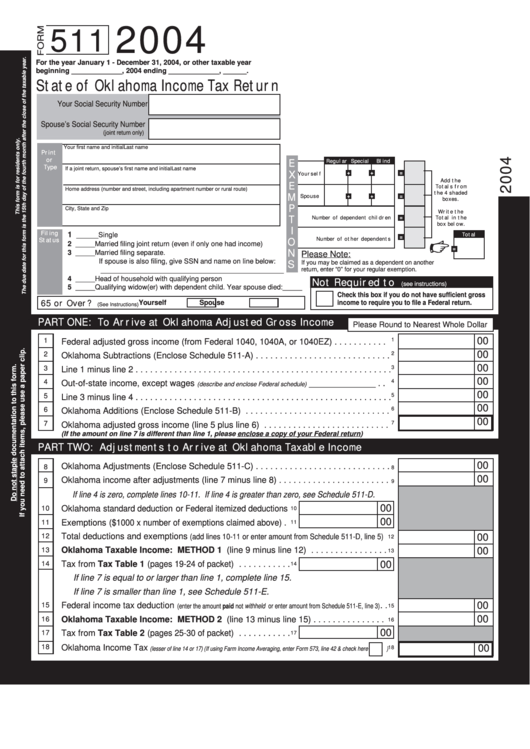

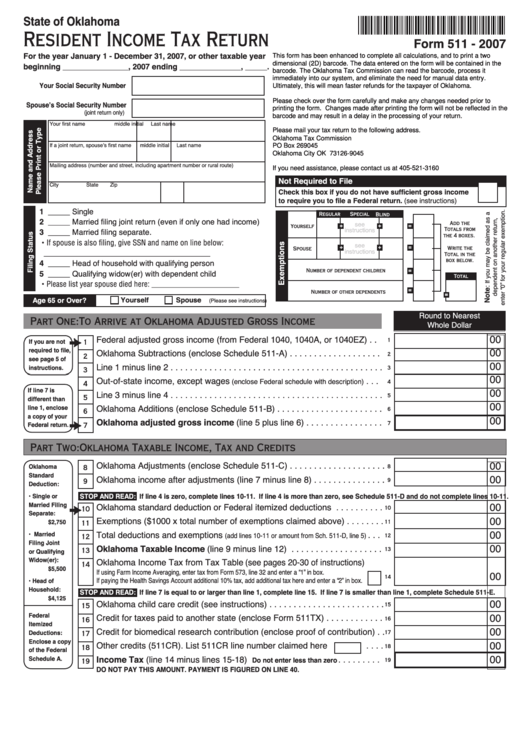

Form 511 State Of Oklahoma Tax Return 2004 printable pdf

This form is for income earned in. The forms include form 511, oklahoma resident income tax return;. Oklahoma resident income tax return • form 511: You can download or print current or. Web 2018 oklahoma resident individual income tax forms and instructions.

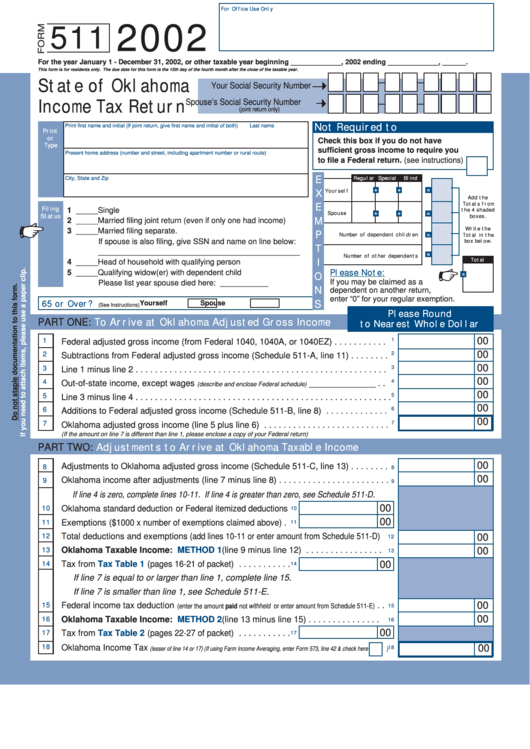

Form 511 State Of Oklahoma Tax Return 2002 printable pdf

Web more about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. Web single married filing joint return (even if only one.

511NR Packet Instructions Oklahoma Individual Form and

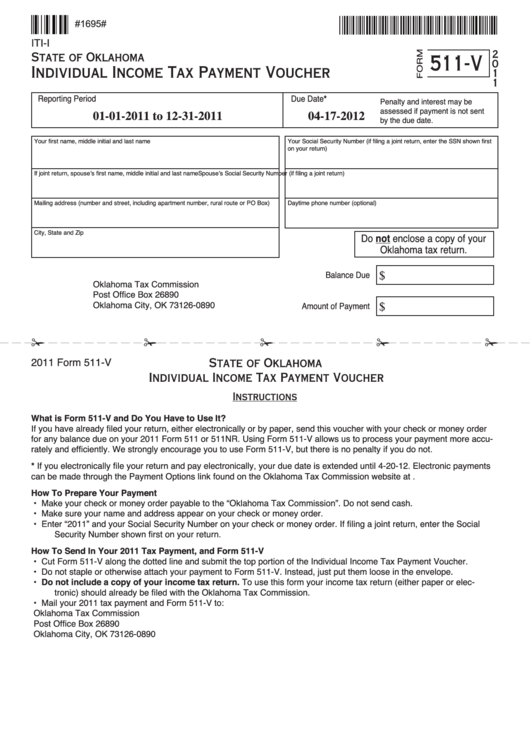

Web form 511ef is the oklahoma individual income tax declaration for electronic filing form. Oklahoma resident income tax return form • form. Send filled & signed 2019. Oklahoma resident income tax return • form 511: If you have already filed your return, either electronically or by paper, send this voucher with your check or money.

Fillable Form 511 Oklahoma Resident Tax Return 2007

This form is for income earned in. This form is for income earned in tax year 2022, with tax returns due in april 2023. Form 511 can be efiled, or a paper copy can be filed via mail. Ad download or email ok form 511 & more fillable forms, register and subscribe now! • instructions for completing the form 511:

Fillable Form 511V Oklahoma Individual Tax Payment Voucher

Name as shown on return: Oklahoma resident income tax return form • form. Sign, mail form 511 or 511nr to. Easily fill out pdf blank, edit, and sign them. Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending.

OTC Form 511CR Download Fillable PDF or Fill Online Other Credits Form

File your form 2290 online & efile with the irs. Name as shown on return: Sign, mail form 511 or 511nr to. Web single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the boxes 4 head of household with qualifying. If you have already.

Fillable Form 511cr Oklahoma Other Credits 2014 printable pdf download

Ad don't leave it to the last minute. Get irs approved instant schedule 1 copy. For more information about the oklahoma. Hb 1039x franchise tax update. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Fillable Form 511Nol Oklahoma Net Operating Loss FullYear Residents

You can download or print current or. Web 2018 oklahoma resident individual income tax forms and instructions. Name as shown on return: Ad download or email ok form 511 & more fillable forms, register and subscribe now! Save or instantly send your ready documents.

Name As Shown On Return:

Oklahoma allows the following subtractions from income: Sign, mail form 511 or 511nr to. Web form 511 is the general income tax return for oklahoma residents. File your form 2290 today avoid the rush.

Send Filled & Signed 2019.

The forms include form 511, oklahoma resident income tax return;. Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending. Web we last updated the schedule for other credits in january 2023, so this is the latest version of form 511cr, fully updated for tax year 2022. If your return contains any of the forms or supporting schedules.

Save Or Instantly Send Your Ready Documents.

Complete, edit or print tax forms instantly. For more information about the oklahoma. Form 511 can be efiled, or a paper copy can be filed via mail. Easily sign the 2019 oklahoma tax form 511 with your finger.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

File your form 2290 online & efile with the irs. Ad don't leave it to the last minute. Web single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the boxes 4 head of household with qualifying. Easily fill out pdf blank, edit, and sign them.