Oklahoma Withholding Tax Form

Oklahoma Withholding Tax Form - Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Complete the required fields and click the ok button to save the information. Web oklahoma taxpayer access point complete a withholding application request 4 2. Agency code '695' form title: Web withholding tax : Your first name and middle initial. You can download blank forms from the business forms. After registration with the oklahoma tax commission (otc) employers will be assigned. Complete this section if you want to withhold based on the oklahoma tax withholding. Web opers has two forms to provide tax withholding preferences for federal and state taxes.

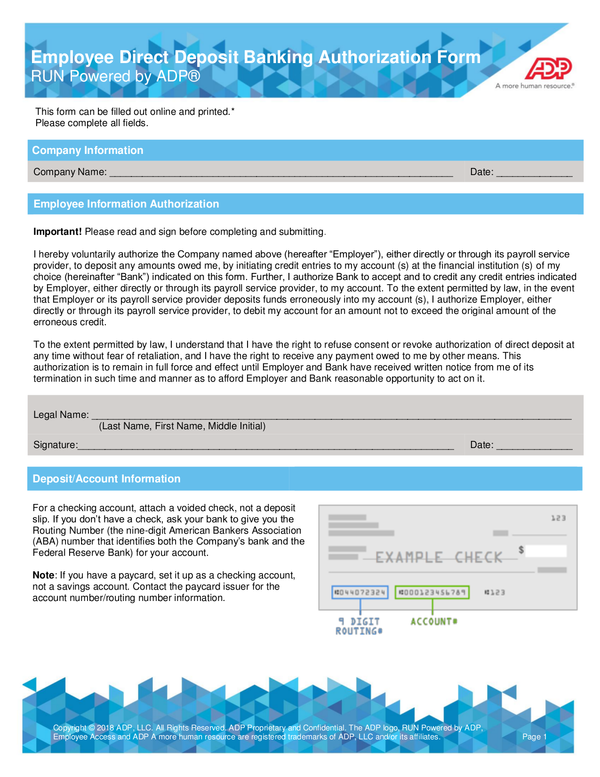

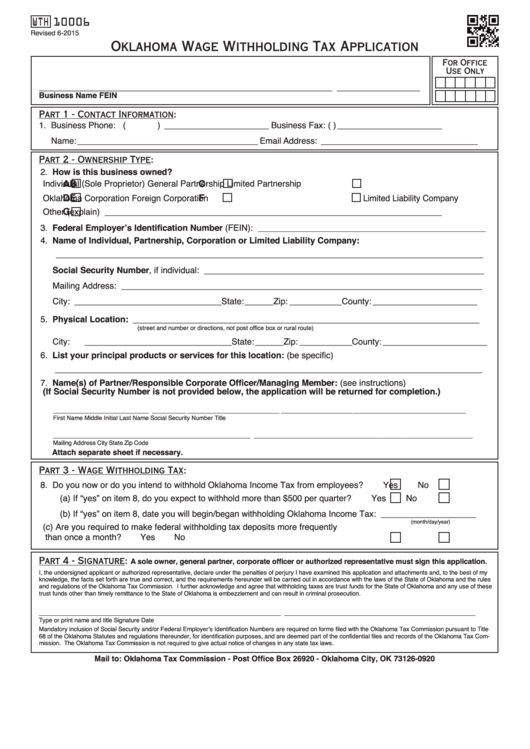

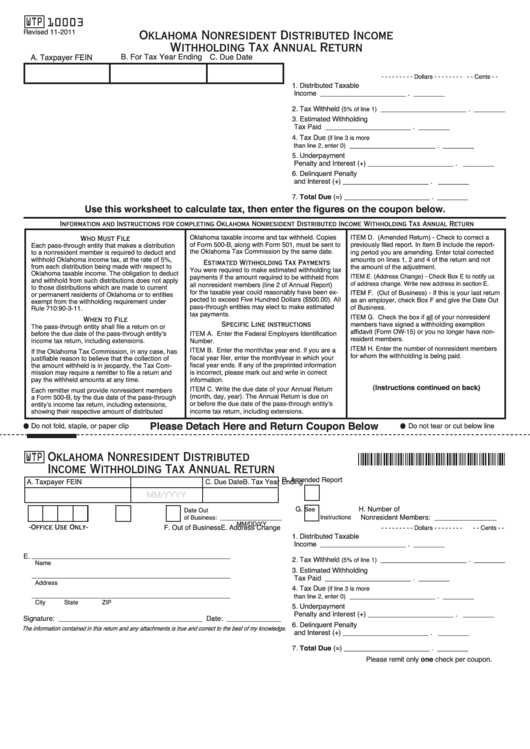

Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. Employee’s signature (form is not valid unless you sign it)date. Pass through withholding tax : Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web opers has two forms to provide tax withholding preferences for federal and state taxes. Complete the required fields and click the ok button to save the information. Instructions for completing the withholding. Oklahoma nonresident distributed income withholding tax annual return: Employee's withholding certificate form 941;

Web any oklahoma income tax withheld from your pension. Pass through withholding tax : The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web withholding tax : Complete this section if you want to withhold based on the oklahoma tax withholding. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Non resident royalty withholding tax : Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Employee's withholding certificate form 941; Instructions for completing the withholding.

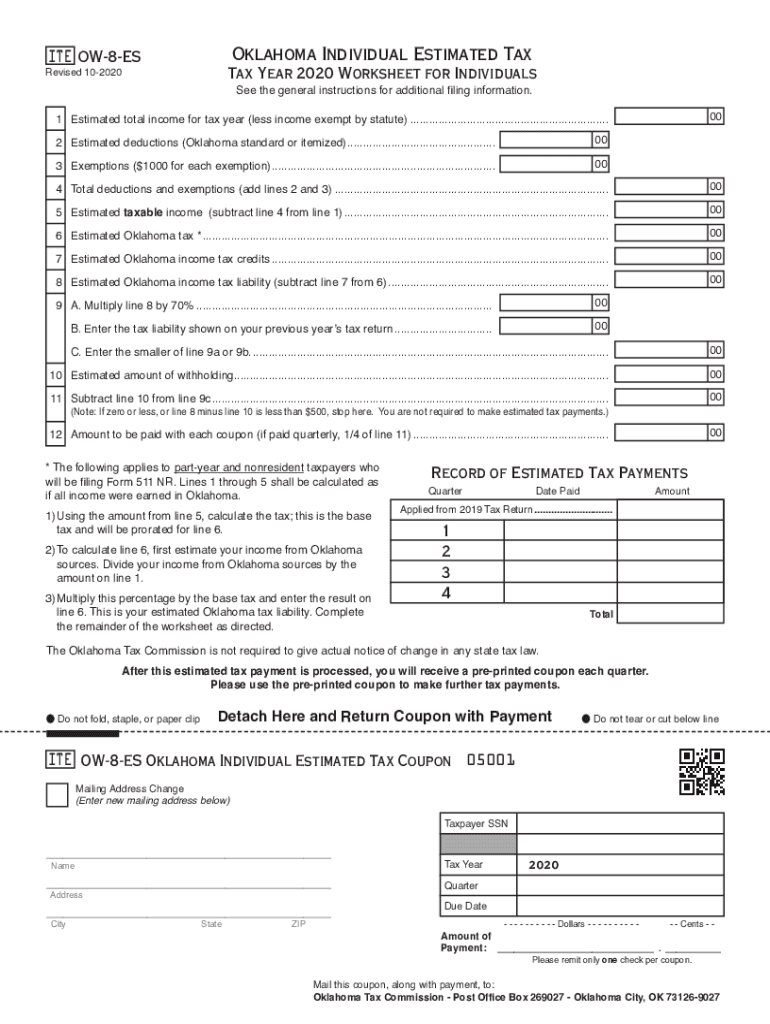

Form Ow 8 Es Tax Fill Out and Sign Printable PDF Template signNow

Pass through withholding tax : After registration with the oklahoma tax commission (otc) employers will be assigned. No action on the part of the. Instructions for completing the withholding. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022.

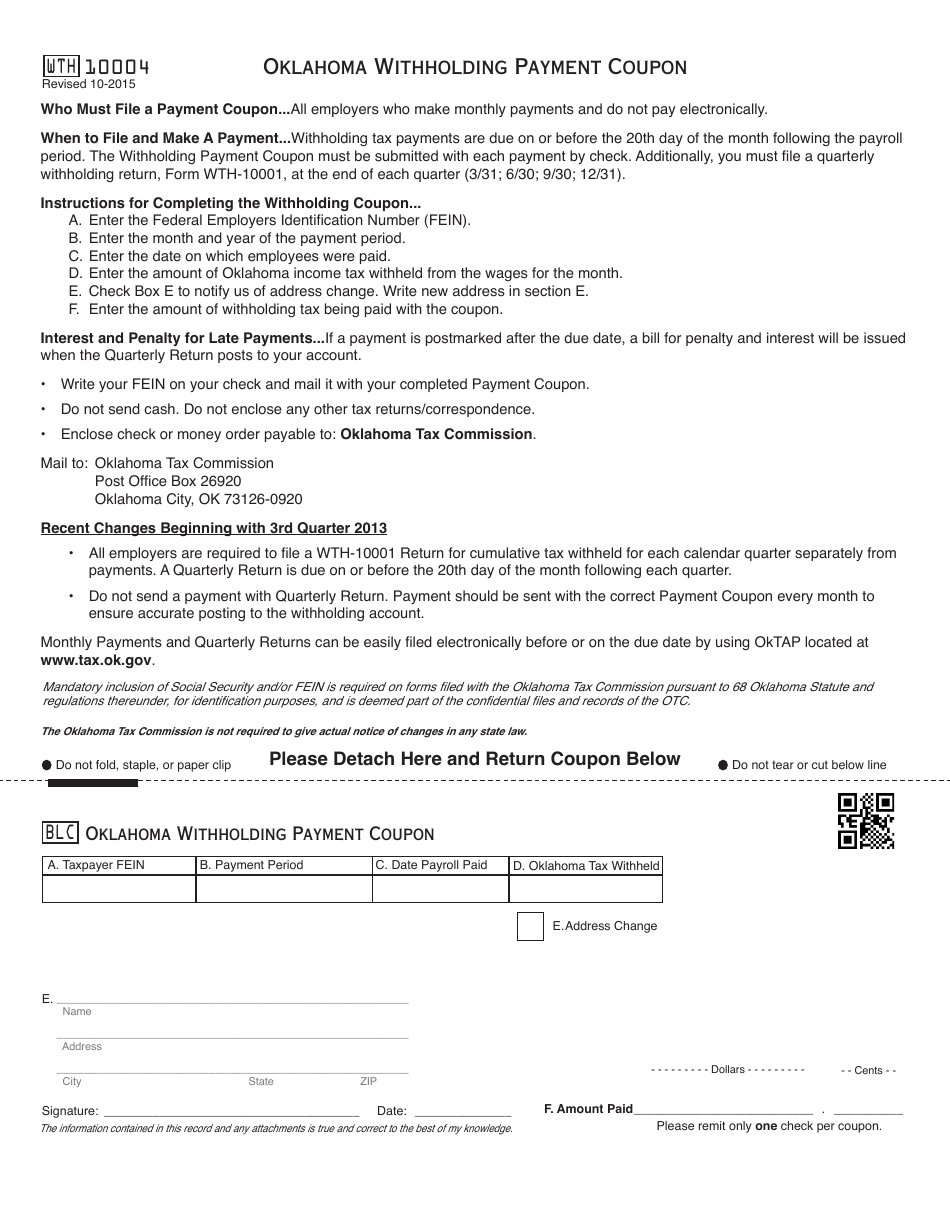

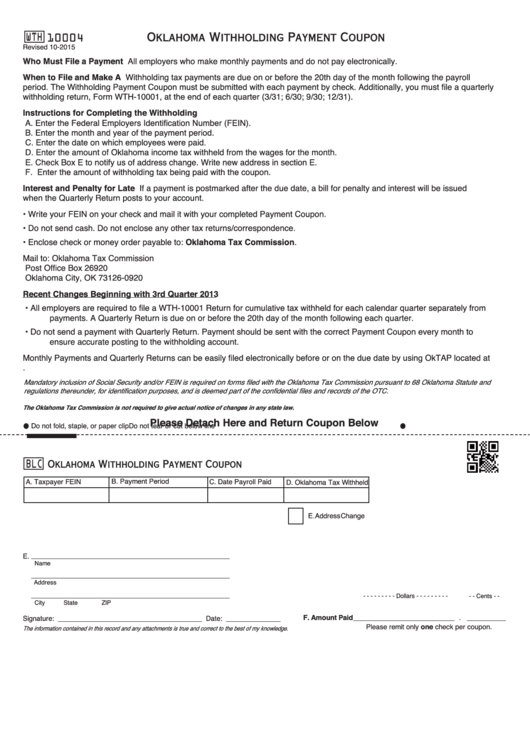

OTC Form WTH10004 Download Fillable PDF or Fill Online Oklahoma

The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web oklahoma taxpayer access point complete a withholding application request 4 2. Complete the required fields and click the ok button to save the information. Non resident royalty withholding tax : Complete this section if you want to withhold.

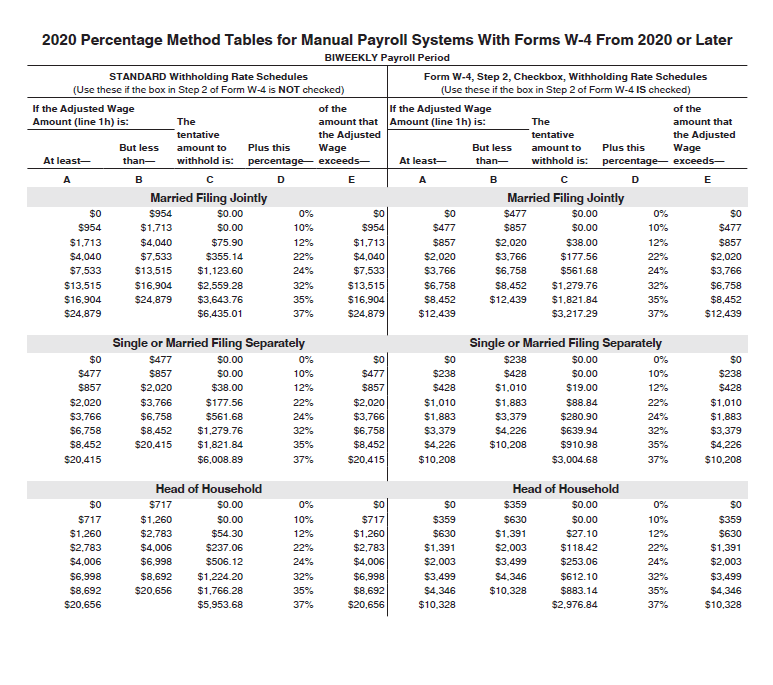

Oklahoma Withholding Tables 2021 Federal Withholding Tables 2021

Complete the required fields and click the ok button to save the information. Web withholding tax : Web this form is to change oklahoma withholding allowances. Agency code '695' form title: No action on the part of the.

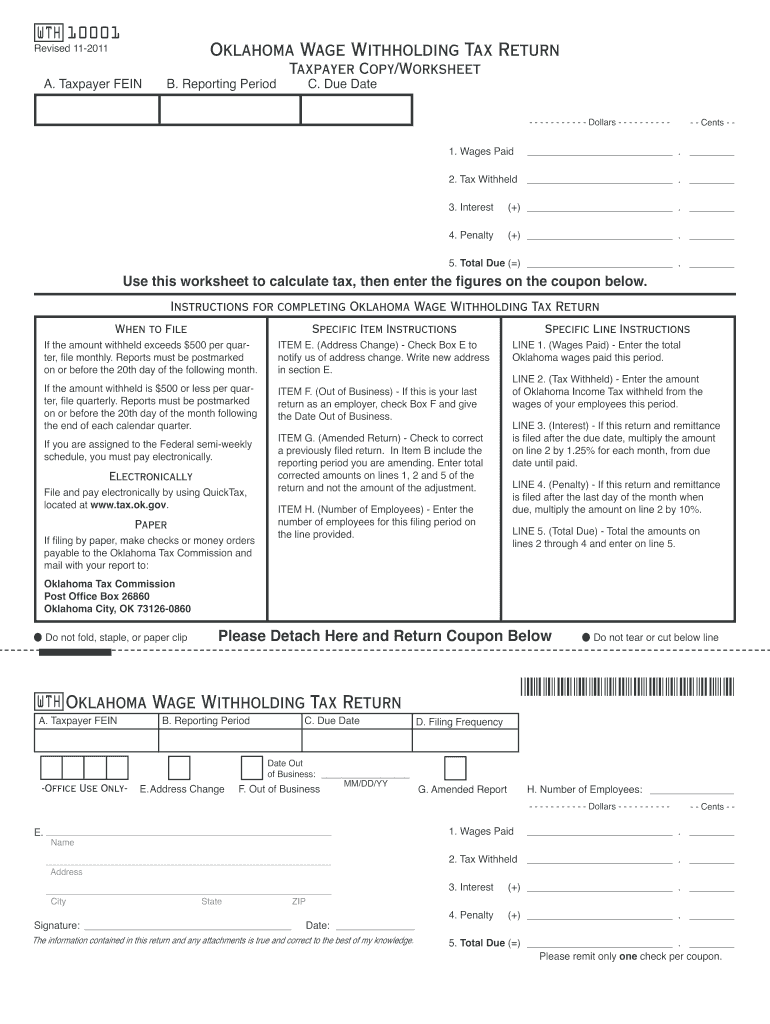

How To Fill Out Oklahoma Employers Withholding Tax Return Form

Agency code '695' form title: The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Employers engaged in a trade or business who. Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. After registration with the oklahoma tax commission (otc).

Fillable Oklahoma Withholding Payment Coupon Tax Commission printable

Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Pass through withholding tax : Web oklahoma taxable income and tax withheld. What are the requirements for oklahoma payroll tax withholding?. Employers engaged in a trade or business who.

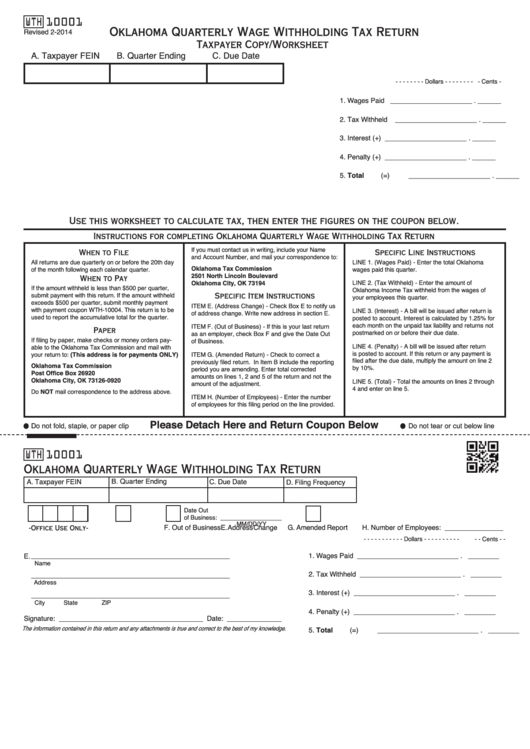

Fillable Form Wth 10001 Oklahoma Quarterly Wage Withholding Tax

After registration with the oklahoma tax commission (otc) employers will be assigned. Complete this section if you want to withhold based on the oklahoma tax withholding. Web this form is to change oklahoma withholding allowances. Employee's withholding certificate form 941; You can download blank forms from the business forms.

2014 Form OK OTC STS20002 Fill Online, Printable, Fillable, Blank

Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Employee’s signature (form is not valid unless you sign it)date. Complete the required fields and click the ok button to save the information. What are the requirements for oklahoma payroll tax withholding?.

Fillable Form Wth 10006 Oklahoma Wage Withholding Tax Application

Complete this section if you want to withhold based on the oklahoma tax withholding. You can download blank forms from the business forms. Oklahoma nonresident distributed income withholding tax annual return: Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov.

2011 Form OK OTC WTH 10001 Fill Online, Printable, Fillable, Blank

Employee’s signature (form is not valid unless you sign it)date. Complete this section if you want to withhold based on the oklahoma tax withholding. Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year.

Fillable Oklahoma Nonresident Distributed Withholding Tax Annual

No action on the part of the. Pass through withholding tax : Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. Complete the required fields and click the ok button to save the information. Instructions for completing the withholding.

Pass Through Withholding Tax :

Oklahoma nonresident distributed income withholding tax annual return: What are the requirements for oklahoma payroll tax withholding?. Employee's withholding certificate form 941; Web any oklahoma income tax withheld from your pension.

You Can Download Blank Forms From The Business Forms.

The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Complete this section if you want to withhold based on the oklahoma tax withholding. Instructions for completing the withholding. Web this form is to change oklahoma withholding allowances.

Web Withholding Tax :

Employers engaged in a trade or business who. Web opers has two forms to provide tax withholding preferences for federal and state taxes. No action on the part of the. Web oklahoma taxpayer access point complete a withholding application request 4 2.

Web Up To 25% Cash Back To Apply On Paper, Use Form Wth10006, Oklahoma Wage Withholding Tax Application.

Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Agency code '695' form title: Complete the required fields and click the ok button to save the information.